Sitthiphong/iStock via Getty Images

Written by Nick Ackerman

Dividend growth stocks aren’t always the most exciting investments out there. They oftentimes aren’t grabbing the headlines; they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. There are definitely yield-traps out there, trust me – I’ve owned a few that I’m not particularly proud of.

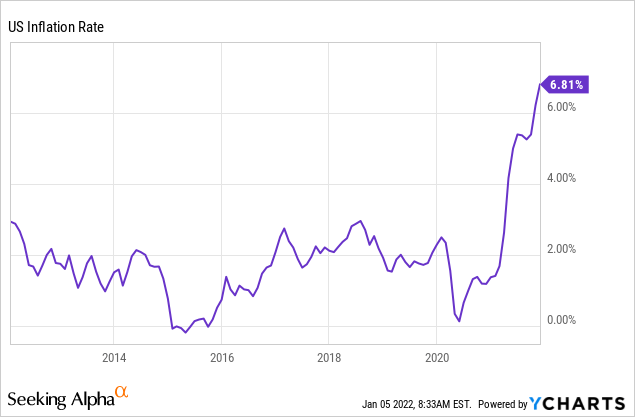

These dividend growth stocks can be even more critical in the current environment as it combats inflation. With the rising prices, an income investor needs a growing income to compensate for the price erosion.

YCharts

Finally, one last important thing about every dividend stock out there. When a company makes a dividend payment, and you receive that cash in your account, that’s a “guaranteed” return. Unless you reinvest that cash (and many do), you have no way of losing those dollars or having them taken back the way you could with stock appreciation alone. Of course, a company can cut a dividend at any time or even suspend them altogether.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all return back into your pocket from that point forward.

All of this being said is important to understand my approach to dividend stocks and why screening of dividend stocks can be important for income investors. There are January’s 5 dividend growth stocks that might be worthwhile for a deeper exploration. As is the case with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors, but earnings payout ratios, debt and free cash flow are amongst these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising year after year, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means that there could have been periods where they paused increases for a year or two.

Taking a look at those factors alone. We are left with 413 stocks at this time, down from December’s 438. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more obviously. I then sorted the list by forward dividend yield, highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

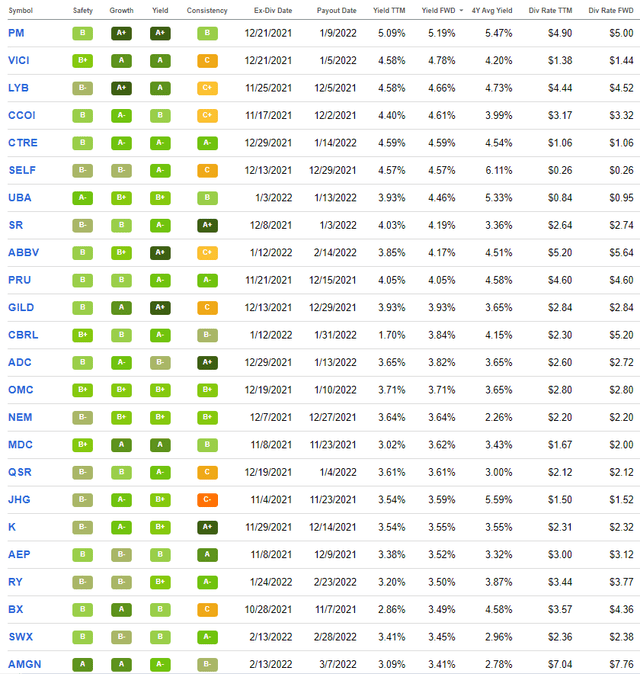

From there, I will share the top 25 that showed up as of 01/05/2022.

Some of these positions might look familiar as holdings in the Cash Builder Opportunities Portfolios. Some names in the Core Income Builder Portfolio and the Satellite Income Builder Portfolio both. They were also names that we took an initial dive into last time.

We will skip past Philip Morris International (PM), as it showed up last time. It’s a dividend machine that’s excellent for building income; however, we don’t have to take a look at it so soon again. That’s the same with Cogent Communications Holdings (CCOI). That one, in particular, caught my attention and is worth exploring further, which I have done.

After this, the next step was to narrow down to just 5 stocks that I wanted to highlight here. Before doing that, I wanted to ensure that the dividends had been trending higher. For example, Global Self Storage (SELF) shows up on this list. However, they haven’t raised their dividend since what would appear to be around 2012. Therefore, I would have skipped past that name.

All that being said, here are the 5 names that could be worth exploring further.

