Drs Producoes

The Direxion Daily MSCI Brazil Bull 2X Shares (NYSEARCA:BRZU) is an ETF that tracks a bucket of Brazilian key stocks and has it so that it mimics the daily movements of that portfolio but with a factor of 2x. In other words, it is a leveraged bet on the movements in the Brazilian economy on a day to day. What matters then is what direction you think the underlying ETF will go in. The big catalyst might be the elections currently underway in the runoff between Bolsonaro and Lula. It’s unclear though which the markets will prefer, although likely it would be Bolsonaro. Lula is considered the favourite, so it’s best to keep away from an aggressive play like this, but because of the state of the Brazilian economy and key similarities in both of their campaigns, who knows what will happen. What is a problem is the general commodity environment globally, and the lack of impulse in the Brazilian banking sector’s earnings growth. As a baseline, this ETF looks to be poorly positioned, and quite aggressively because of how it is engineered.

BRZU ETF Breakdown

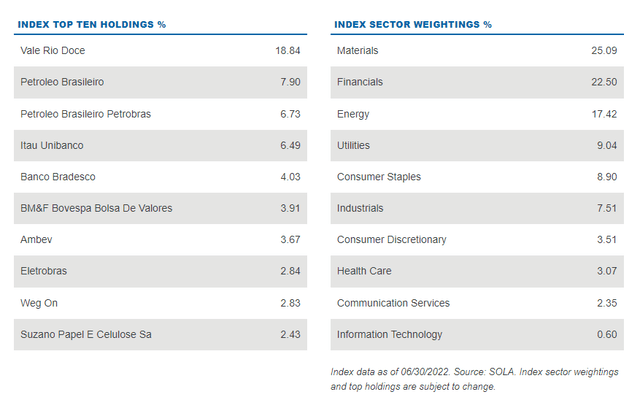

Here are the characteristics of the index that BRZU targets, but with 2x factors on its price movements.

BRZU Characteristics (Direxion.com)

Some of the key stocks are in energy and materials, but lots are in financials. These are the two key exposures that investors should be broadly concerning themselves with.

As far as the financial exposures are going, the rate hike cycle may be at an end for Brazil, which means that the impetus for higher net interest incomes for the resident banks may not be continuing for Brazil, since inflation has been aggressively tackled. The country has for the first time gone into a current account deficit with massive excise tax cuts in order to bring prices down. Energy prices have also generally fallen, taking the pressure off inflation. With the mandate now complete to deal with prices, it is understood that more rate hiking is unlikely, but the central bank is waiting on the sidelines to step in if inflation doesn’t abate. Overall, the benefits of the financial exposure are not as present in this portfolio compared to others.

The materials exposures are pretty mixed. Vale is substantially exposed to iron ore, which has a major cyclical and China specific problem right now. Iron ore prices have retreated back to pre-COVID levels. As far as energy goes, the prices remain crimped by supply chain disruptions with Russia and cuts coming in from OPEC countries.

Remarks

While the global situation for some of the commodities remains relevant for the underlying portfolio, and certainly the outlook isn’t great in iron ore and for global demand in general, there are lots of Brazil specific factors that can influence the portfolio. The state of the economy will affect loan growth for the financials, as well as provisions for banks and for utility companies with bad debt. Also, the banks and energy companies in Brazil are highly regulated. Banks may have to take on more, riskier and lower return debt as part of Lula’s plans to increase home ownership and business loans for low-income people. More capital may be required, and less leverage means less returns. In the case of energy, Petrobras (PBR) is actually mostly state-owned, and Lula has plans to supercharge their renewable transition, meaning CAPEX burdens could be incoming. The outcome of the elections could matter for some of these large players. Even Vale (VALE), while its fortunes are to an extent dictated by the iron ore price in global markets, there is some upside if Lula wins.

Both Lula and Bolsonaro want to stimulate the economy fiscally, but Lula is probably more radical than Bolsonaro. Both want to reduce limits on how much the state can spend, i.e., the Brazilian Debt Ceiling, but Bolsonaro is suggesting a moving quotient with nominal GDP while Lula is suggesting removing it all together. If Lula wins, there will be more stimulation, but more stress of state finances – the Real could suffer. This would affect all businesses outside of energy and materials, so more than half of the BRZU portfolio. Energy and materials may see more support on the Lula fiscal mandate, but he has specific plans that will negatively affect banks and Petrobras. It’s a mixed picture, and it’s made all the more ambiguous because of dynamics with the Senate, that may force Lula to propose a less radical agenda. In fact, support for candidates other than Lula was not expected to be as high as it was.

Overall, the BRZU ETF is a commodity dependent vehicle, which opens investors up to risks with China continuing to be depressed due to the COVID-zero strategy, perhaps not bouncing back as soon as markets expect. Moreover, global recession will affect these commodities, especially where most countries, unlike Brazil, don’t have as good of a grip on public finances post-pandemic, and cannot pull the fiscal lever effectively. Energy prices may be a stronger spot, but materials are exposed. Moreover, there is less upside on financials compared to countries at earlier stages in the rate hike cycle. This is not a good start for BRZU. The election results are also ambiguous. It’s unclear how radical Lula can actually be, and it’s also unclear how his various interventions will affect markets on balance. It’s also unclear if he will actually win, although people believe it will be the case. So the starting point isn’t great, and the delta isn’t clear. It’s a pass.

Be the first to comment