MarkRubens/iStock via Getty Images

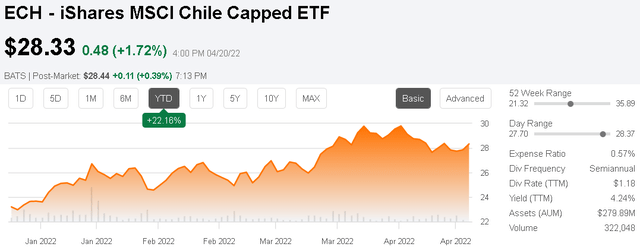

The iShares MSCI Chile Capped ETF (BATS:ECH) offers targeted exposure to Chilean equities. While the South American economy faced significant disruptions during the pandemic, ECH has been a surprising winner, up by more than 20% this year. Indeed, several of the key underlying stocks in the fund have benefited from high commodity prices and mining sector activity amid the global theme of supply chain disruptions.

While the country is dealing with its headwind of inflation, we see the macro environment as an overall positive for economic growth in Chile. The ETF composition with its unique overweight materials sector holdings ends up being an inflation winner in our view. We are bullish on ECH and expect continued momentum through 2022.

Seeking Alpha

What is the ECH ETF

ECH with $502 million in net assets and an expense ratio of 0.57% technically tracks the “MSCI Chile IMI 25/50 Index”. The “capped” term in the fund name refers to the methodology where the largest holding is limited to a weighting of 25% and the sum of the weights of all other stocks representing more than 5% weight at 50%, with a buffer of 10% through each quarterly rebalancing. This rule is often employed in smaller emerging market country equity indexes because a single large-cap stock can sometimes dwarf smaller companies.

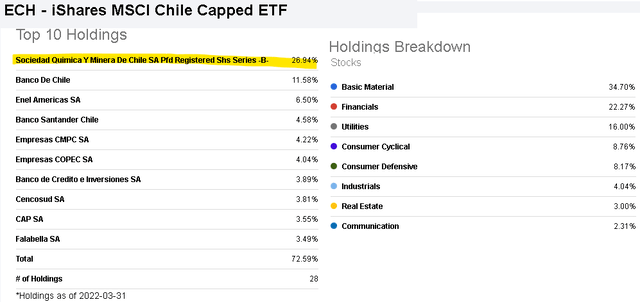

With ECH, the top holding in chemicals and mining giant Sociedad Quimica Y Minera de Chile SA (SQM) representing 27% of the fund is just above the threshold but within the buffer. In this regard, one of the criticisms of ECH is that the fund is “top-heavy” and concentrated with the top-10 holdings representing 73% of the fund.

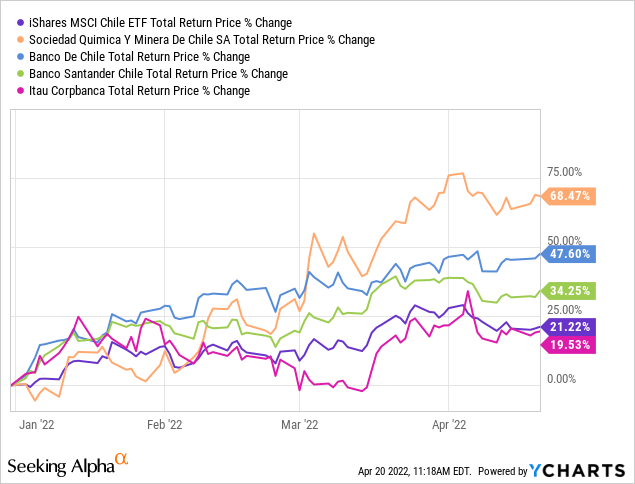

That said, SQM is a stock we are particularly bullish on, and ECH investors likely won’t be complaining about its 68% return thus far in 2022. Again, we typically prefer ETFs that are more diversified, but in this case, SQM as a featured stock within ECH and Chile makes sense.

Seeking Alpha

Down the list of holdings, Chile’s financial sector totaling 22% of the fund is well represented including Banco de Chile (BCH) at a 12% weighting and Banco Santander-Chile (BSAC) at 5% among others. The banks capture high-level trends in the local economy including consumer spending and broader economic growth.

Another important sector for Chile is utilities with a 16% weighting in the fund. Chile holds the distinction of being a pioneer in terms of privatization in the power sector in the 1980s. This means that several utility stocks within ECH as independent power producers operate with unregulated pricing which typically supports higher profitability.

Whether directly or indirectly, we make the case that both Chilean banks and the utility sector share a connection to the mining industry. Chile is the world’s largest producer of copper along with large reserves of precious metals and nonmetallic minerals, like lithium. Investments in the materials sector amid the high commodity pricing environment are positive for the broader economy. The banks benefit from the related financing while utilities get a boost in growth opportunities to power new production facilities.

ECH Performance

Overall, mining plays an outsized and important role in the Chilean economy and we see ECH as doing a good job of expressing those themes with a good sector diversification. SQM has been a big part of the fund’s strong performance this year, but other top holdings including BCH and BSAC, each with a 48% and 32% gain year-to-date, respectively, have also contributed to the positive return.

