hallojulie/iStock via Getty Images

By Jeffrey Schulze

Inverted Yield Curve One of Several Signals Pointing to Slowdown

2022 saw the Federal Reserve initiate a battle against the highest inflation experienced in the United States in a generation, rapidly raising interest rates in an effort to slow the economy. As we look ahead to 2023, recession has gone from a distantly possible scenario to the most probable one, and the potential Fed pivot many equity investors are hoping for is unlikely to occur.

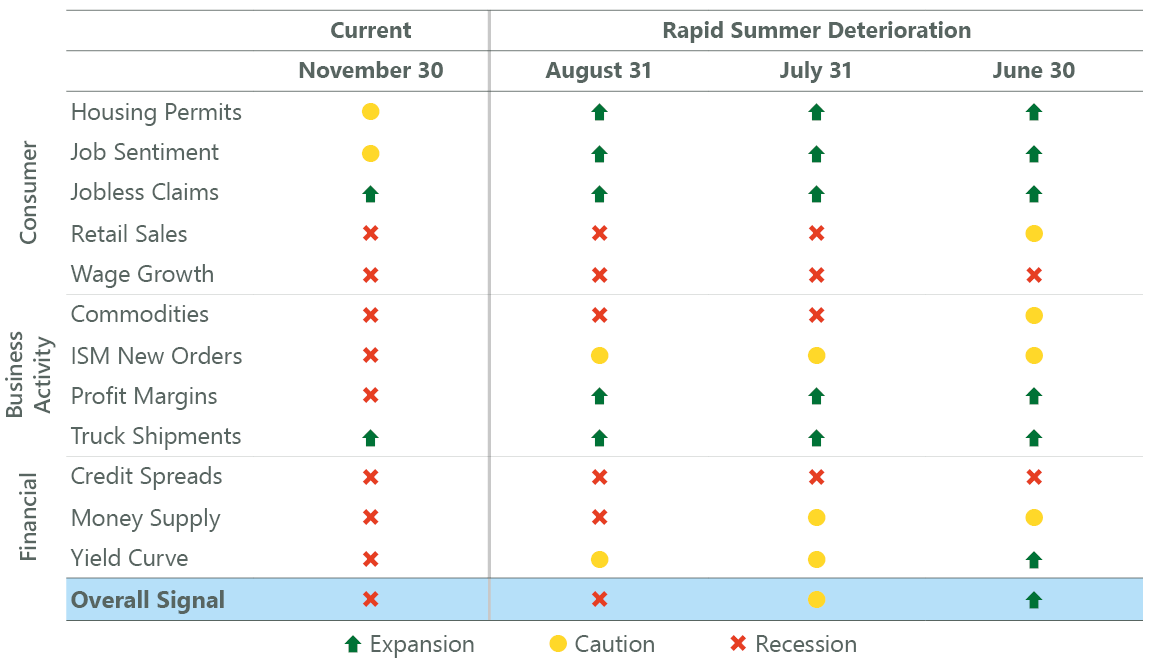

A 2023 recession has become the consensus view, with a 62.5% probability among economists surveyed by Bloomberg. Our views are grounded in the reading of the ClearBridge Recession Risk Dashboard of 12 economic indicators, which has been flashing a red or recessionary signal for the past four months. Eight of the 12 underlying indicators are signaling recession, including traditional recession precursors like the 10-year/3-month yield curve, which inverted this fall. This portion of the yield curve has correctly anticipated the last eight recessions, providing an average of 11 months of warning.

Exhibit 1: ClearBridge Recession Risk Dashboard

Source: ClearBridge Investments.

The Fed’s most dramatic tightening cycle since the 1980s has started to slow activity, and the most interest rate sensitive portions of the economy such as housing are showing the greatest weakness. However, consumption – which drives two-thirds of GDP – remains resilient given strong wage gains, accumulated savings and healthy consumer balance sheets. The Atlanta Fed’s GDPNow, a tool that synthesizes the latest economic releases and translates them into a real-time gauge of where GDP might be, currently shows fourth-quarter GDP at 3.4% with consumer spending driving a healthy 2.5% of this. While clouds may be gathering on the horizon, the storm has not yet arrived.

One of the things bolstering consumption has been strong wage gains resulting from a tight labor market. While many view the health of the labor market as Kevlar armor protecting the economy, it could ultimately prove to be its Achilles heel. With inflation elevated, the Fed has targeted labor market weakness as a key signal in determining how far to tighten monetary policy. Excess demand for labor continues to drive wages to unsustainably strong levels well above what would be consistent with 2% inflation.

