Aguus

Florida-based Jabil (NYSE:JBL) is one of the largest electronic and diversified manufacturing and design services companies with operations in 10 countries. The stock is down 2% over the past year and currently trades at only 8.2x forward earnings despite demonstrating strong revenue & earnings growth this year as it continues to execute very well despite continuing COVID-19 related shut-downs in China and supply-chain challenges. Jabil is expected to generate $700+ million in free-cash-flow this year ($221 million in Q3) and is using the majority of those funds to buyback what I consider to be significantly undervalued shares. Meantime, JBL continues to invest ~$1 billion a year into “industry 4.0” technologies (robotics, AI, and 3D-printing for example) in order to reduce overhead and increase margin going forward. Jabil is a STRONG BUY.

Investment Thesis

IT hardware is a vital area of the technology sector that traditionally outperforms during recessionary periods, given typically strong balance sheets and strong cash-flow. And that is certainly the case with Jabil – a company that continues to perform very well this year despite an arguably very challenging macro-environment. Much of that has to do with the fact that Jabil is today is a much more diversified company as compared to the not-too-distant past:

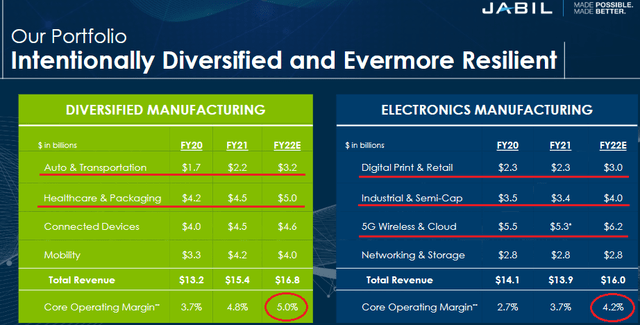

Source: Q3 Earnings Presentation

As can be seen in the graphic above, Jabil is now operating eight sub-segments, each of which has greater than $2 billion in annual sales. Five of the eight (under-lined in red) are expected to deliver strong growth in FY22, while margin is expected to significantly increase on a year-over-year basis in both its DMS and EMS segments. Indeed, core operating margin in DMS, its largest segment, is expected to reach 5.0% this year (up 200 basis points) while it is expected to grow 500 basis points YoY in the EMS segment. I believe that ongoing margin expansion will continue to be a strong catalyst over the next year or two.

Looking at the graphic above, JBL has greatly diversified its operations and markets and is no longer overly dependent on iPhones and/or the cyclical PC market.

Now let’s take a look at the company’s most recent earnings release.

Earnings

Jabil’s Q3 FY22 EPS report was released in June and was a strong beat on both the top and bottom lines. Q3 revenue of $8.3 billion grew 15.4% YoY while adjusted EPS of $1.72/share grew 35.7%. Core operating margin was 4.2%, a little on the light-side in my opinion but admirable given continuing COVID-19 shut-downs in China and supply-chain challenges.

Adjusted free-cash-flow during Q3 was $221 million, or an estimated $1.51/share based on the average of 143.3 million fully diluted outstanding shares at the end of the quarter.

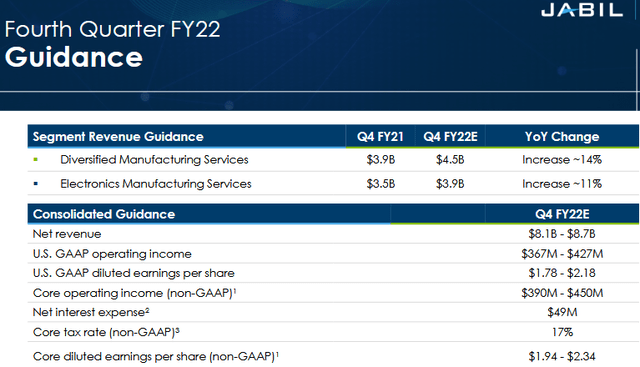

Going forward, Jabil gave the following guidance for Q4 and full-year FY22:

Note total revenue for Q4 is expected to be $8.4 billion, up $100 million sequentially but +$1 billion (13.5%) on a year-over-year basis. Importantly, note the midpoint of core Q4 FY22 EPS guidance ($2.14/share) would equate to a 48.6% increase as compared to the $1.44/share of core earnings in Q4 of FY21.

