Getty Images

Thesis

Morgan Stanley (NYSE:MS) Q3 quarter was not that bad, but the bank disappoints against expectations and peer JPMorgan (JPM). Revenues missed expectations by about $327.80 million and decreased by almost 14% year over year. Meanwhile, J.P. Morgan beat expectations and grew revenues by about 10% year over year. The trading day following the Q3 results, Morgan Stanley stock lost as much as 5%, while JPM stock was up 1%.

I still believe Morgan Stanley is a long-term winning bank. But, if you can buy JPM and MS at competitive valuation (in fact MS stock is slightly more expensive), then I just think it makes perfect sense to underweight Morgan Stanley. Downgrade to Hold.

Morgan Stanley’s Q3

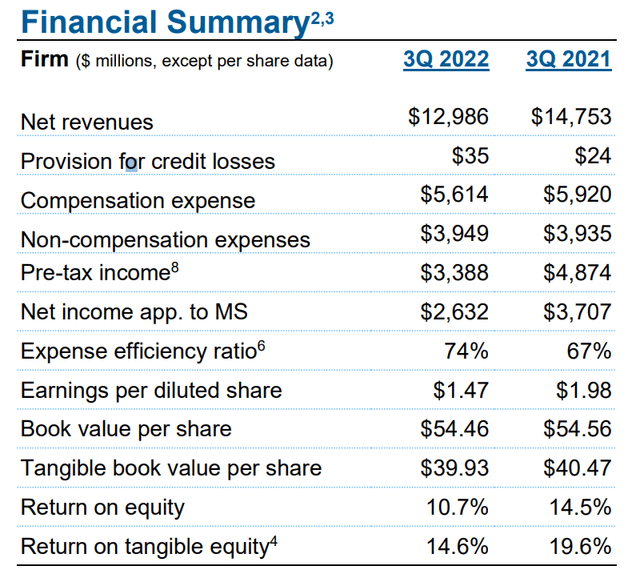

During the period from July to the end of September, Morgan Stanley generated total revenues of $13 billion, which reflects a business contraction of about 14% year over year. For reference, analysts had expected revenues of about $13.3 billion (Source Bloomberg Terminal).

Earnings per share were approximately in line with expectations: EPS GAAP came in at 1.47/share versus $1.51 expected. But investors should note that in the same period one year prior, EPS was considerably higher: $1.98.

CEO James P. Gorman commented:

Firm performance was resilient and balanced in an uncertain and difficult environment, delivering a 15% return on tangible common equity … We continue to maintain our strong capital position while repurchasing $2.6 billion of shares and distributing a healthy dividend.

While investment banking and investment management were impacted by the market environment, fixed income and equity navigated challenging markets well.

Investment Banking Fees Down Sharply

Going into Q3, leading executives at U.S. banks have already warned that fees from investment banking are expected to be down sharply, by around 50% year over year. But Morgan Stanley’s fees dropped even sharper than what the harsh warning implied: down 55% from a year ago. Reasons for such bad performance are obvious: The volume and value of M&A transactions decreased significantly as compared to 2021, and the same argument can be made for capital markets activity (e.g. IPOs, fixed income underwriting).

For reference, JPMorgan’s investment banking fees were down by about 45%.

Trading/Markets Results Mixed

Given the enormous market volatility in Q3, analysts had expected a strong performance from Morgan Stanley’s markets division. Although results were strong, they were far from stellar.

Revenues from the equity desk decreased by about 14% year over year – due to ‘lower client activity’ and ‘declines in equity markets’.

The Fixed Income desk increased revenues by about 33% year over year – due to ‘strength in macro products on high client engagement and volatility in the markets’.

Wealth Management Strong

Arguably Morgan Stanley’s best performing segment was Wealth Management, which is also the bank’s largest segment by revenues. In Q3, Wealth Management fees increased to $6.1 billion, versus $5.9 billion in the same period one year prior. The segment’s pre-tax income increased to $1.6 billion, versus $1.5 billion respectively.

Further highlights include:

pre-tax margin of 26.9% or 28.4% excluding integration-related expenses.

higher net interest income on higher interest rates.

the business added $65 billion in net new assets, bringing total net new assets year-to-date to $260 billion.

Downgrade To Underweight

Trading at a one year forward P/E of about x11.5, a P/B of x1.4 and a dividend yield close to 4%, I continue to believe that the risk/reward for Morgan Stanley is attractive. Moreover, anchored purely on a long-term earnings perspective, the stock should be valued close to $145/share.

However, investing is always a relative discipline – meaning every opportunity must be judged in relation to alternatives. And one alternative to Morgan Stanley is JPMorgan.

Investors should consider that JPMorgan’s Q3 results have clearly outperformed Morgan Stanley’s. And there is one major reason why this outperformance is expected to continue: JPMorgan has a strong commercial banking arm, and Morgan Stanley does not. Thus, in the context of rising interest rates, JPM can push profitability from the deposit/loan interest spread. This helps JPMorgan to buffer the slowdown in investment banking and wealth/asset management.

Given that both JPMorgan and Morgan Stanley are trading at a similar valuation, I argue the risk/reward is skewed in favor of JPM.

Be the first to comment