VICI Properties Inc. (VICI) 4.78% Yield

VICI is a name that we became familiar with earlier in 2021. We utilized the options wheel strategy successfully with this name. Since then, it has been on my watchlist to implement that type of trade again. The kicker here was that we could even get the dividend from this REIT while we were holding onto the shares.

That being said, we still totaled up a return of $1.12 during that time. That works out to 3.11x the quarterly dividend. However, we did so in the span of just 36 days.

We ultimately risked $30 per share or $3000 per contract had VICI went to $0 per share. While there are certainly unknowns and risks with VICI, the chances of that happening seemed quite limited, in my opinion. As is the case with most of the stocks we are going to be writing options on.

Our breakeven would have been the $30 per share minus the $1.12 collected during that time; that put it at $28.88 or $2888. Of course, we won’t know until time goes on what could have happened if we didn’t get these shares called. We would have continued to write calls as opportunities arose.

All this being said, we arrive at a total annualized return of 37.85% if we could generate these same trades every 36 days. Unfortunately, the dividend in there was a kicker that happens only once every quarter. Taking that out of the equation, we would have arrived at $0.76 per share collected. That still works out to an appealing 25.69% annualized return.

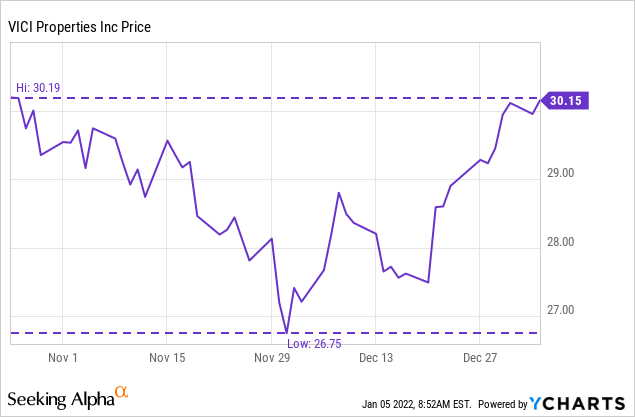

Since then, the shares have sunk to below $27 and have only recently come back above the $30 level. The options volume on this name isn’t the most robust, so we are more limited to pulling the strategy off.

YCharts

At the end of the day, it’s just a strong candidate for holding long-term as well. It has been beaten up as it is sensitive to COVID lockdowns as a gaming, hospitability and entertainment REIT. Since the Omicron variant has been grabbing the headlines and sweeping across the world, that has put additional pressure on the shares. We’ve since been getting some relief as the variant seems to be going so rapidly that it’ll quickly burn itself out.

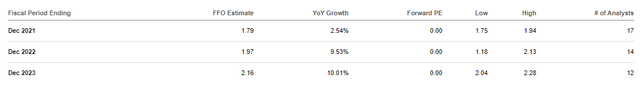

The earnings estimates for this REIT are anticipated to grow, even despite the shorter-term headwinds of this lingering pandemic.

VICI Earnings Estimates Seeking Alpha

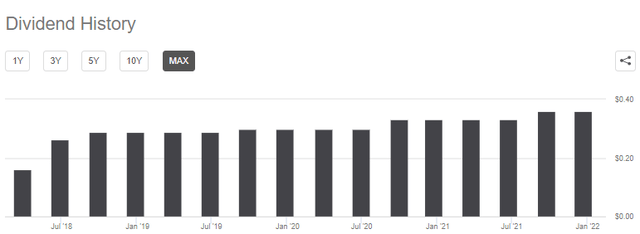

That puts it in a great position to continue growing its dividend, despite it being a somewhat newer REIT, at least as an independent publicly traded REIT. It was a spin-off from Caesar Entertainment Corp. that went public in 2018.

VICI boosted its dividend in 2020, which was definitely impressive considering the circumstances. The dividend payout ratio is just 80.25%, leaving plenty of capacity for further boosts without even considering potential FFO growth.

VICI Dividend History Seeking Alpha

LyondellBasell Industries N.V. (LYB) 4.66% Yield

This is a name I’ve never run across before but could be a really strong dividend play. I don’t hold any significant exposure to the materials sector, and that’s what LYB is. They operate around the world through six different segments in the chemicals industry. They are Dutch-domiciled with U.S. headquarters in Texas.

The company operates in six segments: Olefins and Polyolefins-Americas; Olefins and Polyolefins-Europe, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology. It produces and markets olefins and co-products; polyolefins; polyethylene products, which consist of high density polyethylene, low density polyethylene, and linear low density polyethylene; and polypropylene (“PP”) products, such as PP homopolymers and copolymers. The company also produces and sells propylene oxide and its derivatives; oxyfuels and related products; and intermediate chemicals, such as styrene monomers, acetyls, ethylene glycols, and ethylene oxides and derivatives.