For the full-year, Jabil expects core operating margin of 4.6%, core EPS of $7.45/share, and to generate $700+ million of free-cash-flow. $700 million in FCF for FY22 would compare to $640 million of free-cash-flow last year, or up 9.4%. However, keep in mind that on a per-share basis, the FCF is worth even more now due to the company’s share repurchases, which I will discuss next.

Buybacks

So what is Jabil doing with all that free-cash-flow? Answer: buying back shares. Now, most of my followers know that I don’t like to see companies that greatly over-emphasizing share buybacks over dividends directly to shareholders. That is typically a red-flag in my book (especially in the energy industry). However, I will make an exception for Jabil because I do believe the shares to be significantly undervalued.

As reported the Q3 conference call:

… for the year, we’ve repurchased 7.9 million shares for $475 million as we remain committed to returning capital to shareholders.

That equates to an average share price of $60.13. The stock closed Friday at $60.73, so no big “gain” yet on the share buybacks this year.

However, shareholders have gained from the fact that the average diluted share count has dropped from 152.0 million at the end of Q3 last year to 143.3 million this year (or down 5.7%). The point here is that, the combination of continued margin growth and a reduced share-count means that JBL shares are going to become increasingly more valuable as compared to top-line revenue growth which is, in and of itself, not too shabby. Indeed, FCF is likely to grow on the order 9.5% in FY22, while the number of shares will likely be down by ~6% by the end of FY22. That’s a great combination for shareholders.

Valuation

Over the past 12-months, JBL has generated $6.76/share in adjusted earnings. That equates to a current P/E=9.0x, about half the valuation of the S&P500. That low valuation is despite the fact that the company grew revenue by 15%+ in the most recent Q3.

Going forward, and given JBL’s current $10.4 billion EV, the following table summarizes current EV/EBITDA multiples based actual and estimated EBITDA for FY21, FY22, and FY23:

| YEAR | EBITDA (actual & estimated) | EV/EBITDA |

| FY21 | $2.1 billion – A | 5.0x |

| FY22 | $2.5 billion – E | 4.2x |

| FY23 | $2.6 billion – E | 4.0x |

As can be seen in the graphic, something’s got to give here. Either Jabil’s revenue and earnings trajectory has to significantly slow or the market would need to significantly increase the company’s market cap in order to stay at a still rather quite conservative (I would say cheap) 5x EV/EBITDA ratio.

Meantime, even if the company “only” generates $700 million in FCF this year, that is an EV/FCF multiple of only 14.9x. However, I think the company is more likely to generate somewhere in the neighborhood of $720-$730 million in FCF this year.

Risks

Jabil’s balance sheet is solid: from a total debt to core EBITDA perspective, JBL exited Q3 at 1.3x, had a cash balance of $1.1 billion, and $2.87 billion of long-term debt.

While Jabil has been executing very well in the face of strong headwinds (COVID-19 shutdowns in China, supply-chain disruptions, a slowing global economy, high inflation, etc), I do believe the company is at an elevated risk level due to continuing supply-chain risks and the potential for a more significant slow-down in the global economy.

I expect the global PC market to slow-down significantly as compared to the out-performance demonstrated during COVID-19, probably down 10% or more this year. However, higher ASPs should help and, as noted previously, Jabil today has a much more diversified portfolio that is no longer dependent on anyone (or two, or even three…) technology sub-sectors for growth.

Jabil has competition from companies like FLEX (FLEX), however, note that FLEX also released relatively strong quarterly earnings. The point here being that some of the Technology sub-sectors are growing so strongly that there appears to be plenty of growth in the EMS market for both companies (and others as well). Besides, many tech companies are putting a higher priority on having secure second-sources to help mitigate supply-chain disruptions.

Summary & Conclusion

Jabil is trading at a very-low valuation level in comparison to its revenue, earnings, and FCF growth. The company is due to release Q4 and FY23 earnings on September 27th before the market opens, at which time CEO Mark Mondello will also give an investor briefing and outlook for fiscal-year 2023.

