udra/iStock via Getty Images

Bank of America, Michael Hartnett, Chief Investment Strategist recently stated, “The bear-market rally for stocks has disappeared as investor concerns about inflation and interest rates linger.” “We’re in a technical recession but just don’t realize it.”

Freight Waves, Henry Byers reported, “US import demand is dropping off a cliff as inbound container volumes to the US are reverting to pre-pandemic levels.” Byers went on to say that “The consumer is getting crushed as conditions for the consumer seem to be getting worse and worse as inflation takes hold and prices get more and more expensive.”

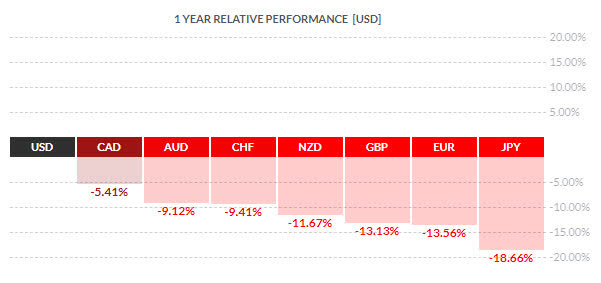

We have quickly moved from seeing the dark clouds on the horizon to the start of entering the initial storm wall. The USD put in a major low on January 6th, 2021. Since then, it has been in a strong uptrend as global investors seek safety with the uncertainties about geopolitical events, record inflation, rising interest rates, slowing housing, plummeting auto sales, increasing retail inventories, expanding consumer credit, and pending layoffs.

Source: Finviz

US DOLLAR ETF: UUP +16.69%

UUP remains in its uptrend as the price continues to move up from its base of accumulation.

After having a brief 2-week pullback of -3.45%, UUP has found support and is now looking to extend its bull market trend.

Investors who are liquidating stocks and moving to a cash position could consider UUP to capitalize on the strengthening US Dollar.

INVESCO DB USD INDEX BULLISH FUND ETF • UUP • ARCA • DAILY

20+ YEAR TREASURY INVERTED ETF: TBF +38.89%

TBF remains in its uptrend as the price continues to move up from its base of accumulation.

After having a 3-week pullback of -6.21%, TBF has found support and is now looking to extend its bull market trend.

Investors who are liquidating stocks and moving to a cash position could consider TBF to capitalize on the Fed raising interest rates to try and curb inflation.

PROSHARES SHORT 1X 20+ YEAR TREASURY ETF • TBF • ARCA • DAILY

S&P 500 SHORT INVERTED ETF: SH +19.33%

SH remains in its uptrend as the price continues to move up from its base of accumulation.

After having a 2+-week pullback of -7.19%, SH has found support and is now looking to extend its bull market trend.

Investors who are liquidating stocks and moving to a cash position could consider SH to capitalize on the falling stock market.

PROSHARES SHORT 1X S&P 500 ETF • SH • ARCA • DAILY

Learn how we use specific tools to help us understand price cycles, set-ups, and price target levels in various sectors to identify strategic entry and exit points for trades. Over the next 12 to 24+ months, we expect very large price swings in the US stock market and other asset classes across the globe. We believe the markets have begun to transition away from the continued central bank support rally phase and have started a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern begin to drive traders/investors into Metals and other safe havens.

Historically, bonds have served as one of these safe havens. This is not proving to be the case this time around. So if bonds are off the table, what bond alternatives are there? How can they be deployed in a bond replacement strategy?

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment