PM Images/DigitalVision via Getty Images

James Hardie Industries plc (NYSE:JHX) share price has been under pressure all year after starting to rebound in April 2020 after the hit it took from the pandemic.

From a low of approximately $9.00 per share on March 16, 2020, it soared to about $41.50 on November 15, 2021, and has since pulled back to trading a little above $19.00 as I write.

Economic headwinds are starting to have a significant impact on the housing industry, and that has been visible for some time based upon the decision by the Federal Reserve to attack rising inflation by raising interest rates, which in turn brought about higher mortgage rates for buying homes, and higher repair costs with repair and remodel (R&R), putting downward pressure on all aspects on the industry.

In this article, we’ll look at JHX’s recent earnings report, and primarily at the headwinds it faces which aren’t likely to be mitigated in the near future.

Latest earnings

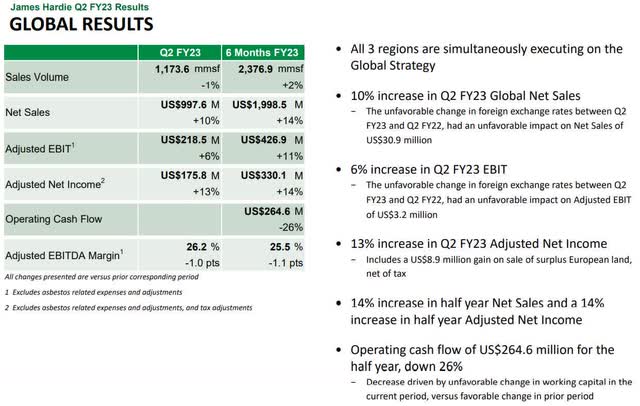

Company Presentation

Net sales in the second fiscal quarter came in at $997.6 million, up 10 percent year-over-year. FX had a negative impact of $30.9 million on net sales in the reporting period, and a negative impact of $3.2 million on adjusted EBIT.

Adjusted EBIT in the quarter was $218.5 million, up 6 percent from the same reporting period in fiscal 2022.

Adjusted net income in the quarter was $175.8 million, up 13 percent year-over-year. That has fallen from 22 percent in adjusted gross income in Q2 of 2020 and adjusted gross income of 29 percent in Q2 of 2021. That is probably going to continue to decline in the quarters ahead.

Operating cash flow in the first half of fiscal 2023 was $246.6 million, down from the first half of the prior fiscal year.

As for the outlook, at the time of the earnings report management stated that over the last 45 days, it has seen a significant change in sentiment in the housing market. While we’ve known the housing market was going to eventually take a hit from rising inflation, interest rates and mortgage rates, it appears, at least within the markets JHX competes in, the practical outworking of increasing negative sentiment is starting to have an impact on construction and repair and remodel).

In regard to new construction, JHX is guiding for it to fall by over 30 percent in the fiscal second half of 2023. For R&R, it’s expected to remain flat. With rising interest and mortgage rates, that’s not going to change over the next two to three quarters at minimum.

According to census data, big builders have reported cancellation rates rising significantly.

