Thomas Lohnes

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on September 2nd.

Real Estate Weekly Outlook

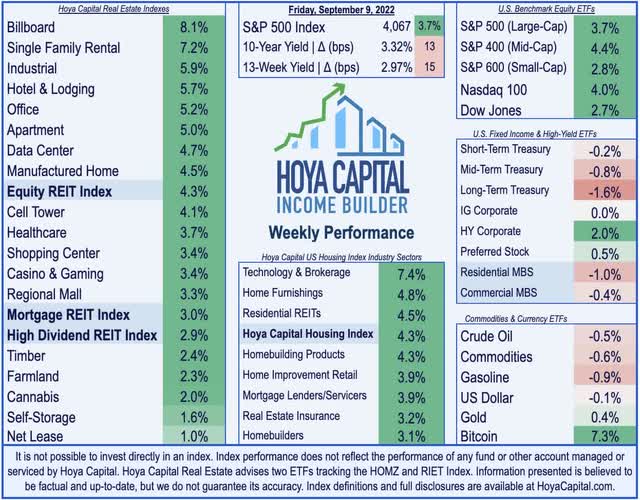

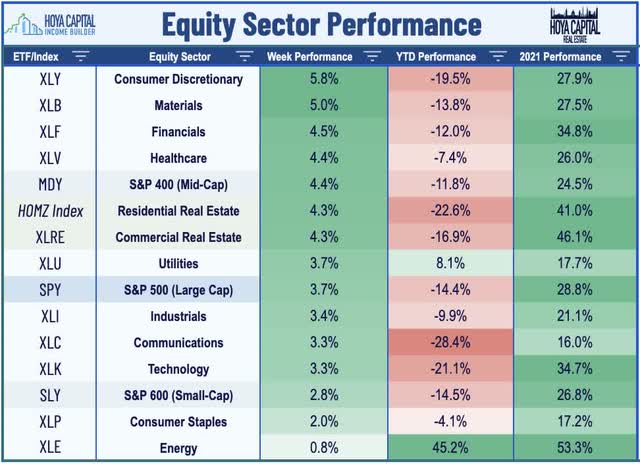

U.S. equity markets snapped a three-week skid with broad-based gains this week as domestic inflation expectations receded sharply amid a further deterioration in the demand outlook for Europe and Asia. Stuck between a rock and a hard place, the European Central Bank delivered a “jumbo” interest rate hike while slashing its forecast for the region’s economic growth amid a crippling energy crisis while China doubled down on its ‘COVID-zero’ policy with another wave of lockdowns. With persistent inflation seen as the most acute threat to U.S. markets, buyers re-emerged ahead of a critical CPI report expected to show month-over-month deflation for a second-straight month.

