DNY59

By Rob Isbitts

Bonds: Shaken and Stirred in 2022

Stocks are volatile. We all know it. But bonds? While they have always had the potential to melt down like they have during 2022, there’s one difference between 2022 and most of the 40 years prior to this one: This year, the steep decline in bond prices is actually happening. This has likely caught investors off guard.

This is especially the case for those in retirement, or nearing it, who decided to pile some of their accumulated wealth into “bonds” without knowing too much about how they work, other than two things:

- They pay income regularly.

- They are not stocks, so they can’t crash like stocks do.

Unfortunately for some folks, No. 2 on that list is simply not true. They just have not lived to see it. And now, when they most need to understand what bonds are and, more importantly, what they are not, the bond market might be forcing them into some critical and misguided decisions.

Since I’ve been around a while (36 years in the investment business) and made all of the classic mistakes along the way, perhaps I can help some baby boomers and younger folks to decipher what the reward – and particularly the risk – potential of bonds is for the remainder of 2022 and into next year.

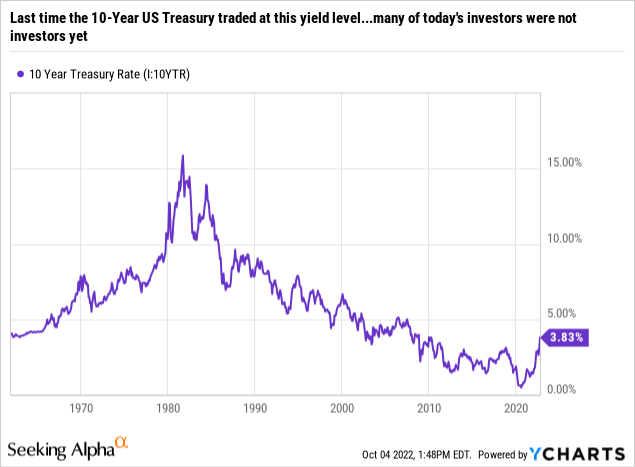

The history, summarized

The Global Financial Crisis that ended in early 2009 spawned one of the most fruitful and productive periods in bond market history. In fact, if we go back to the early 1980s, it has been that long since interest rates have risen with the ferocity that we have seen this year. It is not possible to overestimate what that combination of low and generally falling interest rates have done to create a false sense of security regarding the role of bonds in a portfolio.

Instead, what it has produced is too much complacency, tremendous confusion, oversimplification, and an outright dangerous pursuit of yield, without accounting for some massive risk-taking. In other words, investors are treating bonds like the safety valve they used to be for so long. Furthermore, they are at risk of assuming that a drop in bond prices this year somehow puts bonds “on sale.” That’s not as much of a “layup” as they might think. So, let’s sort it all out.

The result of years of low bond interest rates

These low rates created an era where consumers could borrow about as much as they liked – to buy homes and cars, to get an education, etc. But there is strong evidence that instead of treating this borrowed money as a debt, much of it was dismissed as a cheap way to spend more now and worry about the ramifications later.

Many corporations operated with the same attitude as consumers did. As for governments, you don’t need me to tell you about that “spending like drunken sailors” situation. It is well-documented.

Guess what – it’s “later”

A lot of that debt was issued at floating rates, and that only worsens the reality of where the credit markets are. That in turn brings us back to bonds as an investment. Think of it this way: “Junk” bonds are technically those with ratings of BB or less. But thanks to years of the Fed buying up corporate bonds, that market in particular has become toxic, and not at all what it appears to be.

That is something that investors need to wrap their heads around, quickly. Because it explains the deep drops in the prices of some types of bonds so far in 2022. And it portends some significant, not-so-obvious risks from now forward, at a time when investors seem to be treating the bond market like an early Christmas sale.