If the strong Q3 results are used as a guidepost for Q4, my take is that Jabil is a STRONG BUY going into the earnings report and investor update.

That because JBL is hitting on all cylinders and is no longer the relatively cyclical company it may have been in the past. That’s because JBL has strong operations in a number of strong Tech sub-sectors outside of PC’s and iPhones (i.e., EVs, healthcare, packaging, 5G infrastructure, cloud, etc.).

My 12-month price target for JBL is $75 (up ~24% from here), or 10x FY22’s EPS estimates of $7.45/share.

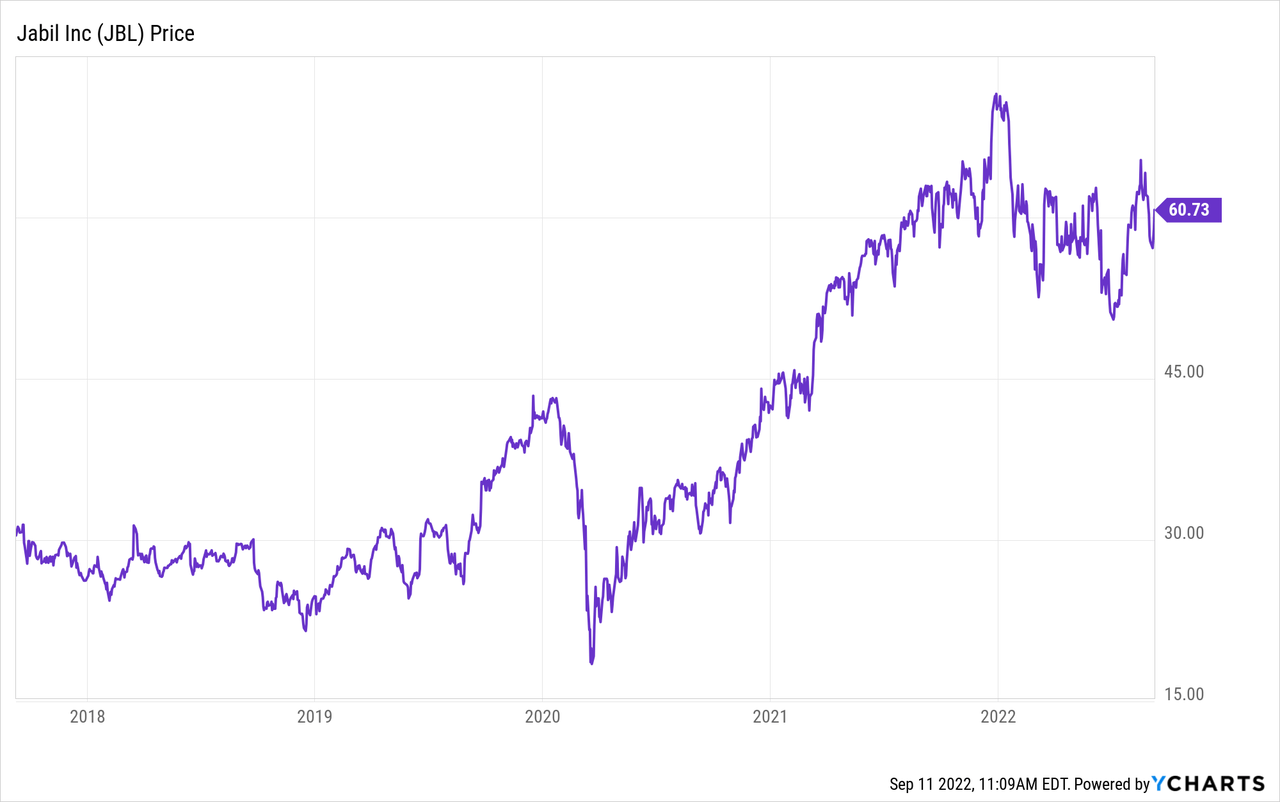

I’ll end with a 5-year chart of JBL and note that a move back to $70 would merely put the stock back where it was in January and would give it a P/E of only 9.4x based on company guidance of $7.45/share of earnings for FY22:

Be the first to comment