Brandon Bell

Occidental Petroleum (NYSE:OXY) saw 10% returns on Friday, driving its market capitalization to almost $70 billion, on the announcement that Warren Buffett’s (NYSE:BRK.A) (NYSE:BRK.B) had received permission to acquire up to 50% of the company up from its current stake of roughly 20%. Despite that, as we’ll see throughout this article, we don’t recommend investing in Occidental Petroleum at the current time.

Fair Value

Berkshire Hathaway is legendary for its pursuit of value. The company won’t repurchase stock, regardless of shareholder pressure to the contrary. Take a look at some of the company’s recent Occidental Petroleum acquisitions in Seeking Alpha’s database:

The takeaway here is clear. As far as we can tell, the company has yet to pay more than $60.3/share during its build-up of its 20% stake, now worth more than $10 billion. Warren Buffett is well known for not caring about what the market things about the timeline or plan that he should follow. A market boost because he can buy up to 50% won’t change that.

The gaps in purchases are also telling. From July 13 until the week of August 4, the company bought nothing. Those were three trading weeks where the company’s stock never dipped below $60 and averaged in the $61-65 range. There was plenty of volume and volatility for the company to invest here, however, it waited for prices to go <$60 the first week of August to buy more.

In many ways, Berkshire Hathaway has placed a floor on Occidental Petroleum’s stock. At less than $60/share we expect the company to buy aggressively as it can. Prior purchases of 0.5-1% of the company on a weekly basis support this. The company will be helped by Occidental Petroleum’s own ~5% share repurchase program recently announced.

It’s worth noting here that the company has warrants to purchase 83.9 million shares, roughly 8% of the company’s outstanding shares at $59.62/share. We see those warrants as being near the upper end of what the company considers fair value. The takeaway here is that investors shouldn’t jump on the rise in prices assuming an offer is going to come in at $80-90/share.

We see no sign of the company rushing to buy.

Occidental Petroleum Financial Performance

Occidental Petroleum had strong second quarter performance, supported by high oil prices.

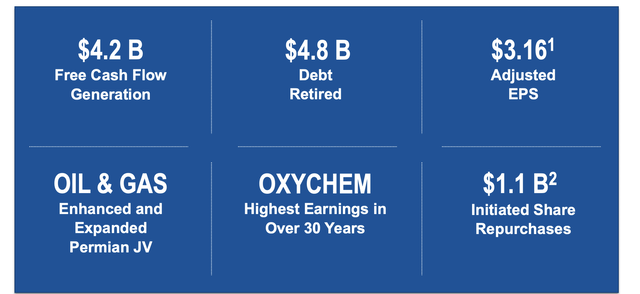

Occidental Petroleum Investor Presentation

The company generate a substantial $4.2 billion in FCF in the quarter, or a 24% market capitalization FCF yield. That FCF yield becomes 16% counting debt and preferred equity, still an incredibly strong FCF yield for the company. The company managed to retire $4.8 billion in debt and initiated $1.1 billion in share repurchases as well.

Financially, the company performed well, of course backed by strong oil prices. The company’s debt is back towards its targets, meaning we expect debt repurchases to slow down, although debt repurchases does save on interest expenditures. The company has intelligently kept its dividend minimal, enabling it to drive returns through repurchases.

Occidental Petroleum Valuation

Determining a fair valuation for Occidental Petroleum is tough. The company’s current fair valuation in our view is predicting long-term oil prices at roughly $80/share. The long oil prices remain above that value, the more the company can improve its value with share repurchases and more. Should prices drop below that level we expect that to change.

In our view, investors should be buying below $65/share. That gives investors a quality company at a strong price, while also enabling them to capture the additional value of a potential acquisition offer. That’s a unique catalysts that investors have that Berkshire Hathaway doesn’t, as the one that would have to pay the catalyst.

Overall that means we don’t recommend investing at the current time, although we recommending holding and waiting for the price to drop further.

Thesis Risk

There’s two risks to our thesis.

The first is timeline. Berkshire Hathaway is traditionally patient, but at some point, once you own enough, the tradition is to make an offer. The reasons vary, but in general, the smaller the float, the harder open market purchases become. At some point, the company will likely make an acquisition offer at a premium rewarding shareholders.

The second is oil prices. Occidental Petroleum has low costs and the company has generated incredibly high returns from crude oil prices sitting at $100/barrel. Should prices go above that level, or higher prices sustain themselves, that could cause the company’s price to skyrocket, affecting our thesis of ideal investment time.

Conclusion

Occidental Petroleum’s share price outperformed on Friday, with the announcement that Berkshire Hathaway can acquire 50% of the company. However, despite that outperformance, we feel that it’s misguided. The company is known for being focused on investments on fair value, and what it sees as fair value is clear.

We recommend investors hold onto their current stock. Occidental Petroleum has strong FCF, but it’s still price for higher oil prices of $80+/barrel. Prices have remained volatility and can drop below that level, hurting the company’s ability to continue shareholder returns. We recommend investors invest if prices drop below $65/share.

Be the first to comment