jasastyle

Markets are fraught with peril. After a quick rally earlier in the week, the hot jobs report has crushed the major averages once again, with investors fearful of an emboldened, hawkish Fed.

As I write this, the Dow is down approximately 1.5%, the S&P 500 is down roughly 2%, and the Nasdaq is down roughly 3%.

It’s clear that we’re in a risk-off market for longer duration risk assets.

And yet, during times like this, I’m happy to wear a contrarian’s hat and scoop up shares of wonderful companies that the market has irrationally beaten down.

Do I know when the macro sentiment is going to shift from bearish back to bullish?

No, of course not.

I don’t have a working crystal ball.

No one does.

But, what I like to do during times like this is stay disciplined to my ground up approach, paying close attention to company fundamentals as I attempt to spot attractive margins of safety, as opposed to allowing the fearful macro headwinds dictate my decision making.

A Quick Physics Lesson

The fact of the matter is, it’s a lot easier to generate strong long-term returns when you’re buying equities down 25%, 30%, 40%, etc., from their highs than it is when you’re buying at a market top.

Yes, higher interest rates have changed the risk/reward calculus for risk assets like equities. As risk-free rates rise higher, it makes sense that fair value premiums on stocks should drop.

And yet, the market has a bad habit of taking things too far and I think that’s what we’re witnessing today.

This irrational habit is exactly what I hope to take advantage of as a disciplined value investor.

Because of the herd mentality that drives markets, the bull/bear pendulum often swings well past rational levels and reasonable valuations.

Anyone who has taken a basic physics class (I’m talking high school, not university level) understands that as a pendulum swings one way, its kinetic energy decreases and its potential energy increases.

This trend continues as the displacement from zero position (which, for the sake of this analogy, should be considered fair value) increases and therefore, as momentum drives bear and/or bear market rallies, creating larger and larger displacements on the pendulum, the potential for a rebound and/or a sell-off increases.

Since we’re currently living through a bear market period, this implies that the potential for a strong market rebound is growing.

As I said before, I can’t predict the day that the bearish kinetic energy will run out, giving way to the bullish potential energy… causing markets to roar back higher.

But, what I do know is that the U.S. stock market has always bounced back from bear market periods and I suspect that will be the case this go around as well.

You see, the U.S. market has always bounced back for two primary reasons.

One, because mean reversion always occurs in the market.

Paraphrasing Benjamin Graham…

In the short-term, markets act as voting machines (driven by sentiment), but over the long-term, they act as weighing machines (accounting for fundamentals).

In other words, eventually the irrational herd will come to its senses and realize that its fear has created bargains that are too good to pass up.

And two, because the capitalistic system that the U.S. economy is built upon has always inspired competition, which has led to innovation, which has led to growth.

This has been the case throughout a myriad of economic conditions and bear market scenarios and moving forward, I expect that this trend remains in place.

Therefore, the combination of ongoing fundamental growth and the prospects of mean reversion leads me to believe that shares of irrationally beaten down stocks have the potential to rise much higher over time.

The market can stay irrational for very long periods of time. We’ve seen this occur throughout history.

However, I remain confident in the blue-chip stocks that I own and I’m happy to continue to build positions in my favorite companies because the vast majority of them pay reliable dividends and therefore, I’m able to rest easy, knowing that I’ll be paid while I wait for the market to come to its senses.

A Market Of Stocks, Not A Stock Market

To be clear, not every company in the market is irrationally cheap.

There are certain stocks that began the year trading with premiums that were so irrationally high that their 2022 sell-offs have still not driven them down below fair value.

Also, it’s important to note that not every company is likely to produce fundamental growth moving forward.

Furthermore, there are also plenty of companies out there with poor balance sheet and the forward-looking prospects of those names are becoming more and more bleak as interest rates rise, meaning that cheap refinancing is no longer an option and therefore, interest rate expenses are likely to cut deeper and deeper into cash flows down the road.

During times like this, when there are numerous wonderful blue chips with solid long-term growth prospects trading at discounts to fair value, I see little reason to speculate on deep value picks and/or chase unsustainably high yields.

Instead, I believe it’s best to accumulate shares of blue chips…or better yet, best-in-breed companies, that trade with wide margins of safety.

Over the long-term, data clearly points towards blue chip dividend growers outperforming the major averages on the whole.

To produce a reliably growing dividend over the long-term, a company must generate reliably increasing fundamentals. Otherwise, the dividend growth wouldn’t be sustainable.

And therefore, to conclude this piece, I’d like to highlight a few of the highest quality REITs that I follow which have illustrious fundamental and dividend growth histories…as well as positive fundamental growth outlooks moving forward.

Realty Income (O)

Anyone who follows me knows that I love Realty Income (my largest holding). This is the best-in-breed triple net lease REIT with a 29-year annual dividend streak. And, after O’s -23.5% sell-off from its 52-week highs, Realty Income shares now yield more than 5%.