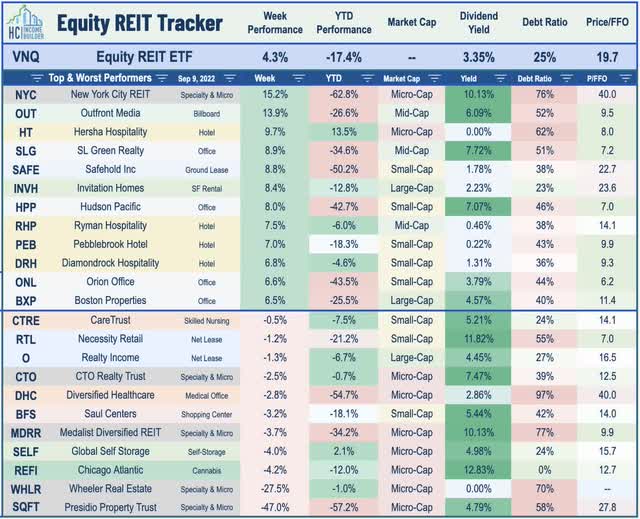

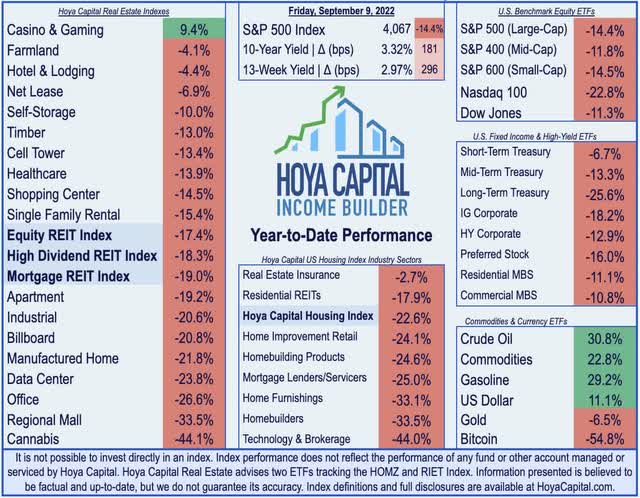

Rebounding after a three-week selloff that had erased much of the market rebound from mid-June to mid-August, the S&P 500 rallied 3.7% on the week, trimming its year-to-date declines to back under 15%. The Mid-Cap 400 rallied 4.4% while the tech-heavy Nasdaq 100 advanced 4.0%. Real estate equities were among the upside standouts of the week with the Equity REIT Index finishing higher by 4.3% on the week with all 18 property sectors in positive territory while the Mortgage REIT Index gained 3.0%. Residential REITs sparked a rebound in the broader Hoya Capital Housing Index after upbeat reports from apartment operators and signs of a potential plateau in the recent rate-driven slump in homebuyer demand.

Bond investors weren’t fully buying the positive rate outlook, however, as the 10-Year Treasury Yield jumped 13 basis points to close at 3.32% – its second highest end-of-week closing level since 2007 – as market-implied odds of another “jumbo” 75-basis-point rate hike jumped above 90% from below 50% last week. Crude Oil dipped to eight-month lows following the China lockdown reports, but pared the declines after Russia threatened to further halt oil and gas exports to Europe. Stateside, the US Dollar Index remained near two-decade highs after decent jobless claims data showing that initial unemployment claims retreated to the lowest levels since June. All eleven GICS equity sectors finished higher on the week with Consumer Discretionary (XLY) and Materials (XLB) stocks leading the advance.

