Alex Wong

The passing of the Inflation Reduction Act has been hailed as a rare win for an administration beset by rising inflation, falling real incomes, and a weakening economy. It is set to be one of the most material climate-focused bills passed by Congress as it allocates $370 billion over 10 years to decarbonization initiatives. The $7,500 electric vehicle tax credit is set to be renewed in January 2023 and will last until the end of 2032, providing a boost for the fledging yet fast-growing US EV sector.

However, the bill includes a prohibitive requirement that qualifying cars must be assembled in North America. It also states that critical minerals in the battery must come from the US or a country with whom the US has a free trade agreement. This would immediately make Fisker’s (NYSE:FSR) Ocean SUV ineligible for the tax credit as soon as the bill takes effect as the company’s upcoming EV will be built by Magna International (MGA) under contract at a plant in Austria.

Fisker has announced a process for reservation holders to retain the federal tax credit if they convert their existing Ocean reservations into a binding sales contract. This will essentially see current reservations become non-refundable orders if the holders take action before the bill is signed into law. Fisker is still on track for its start of production (SOP) in November this year with deliveries to follow soon after in early 2023.

The company recently released its fiscal 2022 second quarter results which provided an update on its efforts to begin SOP to fully realize the opportunities of the transition to zero-emission transportation that lays ahead.

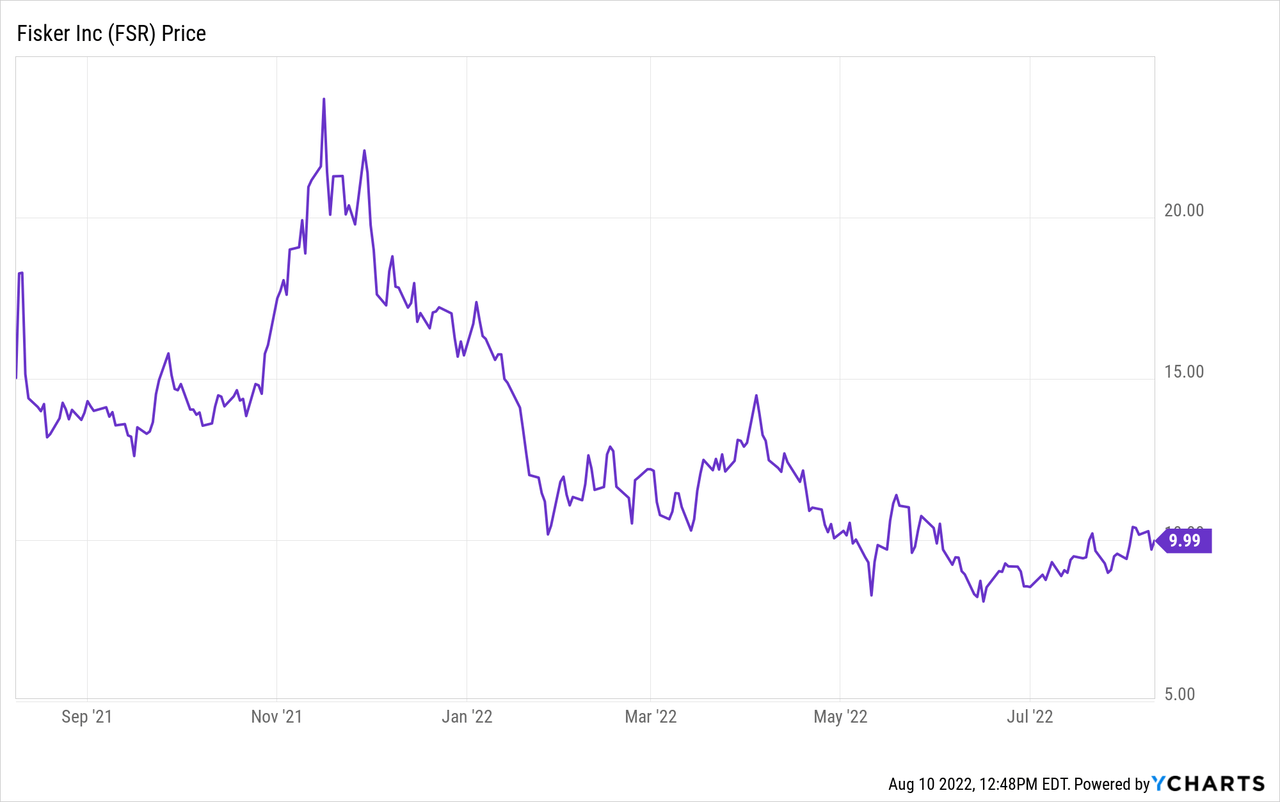

This was against a stock price that has fallen 58% from its 52-week high to just under $10 as the initial enthusiasm around the growth of the sector wilted. This was primarily due to rising inflation risks and an inverting yield curve that removed investor appetite for growth stocks.

Fisker Makes Progress As Ocean Set To Hit The Road

When Fisker reported pre-revenue earnings results for its fiscal 2022 second quarter last week the company stated that its Ocean SUV is on track to begin production in Austria from November 17th. Cash burn from operations during the quarter rose sequentially to reach $149.5 million from $106 million in the first quarter. It also grew 432% from a burn of $28.1 million in the year-ago quarter.

Capital expenditure was lower at $54.2 million, this was a sequential increase of 18.3% with spending ahead of the November SOP date in focus. The company’s reservations have continued to grow and reached 56,000 during the quarter. However, most of these will have to be converted to non-refundable orders if they are to retain the $7,500 tax credit.

The company anticipates non-GAAP operating expenses and capital expenditures for its fiscal 2022 to be in the range of $715 million to $790 million, with capital expenditure to be between $280 million to $290 million. Hence, with cash and equivalents at $852 million as of the end of its last reported quarter, the company has stated it has enough capital to see it past SOP and other projects planned in 2022. Fisker also has a $2 billion shelf, of which $350 million was used during the quarter with an at-the-market equity program.

The company is set to realise hundreds of millions of dollars in revenue from next year as deliveries to its US customers start. Further, Fisker’s forward revenue visibility has been strengthened with most of its reservation holders highly likely to convert to non-refundable orders. This will also likely provide a boost to fundraising efforts when conversion figures come in.

The Emissions Reduction Act

Several automakers have come out to say that the Inflation Reduction Act will jeopardize 2030 EV targets by making most vehicles immediately ineligible for the incentive when it is signed into law. This would in turn reduce EV uptake by making them more prohibitively expensive.

Fundamentally, while the bill is a core part of the US plan to lower carbon emissions by about 40% by 2030, it is also meant to reflect the new geopolitical realities. It is likely to force a number of automakers to onshore production and look to invest in a domestic battery supply chain. Reducing reliance on autocratic regimes around the world on the back of an energy crisis partly caused by one such regime is important. This will help secure the future of EV adoption. This adoption even without federal and state incentives to encourage their uptake is set to grow on the back of elevated gas prices and with the European Union recently announcing a phase-out of fossil fuel vehicles by 2035.

The bill could be disastrous for sales, but with most of Fisker’s competitors in the same boat, it likely will not be.

Be the first to comment