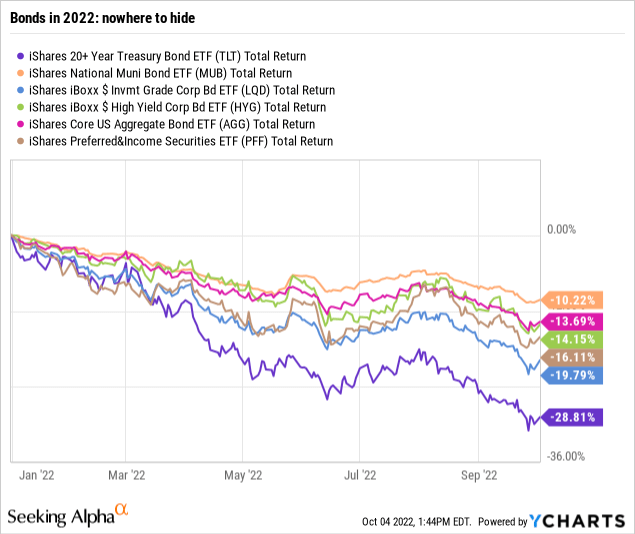

That could turn out to be the case. But if it is, it’s not because bonds were cheap. They are not. Here is how various types of bonds have performed so far in 2022. As you can see, there were no major “performance outliers” here. Bonds as an asset class have been wrecked this year. That has created a “buy the dips” idea among some investors, akin to what we have seen in stocks for years, thanks to easy Federal Reserve policy.

Taking inventory – what bonds used to do

For the previous generation of retirees, bonds were about three things:

- Relatively stable price

- Reasonable returns (mostly from income)

- Sensitivity to interest rates

This paradigm has been completely disrupted in 2022. Bond prices have been anything but stable, whether they be U.S. Treasuries, corporates, munis or others. Prices of short-term and long-term bond maturities have fallen in a way that has to at least get the attention of serious investors.

Whatever yield bonds pay, that yield has been dwarfed by the magnitude of the price declines. This is the sad math of bonds. No matter how much yield you bring in, you can still lose many times that in principal. Before 2022, this was a warning only. Now, it’s reality. And it is part of a larger regime change going on in the financial markets. It is not likely to disappear in weeks or months.

Interest rates are significantly higher than just six months ago. Maybe it’s even a “top” in bond rates for a while. I don’t think so, but no one knows for sure.

The risk of being wrong and committing large portions of a portfolio to the idea that this is a “gimme,” simply because rates are high vs. recent history, is a huge risk. That’s especially true for those trying to replace their old bond portfolio with something they think will work just like that old, traditional bond fund or set of individual bonds did. The bond market just doesn’t work like it used to. Much of the trading activity is consolidated into some very large ETFs that even institutional investors now use to get temporary “exposure” to different types of bonds.

Translated for the retail investor: You don’t control your own bond destiny like you used to, and perhaps like you think you still do. That calls for a new answer to an old problem – what to do for relative price stability compared to the wild and crazy swings of the stock market.

One solution is a bond portfolio without bonds

You may have heard of flourless chocolate cake. That’s right, cake without flour. It’s been a thing for years (though I’ll admit to being merely an eater, not a baker). It used to be that cows produced our milk. Now, milk is derived from almonds, cashews, rice, and soy. Who knew? Some smart corporations did. And as vegetarians know, if you are craving a hamburger, you can get one without beef. Plant-based substitutes are all the rage.

Why bring these up? Not to make you hungry, but to lay the groundwork for what I think is the future of “bond investing.” Specifically, looking at bonds as simply one of many weapons at your disposal to pursue what bonds used to do, but no longer can, thanks to the credit and rate issues noted above.

Here is the start of a game plan for rethinking how to get what bonds used to deliver, but likely can’t for a while. Bond prices are falling while a recession appears more likely by the week. And as recessions go, this one looks very different. That’s because investors have always had their pal, the bond market, to be their “anti-stock” solution.

In an era where inflation is a real, sustainable threat for the first time in over four decades – and talk of “stagflation” (economic stagnation plus inflation/rising costs of living) is increasing – investors have to think outside the traditional bond box. Bonds, particularly when used via ETFs, are simply one of many potential pieces of a total return puzzle.

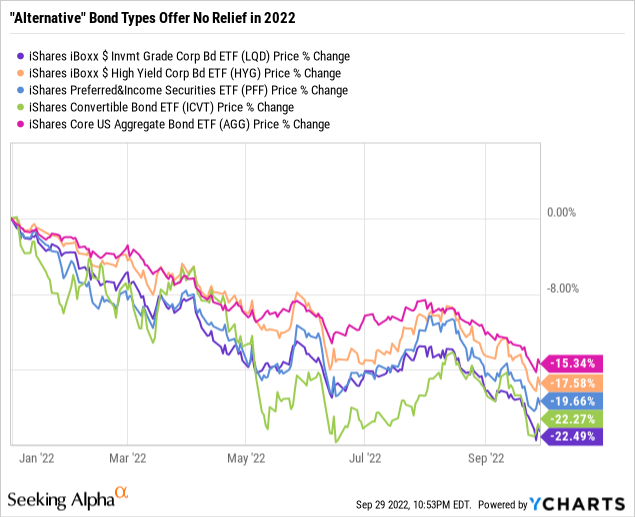

Many popular “alternatives” don’t deliver

Alternatives don’t offer relief, but investors still seem to be relying on them. Here are some examples:

The financial advice industry seems to have an obsession with trying to replace bonds with … bonds. It sounds something like this: “Sure, Treasury bonds are in a bad spot right now. But you can buy other types of bonds, and get higher yields.” This is excellent advice – if you like to lose more money on the price of your bonds than you can possibly make in interest yield. In other words, it’s just a sales pitch to sell products that need to be sold. Ignore it.

The bond market is currently suffering from an illness that infects all types of fixed-income securities. The bond market has become much more intertwined, in part due to how much money has consolidated into the larger ETFs that track such income segments as investment grade corporates, high yield, preferred stocks, and convertibles. This is a sneaky, opaque risk that many new bond investors were completely unaware of until now.

It means that the bond markets now move in sync like never before. So diversification within the bond asset class is not nearly as effective as it used to be. And liquidity is severely constrained, since big money institutions do a lot less individual bond buying. Instead, they are more prone to raise and lower their allocation to bonds by simply buying a chunk of one of those big ETFs and selling that position to reduce that allocation in an instant.

This is a complete sea change in bond investing. Yet I sense retail investors are largely unaware of the implications for their money. Hopefully, this article will help some of them to get more in sync with the realities of “owning bonds” in 2022 and beyond.

Tactical investing enters its golden era

After more than a decade where stock and bond indexing produced some of their best results, and at a very low cost to investors, it’s time to open up the playbook – a lot. That’s where a tactical approach using ETFs can be one viable way to do what bonds used to accomplish. While this particular article is more about warning investors about the not-so-obvious risks of bond investing in modern markets, here are a few headlines in the area of using a set of ETFs to try to replace what used to be individual bonds or bond fund on your investment statement:

- Play offense and defense, with the goal of using non-bond investments to keep volatility low.

- Be as active as needed to get the job done. This is sometimes referred to as “tactical rotation” and its goal is to capture investment returns in smaller chunks. This is essentially another way to “make nickels and dimes” instead of investing for the long-term home run, and risking a big strikeout.

- Get used to “renting” more and “owning” less. Markets of today do not reward “buy and hold” investing like they used to. Maybe they will at some point, but for the foreseeable future, prioritize return of your capital, rather than focusing 100% on return on your capital. Shortening your average holding period, and taking chunks of return when and where you can get them, is a big part of modern investing.

- Research a well-defined and limited universe of diverse ETFs to be considered for your portfolio. There’s a whole wide world of investment segments and niches is pursue, on the way to creating a more stable, sustainable portfolio that produces a more controlled level of total return than bonds and stocks are likely to generate for a while.

The “depth chart” approach to building a modern bond replacement portfolio

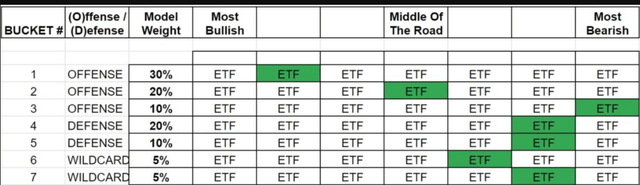

As one example of how to visualize this, here’s an approach I created years ago. The portfolio models we build resemble a grid that we call a “depth chart,” akin to what sports teams do.

In the example below, the “roster” of possible “players” to use (ETFs to consider investing in) is a researched group of 49 different securities. There are seven “buckets,” each of which supplies one of the seven ETFs assigned to that bucket. There are offensive-minded ETFs, defensive-minded ETFs, and a set of “wildcard” positions, which allow for a much wider variety of considerations, including some more volatile ETFs. Importantly, the more volatile the ETF, the lower the allocation to that ETF permitted by this portfolio system.

Get in sync with new investment realities

Bond investing is not dead, but it has changed dramatically. Understanding the why and how of these dramatic changes might be the most important thing an investor within 10 years of retirement (in it or leading up to it) can do. This article was a starting point in helping investors recognize this, and to lay the groundwork for more detailed, specific articles on individual ETFs and portfolio strategies built for contemporary markets.

Be the first to comment