Vittorio Zunino Celotto/Getty Images Entertainment

French beauty and personal care titan L’Oréal (OTCPK:LRLCF) is recovering strong after a pandemic-induced slowdown in 2020. Although inflation may hinder its performance in the coming quarters, their affluent target market, and broad portfolio can mitigate any impact.

Looking ahead, the company has a number of growth drivers. Competitive risks remain however.

Stellar performance despite inflationary headwinds

L’Oreal, the world’s leading beauty player has recovered strongly from a COVID induced slowdown during the pandemic, helped by near term tailwinds related to consumers increasing cosmetics purchases as mobility increased following easing lockdown restrictions. After dropping 6.3% YoY in 2020, revenues surged 15.5% to EUR 32.3 billion in 2021. The momentum continued in 2022 with L’Oreal notching double digit growth in all three quarters of 2022 so far.

Revenues in EUR millions

|

2021 |

2022 |

YoY growth % |

|

|

Q1 |

7,614.50 |

9,060.50 |

18.99% |

|

Q2 |

7,582.10 |

9,305.80 |

22.73% |

|

Q3 |

7,996.60 |

9,575.20 |

19.74% |

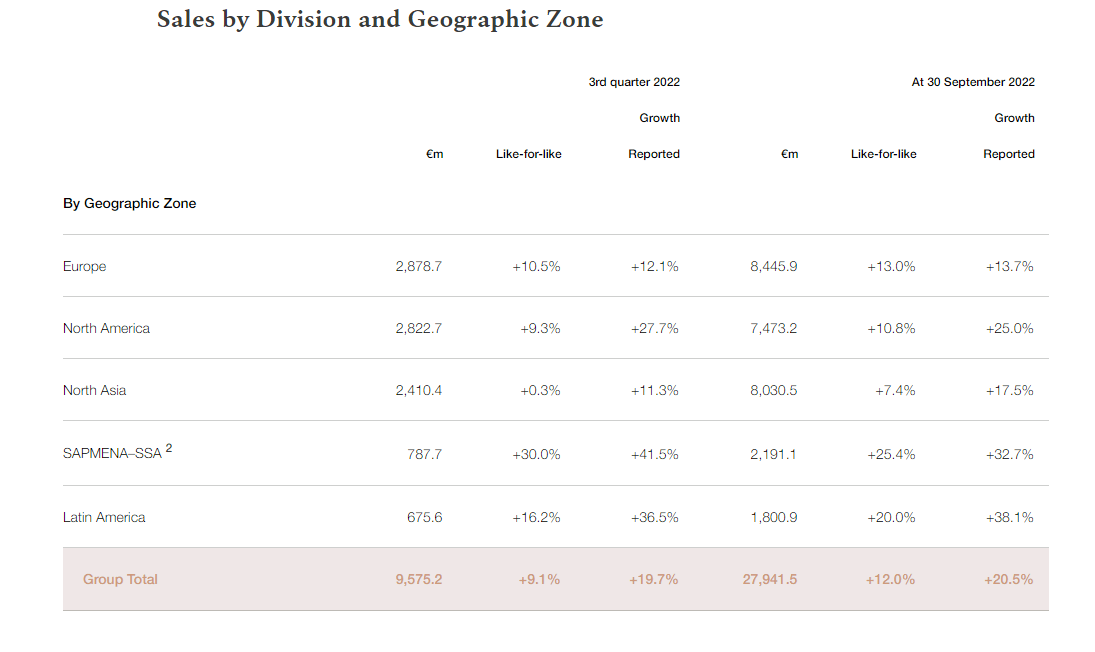

Worldwide sales rose 19.7% in Q3 2022 to EUR 9.58 billion despite inflationary headwinds, with sales growing in every region led by the SAPMENA zone (South Asia Pacific, Middle East and North Africa) which grew 41.5% YoY. Latin America followed with growth of 36.5% YoY driven by double digit growth in all countries and regions.

L’Oreal

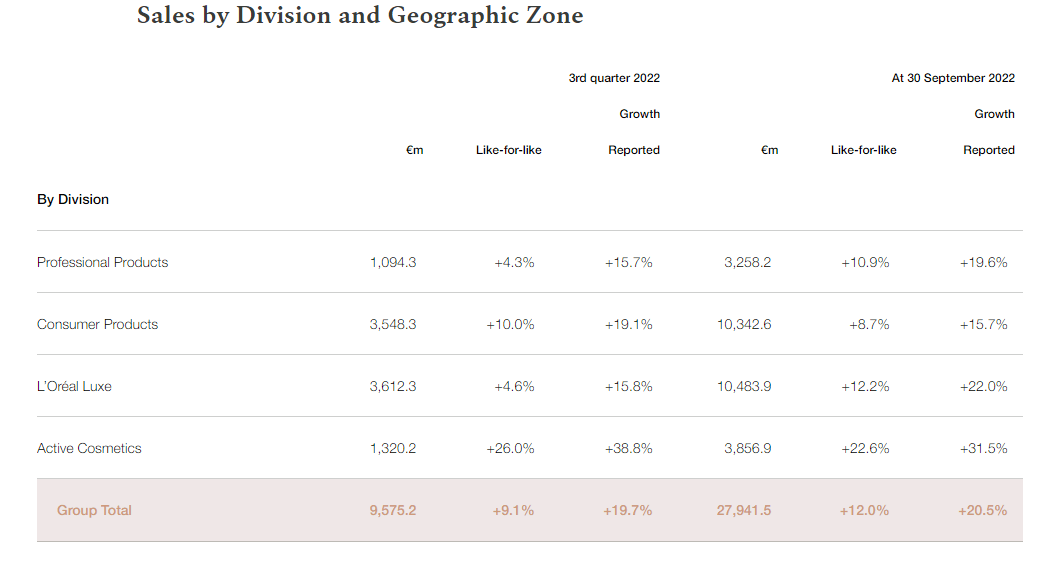

By product division, Active Cosmetics, its most profitable division by margins, led top line growth with revenues up 38.8% YoY, followed by Consumer Products, its second biggest product division covering brands including Garnier, Maybelline, and its namesake brand L’Oreal, which saw revenues rise 19.1% YoY. L’Oreal Luxe, the company’s biggest product division, grew 15.8%.

L’Oreal

Going forward, inflation presents potential headwinds but the company’s typically affluent customer base is likely to be insulated from macro challenges, and even if so, L’Oreal’s portfolio breadth covering luxury to premium, positions them to capture any downgrade opportunities.

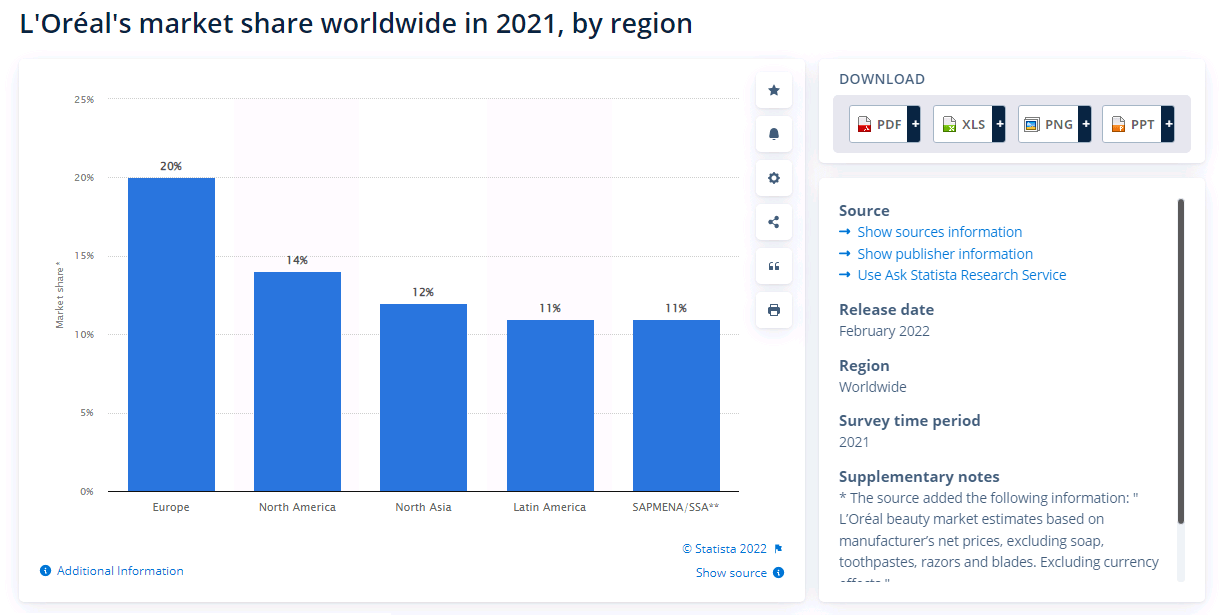

Helped by a combination of organic and inorganic growth efforts, L’Oreal has been gaining market share in the beauty and personal care market over the past few years, and its current market share of 9.8% is ahead of rivals such as Procter & Gamble (PG), Unilever (UL), and Estee Lauder (EL) in the category according to data from Euromonitor. There are reasons to be optimistic about the company’s prospects going forward.

