yoh4nn/E+ via Getty Images

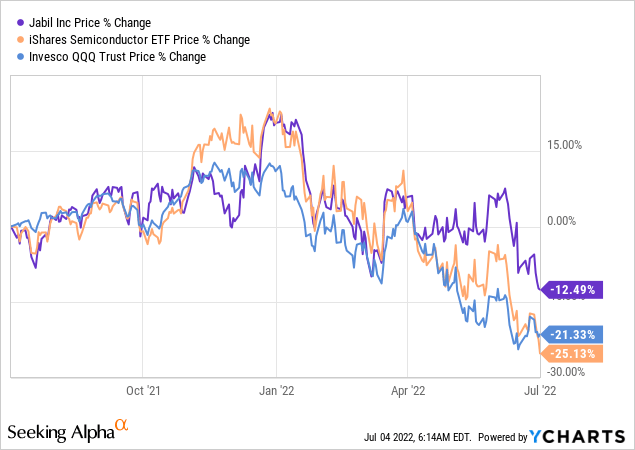

Currently trading at around $50.5, electronic manufacturing services company Jabil’s (NYSE:JBL) stock has been relatively resilient amid the selloff seen in the wider tech sector including semiconductors during the last year.

This is illustrated in the chart below with JBL having suffered less than the Invesco QQQ Trust (QQQ) or the iShares Semiconductor ETF (SOXX) since the beginning of this year, in a period marked by the Federal Reserve hiking rates to address the problem of high inflation.

My objective with this thesis is to assess whether after a year-to-date dip of about 28% and at a forward price-to-earnings ratio of 6.86x, JBL is a buy.

I start by providing an overview of the company’s revenue growth and profit margins.

Jabil’s Revenues and Profitability

The company manufactures electronic circuit boards commonly used in a variety of industries, including 5G, autonomous driving, healthcare, connected devices, automotive, and digital printing, in addition to cloud and networking.

With its worldwide presence and a high degree of automation at its factories which permit just-in-time manufacturing, Jabil plays a key role in the supply chain for electronic components. In this respect, while equipment producers like Cisco (NASDAQ:CSCO) for example have been facing difficulties to get components from China in order to assemble networking devices, the electronics play has been able to deliver thanks to its more diversified approach. This includes flexibility for input (raw materials) it receives from a diversified supplier base and resiliency for output (finished products) delivered to customers through the automated manufacturing process.

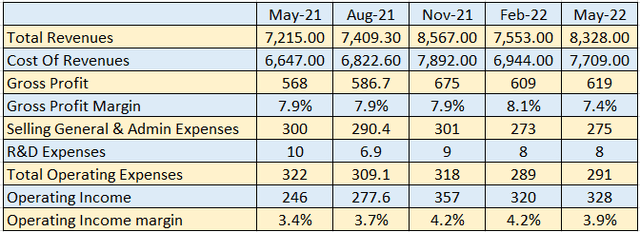

Thus, revenues of $8.3 billion obtained during the third quarter of 2022 (Q3 of FY-2022) were up by 15.3% year-on-year. Equally important, they beat consensus by $80 million.

Quarterly income statement (www.seekingalpha.com)

For greater context for newer investors, Jabil supplies circuit boards to major brands such as Apple (AAPL) Amazon (AMZN), Johnson & Johnson (JNJ), and Tesla (TSLA).

Shifting to profitability, Q3’s results show that there has been a decrease in gross profit margins by 0.5% (from 7.9% to 7.4%) which the executives attribute to product mix, namely variances in production volumes of EMS (Electronics Manufacturing Services) and DMS (Diversified Manufacturing Services), the two operating segments. Still, this shortfall has been compensated for by an operating margin gain of 0.5% (from 3.4% to 3.9%) as shown in the table above. This has been made possible through a reduction in sales and marketing expenses. As a result, Q3’s non-GAAP EPS of $1.72 beat consensus by $0.10.

Still, in a period that is characterized by rising costs of doing business, another key metric to assess the sustainability of Jabil’s business model in view of new competitors emerging in East Asia or an escalation of geopolitical tensions.

The Business Model

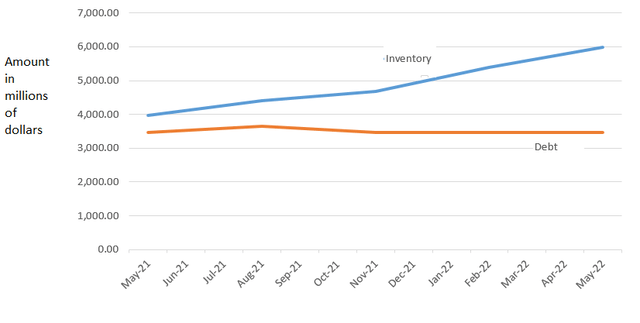

As a U.S.-based company, Jabil faces challenges, especially from low-cost factory operators from China and Vietnam. Furthermore, the company is not growing at the same rate as other companies in the semiconductor value chain like Synopsys (NASDAQ:SNPS), an Electronics Design Automation play that grew by 25% during its last reported quarter. Thus, Jabil may have to spend money on acquiring new companies in order to scale operations which implies an increase in capital expenses, and debt which is already high at $3.47 billion. At the same time, inventory has also surged as shown in the blue chart below.