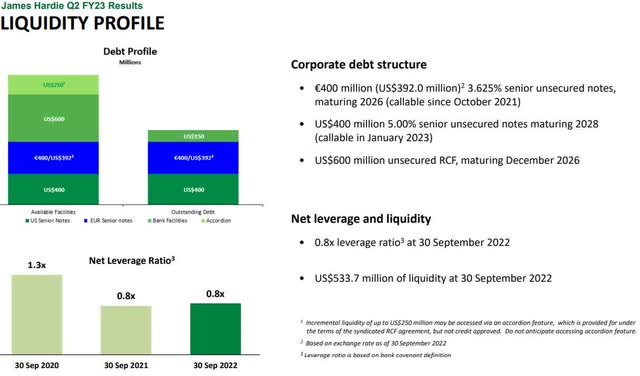

Company Presentation

Breaking down the regions

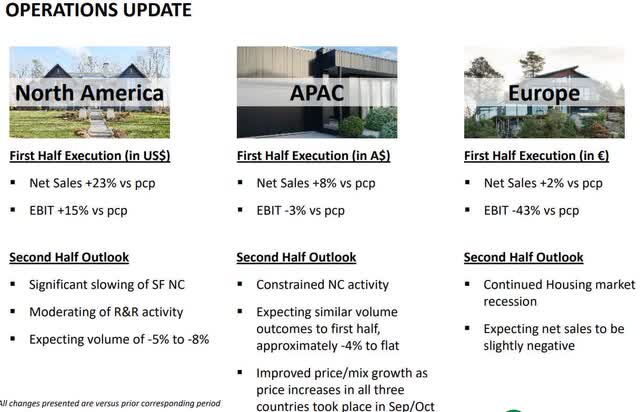

Company Presentation

North America

Net sales in North American for the quarter were $750.6 million, up 18 percent from last year in the same quarter. EBIT was $212.8 million, up 17 percent year-over-year. EBIT margin was 28.4 percent, down 0.3 basis points from Q2 2022, while EBITDA margin was 32.6 percent, down 0.6 basis points from Q2 2022.

Management pointed out that in the last earnings report it was guiding for mid-single-digit volume growth in the North American market and has now downwardly revised that to negative 5 percent to negative 8 percent volume growth when measured against fiscal 2022.

In the period from September 20, 2022 to October 19, 2022, based upon census data, single-family starts in North America were down 17 percent from the same period of 2021. And for the first time in 2022, completions are now growing faster than housing starts. During that time the company said, completions ended up 11 percent higher than starts.

In the R&R segment, demand is slowing down because of falling consumer sentiment, a decline in the price of homes, and material inflation which has increased the cost of projects. Combined with the higher cost of capital, even a level outlook appears to be too ambitious.

Europe

In the reporting period net sales were €102 million, down 2 percent year-over-year, attributed to a 14 percent drop in volume from the slowdown in the region’s housing market.

EBIT plunged to €4.4 million, down 69 percent, at an EBIT margin of 4.3 percent. Reasons given for that was an increase in commodity and materials costs, specifically for “natural gas, freight, gypsum and paper.”

At the same time SG&A investment in Europe was up 10 percent on marketing and employee training. Things are going to get worse before getting better in Europe, and that continue to be a drag on the company’s performance in the quarters ahead. The company expects net sales in Europe to decline in the second half of its fiscal year.

APAC

Net sales in its Asia Pacific segment were AUD$211.1 million, up 7 percent from last year in the same reporting period, even though volumes were down 4 percent due to a constrained labor and housing market in Australia, along with economic challenges. The company’s customers in the region also worked on downwardly adjusting their inventory levels. EBIT in the quarter fell 7 percent to AUD$56.1 million, with a margin of 26.6 percent. Higher freight and pulp costs and lower volumes were the reasons given for the drop in EBIT.

The company started to increase pricing in September and October in response to freight and material inflation and expects margins to widen in the second half of the year.

Conclusion

Even though JHX had a decent quarter, this is probably going to be the last one for the next three quarters, and possibly more. It all depends upon central banks, consumer sentiment, freight and material inflation, and how high interest and mortgage rates climb before reversing direction.

There is no doubt construction is going to get hit hard with new housing starts, but I think management may be overly optimistic with R&R as well because of material inflation and higher interest rates when consumers consider taking out loans for improvement and repairs on their homes.

I don’t see any near-term catalysts that will change my thesis that the industry is probably continue to be under pressure for the next three quarters, and possibly much longer.

JHX is being subjected to a number of market and policy forces that are outside of its control. Until those forces rescind, I don’t see much that is positive in the housing market in the short-term, neither for JHX.

At best, investors should watch and see how far the share price of the company falls before thinking in terms of a good entry point. I think it’s likely to take big hits each time the Fed and other central banks raise interest rates, even if there are modest improvements in inflation.

Be the first to comment