iLexx/iStock via Getty Images

Investment Thesis

Golden Ocean Group Limited (NASDAQ:NASDAQ:GOGL) is a speculative stock suitable for dividend investors seeking short-term returns. We expect to see great dividend payouts and yields ahead, given its relatively stable TCE rates for the next two quarters and improved profitability through FY2024. In the midst of pessimistic market conditions and a 30Y low-order book, we may possibly see attractive returns on GOGL’s aggressive investments by 2025, when the bull market returns.

Combined with its excellent management team and competent cost supervision, long-term investors may see GOGL report steady growth, despite the short-term pain as the Feds continue to raise interest rates through 2023.

GOGL Is Still Riding On The Monster Waves

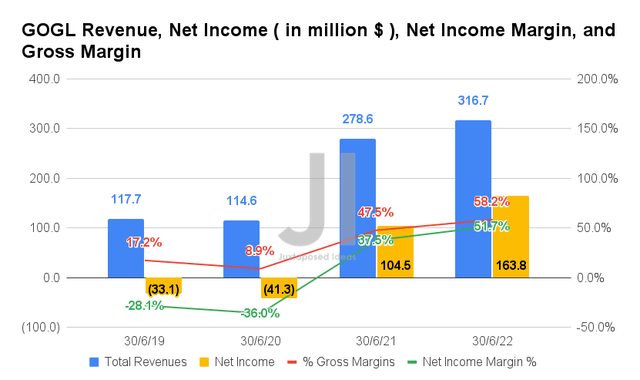

In FQ2’22, GOGL reported revenues of $316.7M and gross margins of 58.2%, representing impressive YoY growth of 13.6% and 10.7 percentage points, respectively. The company also reported improved profitability, with net incomes of $163.8M and net income margins of 51.7% in the latest quarter, representing an increase of 56.7% and 14.2 percentage points YoY, respectively.

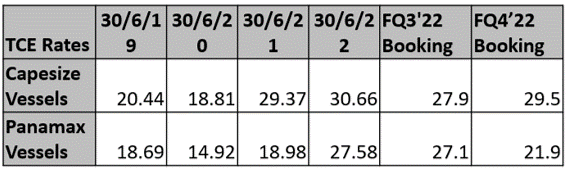

GOGL’s TCE Rates

S&P Capital IQ

Most of GOGL’s tremendous growth was attributed to the elevated TCE rates, which have ballooned by 50% for the Capesize vessels and 47.5% for Panamax vessels by FQ2’22, in comparison with pre-pandemic levels in FQ2’19. Though FQ3’22 and FQ4’22 bookings are showing signs of slower bookings and slightly reduced rates, we must remind investors that these levels still represent tremendous growth from pre and pandemic levels alike.

Combined with its improved operating costs & fleet efficiencies, we expect to see GOGL report robust top and bottom lines ahead, despite the short-term pessimistic market sentiments. China would likely gradually open up by H1’23, once President Xi Jin Ping is re-elected by November 2022. We expect things to also pick up by H2’23, once the macroeconomics improves with the global inflation kept in check. We shall see.

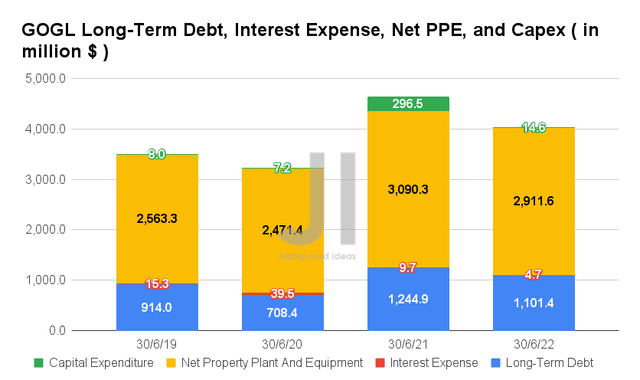

In FQ2’22, GOGL reported long-term debts of $1.1B and interest expenses of $4.7M, representing a notable moderation of -11.5% and -51.5% YoY, respectively. Investors have nothing to worry about as well, since only $162.07M will be maturing by the end of FY2023, significantly aided by the company’s robust profitability thus far.

In the meantime, GOGL reported net PPE assets of $2.91B and capital expenditure of $14.6M, representing notable declines of -5.7% and -95% YoY, respectively. Since the three new Kamsarmax vessels will have minimal impact on its liquidity, the company’s stellar dividend yields will remain relatively safe for the next few quarters.

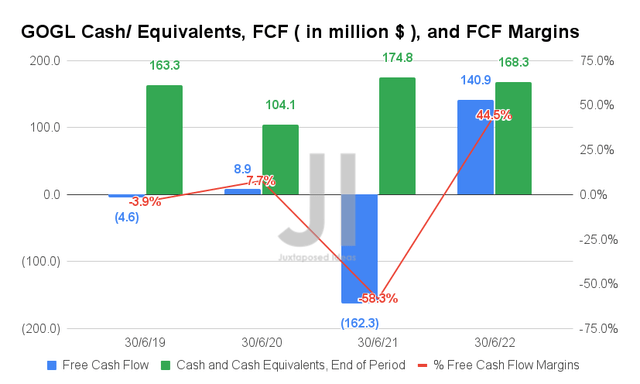

The YoY reduced capital expenditure has also directly improved GOGL’s Free Cash Flow (FCF) generation to $140.9M and an FCF margin of 44.5% in FQ2’22, representing an impressive increase from FQ2’21 levels of -$162.3M and -58.3%, respectively. The company’s cash and equivalents of $168.3M also appear robust, despite the uncertain macroeconomics ahead.