Tech Layoffs Overshadow Resilient Labor Market

While job cuts predominantly in the technology sector have been in the news over the last few months, the industry accounts for less than 2% of total U.S. employment. Further, many of these recent headlines are from large S&P 500 Index companies which in aggregate employ less than 20% of the workforce, according to Jefferies. However, small businesses with fewer than 250 employees employ a substantially larger share of Americans and have been the driving force of labor demand, responsible for 79% of job openings currently and over 90% of the post-pandemic increase.

Put differently, where labor market weakness is occurring so far is unlikely to have a major impact on the health of the labor market, and we will need to see more broad-based layoffs to cause a recession. Companies, and small businesses in particular, may be hesitant to move ahead with such decisions given the scarcity of labor over the past few years, however we believe this could change in 2023 with margins beginning to deteriorate.

Putting this all together, the Fed is likely to remain hawkish until it sees meaningful signs of labor market softness and cooling wages. Another factor that could cause the Fed to wait are the lessons learned from the late 1960s, when the central bank pivoted too quickly amid a tight labor market. It was ultimately unsuccessful in stamping out inflation, which took off in the 1970s and 1980s. This necessitated a more painful adjustment and led to a deeper recession, something the Fed would like to avoid repeating.

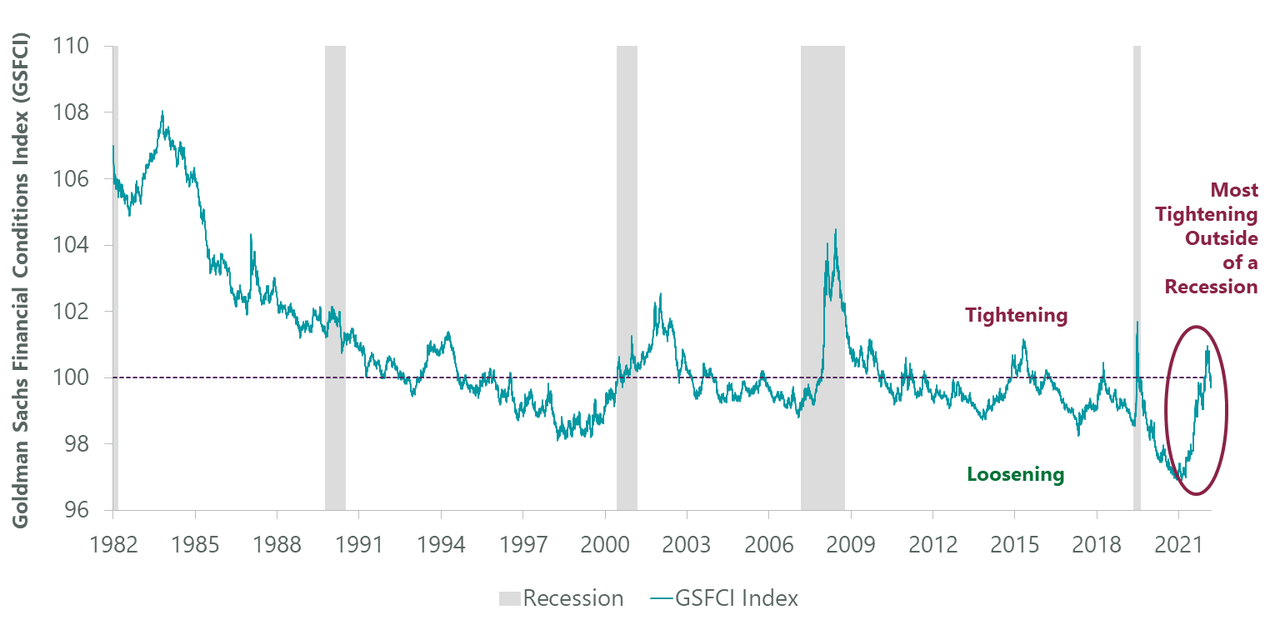

While the central bank has rapidly tightened policy in 2022, financial conditions have eased modestly over the past few weeks and are right on the border of “restrictive” territory, which suggests further rate hikes may be needed to curb inflation. A bit more pain today may be worth it to avoid even more damage in the future.

Exhibit 2: Financial Conditions May Continue to Tighten

Data as of Dec. 7, 2022. Source: Goldman Sachs and Bloomberg.