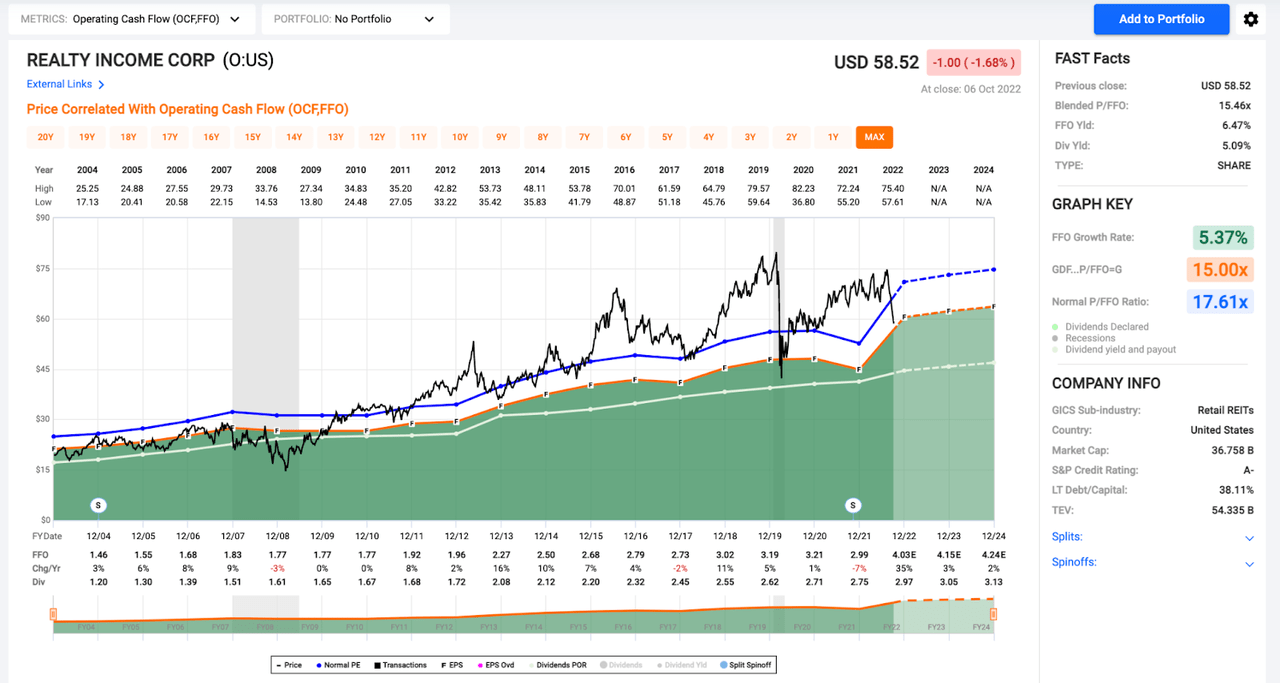

As you can see on the chart below, O has produced negative y/y FFO growth during just 3 out of the last 20 years. On the chart below, you’ll see that these were -3%, -2%, and -7%.

That’s amazing, considering the S&P 500’s earnings-per-share have experienced double-digit drops 4 times during this period. And, looking ahead, the consensus analyst estimates for 2022, 2023, and 2024 all point towards positive growth.

FAST Graphs

O is trading for just 14.5x expected 2022 FFO and approximately 15x expected 2022 AFFO.

Both of these multiples are well below historical averages of 17.6x and 17.8x, respectively.

Therefore, O checks all of my boxes and remains one of my top buys during the recent market sell-off.

Mid-America Apartment (MAA)

If you’re more interested in multi-family real estate than physical retail, well then MAA is another great option in today’s market.

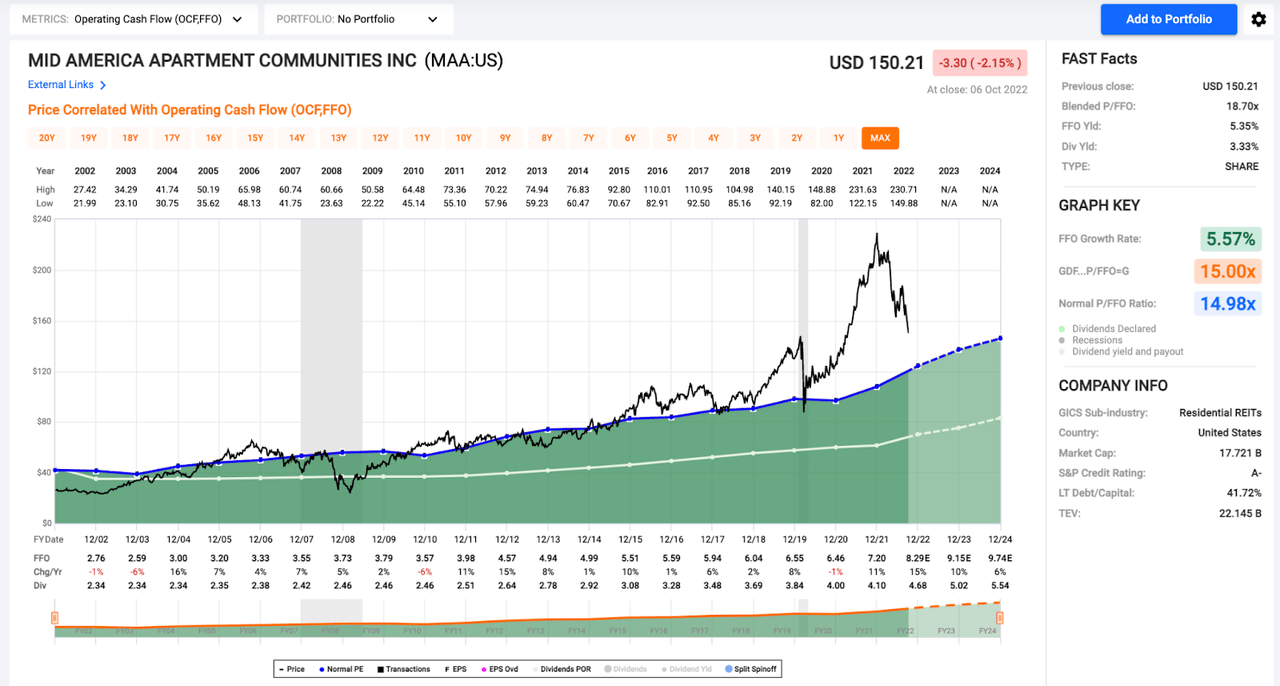

MAA shares have produced negative y/y FFO growth during just 4 out of the last 20 years. And, looking at the chart below, you’ll see that the largest negative y/y growth result was just -6%.

If that doesn’t result in peace of mind, I don’t know what will. MAA’s 3.33% yield isn’t as high as Realty Income’s; however, MAA offers incredibly strong dividend growth prospects. MAA has been growing its dividend for 12 consecutive years.

The company’s most recent dividend raise was 14.9%. Moving forward, analysts are calling for annual FFO growth of 15%, 10%, and 6%, in 2022, 2023, and 2024, respectively. Therefore, I believe that high single-digit/low double-digit dividend growth is likely moving forward.

FAST Graphs

MAA shares are down by 35.6% on a year-to-date basis. This has pushed its P/FFO multiple down from approximately 31x to just 17.5x.

On an AFFO basis, MAA shares are trading for 19.3x 2022 expectations.

Over the last 5-, 10-, and 20-year periods, MAA’s average P/AFFO multiples were 21.1x, 19.0x, and 18.5x, respectively.

With MAA’s strong forward growth estimates in mind, I believe that shares represent a solid value here down more than approximately 37% from their 52-week highs.

Sure, MAA trades at a premium to many of the other REITs in my coverage spectrum; yet, opportunities to buy these shares at a discount have been very rare historically and that’s why I believe investors should strongly consider accumulating MAA after its recent sell-off.

Federal Realty Investment Trust (FRT)

When it comes to quality, investors don’t have to look any further than the REIT with the longest annual dividend increase streak: Federal Realty Investment Trust.

This company has been increasing its dividend for 55 consecutive years now.

FRT shares are down by 33.6% during the 2022 sell-off and this has pushed their dividend yield up to 4.70%.

