Inna Kot/iStock via Getty Images

Screening the stock market for U.S.-listed stocks that offer a very good dividend yield could lead to discovering good hedging solutions for the upcoming periods that promise higher volatility and increased inflation.

Based on these selection criteria, I ended up at Fidelity National Financial, Inc. (NYSE:FNF), a Jacksonville, Florida-based insurance specialist in providing title, annuity, and life insurance products to customers in the United States.

It appears to be a very good stock that offers a dividend yield well above the market average and has also received a buy rating from some analysts. However, something else needs to be known about the near term of this stock.

The Impact of U.S. Federal Reserve’s Tightening Monetary Policy and Elevated Inflation on Fidelity National Financial, Inc.’s Business

Higher credit costs due to the U.S. Federal Reserve’s hawkish stance affected 82% of the entire title insurance business of Fidelity National Financial, as the housing market is virtually the main source of this segment’s revenue.

Because many people are unable to buy the house they want now due to higher borrowing costs, they either buy cheaper houses or are forced to postpone family projects to move to a larger/more luxurious home.

Many consumers may prefer alternative lifestyles like staying with their parents until the economic prospects are better or taking apartments for rent until mortgage rates will get more affordable.

The housing market, the main source of Fidelity National Financials’ title insurance business [45% of the company’s total consolidated revenues], is significantly affected by the following two factors:

- The decision of the U.S. Federal Reserve to increase interest rates to limit the rapid rise in prices for goods and services.

- The record inflationary pressure on consumers.

Currently, these factors are influencing the sale of title insurance products as demand for mortgages to buy houses is softening.

The Fed’s two 75-basis point hikes in the federal funds rate ahead of its third consecutive 75 bps hike during the September meeting, which brought the rate to a current range of 3% to 3.25%, prompted a rapid rise in borrowing costs not seen since 2008.

As a measure of rising mortgage costs, 30-year fixed-rate mortgages for loans that meet Fannie Mae and Freddie Mac guidelines averaged a 6.52% contract rate, the highest in 15 years. This has led to lower demand for mortgage applications in the U.S. for weeks.

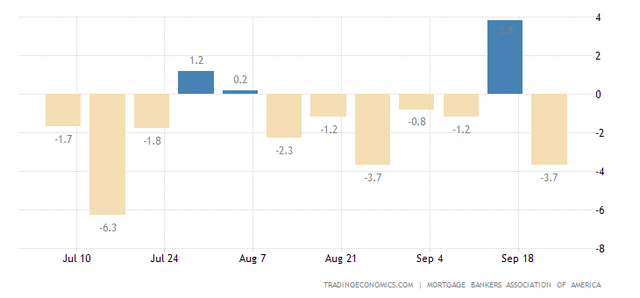

In the most recent calendar week ending September 23, mortgage applications fell 3.7%, resuming the negative trend that lasted five weeks from the week ending August 12 to the week ending September 9. Trading Economics‘ chart shows this clearly.

tradingeconomics/united-states/mortgage-applications

The impact of the U.S. Fed’s hawkish stance is being felt across the spectrum of demand for mortgage applications, resulting in a decline in applications per home loan refinance [down 10.9% sequentially in Sept. 23 week] and mortgage applications for home purchase [down 0.4% sequentially in Sept. 23 week].

Higher Inflationary Pressures Also Affect Home Purchase Mortgage Applications Despite Good Employment Levels

Elevated inflation and the prospect of soaring energy costs due to the war in Ukraine are weighing on home loan refinance requests.

It appears that current employment levels [60.1% in August and still above the historical average of 59.22%] are allowing mortgage applications to weather the rising cost of money. But, as revealed in the last two quarterly reports from Fidelity National Financial Inc., the home-buyer mortgage market also exhibits worrying weaknesses.

On a daily basis, the decline in purchase orders accelerated over the weeks. From a 1% year-over-year decline in Q1 2022, it got worse and became an 11% to 12% year-over-year decline in Q2 2022.

On a daily basis, the decline in refinance orders has worsened over the weeks. From a 57% to 58% year-over-year drop in Q1 2022, it worsened to 67% to 68% year-on-year in Q2 2022.

Rises and falls in commercial orders [approximately 18% of title insurance business] offset each other. While a rising fee per file [from a 46% year-on-year increase to $2,891 in Q1 2022 to a 49% year-on-year increase to $3,557 in Q2 2022] wasn’t enough to offset the decline in mortgage inquiries and their refinancing.

The rising fee per file was due to an increasing value of residential buildings. U.S. single-family home values have soared until recently due to higher home demand fueled by lower interest rates to support the economy during the COVID-19 pandemic crisis and insufficient inventories. This was reflected in the Case Shiller Home Price Index, which measures monthly changes in the value of single-family homes in the U.S. The economic indicator hit a historical peak of 318.63 in June 2022. Also, the U.S. price-to-rent ratio, which indicates whether the U.S. housing markets are fairly valued or inflated, hit a historical peak of 142.55 in the June 2022 quarter, compared to the 52-year average of 100.68.

Lower Mortgage Applications Result in a Profitability Loss in the Title Insurance Business

Lower applications are reflected in negative trends – which are getting worse – in sales, adjusted pre-tax margins and adjusted pre-tax profits for title insurance products.

Total revenue decreased 13.3% year over year to $2.6 billion in the second quarter of 2022 and decreased 4% year over year to $2.4 billion in the first quarter of 2022.

Adjusted Title margin [before tax] decreased 380 basis points year-on-year to 18.9% in the second quarter of 2022 and decreased 280 basis points year-on-year to 17.1% in the first quarter of 2022.

Adjusted income from ongoing business in Title insurance [before taxes] decreased 23.1% year-on-year to $529 million in the second quarter of 2022 and decreased 14.6% year-on-year to $437 million in the first quarter of 2022.

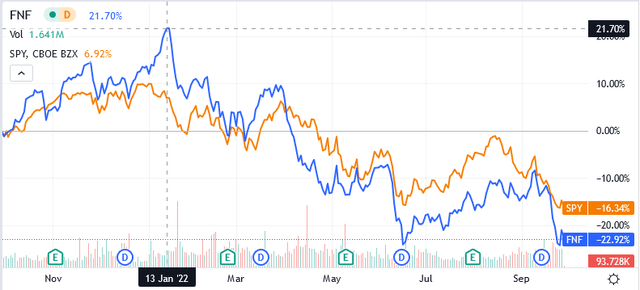

The Reaction of the Stock Price to the Slowing Down Title Insurance Business

The stock price didn’t react well.

After peaking around mid-January 2022 for a gain of more than 20% in the past 3.5 months, the stock then fell on talks about the US Fed on track to raise interest rates against runaway inflation.

After the U.S. Federal Reserve raised the key interest rate by 25 basis points to 0.25%-0.50% in March 2022 — for the first time after months of accommodative very low-interest rates policy — the share price of Fidelity National Financial entered a phase of rapid fall.

Because the market feared the impact on title insurance contracts, Fidelity National Financials’ stock price has fallen below the SPDR S&P 500 ETF Trust (SPY) stock price line, significantly underperforming the U.S. stock market benchmark over the past year.

About the Near Term

The immediate future doesn’t look promising.

Title insurance orders should add additional falls as the U.S. Fed continues to raise its federal funds’ benchmark rate further to bring down the high inflation.

Annual inflation in the U.S. was 8.3% in August 2022. Despite being the lowest level in 4 months, it remains well above the 2% target that will ensure price stability and high employment levels under the Federal Reserve’s dual mandate.

Therefore, the U.S. Federal Reserve will continue a very aggressive rate hike policy to reach the target and avoid more serious consequences for consumption and investment. Since this type of monetary policy can influence inflation but has no power against its triggers [war in Ukraine, geopolitical tensions and energy crisis], it risks a significant reduction in the demand for goods and services and the demand for investment.

In fact, U.S. gross domestic product, whose main components are consumption and investment, is expected to grow much more slowly over the next few months, with the annual growth rate decelerating from 1.80% in the second quarter of 2022 to 1.30% in 2023, according to economists. Amid a slowing down economy, a number of companies are likely to close operations or lay off employees.

So there are concerns about household budgets, as they are affected by energy inflation, food, housing and transportation. And there are concerns about employment [jobless rates in the U.S. are expected to rise from 3.7% rate of the total labor force in August 2022 to 4.40% in 2023].

Mortgages Applications and U.S. Home Values in 2023

Under the impact of the above factors, U.S. mortgage applications are expected to fly extremely low in 2023, which together with the return of a positive trend in the housing inventory, will likely result in a lower value for U.S. homes going forward.

