cmannphoto/iStock via Getty Images

A day of reckoning is coming for the stock market, possibly as soon as Friday at 10 a.m. Eastern. That is when FOMC Chairman Jay Powell will make his annual speech at the Jackson Hole Economic Symposium. His message will be critical as it will likely lay out the direction the Fed plans to take regarding future rate hikes.

The futures, bond, and currency markets relay a straightforward message that the equity market has chosen to ignore. That message is that the Fed will continue to raise rates for some time, and when rates stop rising, they will be held steady until there’s clear evidence that inflation is heading back to the Fed’s 2% target rate.

Powell also must be clear on three key points that created a big mess following the July FOMC meeting. That a slower pace of rate hikes does not mean fewer rate hikes, that slowing growth will not lead to rate cuts, and if inflation fails to come down, the Fed will push rates even higher.

Powell cannot leave the speech open to interpretation if the Fed wants to achieve its goal of bringing down inflation rates. The Fed needs financial conditions to tighten further and enter a restrictive territory to have the impact necessary to slow growth and push inflation lower. Financial conditions have eased since the July FOMC meeting, which delayed and even offset some of the Fed’s progress over the past few months.

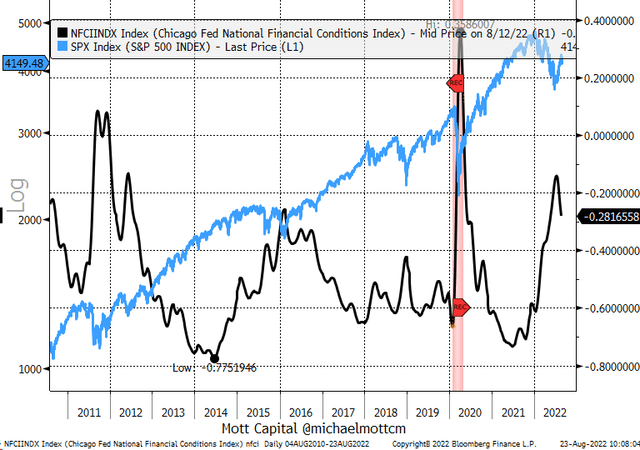

Unfortunately, for the Fed to get financial conditions to tighten, equities prices will suffer. As financial conditions tighten, equity prices and valuations will need to fall – an unbreakable relationship. Easing financial conditions help to push equity prices higher, and tightening conditions lowers those prices. The Fed needs the Chicago Fed National Financial conditions index to get above 0 to have the desired effect on inflation, and right now, that index is at -0.28.

Bloomberg

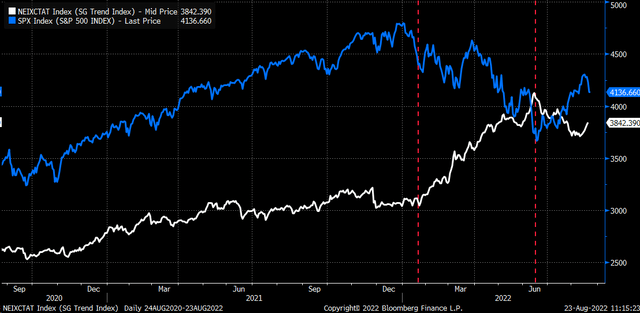

There are reasons why stocks have risen, and they are not all tied to the Fed. One reason is that systematic flows, which are model driven, merely chase momentum. These systematic funds have played a significant part in equity valuation rising over the past couple of weeks. The SG trend index, which tracks 10 trend following CTAs, shows these flows quite nicely and suggests that many of these systematic funds had gotten short the equity market sometime in January and continued to add to their short exposure as the market fell. Once the market turned on the “dovish-pivot” narrative, these flows shifted, and the systematic funds began to cover their shorts, helping to drive equity prices higher.

Bloomberg

So there’s more to the equity market story than just the equity market not being the sharpest tool in the shed and misunderstanding the Fed. It means that once that momentum chasing and short-covering ends, the rally ends, which it appears it has.

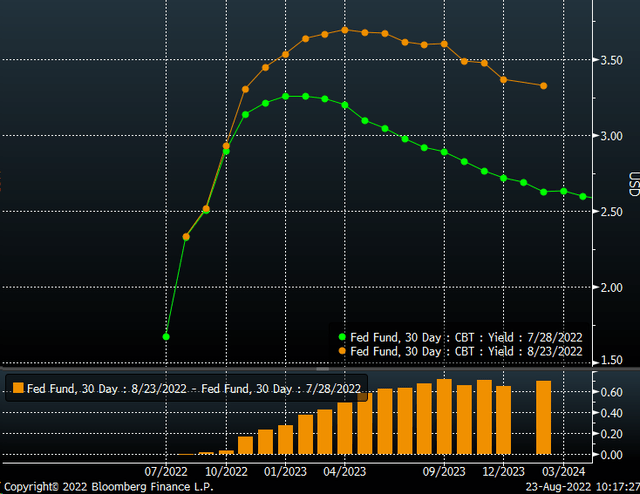

Fed Fund Futures

Make no mistake – Fed Funds Futures have listened very clearly to the Fed governors and board members since the end of July. They have correctly reshaped over the past couple of weeks and removed rate cuts and pricing in a higher for longer interest rate policy path. The Fed fund futures now see rates peaking in the April to June period at around 3.7%. Additionally, the futures show only a minimal decline in rates until October. Again, a sign that the market has repriced toward a higher for longer bias.

That compares to the peak rate of around 3.25% in January and February and rate cuts starting in May, which was the market’s policy path at the end of July.

Bloomberg

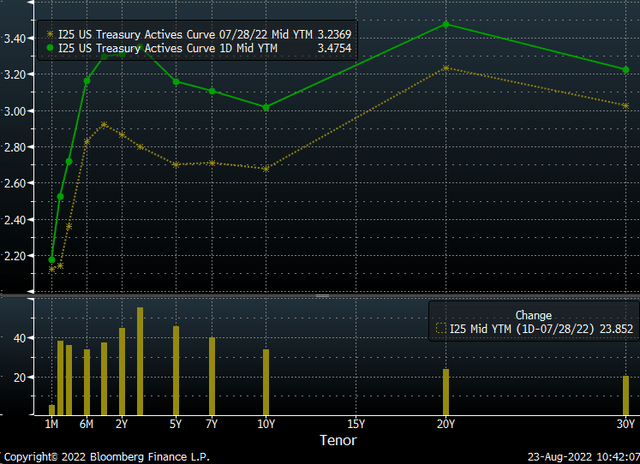

Treasury Curve Shifts

On top of that, the Treasury curve has been reshaped. Two-year rates have risen between 25 and 30 bps climbing from around 2.85% on July 28 to approximately 3.3% on Aug. 22. Meanwhile, the 10-Yr has increased from 2.65% to about 3.01% over that same time.

Bloomberg

The movement in rates has happened despite the consumer price index and the producer price index missing expectations. The bond market is getting the Fed’s message.

The Dollar Confirms

If one needs further confirmation of the Fed’s hawkish statement, one needs to look no further than the dollar index. On July 27, the dollar index was trading around 107.20, and today it trades around 108.50. Again, consider that most of the recent increases in the dollar index have come since the release of the FOMC July minutes on Aug. 17.

Bloomberg

The futures, bond, and currency markets are already telling the world that there is no dovish pivot, and quite frankly, there probably never was a dovish pivot. The only market out that hasn’t gotten the message appears to be the equity market.

If Powell can deliver a message that even a golden retriever (I own two goldens) can understand, then the equity markets’ day of reckoning will arrive in short order.

Be the first to comment