marchmeena29/iStock via Getty Images

Continued loan growth and margin expansion will likely lift the earnings of Eastern Bankshares, Inc. (NASDAQ:EBC) through the end of 2023. On the other hand, high inflation will lift non-interest expenses, thereby restraining earnings growth. Overall, I’m expecting Eastern Bankshares to report earnings of $1.33 per share for 2022 (up 48% year-over-year) and $1.57 per share for 2023 (up 18% year-over-year). Compared to my last report on Eastern Bankshares, I’ve reduced my earnings estimates mostly because I’ve raised my non-interest expense estimates. Next year’s target price is quite close to the current market price. Therefore, I’m maintaining a hold rating on Eastern Bankshares.

Loan Growth to Slow Down but Remain Satisfactory

Eastern Bankshares’ loan portfolio grew by a remarkable 4.1% in the third quarter of 2022, or 16.3% annualized. The management expects loan growth to slow down in the fourth quarter from the third quarter’s level, but remain above the long-term guidance level of mid-to-high-single digits, as mentioned in the earnings presentation. For 2023, the management expects loan growth to be below the 2022 level and at the lower end of the long-term guidance of mid-to-high-single digits.

In my opinion, the high interest-rate environment is bound to dampen credit demand in the coming quarters. Residential mortgage loans, which make up around 16% of total loans, are likely to be hit the most.

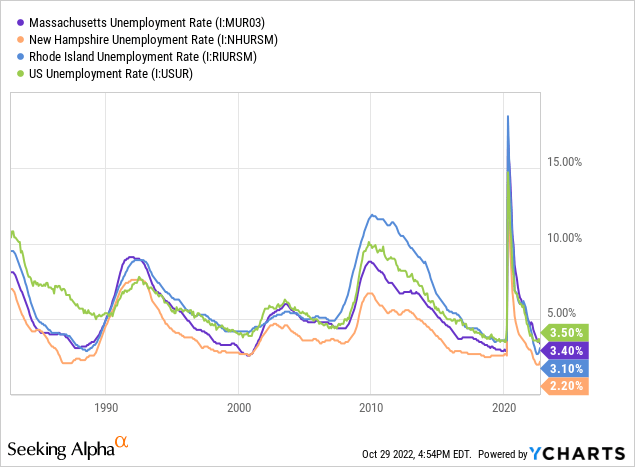

On the other hand, commercial loans, which make up almost three-quarters of total loans, will benefit from satisfactory economic activity. Eastern Bankshares operates in Massachusetts, New Hampshire, and Rhode Island. All three states currently have stronger job markets than most other states. As shown in the following chart, the unemployment rates of these states are near record lows, which indicates strong economic activity.

Considering these factors, I’m expecting the loan portfolio to grow by 1.0% in the last quarter of 2022, leading to full-year loan growth of 5.9%. For 2023, I’m expecting the loan portfolio to grow by 4.1%. Meanwhile, I’m expecting other balance sheet items to grow somewhat in line with loans. However, the equity book value will suffer due to unrealized mark-to-market losses on the Available-for-Sale securities portfolio. The following table shows my balance sheet estimates.

| FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | |||||

| Net Loans | 8,899 | 9,594 | 12,157 | 12,880 | 13,403 |

| Growth of Net Loans | NA | 7.8% | 26.7% | 5.9% | 4.1% |

| Other Earning Assets | 1,736 | 5,122 | 9,600 | 7,383 | 7,683 |

| Deposits | 9,551 | 12,156 | 19,628 | 18,827 | 19,592 |

| Borrowings and Sub-Debt | 235 | 28 | 34 | 423 | 440 |

| Common equity | 1,600 | 3,428 | 3,406 | 2,460 | 2,676 |

| Book Value Per Share ($) | NA | 18.4 | 18.2 | 13.2 | 14.3 |

| Tangible BVPS ($) | NA | 16.3 | 14.8 | 9.6 | 10.8 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million, unless otherwise specified) | |||||

Margin’s Moderate Rate-Sensitivity to Further Boost the Topline

Eastern Bankshares’ net interest margin grew by 24 basis points in the third quarter after rising by 21 basis points in the second quarter of 2022. Margin expansion will likely continue as I’m expecting a further 150 basis points hike in the fed funds rate till the mid of 2023.

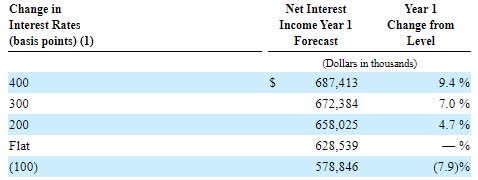

The loan portfolio is moderately rate-sensitive because around 36% of all loans reprice within a month, as mentioned in the earnings presentation. The deposit book’s rate sensitivity, or deposit data, is also quite high because of the large balance of interest checking, savings, and money market accounts. These deposits altogether made up 63% of total deposits at the end of September 2022. The results of the management’s rate-sensitivity analysis given in the second quarter’s 10-Q filing show that a 200-basis points hike in rates can boost the net interest income by 4.7% over twelve months.