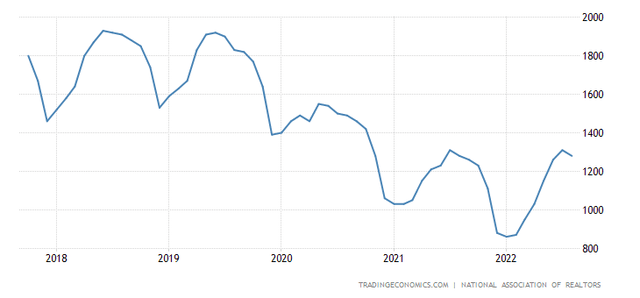

The last part of the curve in the below chart from Trading Economics suggests housing inventory is picking up again.

tradingeconomics/united-states/total-housing-inventory

Economists are also predicting lower U.S. home values going forward as they forecast the S&P Case-Shiller Home Price Index to hover at 284 points in 2023, compared to the current level of 316.28 points.

Fewer applications coupled with the expected decline in home values in the United States will negatively impact the company’s title insurance segment over the next few months and potentially put downward pressure on the stock price.

About the Annuity Business

Additionally, through F&G’s wholly owned subsidiary, the company helps Americans hedge against the market risk of devaluation while planning for their future by offering annuity and life insurance products.

The F&G subsidiary generated total revenues of $3.1 billion [up 15% YoY], which allowed total assets under management to grow, reaching $40.3 billion at the end of H1 2022 [up 27% YoY].

The improvement reflected the strengthening of the retail channel, mainly due to robust demand for annuities amid higher interest rates and reflected strong momentum in the institutional channels despite the challenging conditions the company said are currently dominating the space.

F&G is expected to perform well over the next few months as many investors will flock to annuities as a hedging tool against heightened market volatility and growing inflation.

Because of market instability and high inflation, the U.S. annuity market, estimated at $231.63 billion in 2021, should grow at nearly 5% per year over the next 5 years from 2022 to 2026 and likely reach $298.7 billion by the end of that period, according to a report of ResearchAndMarkets.

As a leader in the market, Fidelity National Financials’ F&G subsidiary is on track to increase earnings as demand for annuities is fueled not only by better payouts but also by guarantees as interest rates rise. This segment will offset lower margins from the title insurance business.

However, the expected offsetting effect of higher earnings from the F&G business will account for no more than 25% of Fidelity National Financials’ consolidated adjusted net income. Also, F&G’s higher earnings will unfold their catalyst after 15% of F&G’s ownership is transferred to Fidelity National Financials shareholders and becomes a publicly traded entity. The transition should take place before the end of 2022.

It will reveal to the market a modest addition to the adjusted earnings per share from continuing operations, which was $3.27 for the first half of 2022 [down 10% year over year].

Analysts’ Estimates for Revenue and Profits in 2022 and 2023

Looking ahead to full-year 2022, analysts estimate that revenue will fall 18.24% to $12.79 billion and earnings per share will fall 21.27% to $6.22.

Looking ahead to full-year 2023, analysts are expecting revenues to fall 1.55% to $12.59 billion, while earnings per share are expected to fall 3.22% to $6.02.

These estimates are likely, and if they come true, they will put pressure on the stock price.

Stock Valuation and Analysts’ Recommendation and Target Price

For the analysts, Fidelity National Financial is a Buy with an average price target of $57.6, reflecting an upside potential of 59%, but with a low probability of occurring from the point of view described in this article.

Shares are trading lower compared to recent valuations as the current share price of $36.26 [which dictates a market cap of $9.6 billion as of this writing] is just a few bits above the lower bound of the 52-week range of $34.51 to $56.44. Additionally, it is trading well below the long-term trend of the 200-day moving average of $43.65.

Those low valuations may not stop shares from falling further if they need to, and even a dividend yield [fwd] of about 4.86% [well above the S&P 500’s 1.76% yield] isn’t enough to deviate from the current bearish sentiment.

The company pays a quarterly dividend of $0.44 per common share for a payout ratio of 22.78% and has achieved a 5-year growth rate of 19.51% and 6 years of dividend growth.

However, these metrics don’t guarantee that the company will continue to use higher cash flow to pay dividends given the prospect of lower sales and earnings. So if the stock price is likely to go down, dividends won’t necessarily go up.

Fidelity National Financials’ 14-day Relative Strength Index [RSI] of 37.4 means shares still have plenty of room to fall well below current levels.

Conclusion – Annuities Earnings Won’t Counteract Headwinds from U.S. Federal Reserve’s Hawkish Stance

Rate hikes due to the aggressive stance of the U.S. Federal Reserve will continue to negatively impact the title insurance business in the coming months.

Higher rates are driving greater demand for annuities, but this will still be too small in terms of publicly traded earnings to mitigate the headwinds to the title insurance division’s earnings.

As a result, the Fidelity National Financials share price may continue to lose ground despite the very good dividend yield.

Be the first to comment