Leestat

Thesis

Cheniere Energy, Inc. (NYSE:LNG) stock has had a huge run in 2022, with a total return of more than 60% YTD. Therefore, astute investors who capitalized on LNG’s thesis have outperformed the market significantly, as the SPDR S&P 500 ETF (SPY) fell nearly 14% over the same period.

Leading US LNG players have also benefited from the energy crisis in Europe, despite near-term weakness in China. Russia has been throttling down the gas flows from the Nord Stream pipeline to starve Europe of its critical commodity in retaliation to western sanctions. Recently, Putin even turned off its gas flows to Europe entirely for an indefinite period as the crisis reached its feverish pitch.

Therefore, we urge investors not to jump on the bandwagon now. We surmise that LNG’s momentum surge has likely stalled and could fall from here. Despite a low valuation, investors need to prepare for challenging comps, as Dutch TTF and Henry Hub prices (NG1:COM) are primed to fall further. While we have not identified a sell trigger in LNG’s price action, we have noticed ominous price structures that suggest extreme caution should be heeded.

Accordingly, we rate LNG as a Hold for now.

Cheniere Can’t Keep Up This Momentum Moving Forward

Management is confident that the long-term structural drivers in the natural gas market remain intact. Furthermore, China’s near-term uncertainties should be resolved over time, providing the company with other critical growth tailwinds over the medium- to long-term, given China’s massive natural gas imports.

Despite that, China has also been leveraging the current energy crisis in Europe. It bought Russian gas at massive discounts, securing supply at much lower rates, as Credit Suisse (CS) highlighted:

Russian supply is still making its way into the market, just with a reorganization of trade flows via market participants who don’t take issue with accepting Russian cargoes. It appears China is happy to take Russian LNG cargoes at discounts, swapping out alternative supply that can then be directed to Europe at higher prices. (Bloomberg)

Therefore, we believe investors need to remember that the Russian gas supply has not disappeared but merely changed hands with different market participants willing to capitalize on the current geopolitical crisis.

Putin knows he will be able to find willing buyers for his energy flows. Therefore, we don’t think the current contract pricing in the natural gas market is sustainable, given its massive surge over the past year. Investors also need to consider the backwardation in forward pricing for Henry Hub contracts expiring in September 2026. It suggests pricing could be down by more than 40%.

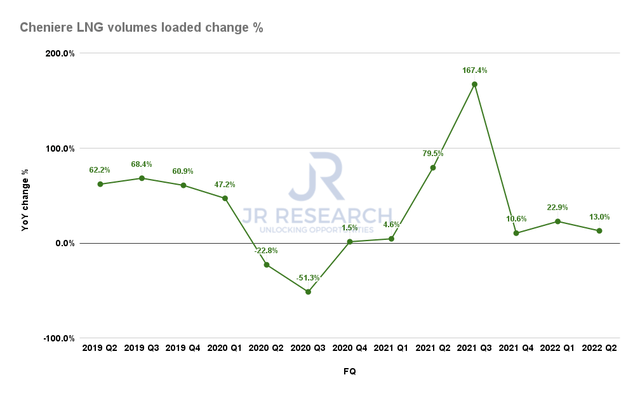

Cheniere LNG volume loaded change % (Company filings)

Furthermore, note that the growth in Cheniere’s LNG volume loaded has continued to moderate in Q2, up 13%, but down from Q1’s 22.9%.

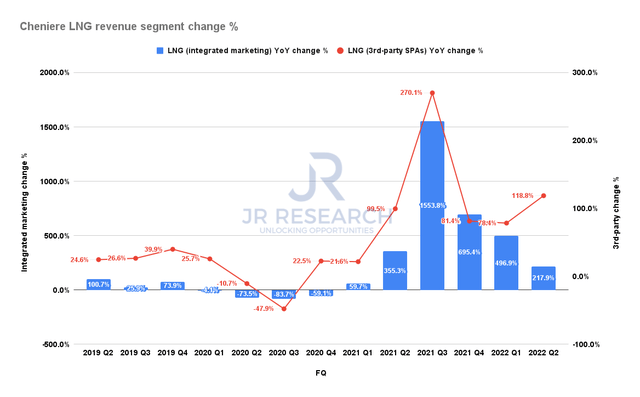

Cheniere LNG revenue by segment change % (Company filings)

Despite that, it’s critical LNG revenue segments still saw a massive surge in Q2. For example, integrated marketing revenue was up more than 200% YoY, while third-party’s revenue increased by nearly 120%.

Therefore, we surmise that the company has been benefiting from the underlying market, given the current pricing. But, we surmise that Cheniere would find it highly challenging to keep up its growth cadence, given much tougher comps from Q3. Furthermore, we deduce that the underlying market is primed for a steeper fall moving ahead, lending further headwinds to Cheniere’s growth momentum.

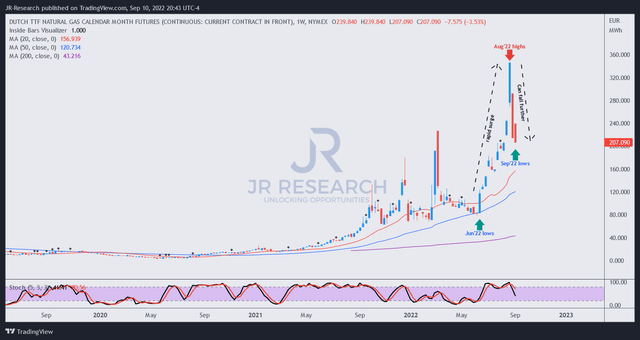

Dutch TTF futures price chart (weekly) (TradingView)

As seen above, a massive correction saw TTF fall initially to its June/July lows. However, the energy crisis in Europe escalated further, culminating in Putin turning off the gas flows to Europe entirely for an indefinite period.