Real Estate Economic Data

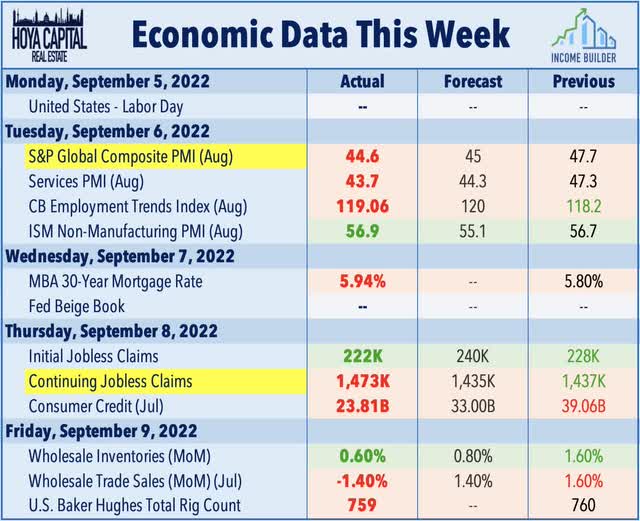

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

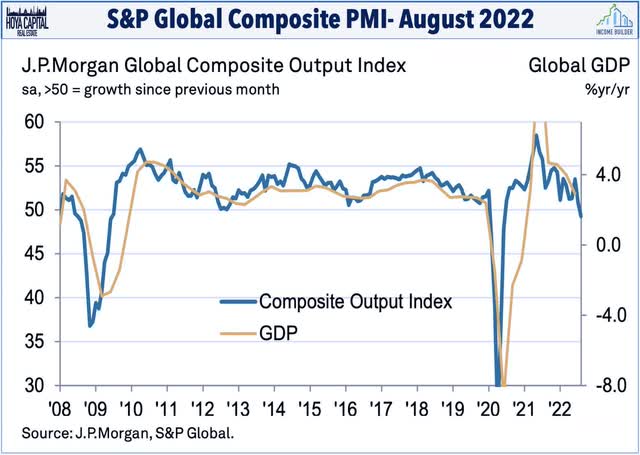

A mixed slate of PMI data highlighted a relatively quiet week of economic data. S&P Global reported this week that August saw global economic activity contract for the first time since June 2020 “as new order inflows declined, international trade volumes fell and signs of excess capacity grew.” The JPMorgan Global Composite PMI fell to 49.3 in August from 50.8 in July with output contracting in both the manufacturing and service sectors, the first time both categories have been in concurrent downturns since June 2020. S&P’s U.S. PMI report, meanwhile, showed that U.S. Services PMI Business Activity Index fell to 43.7 in August, worse than the initial “flash” estimate of 44.1 and a reading of 47.3 in July. Interestingly, a separate survey from ISM – which tends to lag the S&P metrics by 2-3 months – showed that U.S. services sector activity rose in August to the highest level since April. Given that respondents reported higher diesel and gasoline prices in the month, however, the survey period appears to reflect conditions before early July.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

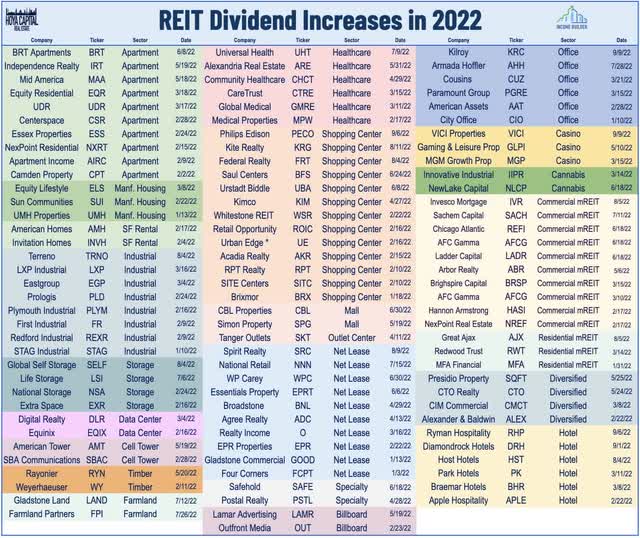

Another week, another wave of REIT dividend increases. Four more REITs raised their dividends this week, bringing the full-year total across the real estate sector to 105. Casino REIT VICI Properties (VICI) boosted its quarterly dividend by 8% to $0.39/share – following its recent pattern of hiking its dividend in the third quarter of each year since its IPO. Office REIT Kilroy Realty (KRC) raised its quarterly payout by 4% to $0.54/share – the sixth office REIT to raise its payout this year while fellow office REIT Equity Commonwealth (EQC) declared a $1.00/share special dividend. Shopping center REIT Phillips Edison (PECO) – the newest shopping center REIT that went public in 2021 – also hiked its monthly dividend by 4% to $0.0933/share. Elsewhere, Ryman Hospitality (RHP) reinstated its quarterly dividend – which had been suspended since March 2020 – at $0.10/share, the sixth hotel REIT to reinstate its dividend. Also of note, NexPoint Diversified (NXDT) – which recently converted to a REIT from a closed-end fund – announced that it is switching from a monthly to a quarterly distribution frequency.