All that might be quite difficult to read through, at least it was for me. Essentially, they are a plastics, chemical and refining company. The use of plastics and chemicals certainly isn’t going away anytime soon. I’d have to believe that means LYB will be around for decades more after being founded in 1955.

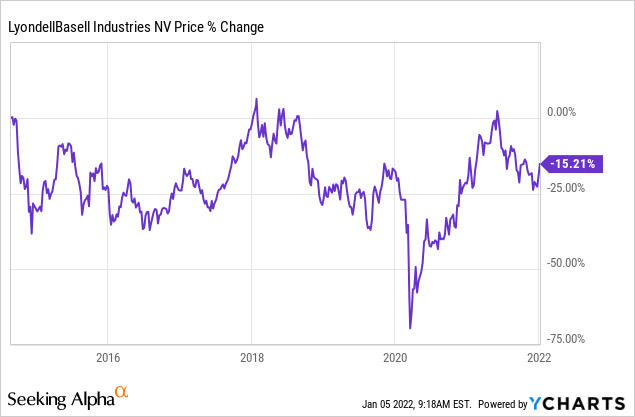

The stock price itself hasn’t done much going all the way back to the latter half of 2014.

YCharts

So for this name, it really comes down to one wanting to see growing dividends for the return instead of appreciation, it would seem. On the other hand, it isn’t overly priced now like many other stocks in this market.

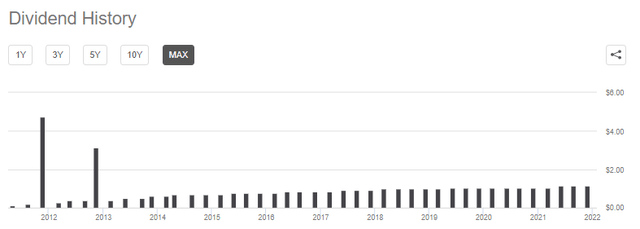

They have been growing their dividend and had initially paid some large one-time payouts to shareholders initially. They froze their dividend through 2019 and 2020 for 8 quarters. They then raised it once again in 2021. Given the environment of 2020, I don’t fault any company for making a proactive move to preserve cash.

LYB Dividend History Seeking Alpha

The payout ratio of this dividend based on EPS comes to just 24.21%. I believe that puts them in a strong situation where they can sustain the current payout with plenty of capacity to grow it.

That being said, analysts are all over the board for earnings estimates, but they believe that earnings will decline in 2022. The general idea is that earnings will take a hit since the raw material costs have increased and will continue to squeeze margins from here. Still, I believe that it is in a strong position and quite an interesting stock to do further due diligence on.

CareTrust REIT, Inc. (CTRE) 4.59% Yield

As this REIT’s name would suggest, this is a healthcare REIT that engages in “ownership, acquisition, development and leasing of skilled nursing, seniors housing and other healthcare-related properties.”

Nursing facilities and senior housing are in high demand as baby boomers continue to age every day. Despite that demand, it hasn’t translated into much demand for CTRE shares. Staffing issues with labor shortages in every industry don’t help. Combining that with needing additional skills and personality when it comes to working with the elderly adds an additional layer of complexity and shortages in labor.

The share price hasn’t done much over the last few years besides going sideways for the most part; excluding the declines it experienced through 2020, along with the rest of the market. That isn’t always bad, as the dividend has grown for investors. Earnings estimates are even expected to continue to grow in the future.

That is if this continues being a standalone REIT in the future. The latest news is that they are exploring a potential sale. Despite the challenges of CTRE, they’ve been able to grow their dividend over time.

CTRE Dividend History Seeking Alpha

The payout ratio comes to 71.30%, and the 5-year growth rate of the dividend comes to a strong 9.28%. That puts it well above the growth rate of its peers.

Urstadt Biddle Properties Inc. (UBA) 4.46% Yield

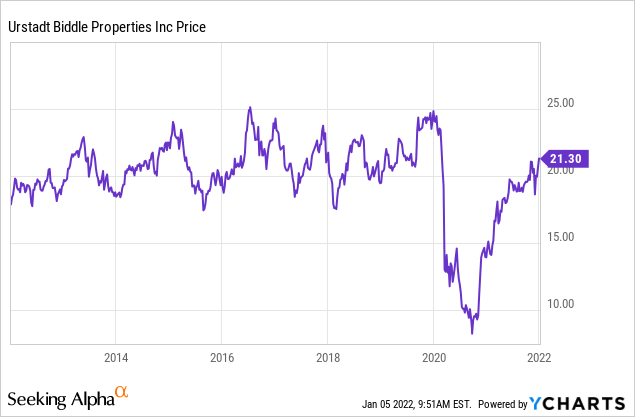

UBA is one that I’d personally not be too interested in. It also cut its dividend last year but has been growing it back rapidly. This is a smaller REIT with a market cap of less than $813 million. They have 5.2 million square feet of lease space available but over just 81 properties. These retail properties are concentrated in the northeastern part of the U.S. and, more specifically, around New York.