Despite that, we gleaned that the TTF futures exhibit classic topping price structures that could portend a steeper fall. Despite the recent pullback from its August highs, we surmise the rapid momentum spike from June to August could come under more pressure, as the price action suggests.

Furthermore, Europe is committed to instituting price caps on energy flows to reduce the significant damage it has done to its economy. Moreover, Putin has pulled the ultimate lever on Nord Stream by completely shutting down its gas flows. Hence, what else could Russia do from here? The tailwinds seem to be turning into headwinds, given TTF’s unsustainable surge and challenging comps from Q3.

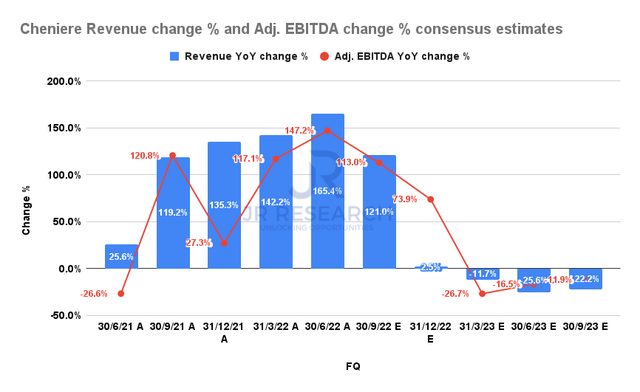

Cheniere revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Consequently, we are not surprised that the consensus estimates (very bullish) indicate that Cheniere’s Q2 could be its near-term peak. Therefore, investors should expect its revenue and adjusted EBITDA growth to decelerate markedly from Q3 through FY23.

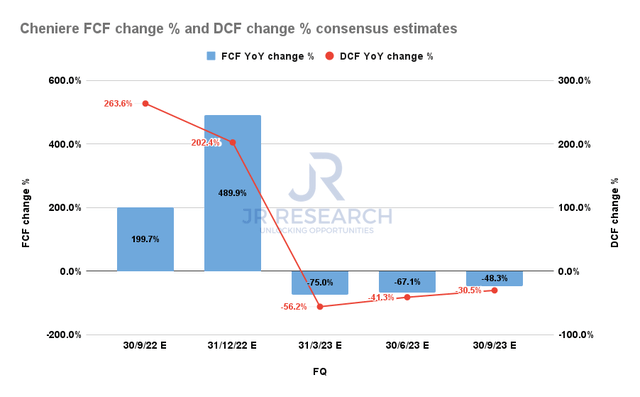

FCF change % and DCF change % consensus estimates (S&P Cap IQ)

As a result, it’s also projected to impact the growth cadence in its free cash flow (FCF) and distributable cash flow (DCF), with FY22 expected to be its peak.

Therefore, we deduce that the company could be hampered in improving its dividend yield significantly given its high debt levels, even though we don’t expect the current dividend policy to be impacted. With a low payout ratio offering a low NTM dividend yield of 1%, we believe the dividend payouts look relatively secure based on its projected FCF margins through FY24.

Is LNG Stock A Buy, Sell, Or Hold?

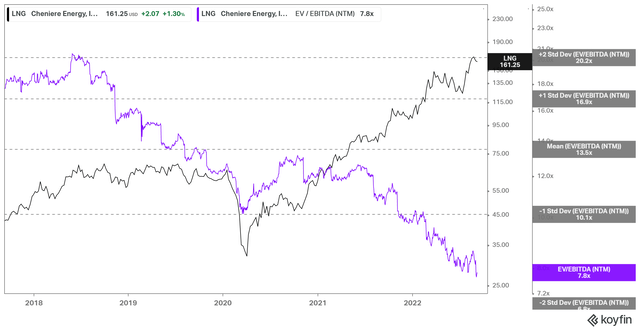

LNG NTM EBITDA multiples valuation trend (Koyfin)

We concur that LNG’s low valuation seems to disagree with our thesis that LNG’s momentum could slow dramatically moving ahead.

However, we urge investors to consider our discussion that its EBITDA growth could decline. Therefore, we surmise that the market is looking well ahead and assessing whether Cheniere could keep up its growth cadence.

As a result, we believe LNG’s low NTM valuation should not be construed at face value. Instead, we encourage investors to look beyond the NTM, as Cheniere’s falling adjusted EBITDA estimates could impact its valuation markedly.

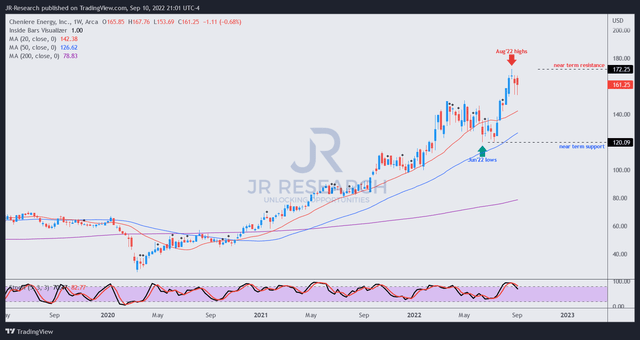

LNG price chart (weekly) (TradingView)

We gleaned that the upward momentum in LNG’s price action has stalled since late August, even though the rapid digestion has yet to occur.

But, we postulate that the rapid spike from its June lows to its August highs is unsustainable. Coupled with well-overbought momentum, we urge investors to be patient and wait for the recent surge to be digested first.

As a result, we rate LNG as a Hold for now.

Be the first to comment