A recession is not a done deal, however. History is on the side of a soft landing, with zero recessions occurring since World War II during the third year of a presidential cycle. With that said, the past few years have been filled with a series of firsts and we cannot rely solely on history to gauge the prospects of a soft landing. The most likely positive path involves what we have dubbed the “immaculate slackening,” where the labor market loosens but not too many jobs are lost.

Job openings are still over three million above their pre-pandemic level (but down 1.5 million from peak), while the total number of persons employed is only around one million greater than before COVID-19. This suggests room exists to loosen labor demand but not destroy as many jobs, which would help restore balance and ease wage gains. Importantly, this could help ease inflation, particularly in service industries where wages are a larger component of prices.

The most important factor in achieving a soft landing is a substantial reduction in inflation, which would allow the Fed to back off its aggressive actions. A year ago, much of the upside in inflation was the result of goods categories such as used cars and furniture, which are now seeing price declines. Today, broad-based price strength in services is the problem, which is concerning given they tend to be stickier.

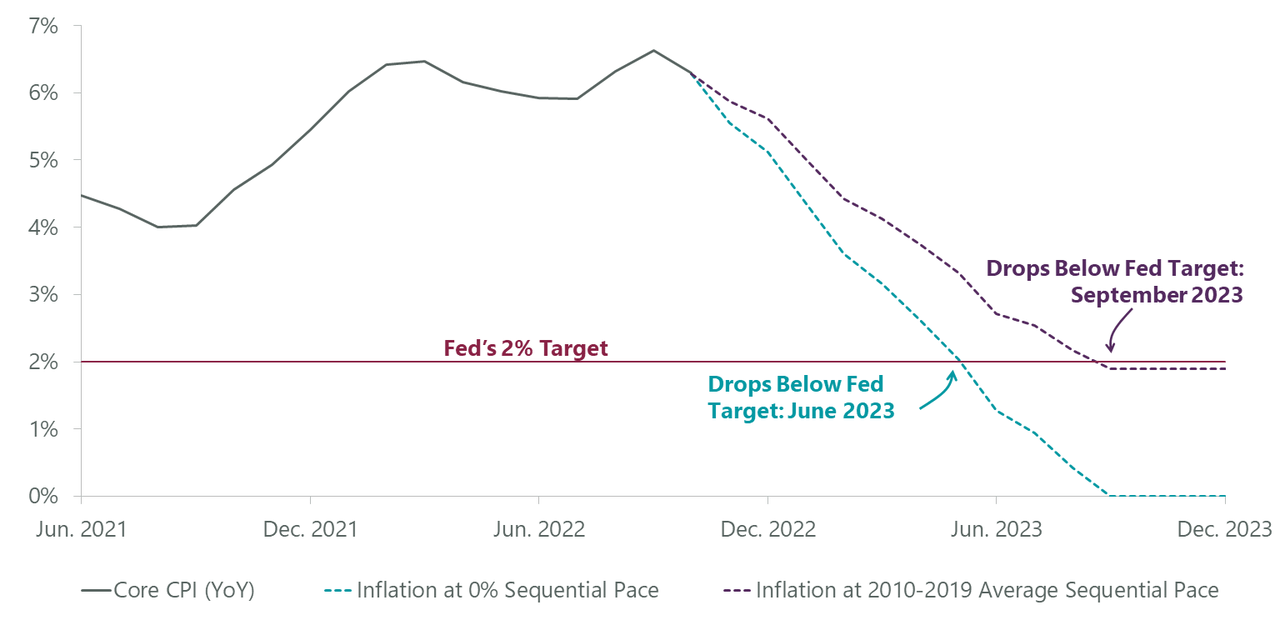

Inflation has a steep hill to come down in 2023, and even if the monthly change in core CPI were to be 0% going forward, we would not see 2% on a year-over-year basis until nearly midyear. Any prints in positive territory would push that date out even further, and it is important to note that since 1960 (755 months), there have been just 10 monthly readings with negative core CPI. Importantly, all but one of them can be associated with recessionary periods, suggesting that inflation is unlikely to come down to the Fed’s target in short order absent a recession.

Exhibit 3: Can Fed Hit Inflation Target in 2023?

Data as of Nov. 30, 2022. Source: Bloomberg, Bureau of Labor Statistics.

With inflation unlikely to return to 2% in 2023 and the labor market proving resilient, the Fed is likely to continue to tighten monetary policy to slow the economy and curb price increases, which will ultimately result in a recession. Monitoring the health of the labor market will be important in the coming year, given its role as a key inflation barometer for the Fed. We will also be looking for signs of weakening consumption outside of the most interest rate sensitive areas as evidence that a slowdown is taking deeper root.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment