krblokhin

Altria (NYSE:MO) remains a desirable dividend stock for investors after the cigarette firm raised its quarterly dividend payment to $0.94 per-share at the end of August. Additionally, e-cigarette marker Juul Labs settled a probe into its marketing practices for vaping products for $440M which may help clear some of the negative sentiment overhang that has been created in recent months. With a higher dividend and a settlement announced, shares of Altria could go into a new up-leg!

Juul Labs to pay nearly $440M to end a two-year probe into its marketing practices

The U.S. Food and Drug Administration banned the sale of Juul’s e-cigarettes in the US marketplace in June, but a US federal appeals court immediately put a hold on the FDA’s ban. The FDA’s decision created significant selling pressure and negative sentiment overhang for Altria’s stock since the cigarette company acquired a 35% ownership interest in Juul Labs in 2018 for $12.8B. Juul Labs has been one of the fastest growing businesses for Altria in a market that has seen gradual decreases in the share of smokers for a very long time. The initial (and later suspended) FDA ban of Juul’s e-cigarettes has been the key reason why Altria was forced to write down the value of its investment in Juul Labs to just $450M in the second-quarter. Altria will continue to challenge the ban in court.

Last week, Altria announced that Juul Labs agreed to a settlement with 34 states and territories that requires Juul Labs to pay $438.5 over a period of 6-10 years. US states have probed Juul Labs for marketing its vape products to younger consumers.

What impact will the settlement have on Altria?

The settlement removes a major legal liability for Juul Labs and, as I stated before, I believe a complete ban on Juul’s e-cigarettes is highly unlikely to occur considering that traditional tobacco products are freely available to US adults. Altria also had $2.57B in cash on its balance sheets as of June 30, 2022, meaning the settlement does not pose in any way a liquidity risk for the cigarette company.

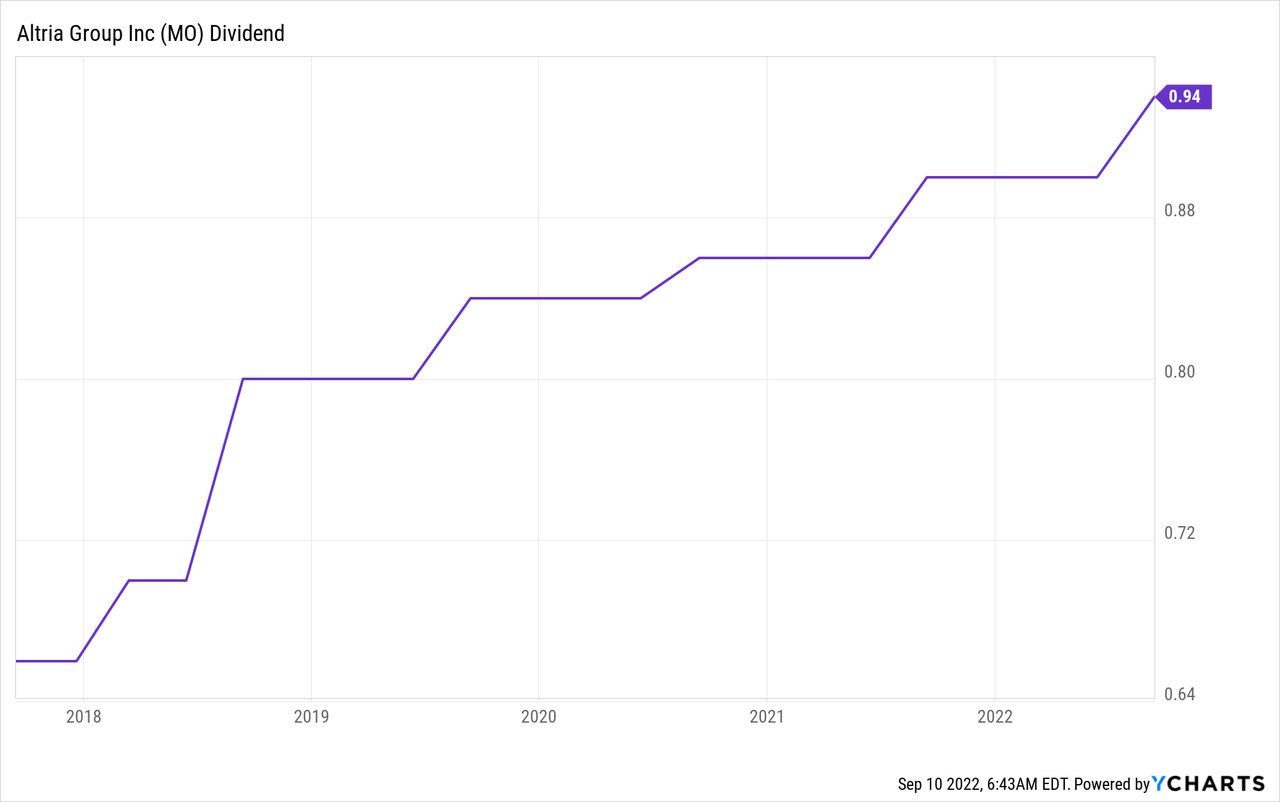

Altria increases its dividend

Altria raised its quarterly dividend by 4.4% in August to $0.94 per-share, meeting my top end expectation (I projected a new dividend rate between $0.92-0.94 per-share earlier this year). Based off of the new dividend rate, shares of Altria yield an attractive 8.3%.