Beauty & personal care market is growing

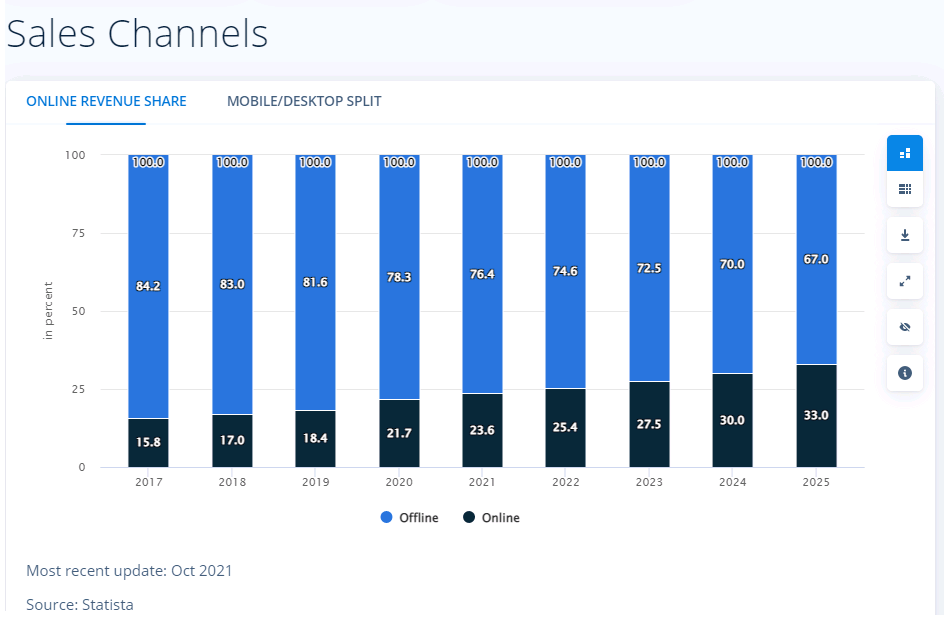

The global beauty & personal care market is a growing market driven by a number of structural growth drivers including digitalization, premiumization, and growing penetration around the world, particularly in emerging economies. Online is fast growing as a sales channel and its share of global beauty and personal care sales are expected to grow from 23,6% in 2021 to 33% by 2025. L’Oreal, who derives 28.9% of sales (as of 2021) from eCommerce is well positioned.

Statista

The industry is forecast to grow nearly 6% CAGR through 2026. L’Oreal, who is well established across all regions worldwide and enjoys strengths including strong brand equity (L’Oreal was named the world’s most valuable brand) and omnichannel capabilities, is well positioned to capitalize on this growth.

Statista

China, the world’s second largest market and India, the fourth largest market in particular offer exciting growth opportunities. Per capita incomes in the U.S. are about five times higher than in China and about thirty times higher than India, but both Asian countries have been growing incomes at a faster rate than the U.S.: between 2010 and 2021, China’s per capita incomes rose at a CAGR of 9.7% and India’s rose 4.8%, compared with 3.3% for the U.S. during the same period. Rising household incomes and consumer spending power are expected to continue driving demand in these countries and ‘L’Oreal, who is a well established player (L’Oreal has been operating in China since 1997, and in India since 1994) is positioned to capture some of that growth.

Venturing into fast growing beauty tech

L’Oreal has been making strong efforts to position itself as a beauty tech player from striking strategic partnerships with Alphabet’s (GOOGL) precision health arm Verily (announced in January 2022) to acquiring tech companies (such as beauty tech player ModiFace, acquired in 2018), and investing in product and service innovations that combine tech with beauty such as hair diagnostic and skincare formulation services.

The global beauty tech market is expected to grow at a double-digit pace, far outpacing the broader beauty and personal care market, and L’Oreal’s investments in this space may help support top line growth in the years ahead.

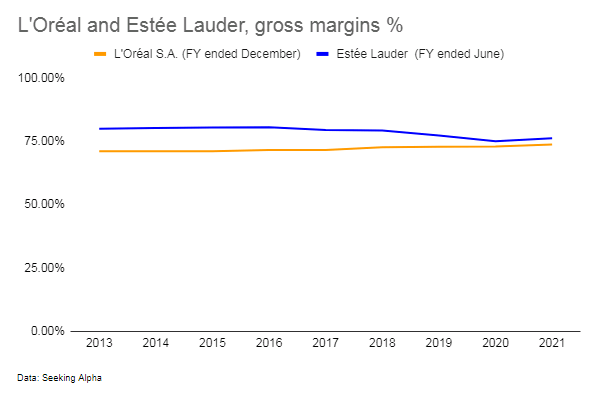

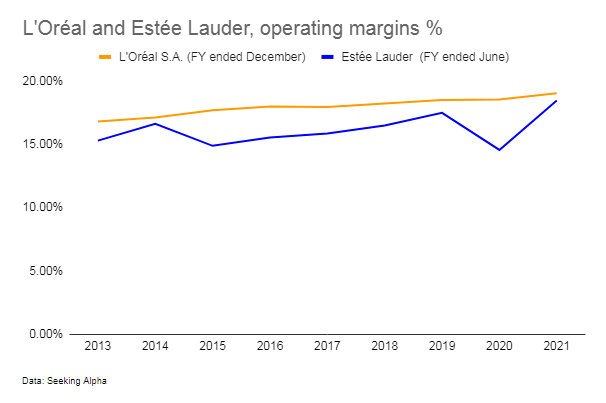

Expanding margins

L’Oreal’s margins have been expanding over the past several years suggesting improving pricing power and brand strength.

