Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 22.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the third week of October.

Be sure to check out our other Weeklies – covering the Closed-End Fund (“CEF”) as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

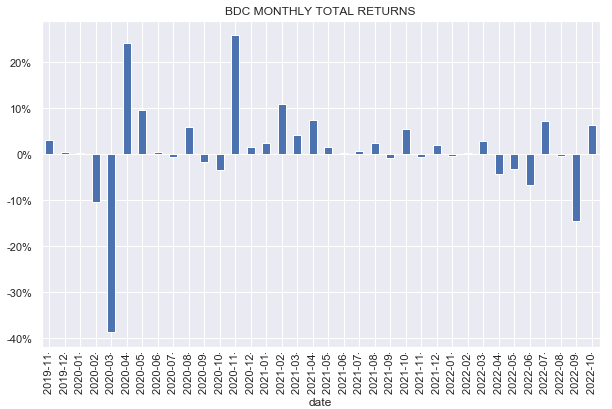

The BDC sector finished in the green, supported by higher short-term rates and stronger stocks. Month-to-date, all BDCs in our coverage universe finished in the green. October is shaping up to be a decent month so far with a return of around 6% for the sector, shaving off about half of the September drop.

Systematic Income

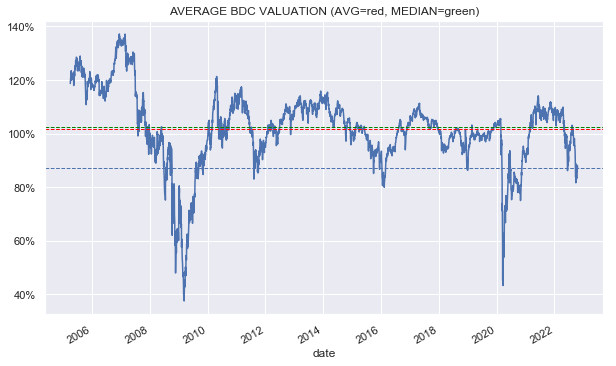

BDC valuations have come back to their June level of about 86%, bouncing off a depressed 81% figure in August.

Systematic Income

Market Themes

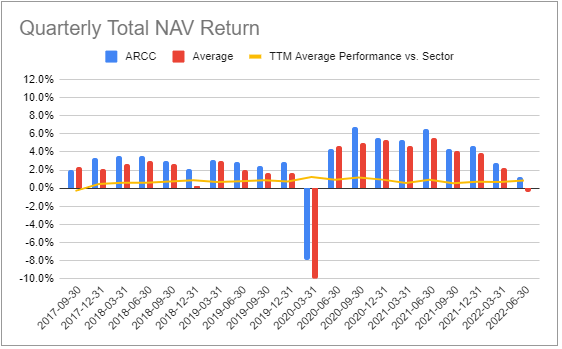

There was a question on the service of why not just hold (ARCC) in the BDC space. This is definitely not a crazy idea. First, ARCC has put up not just strong performance but also consistent performance over time – over the last 5 years it only had two quarters of below sector total NAV returns.

Systematic Income BDC Tool

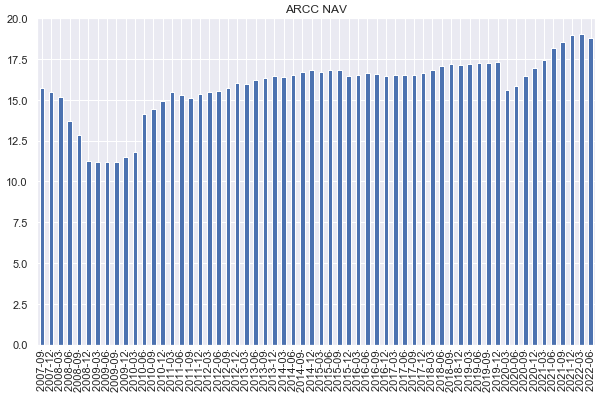

Second, it has been very resilient, seeing its NAV reach new highs over various market shocks such as the GFC, Energy and COVID shocks.

Systematic Income

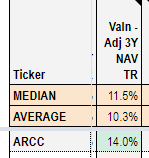

Third, it’s not outright cheap but its valuation premium of about 8% in relative terms is less than its performance premium of 22% (12.9% vs 10.5% 5Y total NAV CAGR). We calculate a 3Y metric in the BDC Tool that combines the company’s 3Y total NAV return and its current valuation. By this metric, ARCC looks very attractive – well above the sector average figure.

Systematic Income BDC Tool

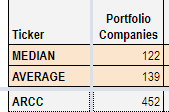

Fourth, BDCs give you automatic diversification even in a single holding. ARCC has exposure to 452 companies which is a lot more than you find even in actively-managed credit funds like CEFs. It is also 3.25x higher than the average BDC.

Systematic Income BDC Tool

With all of that said, holding a single BDC is not something that makes sense to us for a few reasons. First, holding a single BDC means holding it through all levels of valuation. Imagine a scenario where ARCC rises to a valuation of 150% – that may seem crazy but there were multiple BDCs over the past year that reached this level. That kind of premium is not justified for any BDC.

Second, investing using a rear-view mirror is very dangerous. There are many examples where the strongest performer over a given period then fizzled out and underperformed – in fact, there are many BDCs like this. This is not to say that ARCC is guaranteed to underperform but betting that an outperformer will keep outperforming is not a sound investing strategy. ARCC could underperform either because something goes awry in its process or because of unfavorable conditions for its investment tilts such as a challenging environment for second-lien and subordinate paper which it is overweight.

Ultimately, diversification makes sense in all sectors of the portfolio including BDCs. This may seem like “diworsification” since it involves allocating to BDCs with a weaker longer-term track record than ARCC, but it’s really not. That’s because investors are not diversifying based on performance but across performance risk factors. This includes things like the target market – ARCC doesn’t actually target the middle-market segment (i.e. $10-150m EBITDA) unlike nearly all other BDCs but a larger segment (its weighted-average EBITDA is $179m). ARCC also has a lower-lien profile and a lower equity profile which gives it a higher yield but less of a lottery-like potential. Other BDCs allow investors to cover these other areas of the BDC market.

Market Commentary

BDC Main Street Capital Corp. (MAIN) provided very healthy Q3 guidance with a strong rise in net income of 13% and a 2% rise in the NAV. Overall, sector NAV guidance is running fairly flat in Q3 which means that we could be looking at high single-digit annualized total NAV returns for Q3 which would be a great result for the space. We could be set up for a nice rally once people realize that NAVs have not fallen nearly as much as prices.

Hercules Capital (HTGC) increased its base dividend by 3% – total dividend was increased by 2% as the special remained the same. At this point most of the sector has raised dividends this year – a nice result in a difficult overall environment.

Stance And Takeaways

The BDC sector has held in well over the past month despite continued volatility across markets. This is likely due to the fact that initial Q3 estimates have been nearly uniformly positive. In our view, this sets up the sector for potential gains as the earnings period gets under way, especially since BDC valuations remain attractive overall.

Be the first to comment