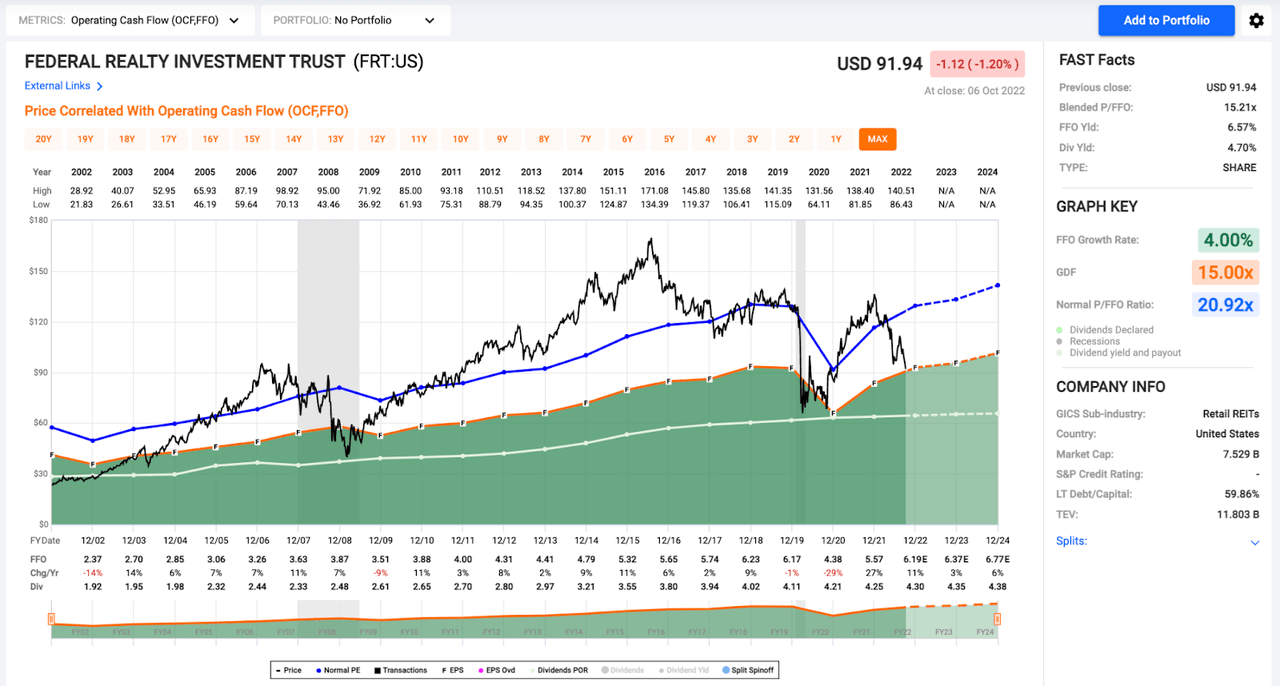

Like MAA, FRT has only posted negative y/y FFO growth during 4 out of the last 20 years.

FAST Graphs

Looking at the chart above, you’ll see that FRT’s results have been a bit more volatile – especially during the COVID-19 recession where social distancing policies and regulations forced many of Federal’s establishments to shut their doors.

However, we view that as a historical aberration and therefore, looking at the rest of FRT’s data, you’ll see a very reliable growth trajectory.

Furthermore, coming out of the COVID recession, FRT has performed well. The company posted 27% FFO growth in 2021 and analysts expect to see the stock post positive bottom-line growth in 2022, 2023, and 2024 as well.

After FRT’s recent sell-off, shares trade for just 14.7x expected 2022 FFO and 19.1x expected 2022 AFFO.

Once again, this dip has brought both of these multiples down below FRT’s long-term averages.

FRT’s 20-year average P/FFO multiple is 20.9x and the company’s 20-year average P/AFFO multiple is 28x.

No, FRT doesn’t offer the highest dividend yield in the REIT space; however, management has made it clear that they prioritize shareholder returns and therefore, circling back to the fact that dividend growers tend to outperform over time, I feel comfortable placing a “Strong Buy” rating on FRT shares here near 52-week lows.

Conclusion

These are just 3 of the many blue-chip REITs that are currently trading below my fair value estimates. Frankly, after the market’s strong double-digit dip, I could write a novel-length report on undervalued blue chips.

My team and I at iREIT talk about these wonderful opportunities every day with subscribers. Yes, it’s true that there are higher yields and deeper values available right now.

And yes, depending on one’s risk tolerance and conviction levels, those more speculative stocks could provide more upside potential.

But, it’s during moments like these, where anxiety and fear are dominating the markets (and the collective psyche of individual investors) that a simple and easy focus on quality can work best.

You don’t have to chase yield in this environment. You don’t have to take outsized risks.

Instead, due to the rare discounts currently being applied to the best of the best stocks, all you have to do to put yourself in a situation to generate strong passive income in the present and enormous wealth over the long-term, is to buy and hold beaten down blue chips.

This isn’t exciting. It’s not sexy. And honestly, it can be a little boring.

But, boring is fine by me in markets like this. This sort of strategy allows me to sleep well at night knowing that I own bits and pieces of wonderful companies that pay me reliably increasing dividends.

And, if I had to guess, I’d say that this sort of strategy would allow you to rest easy too.

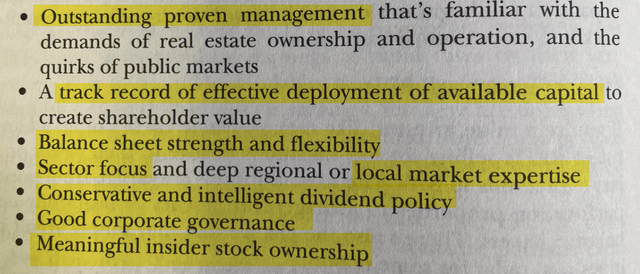

From my book, The Intelligent REIT Investor Guide (WLY):

Be the first to comment