Altria has said it plans to pay out 80% of its adjusted EPS. Adjusted EPS expected for this year to be $4.79-4.93 per-share and the guidance for FY 2022 implies 4-7% earnings growth year over year.

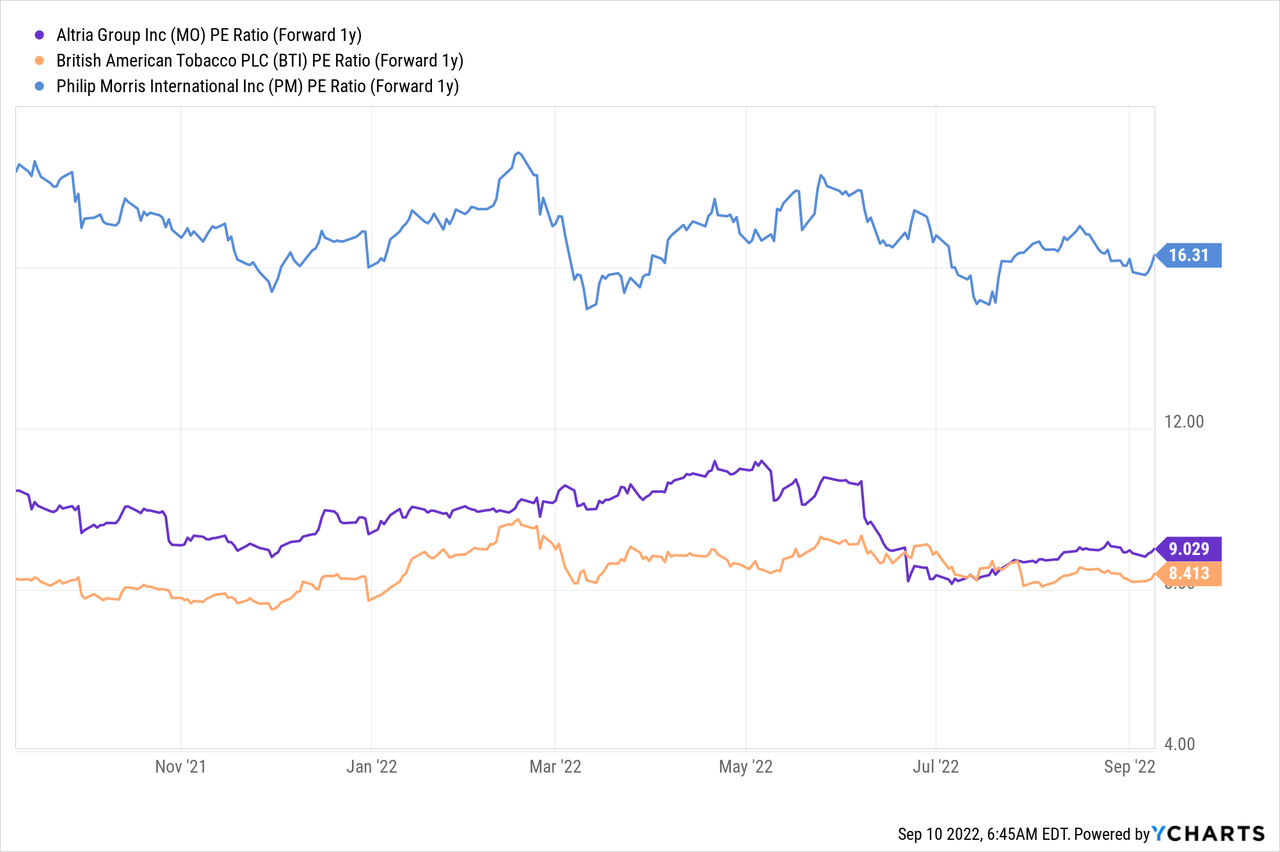

Altria is cheap based off of earnings

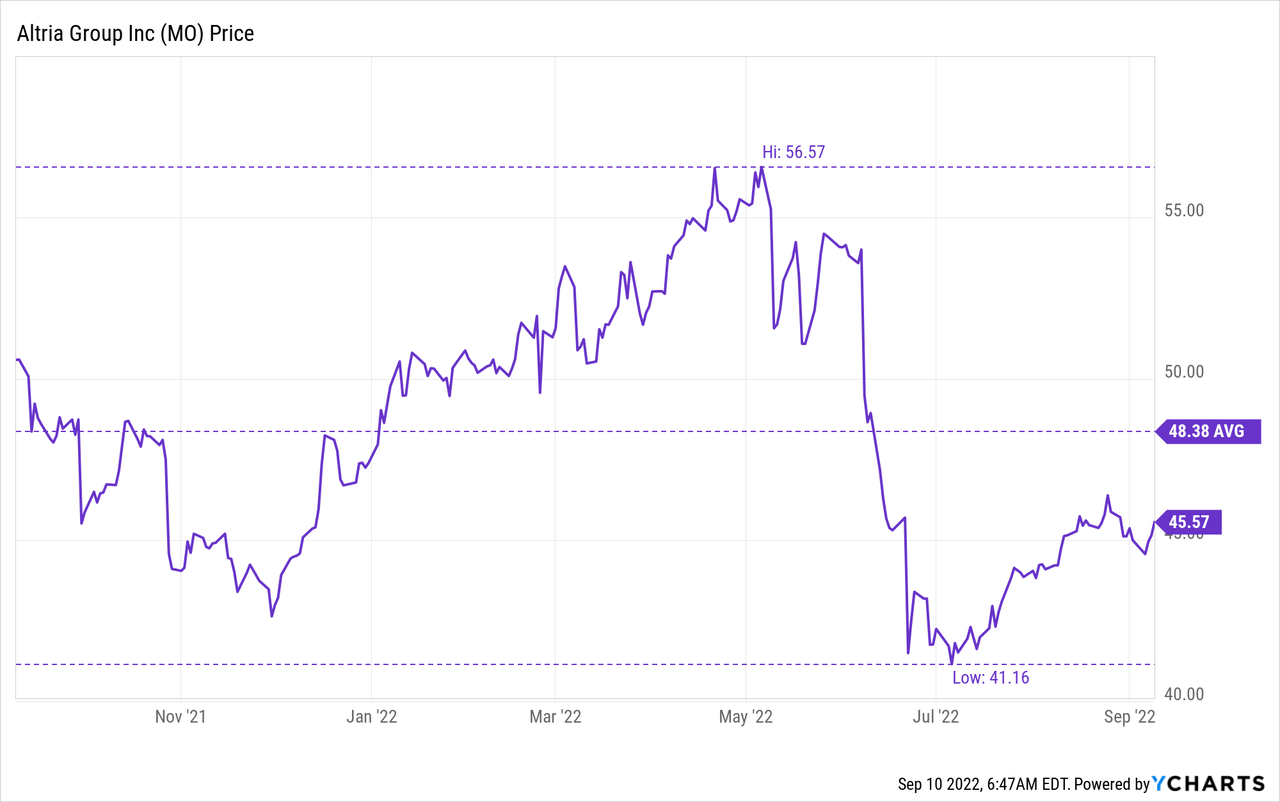

Shares of Altria have failed to recover from the sell-off in June. Although shares have moved up from $40 to $45, they are still trading 16% below the early June level. The lack of a rebound creates an opportunity for dividend investors to swoop in and buy shares of Altria at a higher dividend yield and a lower price based off of expected earnings.

Altria currently has a P-E ratio of 9.0 X while British American Tobacco (BTI) has a P-E ratio of 8.4 X. Philip Morris International (PM) has a P-E ratio of 16.3 X and it is the most expensive of the lot.

Altria’s current P-E ratio is also below the average P-E ratio over the last year and the stock clearly appears to have bottomed in July…

Risks with Altria

Altria’s biggest risk relates to the political/regulatory landscape. The Juul Labs’ e-cigarette ban had a very negative impact on Altria’s shares and the company has almost completely written off its investment in the e-cigarette maker as a result. While I continue to believe that a complete ban of vape products is unlikely, Altria’s stock may revalue lower if new restrictive measures on tobacco/vape advertising are announced. A complete vape ban, as unlikely as it is, would likely be a very negative event for Altria’s stock. What would change my mind about Altria is if the company lowered its EPS guidance for FY 2022 or were to slow its dividend growth.

Final thoughts

Juul Labs’ settlement with a large number of US states and territories removes uncertainty and it could drive shares of Altria into a new up-leg. Shares of Altria have still not recovered from the June sell-off, but the settlement may clear the path for a higher valuation. Additionally, the increase in the dividend rate is a positive for investors who are currently receiving an attractive 8.3% yield. Since the tobacco company is trading at a very low P-E ratio and has a targeted 80% payout ratio, Altria is an attractive buy, not only for dividend investors!

Be the first to comment