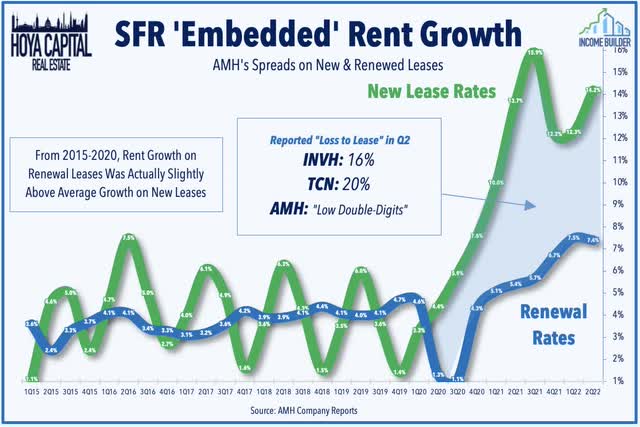

Single-Family Rentals: Invitation Homes (INVH) – which is one of our largest holdings in the REIT Dividend Growth Portfolio – rallied more than 8% on the week after S&P announced that INVH will be added to the S&P 500 Index in its upcoming quarterly rebalance alongside real estate data firm CoStar Group (CSGP). INVH – which is the nation’s largest owner of single-family rental homes. This week, we published Single Family Rental REITs: Renting the American Dream. One of the best-performing property sectors over the past quarter, SFR REITs have been beneficiaries of surging mortgage rates, which has made renting single-family homes a relative bargain. Single-family rents rose at the fastest pace on record through mid-2022, an elevated pace that has staying-power given the significant ’embedded’ rent growth resulting from below-market renewal offers as SFR REITs have “throttled” rent hikes on existing tenants. Additionally, cooling home price appreciation and tightening credit conditions have prompted many smaller SFR investors to pull back, providing a more favorable external growth environment for SFR REITs.

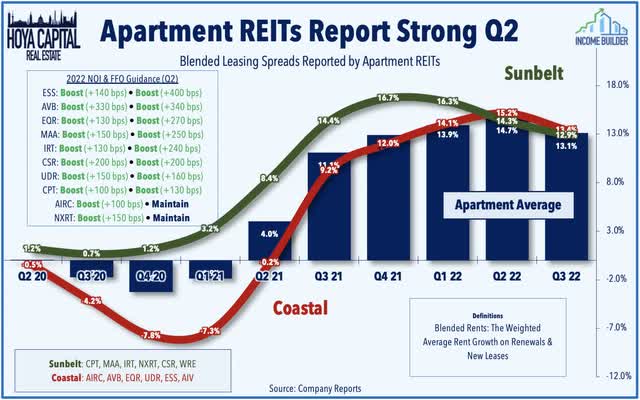

Apartment: A pair of REITs provided business updates ahead of the Bank of America Securities 2022 Global Real Estate Conference next week which showed that rent growth remains in the low-double digits despite the broader housing industry cool-down. Sunbelt-focused Camden Property (CPT) rallied more than 6% on the week after it noted that it has achieved blended rent growth of roughly 12.4% so far in Q3 – moderating from the 15.2% rate in Q2 – comprised of new lease spreads of 12.8% and renewal spreads of 11.9%. UDR (UDR) advanced nearly 6% after announcing that it achieved blended rent growth of 15.7% in July and 13.5% in August – moderating from the 17.4% achieved in Q2. Elsewhere, Equity Residential (EQR) announced plans with Toll Brothers (TOL) to develop three new luxury multifamily rental communities totaling 1,053 units in the Dallas/Ft. Worth area. EQR will invest 75% of the equity while Toll Brothers will invest 25%.

