jimfeng

Introduction

The preferred stock market has been treacherous with the Fed relentlessly hiking interest rates. This is why we like to focus on special situations at our Conservative Income Portfolio service. Special situations are independent of the economic and interest rate environment. With the merger of SAFE and STAR in process, we believe we have a shorter term investment with little downside risk but with upside potential. Risk versus reward should always be the focus in determining one’s investment decisions.

iSTAR & Safehold

Investor Presentation Investor Presentation

iSTAR (NYSE:STAR) is a real estate investment trust (‘REIT’) that has changed its focus over time. It started out as a financial REIT, but then bought a triple net property REIT and STAR became a hybrid REIT. During the 2008 crisis, some of its real estate loans went bad and STAR foreclosed on those properties adding more properties to its portfolio. After that, Safehold (NYSE:SAFE) was created and iSTAR became a large holder of SAFE stock. Now STAR and SAFE are planning to merge.

SAFE is a REIT that invests in ground leases, and for all intents and purposes SAFE is controlled by STAR. A ground lease is a lease on the land upon which buildings sit. So SAFE may own the land under an office building and the owner of the office building leases the ground upon which the building sits. The benefit to the holder of the building is that they can purchase the building at a lower price if they sell the land underneath the building and the land doesn’t bring in any cash flow for them.

In preparation for the merger, STAR has sold all of its properties except for 2 developments. Their loan portfolio has been greatly reduced to the point that it is very small now. Now STAR is pretty much simply a holding company for SAFE stock. That is their major asset.

As part of the merger, STAR will spin off it 2 development properties, its loans portfolio and some of its SAFE common stock into a new company and then merge with SAFE. Also, according to STAR’s merger filing, STAR plans to call their preferred stocks and their bonds. The fact that they plan to call their preferred stocks that trade well below par is part of what makes the STAR preferred stocks very interesting.

STAR & SAFE Appear Very Safe

SAFE has a strong investment grade rating from the ratings agencies. S&P has them at BBB+ and Moodys at Baa1. And SAFE hopes to get a credit upgrade as a result of this merger. The ratings agencies want to see STAR and SAFE remove the complex management arrangement, reducing possible conflicts of interest, and simplifying its structure in order to upgrade the credit rating. Presumably the call of STAR preferred stocks and their bonds are also part of the strategy to get a better credit rating by reducing debt.

The reason the ratings agencies consider SAFE very solid is that ground leases are extremely safe (thus the name Safehold). If the owner of the building which sits on land that SAFE owns defaults on its ground lease, SAFE has the building that sits on its land as collateral. It is very difficult to imagine an owner of a building will default on their land lease and lose their building as a result.

Additionally, STAR is also very safe now. Although the merger is almost certain to happen, as STAR has huge voting power with their large holdings in SAFE shares, even without the merger, STAR looks extremely safe. With the sale of their properties, they now have a massive cash position of more than $15 per share.

22% Yield To Call On STAR Preferred Stock “G”

STAR has 3 preferred stocks (STAR.PD), (STAR.PG) and (STAR.PI). All 3 are fixed-rate perpetual cumulative preferred stocks that are callable any time at $25. And being preferred stocks of a REIT, they benefit tax-wise as 20% of their dividends are tax free.

Management is targeting the closing of the STAR/SAFE merger by the end of the first quarter. Assuming the STAR preferred stocks are called, the yield-to-call (YTC) of the 3 preferred stocks will be as follows if called on March 31st, 2023.

STAR.PD 13.5% YTC

STAR.PG 22% YTC

STAR.PI 19% YTC

On its very recent conference call, management was asked if they were considering changing their plans for the merger due to changes in the credit markets, and management responded “we think the structure we’ve come up with is still the best”. So nothing seems to have changed in terms of calling the preferred stocks as part of the merger.

If STAR Preferreds Become Preferred Stocks of SAFE

Although STAR states in their merger documents that they will be calling their preferred stocks, there is no 100% guarantee that they won’t decide to change their plan. So it is important to look at what happens if the STAR preferreds are not called, just in case.

Although SAFE is hoping and working toward a credit upgrade to “A-“ from “BBB+”, we will assume that they receive no credit upgrade. So if SAFE remains a BBB+ credit, then STAR preferred stocks will become BBB- rated preferred stocks. Preferred stocks are almost always rated 2 notches below the company’s unsecured bond rating.

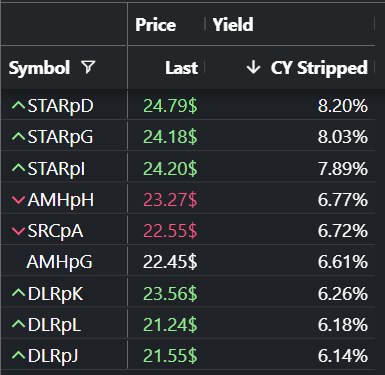

So let’s take a look at how STAR preferreds currently stack up against other REIT preferred stocks with the same “BBB-“ credit rating.

Author

As you can see from the above chart, the current yield of the STAR preferreds is about 30% higher than the 3 other REIT preferreds with a BBB- credit rating. Thus, after the merger, if STAR preferred stocks are not called, STAR preferred stocks will likely trade above par. This will also get you a 22%+ return on STAR.PG from now to the merger just as you will get if STAR preferred stocks are called. That is why this is a win/win situation. Either way, call or no call, you do very well.

Author

Since there were only a couple of BBB- REITs with preferred stocks for comparison, let’s compare STAR to even lower rated “BB+” preferred stocks. Even against preferred stocks rated inferior to where STAR preferred stocks should get rated upon the merger, STAR preferred stocks blow them away.

Currently STAR.PG looks to provide the best combination of YTC and best current yield. STAR.PI would be next and then STAR.PD trailing the group with a lower YTC. If they are not called, these also look like very nice long term holdings given the significant mispricing against its credit rating peers.

Bottom Line

The merger between STAR and SAFE looks like an almost virtual certainty. With the merger plan being that STAR preferred stocks are called, that should generate a 22% return on STAR-G from now until the closing, presuming it closes March 31st.

If for some reason a decision is made to not call the preferred stocks prior to the merger, the huge credit upgrade that STAR preferred stocks will achieve as part of the merger should also rocket them higher, probably above par. So a 22% return to the merger date is also a good probability even if the STAR preferred stocks are not called.

This is why this is a win/win situation and why STAR preferred stocks look to be one of the best fixed-income special situations that we currently see at our Conservative Income Portfolio service.

Be the first to comment