Guillem de Balanzo/iStock via Getty Images

Situation Overview

To crystalize value and to delever, Tidewater Midstream (TWM:CA) put its biofuel assets in Tidewater Renewable (TSX:LCFS:CA) and took it public. LCFS completed in August 2021 at $15/share. TWM continues to own 69% of LCFS. For an overview of the TWM and LCFS, you can read my previous article.

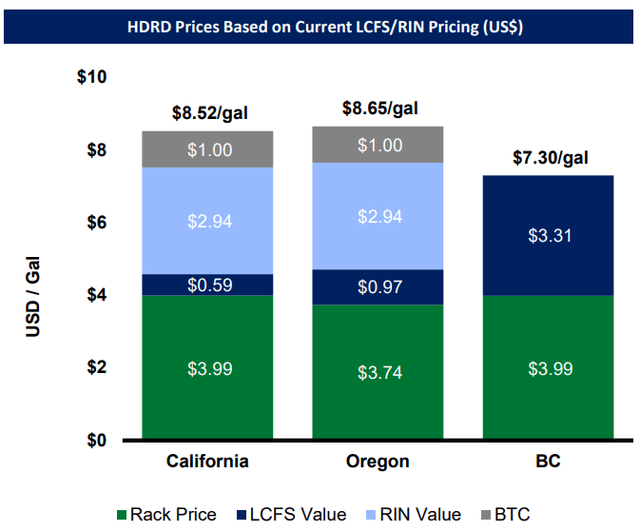

LCFS has three primary assets in the development stage. The first one is Renewable Diesel & Renewable Hydrogen Complex (HDRD). This plant will take various organic waste feedstock (e.g. Used Cooking Oil, Tallow, Canola, and Soybean oil) and turn them into renewable diesel (RD). This project has a nameplate RD capacity of 3.0 Mbbl/d, and as a part of the refining process, will be able to produce 10.0 MMcf/d of renewable hydrogen. This will be Canada’s first renewable diesel project. The second project is called Co-processing Projects, which is embedded in the operation of the Prince George Refinery (PGR). Simply put, LCFS is spending some capex to give PGR the capability to produce a small amount of renewable diesel and gasoline. Finally, LCFS recently entered into a Renewable Natural Gas partnership with Rimrock RNG. The first RNG project already signed a 20-year offtake agreement with FortisBC (the gas utility company for British Columbia). The partnership is contemplating three more RNG projects (2 more in Alberta and 1 in Nebraska).

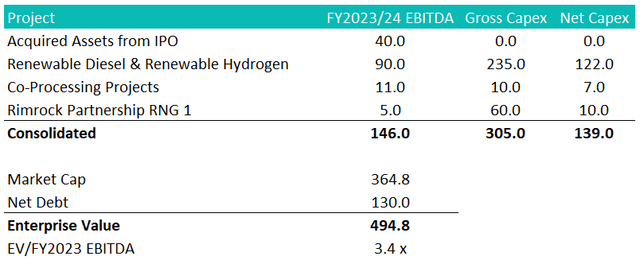

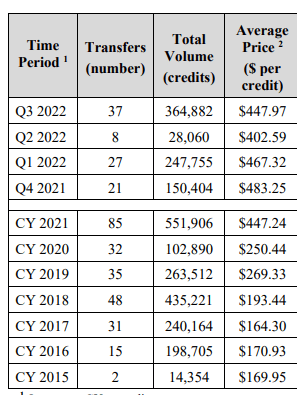

The run-rate EBITDA of each project is listed below. I took the lower end o where a range is provided. Importantly, because of the generous government incentives, LCFS is able to cut down the gross capex by more than half, while maintaining 100% of the economics. For example, almost half of the Renewable Diesel & Renewable Hydrogen project ($90-110 million run-rate EBITDA) will be funded by monetizing the British Columbia Low Carbon Fuel Credit. When the project reaches certain milestones, the BC government issues credits to LCFS which then turns around and sells into the credit market. Note that the value of these credits keeps on going up each year since 2015. On a consolidated basis, LCFS is building these projects at ~1.0x build multiple ($146 million EBITDA associated with $139 million net capex).

Investor Presentation

gov.bc.ca

On October 24, LCFS entered into a $150 million 5-year second-lien credit facility with AIMCo (the manager of various pension plans in Alberta). This credit facility comes with 3.375 million 5-year warrants at a strike price of $14.84. This is a big milestone for LCFS because this takes care of all the financing needs for all the in-progress development projects, as well as pushing its maturity wall to 2027.

Valuation

As shown above, LCFS is currently trading at 3.4x of FY2023/2024 EBITDA of ~$150 million. The stock is down roughly 30% since IPO. The market sees quite a lot of uncertainty with the management’s run-rate EBITDA projection. One could justify the low multiple with the fact that investors are taking on project development risk. Large-scale projects hardly ever come in on budget. However, based on a couple of take-private transactions in 2022, the valuation disparity seems excessive.

Chevron purchased Renewable Energy Group for US$2.75 billion or ~10.0x FY2022 EBITDA. More recently, BP purchased Archaea for US$4.1 billion or ~13.0x FY2023 EBITDA. No doubt that both targets are more established than LCFS but the point is that the trend of integrated energy companies consolidating renewable fuel companies won’t stop soon. Integrated energy companies, faced with ESG pressure, will need to reduce the carbon content in their product, and an easier way is to use biofuel as an offset. They are able and willing to pay a double-digital multiple for renewable fuel companies as the logistical integration alone can reduce the effective purchase multiple by a big margin.

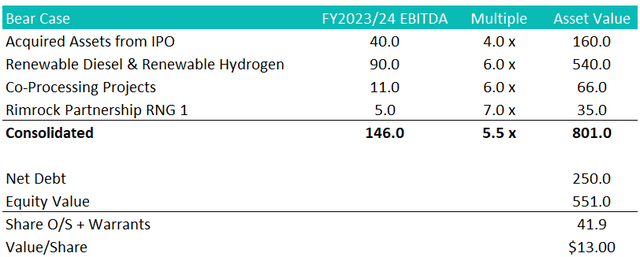

I took a SOTP approach to value LCFS. In my bear case, I assumed 5.0x for the legacy storage and logistic assets, 6.0x for the HDRD and Co-Processing Projects, and 7.0x for the RNG project. I also assumed $100 million more net debt and further dilution by 10% (increasing the share count by 10%). I get to a fair value of $13/share (~30% upside).

Author’s Estimate

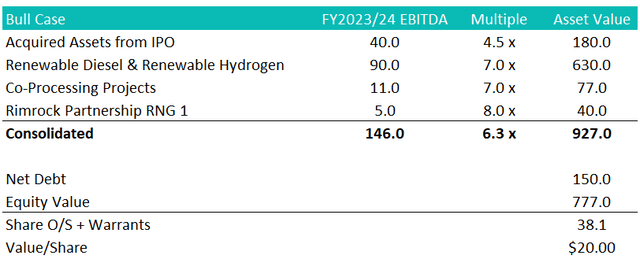

In my bull case, I increased the valuation multiple by 1.0x for each asset except for the legacy asset (increase by 0.5x). Assume no additional funding is required (i.e. no increase in net debt and share count). I get to a fair value of $20/share (~100% upside).

Author’s Estimate

Risks

Valuation Risk – I believe the valuation multiple I assigned is reasonable, if not conservative, so the valuation risk should only stems from the uncertainty of the run-rate EBITDA projection. The acquired assets EBITDA of $40 million is a sales/leaseback transaction between LCFS and TWM. I’m confident that TWM won’t go away anytime soon. Also because these are storage and logistical assets essential to the operation of PGR (TWM’s crown jewel asset), I don’t see too much risk with the $40 million number.

HDRD and Co-Processing project EBITDA will largely be influenced by the crack spread, as the final product is diesel and gasoline. Crack spread is at multi-year high everywhere and the undersupply issue don’t be resolved until the Ukraine situation comes to a resolution. On the flip side, the PGR is a regional monopoly (it’s the one of the only two refineries in BC), so even in a downside scenario, PGR should be able to enjoy a profitable crack spread level. In addition, the production of renewable diesel generates low-carbon fuel credit which LCFS can monetize, providing a significant degree of certainty (see below). Lastly, Rimrock RNG 1 has a 20-year offtake agreement with an IG counterparty as mentioned above. Given where the stock is trading, and the fact that funding is de-risked, I don’t see much valuation risk at this point.

Investor Presentation

Execution Risk – at the end of the day, going long LCFS requires one to believe that the management can bring these projects online on time and on budget. This sounds challenging given all the logistical and labor issues that we often hear about, but so far the projects seem to be on track. I’d also note that TWM (the same management) had experience construct two large capital projects (Pipestone gas processing plant and Pioneer pipeline) so hopefully the skillset and any learnings will carry over.

Dilution/Technical Risk – TWM holds ~69% of LCFS. If for whatever reason, TWM needs to monetize more LCFS, the LCFS stock price will experience some downward pressure. The AIMCo credit facility came with a ~10% dilution via the 5-year warrant, but it has a cashless exercise option that limits the dilution somewhat. TWM also took care of its own debt maturity recently so I don’t expect TWM to be needing liquidity any time soon.

Catalysts

The in-service date of HDRD is in Q1-2023 should be a huge catalyst, but I expect the market to warm up to LCFS until the utilization rate stabilizes hopefully above 90%. By the end of 2023, LCFS will have demonstrated its FCF generation ability as operations ramp up and stabilize. I’d be very surprised if the stock doesn’t rerate to +6.0x multiple by then.

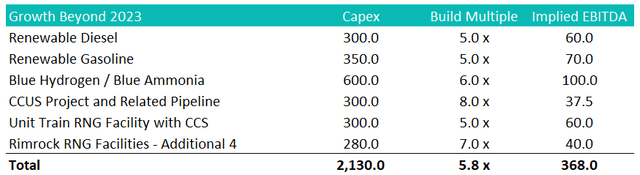

Another “catalyst” is a take-private transaction by another larger, better-capitalized energy company. LCFS has identified +$2.0 billion in growth opportunities. At sub-$400 million market cap and a run-rate EBITDA sub-$150 million when existing projects come online, it’s difficult to imagine how LCFS can finance these growth projects. I get a sense that LCFS is doing the legwork now for a much bigger entity.

Investor Presentation

Conclusion

The thesis boils down to this – at ~3.4x EV/EBITDA multiple, the LCFS is trading way too cheap, judging by the recent double-digit multiples paid for other biofuel companies. There is also a major divergence between fundamentals and the stock price – the project funding has been de-risked, the maturity wall has been pushed out, and we are months away from major projects going in-service, while the stock price is 30% below its IPO price. I see an upside between 30-100% in the next 12-18 months.

Be the first to comment