Chart built using data from (www.seekingalpha.com)

Moreover, with wage inflation being higher in the U.S compared than Asia, there are risks that operating margins which are less than 4% fall further due to higher component prices resulting from expedited shipping expenses following COVID-related lockdown measures in China.

Looking for answers, I noted that the management expects the bulk of the company’s growth to occur organically thanks to in-house domain expertise. This implies fewer capital expenses and augurs well for debt.

I also noted the company’s ability to merge capabilities in different areas rapidly which suggests process efficiency and by ricochet, better profit margins. The management aims at an operating margin of 5% in FY-2024 or more than a 25% rise from the current level. This remains feasible considering that the company has managed to deliver more sales without necessarily incurring additional expenses despite being exposed to two months (April and May) of China’s lockdown in its third quarter, which ended in May.

Furthermore, Jabil’s business model seems designed to circumvent risks of inventory build-up in expectation of higher sales numbers as is usually the case with manufacturers. Thus, any inventory order for a finished good requires a customer PO (purchase order) before raw materials can be purchased. In this way, the company has offset part of the higher inventory levels with the advance part payments received from customers through POs. As a result, while the number of inventory days in Q3 showed as 85, the actual figure was 70, or one day less than the previous quarter.

Investigating further, the majority of Jabil’s inventory consisted of raw materials in Q3, with finished goods representing only about 11% of inventory, implying less money lying idle.

Thus, the business model is resilient, but in high inflation times, it is also important to assess FCF (free cash flow).

Cash flow and Valuations

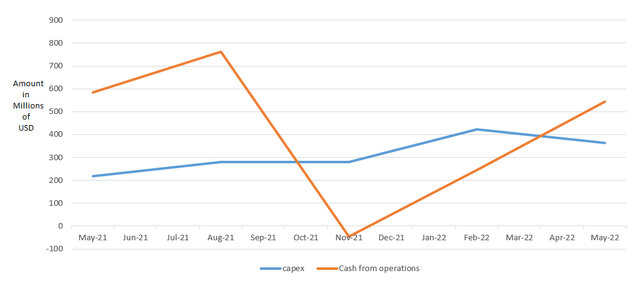

The levered FCF which was negative for the November 2021 and February 2022 quarters turned positive in Q3 when cash flows from operations were $545 million, against capital expenditures of $324 million. Assessing for sustainability, I noticed that the company was able to deliver two consecutive quarters of positive cash from operations as depicted in orange in the chart below, while Capex (in blue) is trending slightly downwards. The upward trend in cash from operations looks to continue as the management remains committed to delivering at least $700 million in FCF for its FY-2022 which ends in August. This would represent a 9.4% increase over FY-2021’s $640 million.

Capex and Cash from operations trend (www,seekingalpha.com)

Another metric I find useful is the Capex to Sales ratio which is the percentage of the company’s revenue that is spent on capital expenses. This has been oscillating in the 3% to 5.6% range during the last five quarters signifying that Jabil is demonstrating efficiency in allocating capital. In this respect, according to executives, the investments made in operations and automation of factories should last till FY-2024.

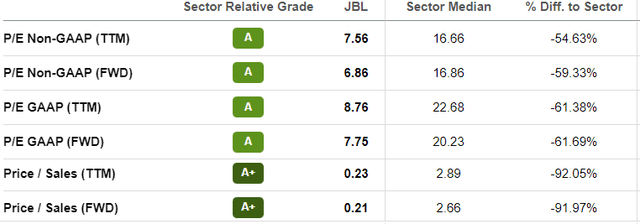

Consequently, with a sustainable cash flow, Jabil makes for a buy, and, it remains undervalued by at least 50% when considering price-to-earnings and price-to-sales metrics as shown in the table below. Making an adjustment to its current share price of $50.5, I obtain a target of $75-76.

Valuations metrics (www.seekingalpha.com)

This said, as shown in the introductory chart, the stock has been highly volatile since the beginning of 2022, despite SA’s quant and Wall Street analysts being bullish on the stock. This is probably because of its lower profit margin grades when compared to the IT sector. Now, with factors like profitability taking center stage as the value strategy prevails and recession risks loom, further downside risks for the stock should not be excluded.

Conclusion

Still, I remain bullish for the medium term given the company’s long streak of earnings beats, but the upside may come only in mid-September when fourth-quarter financial results are announced. Finally, after going through growth, profitability, inventory, and cash flow, it is found that Jabil’s product portfolio remains well-diversified and its business model is resilient to continued demand fluctuations. This said, with the stock market exhibiting a high degree of volatility, it is better to wait for the dust to settle and a better margin of safety before investing.

Be the first to comment