New York is certainly a strong area to own properties in due to the high concentration of population. That being said, it does put this REIT in a position where it has geographic concentration risk in an industry that isn’t necessarily on the up and up.

Given the pandemic environment of 2020, we can see that this had additional pressure put on the stock. The price collapsed as expected in the retail space when a large portion of the underlying businesses would have been struggling.

YCharts

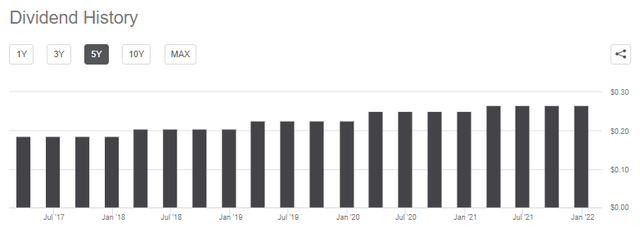

That led to the cut in their dividend from $0.28 per quarter to $0.07 in 2020. However, they have rapidly raised it back up with the latest ex-div date on January 4th, 2022, good for a quarterly dividend of $0.2375. They aren’t paying what they were previously yet, but it has certainly rebounded significantly.

Though that trajectory seems to have stalled a bit since the last increase was a 3% increase. On the other hand, the increase before that was just 6 months ago and came in at a blistering 64.3% increase.

This is an interesting name and could be suitable for some people. For me, it isn’t the type of REIT I would necessarily be looking for. However, it is on the cheaper side at a P/FFO of 13.71.

Spire Inc. (SR) 4.19% Yield

SR is another interesting name showing up on this list. I admit it; I’m biased since it is a utility company. I also am biased towards REITs, so it was great covering 3 different REITs for January’s screening.

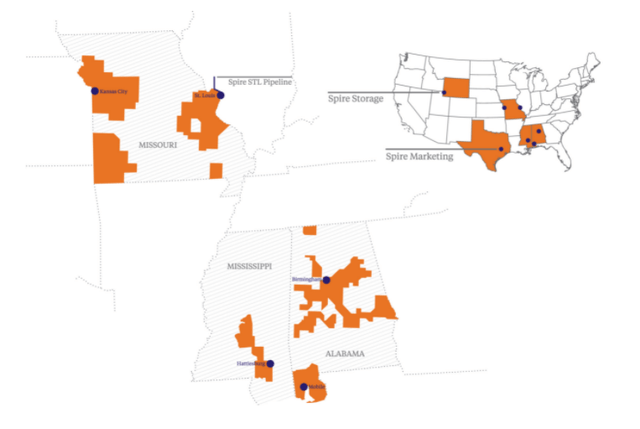

This is a regulated gas utility company that has gas utilities and gas marketing. They are involved with both natural gas and propane. It was founded in 1857 but has remained a relatively small company with a market cap of just $3.38 billion. That puts it on the lower end of being a mid-cap stock.

They have 1.7 million homes that they service throughout Alabama, Mississippi and Missouri.

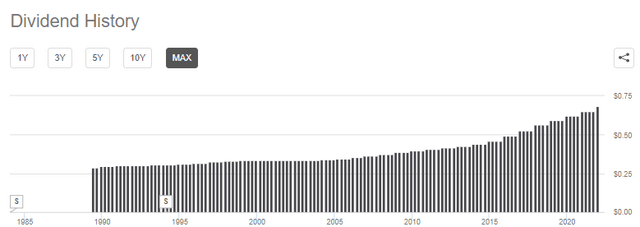

They boast 5-7% long-term EPS growth. That isn’t bad at all, considering that utility companies are mostly slow growers. In this sector, we are looking for slow and steady. That helps provide the type of stability that we need for growing dividends. Which, they mention that they have 18 years of increasing dividends consecutively.

The growth hasn’t been massive but has been ramping up more over the last roughly 8 years. I believe that is positive to see as they’ve focused on growth. The 10-year CAGR of the dividend is above the industry average. However, the last 3 and 5 years have been in line.

SR Dividend History Seeking Alpha

The payout ratio comes to 69.8%. That might seem high if it was any other company, but it is a utility company where payout ratios tend to be elevated across the industry. They have predictable cash flows and can easily finance growth projects through debt.

I believe that SR is definitely another name that is worth considering and doing a deeper dive into.

Be the first to comment