2Q 2022 10-Q Filing

Considering these factors, I’m expecting the net interest margin to grow by 15 basis points in the last quarter of 2022 and eight basis points in 2023.

Higher Operating Expenses to Restrict Earnings Growth

A surge in non-interest expenses will likely weigh down earnings through the end of 2023. The management plans to book non-cash pension expenses of $10 million to $15 million in the fourth quarter of 2022, which will boost non-interest expenses. Further, high inflation and tight labor markets will continue to exert pressure on salary expenses. As the inflation has been higher and more persistent than I previously anticipated, I’ve decided to raise my non-interest expense estimates for the fourth quarter of 2022 as well as 2023. Previously I was expecting non-interest expenses of $447 million for 2022 and $461 million for 2023. I’m revising upwards these estimates to $465 million for 2022 and $508 million for 2023.

Apart from higher non-interest expenses, the normalization of provision expenses will also limit earnings growth. Thanks to the recent improvement in asset quality, allowances are now 387.77% of non-performing loans, up from 245.77% at the end of September 2021. As a result, the high reserve level will likely cushion the blow from heightened inflation. Overall, I’m expecting provisioning to be near the 2019 level going forward.

Overall, I’m expecting Eastern Bankshares to report earnings of $1.33 per share for 2022, up 48% year-over-year. For 2023, I’m expecting earnings to grow by 18% to $1.57 per share. The following table shows my income statement testaments.

| FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | |||||

| Net interest income | 411 | 401 | 430 | 577 | 663 |

| Provision for loan losses | 6 | 39 | (10) | 9 | 8 |

| Non-interest income | 182 | 178 | 193 | 182 | 191 |

| Non-interest expense | 413 | 505 | 444 | 465 | 508 |

| Net income – Common Sh. | 135 | 23 | 155 | 218 | 257 |

| EPS – Diluted ($) | NA | 0.13 | 0.90 | 1.33 | 1.57 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million, unless otherwise specified) | |||||

In my last report on Eastern Bankshares, I estimated earnings of $1.39 per share for 2022 and $1.60 per share for 2023. I’ve slightly reduced my estimates for both years mostly because I’ve increased my non-interest expense estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Maintaining a Hold Rating

Eastern Bankshares is offering a dividend yield of 2.1% at the current quarterly dividend rate of $0.10 per share. The earnings and dividend estimates suggest a payout ratio of 26% for 2023, which appears sustainable. As the IPO of Eastern Bankshares was completed in 2020, there isn’t enough data to determine what is a comfortable payout rate for the management. Therefore, I haven’t incorporated any change in the dividend level for my investment thesis.

I’m using the peer average price-to-book (“P/B”) and price-to-earnings (“P/E”) multiples to value Eastern Bankshares.

| ASB | ABCB | PPBI | FHB | CBU | Peer Average | |

| P/E GAAP (“FWD”) | 10.3x | 9.9x | 11.8x | 12.7x | 17.9x | 12.51x |

| P/E GAAP (“TTM”) | 11.1x | 10.7x | 11.4x | 14.0x | 18.5x | 13.12x |

| Price to Book (“TTM”) | 0.9x | 1.2x | 1.2x | 1.5x | 2.2x | 1.40x |

|

Source: Seeking Alpha Data extracted after the market closed on October 28, 2022 |

Multiplying the peer average P/B multiple with the forecast book value per share of $14.3 gives a target price of $20.1 for the end of 2023. This price target implies a 3.6% upside from the October 28 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/B Multiple | 1.20x | 1.30x | 1.40x | 1.50x | 1.60x |

| BVPS – Dec 2023 ($) | 14.3 | 14.3 | 14.3 | 14.3 | 14.3 |

| Target Price ($) | 17.2 | 18.7 | 20.1 | 21.5 | 23.0 |

| Market Price ($) | 19.4 | 19.4 | 19.4 | 19.4 | 19.4 |

| Upside/(Downside) | (11.2)% | (3.8)% | 3.6% | 11.0% | 18.3% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $1.57 gives a target price of $20.6 for the end of 2023. This price target implies a 6.0% upside from the October 28 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.1x | 12.1x | 13.1x | 14.1x | 15.1x |

| EPS – 2023 ($) | 1.57 | 1.57 | 1.57 | 1.57 | 1.57 |

| Target Price ($) | 17.4 | 19.0 | 20.6 | 22.1 | 23.7 |

| Market Price ($) | 19.4 | 19.4 | 19.4 | 19.4 | 19.4 |

| Upside/(Downside) | (10.2)% | (2.1)% | 6.0% | 14.1% | 22.2% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $20.3, which implies a 4.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 6.9%. Hence, I’m maintaining a hold rating on Eastern Bankshares.

Be the first to comment