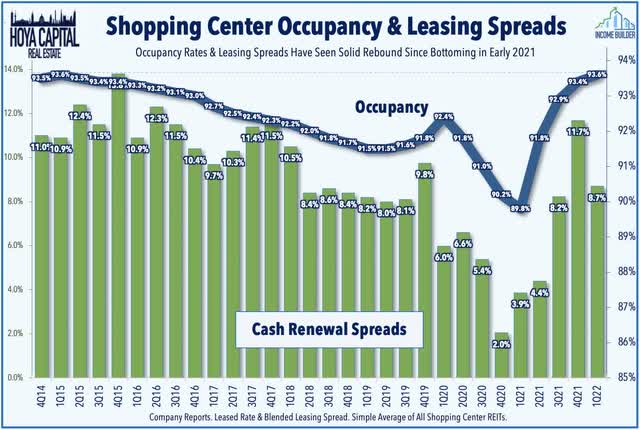

Shopping Center: Urstadt Biddle (UBA) – which we own in the REIT Focused Income Portfolio – advanced about 1% on the week reporting solid third-quarter earnings results highlighted by a 7.1% increase in renewal spreads and a 20 basis point increase in its occupancy rate to 92.1%. The company noted that its “earnings and FFO have returned to pre-pandemic levels and there is still room to grow as we fill our vacancies,” while highlighting that 87% of its properties are anchored by grocery stores, wholesale clubs or pharmacies. As noted in our recent Shopping Center REIT report Winning The Last Mile, fundamentals are now as strong – if not stronger – in the strip center sector than before the pandemic as occupancy rates climbed to the highest level since early 2015 in the most recent quarter while rental rates continue to accelerate.

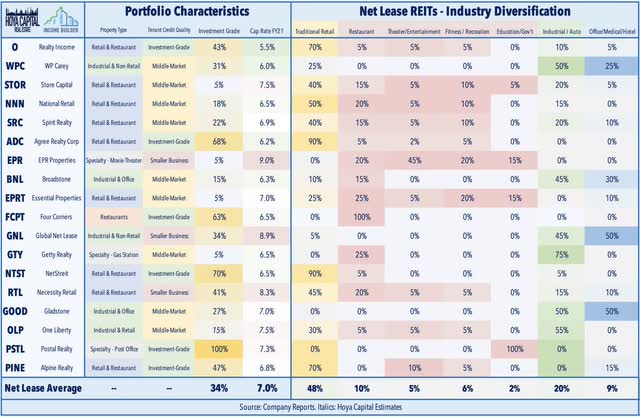

Net Lease: EPR Properties (EPR) was higher by about 4% on the week after movie theater owner Cineworld – the global No. 2 movie-theater chain and owner of Regal Cinemas – officially filed for bankruptcy in the United States. The filing comes after reports last month that the operator was struggling financially as recent box office revenues have slowed following an early summer rebound. Cineworld noted that it anticipates emerging from bankruptcy protection in early 2023, and is “confident that a comprehensive financial restructuring is in the best interests of the Group and its stakeholders, taken as a whole, in the long term.” Cineworld accounted for roughly 13% of EPR’s rents through the first half of 2022, but analysts expect the operator to continue paying rent during the proceedings, but negotiate a “haircut” of between 10% and 25%. A handful of other net lease REITs have between 1.5% and 5% of their rents coming from movie theater tenants including Realty Income (O), STORE Capital (STOR), National Retail (NNN), Essential Properties (EPRT), Spirit Realty (SRC), and Alpine Income Property (PINE).

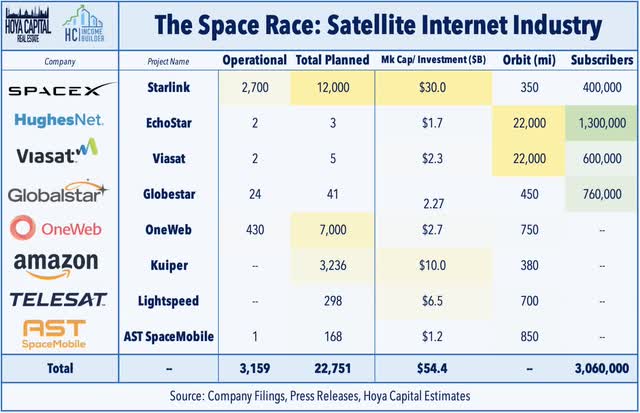

Cell Tower: Apple (AAPL) announced that its new iPhone 14 will be capable of using satellites to send emergency messages when out of cellular range utilizing the Globalstar (GSAT) network of low-earth orbit (“LEO”) satellites – a feature that had been rumored for several years. Given the power consumption requirements of satellite communications, the feature will be capable of only low-bandwidth applications for a limited amount of time and users will need to physically aim the phone at the satellite. We continue to monitor – and be impressed by – the pace of Low Earth Orbit satellite service deployment, led by Starlink and OneWeb. While there is some risk of disintermediation to towers if the mobility and power efficiency of satellite connections improves, we see a higher likelihood that LEO networks will be “customers” rather than “competitors” to tower REITs. Cell Tower REITs – American Tower (AMT), Crown Castle (CCI), and SBA Communications (SBAC) – were each REIT higher by about 4% on the week.