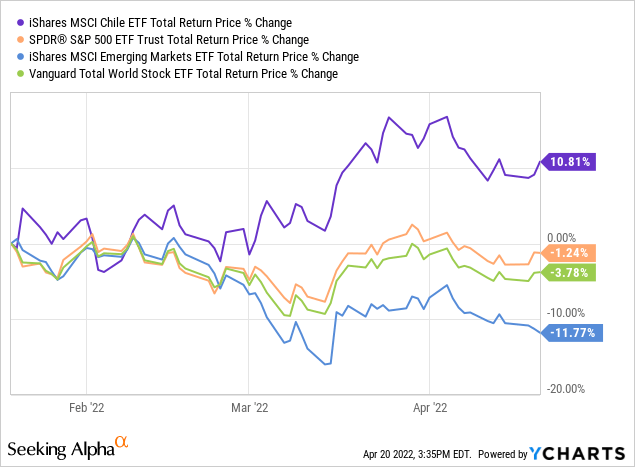

The other point here is that ECH with an 11% return just over the past month has outperformed global benchmarks including the iShares MSCI Emerging Markets ETF (EEM) which has declined by 12%, and even the S&P 500 (SPY) which is down about 1% over the period. The relative strength here also reflects a recent appreciation in the Chilean Peso currency which is up about 5% year-to-date, benefiting from the same commodities exposure dynamic. We expect the momentum to continue.

Chile Macro Outlook

In terms of the Chilean economy, GDP grew 12% in 2021 reversing the pandemic contraction of -5.8% in 2020. The story last was the early reopening dynamic along with fiscal level stimulus policies that boosted the economy. On the other hand, the challenge for 2022 has been to maintain that momentum considering what is now a difficult comparison period. Chile is also facing a spike in inflation with the CPI last reported approaching 8% y/y which follows a trend seen around the world.

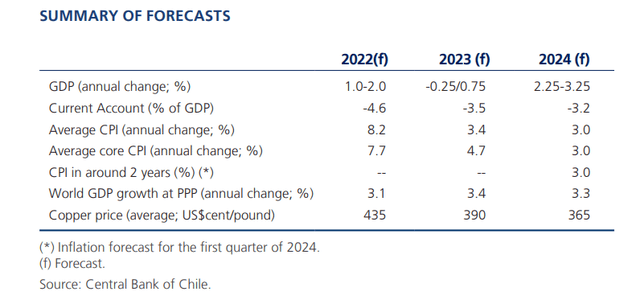

Central Bank of Chile

The result is a current forecast by the Central Bank of Chile for 2022 GDP to slow towards a range between 1% and 2%. Looking ahead, the group expects either flat growth in 2023 with GDP between 0.75% down to a technical recession, contracting by -0.25% in real terms. The thinking is that efforts to stem inflation including a string of interest rate hikes by the Central Bank will work to ease the CPI down towards 3.4%, but at the same time limit growth before a rebound in 2024.

The bullish case for Chile and the ECH ETF is that these estimates may prove to be conservative. We see the upside, particularly from the strength in the industrial production that includes mining and the materials sector. The banks benefit from higher interest rates and credit demand from mining which has a spillover effect on the broader economy and the labor market.

SQM Anchors ECH

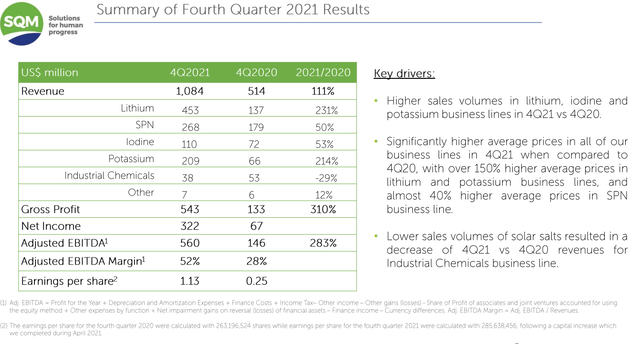

With a 27% weighting in the fund, the importance of SQM within ECH cannot be understated. The company is coming off a record 2021 where revenues more than doubled driving strong profitability. Surging prices for lithium, iodine, and potassium have been a windfall that is likely to remain high amid global supply chain disruptions.

What’s interesting is that these minerals are critical to high-growth segments including the strong demand for electric vehicle batteries and even fertilizer in food production. The company expects to expand production with new projects coming online as a positive for its outlook. There is a component here related to sustainability, ESG, and also agriculture that carries over into the broader ECH ETF.

source: company IR

So a valid question would be, “why not just buy SQM?”. The attraction here in ECH is the diversification beyond this single stock with the fund covering several bullish trends that are positive for the economy. You get the commodity exposure through the materials sector, a strengthening Chilean Peso currency, the long-term structural growth tailwind for emerging markets, and the current share price momentum. With the potential that the economy can outperform GDP expectations this year, the setup should support more upside as sentiment turns positive.

Final Thoughts

There’s a lot to like about ECH and the Chilean economy through 2022. In our view, Chile can benefit from high inflation in the rest of the world because it indirectly represents a tailwind to the country’s mining sector.

In terms of risks, keep in mind that foreign stocks have an added layer of risk considering the uncertainty related to FX trends. The possibility of a deteriorating global growth outlook or sharply lower metals prices would be bearish headwinds for the fund. Overall, ECH is a good option for investors to diversify beyond U.S.-centric portfolios into a high-quality and investment-grade emerging market economy. We’re bullish.

Be the first to comment