Author Author

Solid balance sheet

L’Oreal has one of the strongest balance sheets compared to its major rivals.

|

Total debt to equity |

Current ratio |

|

|

L’Oreal |

0.93 |

|

|

Estée Lauder |

1.68 |

|

|

Procter & Gamble |

0.62 |

|

|

Unilever |

0.80 |

A solid financial position gives the company the flexibility to support organic growth efforts with inorganic growth strategies such as acquisitions to expand its addressable market and drive market share gains. Moreover, in a world of hyperchoice and hypersegmentation and declining barriers to entry, new brands are constantly emerging, and a solid warchest of funds could help established brands such as L’Oreal make acquisitions where relevant. In China for instance, the ‘guochao’ trend is boosting demand for local brands and acquisitions are expected to play a crucial role in helping established foreign brands such as L’Oreal succeed.

L’Oreal has been acquisitive lately, notable acquisitions made recently include Skinbetter Science (an American medical-dispensed skincare brand, acquired in September 2022), and Youth the People (a Californian vegan, superfood skincare company, acquired in December 2021), L’Oreal also invested in a minority stake in Chinese perfume brand Documents in September 2022.

Risks

Changing consumer preferences and competition from local players are risks to L’Oreal’s growth prospects, particularly in skincare which accounts for about 40% of L’Oreal’s sales. In China for instance, one of L’Oreal’s biggest skincare markets and where L’Oreal is the leading skincare player, local brand Pechoin is a close second and is arguably better positioned to profit from China’s growing ‘guochao‘ trend whereby younger consumers, notably Gen Z consumers, increasingly favor local brands, and products infused with local culture and elements. Pechoin was founded in 1931, boasts a rich history having been a favored brand among Japanese royalty and Chinese elite, and enjoys a solid market position as a uniquely local brand using local Chinese herbs rather than synthetic chemicals, and formulations based on Traditional Chinese Medicine.

Meanwhile over in India, where local brands are very prominent, most notably among luxury consumer products, homegrown beauty titans such as Forest Essentials enjoy a similar market position, offering luxurious beauty and personal care products based on natural ingredients and ayurvedic formulations, a major draw for India’s relatively health and sustainability-conscious, younger consumers.

Summary

Beauty and personal care brand L’Oreal has recovered strongly after a pandemic-induced slowdown and their revenues have grown at double digit rates over the past three quarters of 2022. Looking ahead, inflation may be a concern, but L’Oreal’s typically affluent target market, as well as the company’s extensive portfolio breadth could soften any impact.

Deutsche Bank expects L’Oreal to outperform amid a tough macro climate.

Beauty and personal care is a growth market, with a number of structural growth drivers expected to propel demand going forward. L’Oreal, as the world’s leading player with a presence across all regions worldwide is positioned to benefit. The company’s investments in beauty tech, an industry growing at a much faster rate than the overall beauty and personal care industry, could help support growth.

Competitive risks, particularly from local players who are better positioned to benefit from localization trends, may limit growth however with a fortress balance sheet, the company could make acquisitions where relevant to bolster their brand portfolio and support market share.

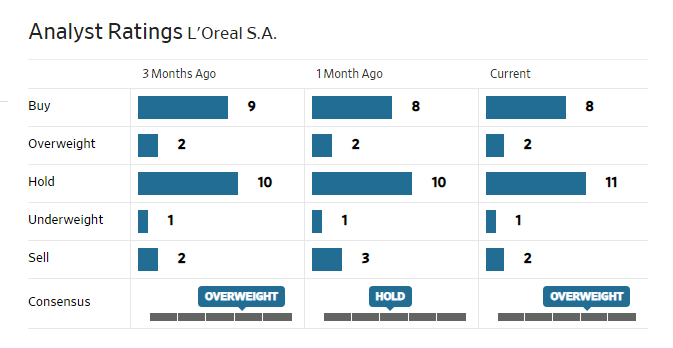

With a P/E of 34, the company is expensive relative to peers (however some may argue it is a fair price for a high-quality, global market leader).

Analysts are split between buy and hold.

WSJ

Be the first to comment