JohnCarnemolla

Vale S.A. (NYSE:VALE) is scheduled to pay $0.64 per share in cash dividends on September 9, 2022, to shareholders who purchased the shares before August 12. The company already paid $0.73 per share in dividends back in March 2022, which implies the 2022-to-September dividend yield will be as high as 10.6%.

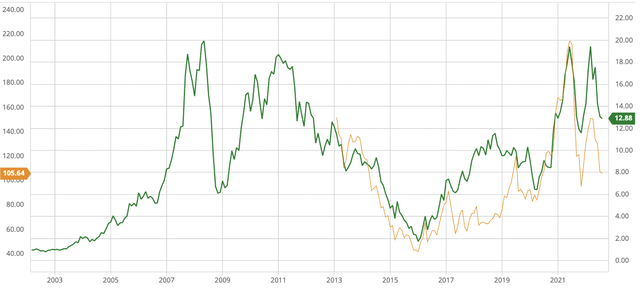

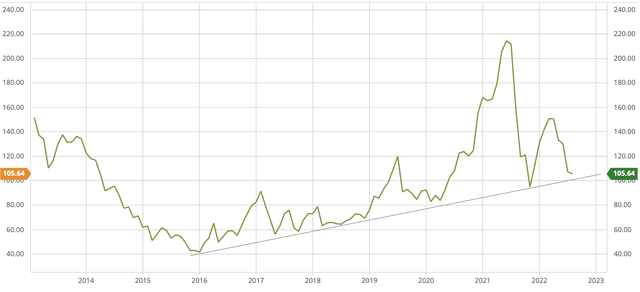

Such a high yield attracts numerous income investors, especially now that the stock has pulled back by some 37% since April 2022 (Fig. 1). The question, however, is whether the >10% dividend yield will sustain into the future. Below, let’s have a quick look.

Fig. 1. The stock chart of Vale, dividend back-adjusted, in comparison with iron ore 62% Fe CFR spot price (modified from Seeking Alpha and Barchart)

Vale shareholder remuneration Policy

Since 2018, Vale has established the following shareholder remuneration policy:

- The shareholder remuneration will consist of two semi-annual installments, the first to be paid in September of the current year and the second in March of the next year.

- Vale shareholder remuneration policy is variable, depending on how the business is doing. The minimum remuneration will be 30% of the adjusted EBITDA less sustaining investments, in other words, minimum remuneration = 0.3 X (adjusted EBITDA – sustaining investments), calculated based on the 1H results for the September installment, and on the 2H results for the March installment.

- The board of directors may approve additional remuneration in the form of extraordinary dividends.

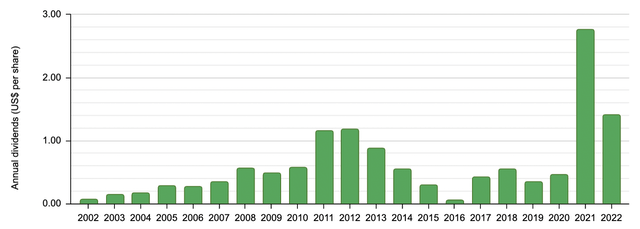

Operating in a hyper-cyclical industry, Vale has actually been rather shareholder-friendly considering its record of paying dividends in each and every year since 2002, which may be attributed to the influence of the Brazilian government through shareholding and the golden shares.

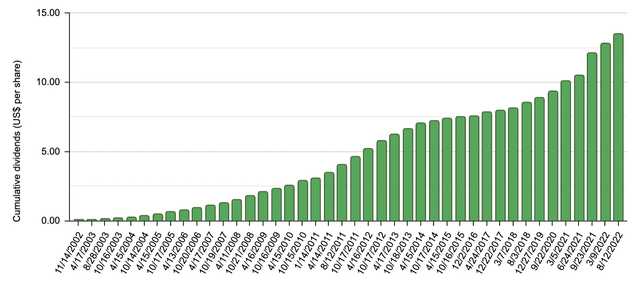

Dividend payments varied wildly across the years (Fig. 2), which may have attracted a lot of swing trading around dividend declarations. However, those who have held the stock since 2002 received a total of US$13.5 per share (Fig. 3). That is 13.5 times as much in cash dividends as the original cost of ~US$1 per share, in addition to a 12-bagger in capital appreciation (Fig. 1). Therefore, Vale shares – if bought on deep undervaluation – can reward long-term shareholders richly.

