gahsoon

Sometimes, the most boring types of companies can make for some of the most attractive prospects. And also sometimes, generating an attractive return on those types of firms can take some time. One company that has fared reasonably well in the current environment over the past year or so and that I still have a great deal of faith in is Concrete Pumping Holdings (NASDAQ:BBCP). This particular enterprise focuses largely on providing concrete pumping services to infrastructure companies in the US and the UK. Although the company is outperforming the broader market, it’s not generating the kind of upside I would have anticipated. But given the fact that management continues to grow the firm and considering how cheap shares are right now, I do believe that attractive upside still exists for shareholders.

A solid prospect

Back in early September of 2021, I wrote a bullish article covering Concrete Pumping Holdings. At that time, I called the company’s business model intriguing and I acknowledged that management had done well to grow cash flow over time. Low profitability and high levels of debt were areas of pain that I pointed out. But given how cheap shares were, I felt as though the upside potential was well worth the risk. This led me to rate the company a ‘buy’, reflecting my belief that shares should outperform the broader market for the foreseeable future. Since then, the company has achieved that outperformance, but only marginally, with shares falling by 11.2% at a time when the S&P 500 is down by 12.5%.

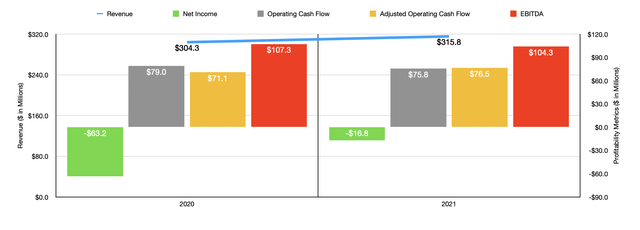

Author – SEC EDGAR Data

This is not exactly a win. And what’s interesting is that it’s difficult to understand exactly why the company is generating lackluster results when you really dig into the numbers. For starters, let’s talk about the 2021 fiscal year in its entirety. During that year, revenue came in at $315.8 million. That represents an increase of 3.8% over the $304.3 million generated only one year earlier. According to management, this increase in sales came largely as a result of the company’s operations in the UK, with revenue there surging by 22.9%. Excluding the impact of foreign currency fluctuations though, growth would have been a more modest 14%, driven by increased demand as the world economy staged a recovery following the COVID-19 pandemic.

On the bottom line, the picture also improved. The company went from generating a net loss of $63.2 million in 2020 to generating a loss of only $16.8 million last year. Operating cash flow went from $79 million to $75.8 million. But if we adjust for changes in working capital, it would have risen from $71.1 million to $76.5 million. The only metric that really showed a decline year over year besides operating cash flow was EBITDA. It managed to fall from $107.3 million to $104.3 million.

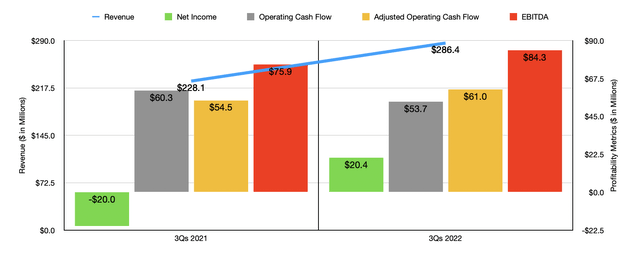

Author – SEC EDGAR Data

Now that we are into the 2022 fiscal year, recent data deserves attention. For the first three quarters of 2022, revenue for the company totaled $286.4 million. This can be chalked up to strength across the board. In the US Concrete Pumping operations portion of the company, revenue jumped by 27.4%, driven by two different acquisitions that added a combined $28 million to the company’s top line and by robust organic improvements in many of its markets that resulted in higher volumes and rate per hour increases for its services. Revenue under the UK side of the company grew by 16.6%. But excluding foreign currency translation, it would have grown even more at a rate of 23.7%. Continued economic recovery and rate per hour job increases in that region contributed to the company’s upside. And finally, revenue under the US Concrete Waste Management Services segment of the firm jumped by 25.4%. Strong organic growth, increased pricing, and recovery following the pandemic, all played a role on this front.

On the bottom line, the picture for the company came in quite strong. The firm went from generating a net loss of $20 million in the first nine months of its 2021 fiscal year to generating a profit of $20.4 million. Operating cash flow did fall, declining from $60.3 million to $53.7 million. At the same time, however, the adjusted figure for this rose from $54.5 million to $61 million. And finally, EBITDA for the company also increased, rising from $75.9 million to $84.3 million.

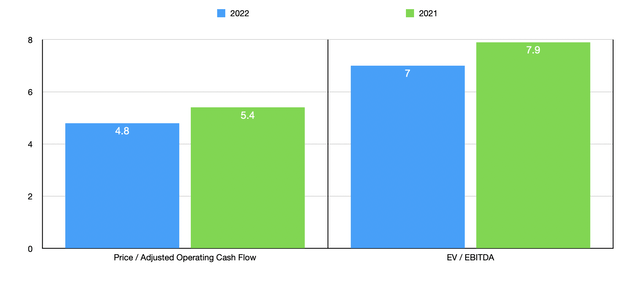

Author – SEC EDGAR Data

When it comes to the 2022 fiscal year in its entirety, management expects revenue to total between $380 million and $390 million. That compares to the prior expected range of between $360 million and $370 million. Meanwhile, EBITDA is forecasted to be between $115 million and $120 million. If we use the midpoint figure there and apply the same growth rate to the adjusted operating cash flow of the company, that should translate to a reading this year of $86.2 million. This would mean that the company is trading at a forward price to adjusted operating cash flow multiple of 4.8 and at a forward EV to EBITDA multiple of 7. By comparison, the multiples using the data from 2021 would be 5.4 and 7.9. As part of my analysis, I also compared the company to five similar firms. On a price to adjusted operating cash flow basis, these companies ranged from a low of 2.2 to a high of 69.3. And when it comes to the EV to EBITDA approach, the range was between 4.1 and 12.5. In both cases, only one of the five companies was cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Concrete Pumping Holdings | 4.8 | 7.0 |

| Tutor Perini (TPC) | 2.2 | 9.7 |

| Northwest Pipe (NWPX) | 10.8 | 7.8 |

| Great Lakes Dredge & Dock (GLDD) | 36.8 | 8.6 |

| Argan (AGX) | 20.6 | 4.1 |

| Granite Construction (GVA) | 69.3 | 12.5 |

Takeaway

Based on what data we have available, it seems to me as though Concrete Pumping Holdings is doing much better for itself than it was doing last year. Through a combination of acquisitions and organic growth, the company continues to expand. As recently as August of this year, the company made an acquisition of a company that it says is the largest concrete pumping service provider between North and South Carolina, with some operations also in other areas. Bottom line results also show signs of improvement and shares are looking very cheap on a cash flow basis. The company still does have quite a bit of debt on hand, with a net leverage ratio right now of 3.28. But so long as the company can continue to expand while keeping cash flows robust, I do think that it’s cheap enough to warrant meaningful upside from here. And because of that, I’ve decided to keep my ‘buy’ rating on the stock for now.

Be the first to comment