Jason Kempin

Business Overview

RH (NYSE:RH) is a company focused on selling high-end furniture directly to customers in-store and online.

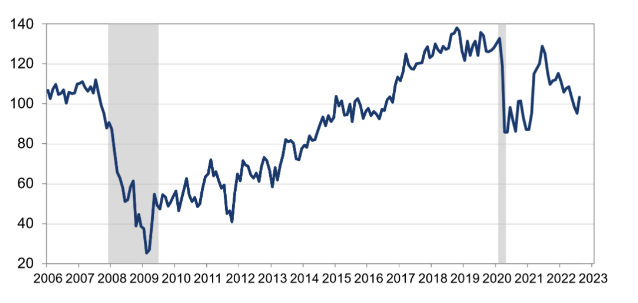

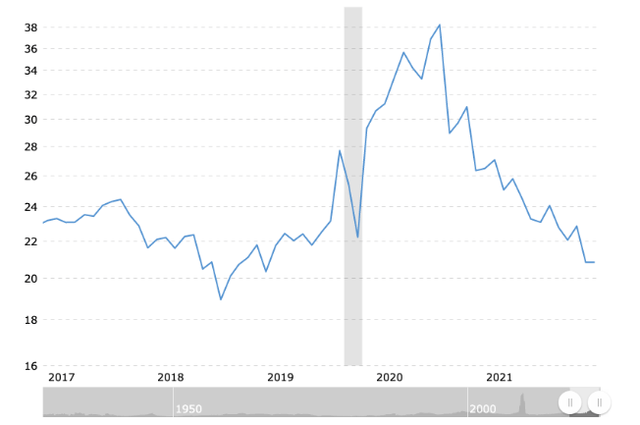

With consumer confidence eroding this year (chart below), RH FY sales guidance has been resistant due to its customer base. Based on an article from the Financial Times in 2015, RH sells to customers with an average household income of $200k, ~4x the national average, allowing the RH customer not to be as impacted by economic changes.

Consumer Confidence Index

Conference-board.org

While RH is forecasting declining sales for FY 2022, that’s before any job losses have started to take effect from the recent interest rate hikes from the Federal Reserve. The increases that the Federal Reserve has made this year take time to take effect, with some estimates targeting 9-12 months for the interest rate impact to be felt. With the first in March 2022, it might not be until the holiday shopping season or early 2023 for the full impact of the interest rate change to be felt. In addition, there is speculation that a white-collar recession, which will directly impact the customer segment where RH operates.

Bank of America recently published an analysis that looks at different types of consumer spending while going into a recession, with the summary of furniture sales mentioned below:

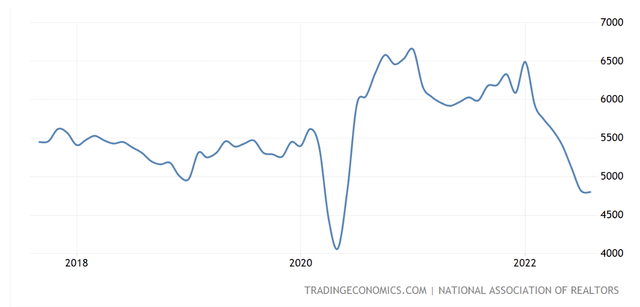

Looking just at furniture spending as a share of total PCE, the share usually starts dropping months before recessions and continues to decline during recessions. Another factor that makes furniture spending even more sensitive to recessions is that an economic recession also usually correlates with a softening housing market (i.e. a drop in home sales), which in turn dampens demand for furniture

As Bank of America mentions, furniture sales are correlated to home sales and existing homes sales data has been deteriorating every month in 2022 (chart below) as the Federal Reverse interest rate increases typically first filter through the housing market.

Company Financials

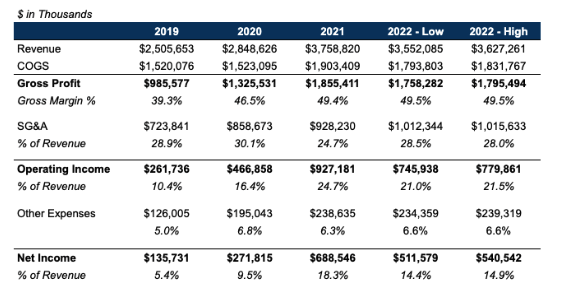

In the company’s earnings report in August, the company provided the below guidance for FY 2022:

-

YoY Sales Growth: (5.5%) to (3.5%), not adjusted for inflation

-

Operating Income Margin: 21.0% to 21.5%

That guidance is reflected in the below table:

SEC Annual Filings

Company Valuation

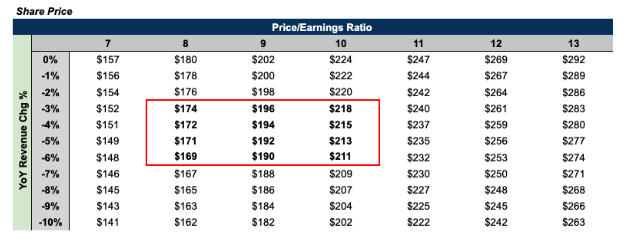

The company hasn’t provided 2023 guidance but based on the deteriorating macroeconomic environment, it’s realistic to expect further sales contraction in 2023. The company is currently trading ~10x P/E ratio, with shares already selling off by 55% YTD. The PE ratio for the S&P 500 has been under pressure since November 2020 and likely has further contraction to take place given the rising rate environment, beginning to make the yield on bonds a more attractive investment.

In 2023, as a result of declining sales and a contracting PE environment, I expect that RH shares will contract an additional 10-30% from current levels in the next 12 months, with a price target in the range of $169-$218.

My Estimates

To be bullish on the company shares over the next 12 months, investors need to believe sales will grow YoY or that P/E ratios will expand. Given the macroeconomic environment, it’s unlikely that the company’s sales trajectory will change from 2022. For P/E expansion, that belief would be rooted in a key reversal across the entire S&P, as multiples have been contracting for the past ~2 years.

Near-Term Catalyst

The company is expected to report its next earnings report in early December. In advance of the next earnings report, there will begin to additional reports and estimates on the holiday selling season. Extrapolating for the current economic data points mentioned earlier, with additional interest rate increases expected by the Federal Reserve, the economy will likely slow even further, putting pressure on holiday sales, which will be felt in RH sales due to the discretionary nature of the business.

Be the first to comment