Fig. 2. Dividends paid out by Vale in years 2002-2022, by ex-dividend dates (compiled by Laurentian Research based on Vale financial releases)

Fig. 3. Cumulative dividend payments from Vale, by ex-dividend dates (compiled by Laurentian Research based on Vale financial releases)

Vale business characteristics

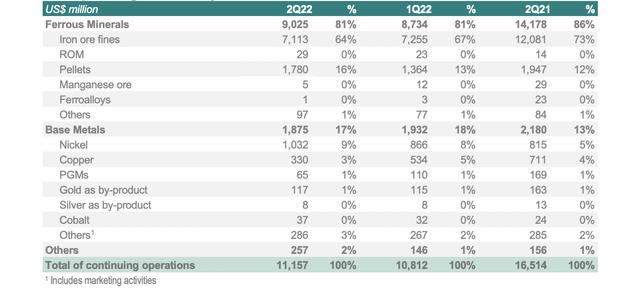

Vale is predominantly an iron ore producer. Iron ore fines and pellets account for 80% of its total revenue in each of 2Q2022 and 1Q2022, and as high as 85% in 2Q2021 (Table 1). The sales volume and realized prices of iron ore and the operating efficiency of the iron ore mines determine the profitability of Vale to a large extent.

Table 1. Net operating revenue of Vale by business area (Vale)

Iron ore prices

Iron ore prices have been particularly volatile since mid-2021. The Chinese government crackdown on the real property sector led to iron ore prices crashing to sub-US$100/ton levels in 2021. The war in Ukraine gave iron ore prices some support. However, lockdowns in major industrial hubs in China over the so-called zero-Covid policy brought the world’s second largest economy to the brink of collapse, resulting in another episode of weakness in iron ore prices. As of late August 2022, iron ore trades slightly above US$100/ton (Fig. 4).

Fig. 4. Iron ore 62% Fe CFR spot price (modified from Seeking Alpha and Barchart)

The China factor

China is the elephant in the room when it comes to the iron ore market. Many investors count on a stimulus package in China to support iron ore prices, as it had happened in the aftermath of the global financial crisis.

However, a lot has changed since 2008. Today’s China faces a myriad of unprecedented challenges; its population already began to dwindle; urbanization has stalled, while infrastructure is overbuilt; continual crackdown of non-government-owned industries made the private sector crestfallen, while three years of rolling lockdowns made the Chinese much less wealthy; with export-oriented manufacturing capacity moving to countries that are more business friendly and of lower labor cost, foreign capital is taking a flight from China.

Given the above, I am not sure if Beijing still has enough financial resources to stimulate its stagnated economy; even if the central government is committed to a financial stimulus after the conclusion of the CCP Congress later this year, it is uncertain whether the economy can still be revived while a new cultural revolution goes on in earnest.

Iron ore may find support at US$100/ton or it may not (Fig. 4). Given the shaky state of the Chinese economy, I would not rule out the possibility of iron ore prices dropping substantially below US$100/ton, e.g., ~US$42/ton in the worst case.

If iron ore prices decline further, the share price of Vale will likely go down with them. Such high uncertainty, in my opinion, diminishes the probability of an extraordinary dividend payment in the near future.

Investing in Vale for high yield

It is understandable retirees need high-yield dividends. However, we have heard too many stories of high yield chasers who got burned as the underlying business went kaput.

It is critically important to take no undue risk when investing for high-yield dividends. As I laid out in a previous article,

Here are three practical income strategies that are proven to deliver a stream of reliable yet expanding income:

- Strategy 1: wide-moat stalwarts in a cyclical industry;

- Strategy 2: wide-moat business in turnaround; and

- Strategy 3: wide-moat, secularly-growing businesses, bought during a recession or idiosyncratic crisis.

I believe Vale falls into strategy 1. It is the world’s leading iron ore producer, protected by a wide economic moat but unfortunately operating in a hyper-cyclical industry.

A prudent investor will only purchase shares of Vale during an industry downturn, when its iron ore business has been decimated as measured by reduced volume and low prices realized, and when dividends are cut and the stock is sold off as though the company were going bankrupt. Pulling the trigger to load up on Vale when everybody else is selling is not an easy decision to make. However, after the storm has passed, shareholders will most probably find a surviving Vale with its moat intact, that the iron ore business improves, and that dividends are raised. Soon, they may find Vale delivering ultra-high yield to the original cost.

Investor takeaways

Vale as the leading iron ore producer is a good stock for long-term income investors, given its established dividend policy and shareholder friendliness. The dividends do vary a lot as the iron ore cycle gyrates.

I am not sure the market has fully priced in the downside risk of iron ore prices, introduced by the shaky Chinese economy. Therefore, I am not a buyer of Vale stock at this time.

However, should iron ore prices break down, fall below US$100/ton, and settle at new lows, I plan to load up on Vale so as to reap high-yield income for years to come.

Be the first to comment