Land REITs: This week, we published Land REITs: Hedge Inflation – And Chaos. While still outperforming the REIT Index this year, timber and farmland REITs have pulled back amid cooling inflation expectations, slumping global commodity demand, and regional weather complications. As the Russia-Ukraine conflict drags on, significant global market share gains are accruing to North American producers of the disrupted agricultural products – notably lumber and grains – supporting land values. “Feast or famine” has been a theme in the farmland sector of late. Despite severe drought conditions in the West, a productive growing season in the Midwest and South has raised aggregating U.S. farm incomes to near-record highs this year. For timber REITs, lumber prices have moderated back towards pre-pandemic levels as slumping home construction demand resulting from rising rates follows a record year of profitability. The rate-driven cool-down, however, simply defers the longer-term need for increased single-family home production.

Mortgage REIT Week In Review

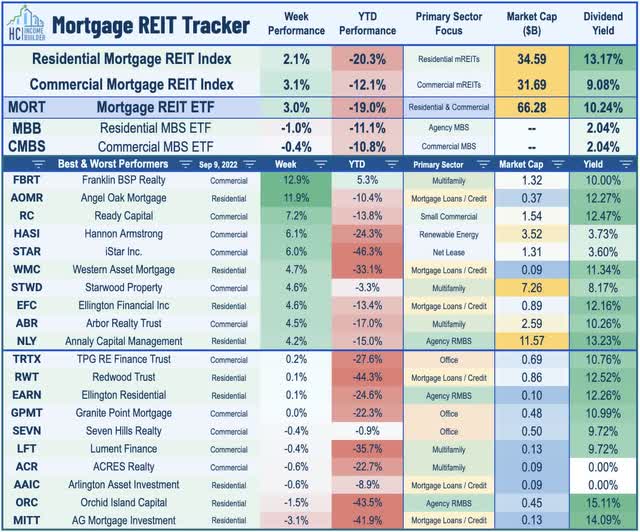

Mortgage REITs also rebounded this week despite continued pressure on mortgage-backed bond (MBB) valuations given the recent hawkish Fed commentary and the leg higher in longer-term interest rates this week. Annaly Capital (NLY) advanced about 1% on the week after S&P announced that it will be added to the S&P Mid-Cap 400 Index in its quarterly rebalance on September 19th – becoming the only mortgage REIT in the S&P Mid-Cap 400 Index. Annaly also announced that it will implement a reverse stock split of its common stock at a ratio of 1-for-4, to make its number of common shares more in line with companies of a similar market capitalization. The reverse stock split is expected to take effect after the close of business on Sept. 23, 2022. NLY also maintained its quarterly dividend of $0.88/share, consistent with the $0.22/share rate before the reverse stock split.

