grandriver

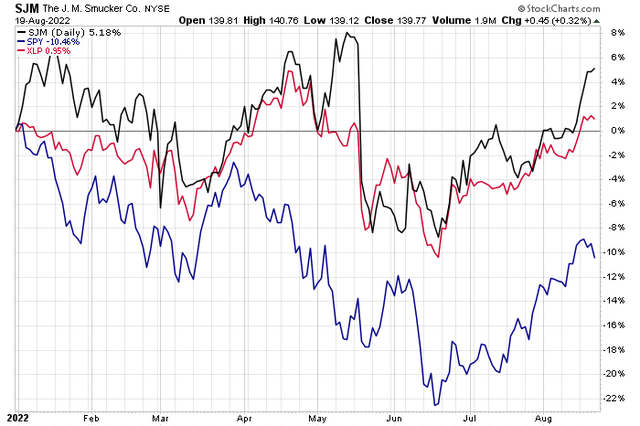

Consumers are tightening their purse strings. The Consumer Staples SPDR ETF (XLP) is positive on a total return basis this year as families make the shift away from luxuries toward necessities. One household name, reporting earnings Tuesday morning, is beating both its sector and the broad market right as kids head back to school.

Consumer Staples Positive This Year

According to Bank of America Global Research, J. M. Smucker Company (NYSE:SJM) is one of the largest U.S. food manufacturing and food service companies, with $8 billion in sales and $1.4 billion in operating profit in FY22 across its four main sectors: U.S. retail consumer coffee, U.S. retail consumer foods, U.S. retail pet foods, and international and foodservice.

The $15 billion Ohio-based Food Production industry company within the Consumer Staples sector is listed on the S&P 500 and has a high price-to-earnings ratio near 24-times last year’s earnings, according to The Wall Street Journal. SJM pays a solid yield of 2.9%, and it reports Q2 results before the bell Tuesday this week.

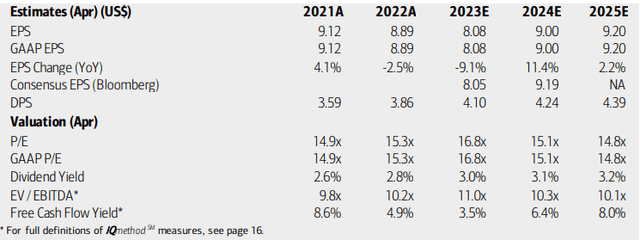

Analysts at BofA expect profits per share to drop off this year and next before a solid earnings increase in 2024, due in part to Jif peanut butter recalls. Dividends are seen as increasing throughout the next several years, however. Using forward operating earnings, the stock’s P/E is much more attractive near 17. Moreover, the firm is free cash flow positive now and is expected to be in the years ahead.

SJM: Earnings, Dividend, Valuation Forecasts

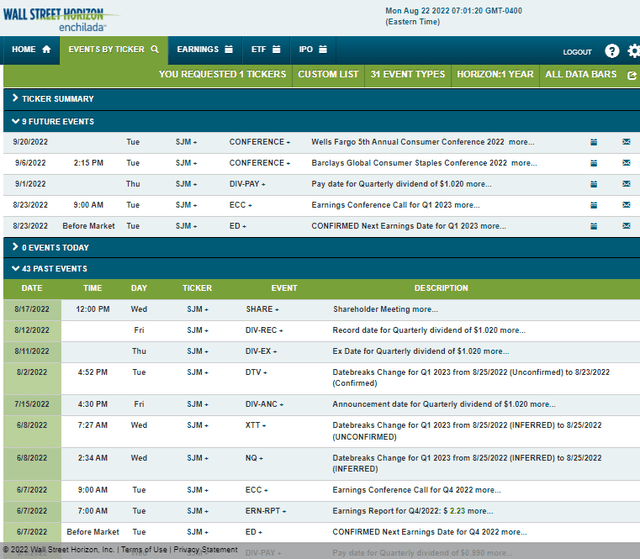

SJM’s corporate event calendar shows Tuesday morning’s Q1 earnings report and conference call beginning at 9:00 AM ET. You can listen live here. More volatility could strike around a pair of industry conferences in September. Wall Street Horizon lists SJM as a presenter at both the Barclays Global Consumer Staples Conference on September 6 and the Wells Fargo 5th Annual Consumer Staples Conference on September 20.

Corporate Event Calendar: Earnings & Two September Conferences

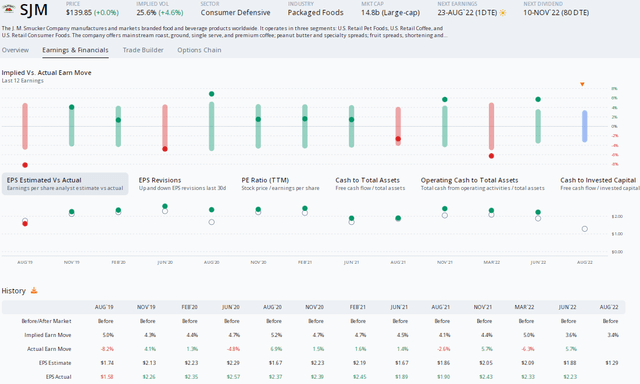

Digging into the earnings report and its expectations, data from Options Research & Technology Services (ORATS) show an expected stock price change of 3.4% on Tuesday following the earnings release using the nearest-expiring at-the-money straddle. Analysts see $1.29 of EPS, which would be a decline from the same quarter a year ago as SJM dealt with Jif recalls and some divestitures. ORATS reports that there have been 2 analyst upgrades of the stock in the last three months and a single downgrade. Remarkably, SJM has beaten EPS estimates in the previous 11 quarters.

SJM Earnings Preview: A Small Implied Stock Price Swing

The Technical Take

I like the price action in SJM over the last several months. The stock is positive year-to-date, easily beating both the staples ETF and the broad market while continuing to work off a bullish double bottom pattern from late 2018 and early 2020. More recently, shares found support around $120 before a massive jump just last week. Some resistance is seen in the low to mid-$140s before the all-time high can be approached.

I like the bullish rounded bottom over the years, and I see the broad trend higher continuing. While a slow & steady rise, investors are also paid to own this low-beta stock considering its dividend yield. I expect SJM to challenge the all-time high in due time, but $118-$120 must hold.

Bullish Rounded Bottom, Near-Term Price Levels To Watch

The Bottom Line

SJM looks good now that the Jif recall woes are past and that the firm has sold off some product lines. That re-focus should boost earnings in the years ahead, all while the current valuation is not bad. The technical picture looks good ahead of earnings Tuesday. I expect an EPS beat given its earnings history.

Be the first to comment