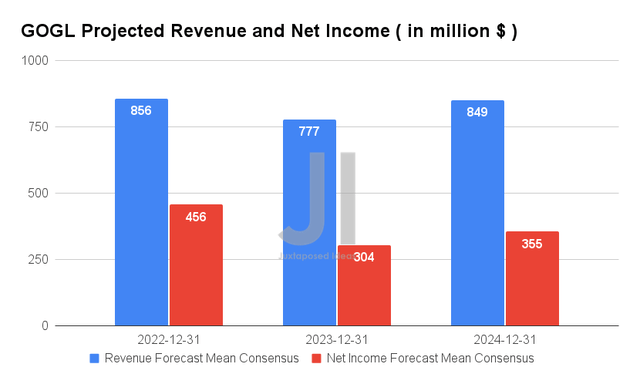

Over the next three years, GOGL is expected to report an adj. revenue and adj. net income growth at a CAGR of 3.81% and 57.02%, respectively, between FY2019 and FY2024. It is apparent that Mr. Market is very optimistic about its forward execution, given the massive improvement in its net income margins from 5.3% in FY2019, 43.9% in FY2021, and finally settling at an exemplary 41.8% in FY2024.

Given the perceived fall in demand and lower TCE rates for Q4’22, consensus estimates that GOGL will report revenues of $856M and net incomes of $456M in FY2022, representing a notable decline of -28.7% and -13.5% YoY, respectively. However, it is important to note the continued YoY improvement in its projected net income margins, from 43.9% in FY2021 to 53.2% in FY2022. Stellar indeed, given the market’s extreme pessimism.

In the meantime, we are a little more optimistic, since GOGL has reported stellar revenues and profitability in H1’22. We may potentially see an upwards rerating of its full-year revenues to $1.04B and net incomes to $0.55B, indicating a 22.3% and 22.2% upside from current estimates, respectively. Naturally, this is assuming a decent Q4’22 charter coverage and sustained global demand for coal through winter, given the record high energy prices and the recent Nord Stream 1 shutdown in the EU. It will help to balance the declines experienced in the iron ore market, given China’s bursting property bubble, as the country accounts for 70% of global iron ore imports in 2021.

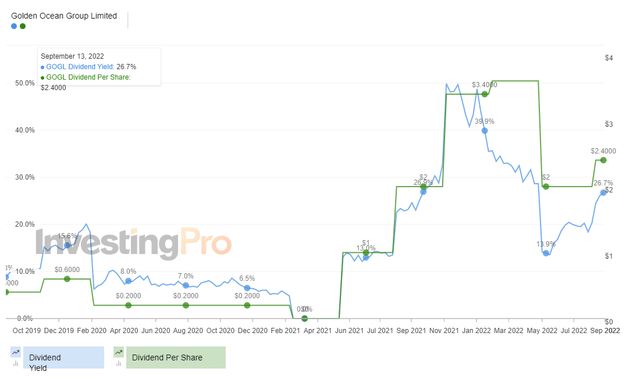

GOGL’s Dividends Per Share & Dividend Yield

Meanwhile, long-term GOGL investors would have been delighted with the excellent dividend payouts thus far, with $1.6 paid in FY2021 and $2 paid in the first three quarters of 2022. These represent stellar dividend yields of up to 39.9% at its peak and an average of 24.08% in the past five quarters. Combined with its improved profitability ahead, we speculatively expect to see another dividend hike for Q4’22 with similarly handsome dividend yields of 20% through 2023. It’s a monster cash cow for short-term investors, indeed.

So, Is GOGL Stock A Buy, Sell, or Hold?

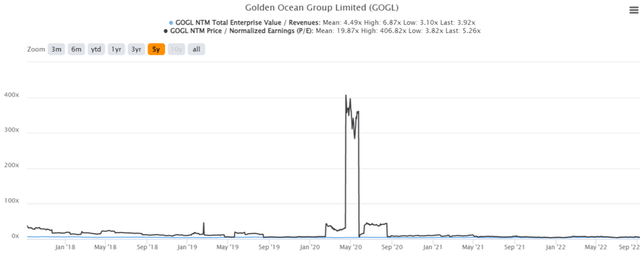

GOGL 5Y EV/Revenue and P/E Valuations

GOGL is currently trading at an EV/NTM Revenue of 3.92x and NTM P/E of 5.26x, lower than its 5Y mean of 4.49x and 19.87x, respectively. The stock is also trading at $9.23, down -43.9% from its 52 weeks high of $16.46, though at a premium of 21.6% from its 52 weeks low of $7.59.

GOGL 5Y Stock Price

Nonetheless, consensus estimates remain bullish about GOGL’s prospects, given their price target of $15.33 and 66.63% upside from current prices. Due to the drastic pullback in the past three months, it is apparent that the stock is trading at near bottom levels, making it a very attractive entry point for any interested investors. Its impressive dividend yields are nothing to sneeze at as well, given the current bearish market condition, with the S&P 500 Index already plunging by -18.01% since the start of the year, worsened by the Fed’s upcoming 75 basis point hike in September 2022.

In August 2022, the inflation rate remained elevated at 8.3%, compared with 2% before the pandemic. As a result, we may see continued aggressive interest rate hikes in the coming months through 2023. This is significantly worsened by the record high energy, food, and automotive prices, with many US automakers, such as General Motors (GM) and Tesla (TSLA), reporting insatiable consumer demand despite the economic downturn.

Therefore, we encourage investors with a higher risk tolerance to take advantage of Mr. Market’s gift and load up at these levels for maximum short-term returns ahead. In contrast, conservative ones may nibble once the stock dips in the coming week.

Be the first to comment