REIT Capital Raising & REIT Preferreds

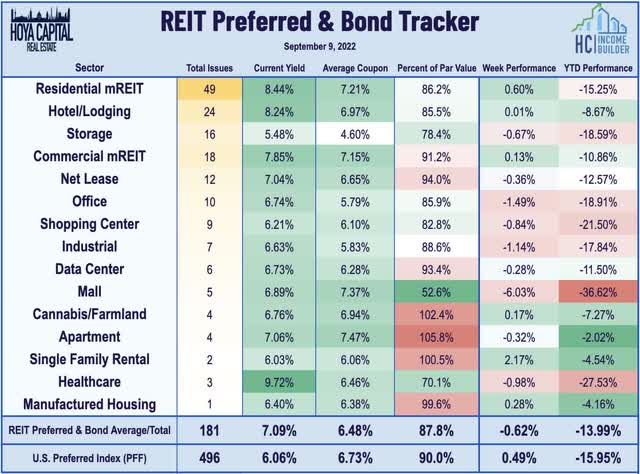

The Hoya Capital REIT Preferred Index finished lower by 2.7% this week – slightly underperforming the broader iShares Preferred ETF (PFF) which declined 2.0% – and pushing its year-to-date declines back to roughly 13% on a price return basis. This week, AGNC Investment (AGNC) announced a new preferred issuance today – pricing $150M of 7.75% Series G Fixed-Rate Cumulative Redeemable Preferred Stock that will trade on Nasdaq under the symbol AGNCL beginning next week. AGNC intends to use the net proceeds to expand its portfolio and general corporate purposes which it noted may include the redemption of its 7.000% Series C (AGNCM) Fixed-to-Floating Preferred.

2022 Performance Check-Up

Nearing the end of the third quarter, Equity REITs are now lower by 17.4% on a price return basis for the year while Mortgage REITs have slipped 19.0%. This compares with the 14.4% decline on the S&P 500 and the 11.8% decline on the S&P Mid-Cap 400. Within the real estate sector, casino REITs are now the lone property sector in positive territory for the year while eight REIT sectors are lower by at least 20%. At 3.32%, the 10-Year Treasury Yield has climbed 181 basis points since the start of the year and is back within shouting distance of its recent June intra-day highs of 3.50% and above its prior post-GFC-highs of 3.25% seen back in late 2018.

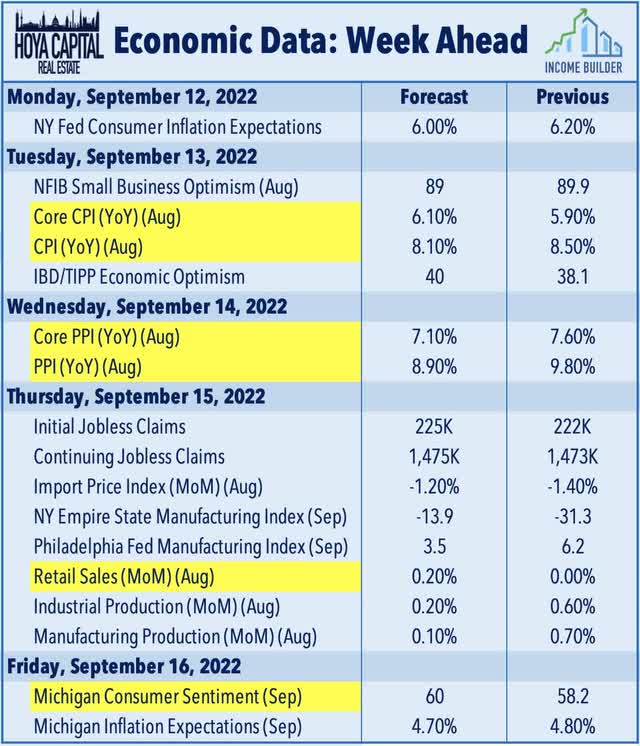

Economic Calendar In The Week Ahead

Inflation data highlight a busy week of economic data in the week ahead of the Fed’s September meeting in the following week. On Tuesday, the BLS will report the Consumer Price Index which investors – and the Fed – are hoping to show that the fastest pace of year-over-year increases is finally behind us. The headline CPI is expected to decline on a month-over-month basis for a second-straight month, pulling the annual increase back down to 8.1% from the four-decade-high set in June as the effects of declining gasoline prices filter into the data. Gas prices have declined about 26% since their peak on June 13th at over $5 per gallon nationally. The following day we’ll see the Producer Price Index for August which is expected to exhibit similar trends of peaking price pressures. On Friday, we’ll get our first look at Michigan Consumer Sentiment for September. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential “wage-price inflation spiral” through elevated consumer wage expectations.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment