andresr

Investment Summary

We remain bullish on the long-term outlook of Universal Health Services, Inc. (NYSE:UHS) given the resiliency and quality factors the company exhibits. Let’s get one thing straight – you’re not buying UHS for the growth potential or as a speculative play on the long end in an equity portfolio. UHS is as defensive as they come, with 5-year total returns of just 2.28%.

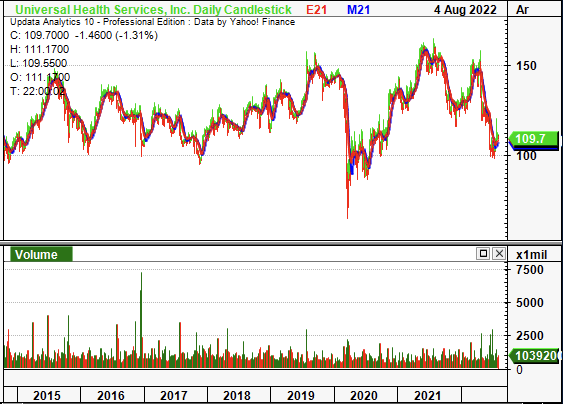

Exhibit 1. UHS 7-year price action: Long-term sideways territory

Data: Updata

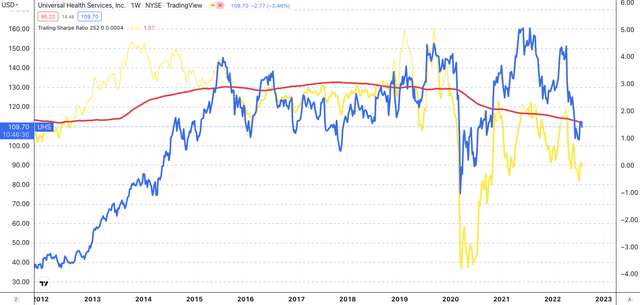

Defensive by nature: UHS lends investors less volatile returns as a quality portfolio stabilizer that also offers marginal dividend yield. Since 2015, returns have been flat with the stock trading at $143 apiece back in August FY15. However, over the same time, investors have enjoyed the resiliency and defensive characteristics in smoothing equity returns as the stock has a 5-year TTM risk adjusted return (Sharpe ratio) of 1.57, whereas the impact of Covid-19 clearly visible on the share price as seen in the chart below. In light of the quality premia on offer, we rate UHS a buy.

UHS 5-year TTM Sharpe ratio (red) versus price (blue).

Strong Q2 sales with long-term trends in tact

Coming off a high base in Q2 FY21, this year’s second quarter sales came in 390bps higher to $3.23 billion. Alas, operating results were well behind original projections and this fell due to the volatility in non-Covid patient turnover, with trends recovering at a slower pace than what was originally expected. Last time cases began to diminish, there was a rapid recovery in patient turnover and backlog was sorted through quickly. This has resulted in minor savings on expenditure here, but the opportunity cost of lost income is higher we believe.

This time, however, management note that demand recovery has been slow, underlined by labor shortages that prevent the company from meeting demand in the first place. In other words, there’s been a rapid slowdown in Covid-19 patient turnover but this hasn’t been replaced by non-Covid patients, thereby hurting income down the P&L. To illustrate, in Q1 FY22, Covid-patients made up 13% of total admissions, and this fell 10 percentage points to 3% in Q2 FY22. Management wasn’t able to provide certainty on the ongoing impact of Covid-19 to patient turnover on the earnings call.

Segmentally, acute care saw net revenue/day fall flat YoY whereas the behavioral health care segment saw net revenue per admission increase by 260bps YoY. Net revenue per day in behavioral health care also gained 180bps YoY. Moving down the P&L, UHS recognized operating income of $209 million, down ~50% YoY due to an increase in OPEX vertically. It brought this down to a net income of $164 million or $2.20 in EPS down from $3.79 EPS in Q2 FY21.

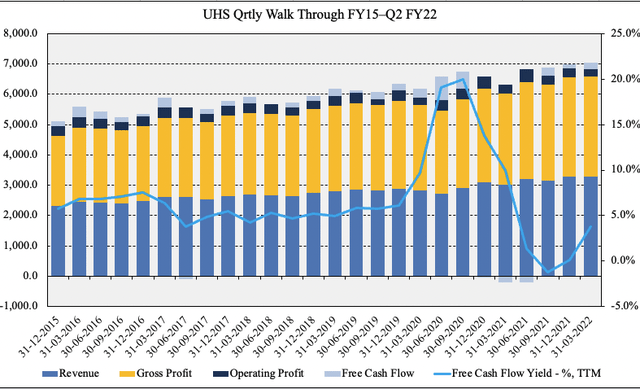

We encourage investors to consider looking at normalized figures or averages with UHS considering the value proposition that’s on offer here. As seen in Exhibit 2, quarterly operating metrics continue to stretch up on a sequential basis regardless of the start of the market. This trend has been in situ since FY15 to date. UHS has printed $444 million in FCF over the past TTM and investors realize a c.5% yield on this and if we factor this data in, it’s not an unreasonable expectation to believe Covid-19 will diminish and patient turnover trends will revert back toward longer-term averages. On this, we are confident UHS is positioned well do capitalize on this.

Exhibit 2. Quarterly operating metrics continue ratcheting up on a sequential basis without fail

Data: HB Insights, UHS SEC Filings

In terms of the lost days from lack of staffing capacity, whilst there wasn’t a quantified answer from management, CFO Steve Filton said:

We do track that [lost days from staffing issues] internally. We don’t disclose those numbers in part, because I think different hospitals track them a little bit differently, et cetera, and we don’t view them as the most precise statistics. But we do know that we have turned away during the pandemic, a significant number of patients either because we didn’t have the staff to treat them or because we had certain beds blocked because patients couldn’t be exposed to other patients with COVID, et cetera.”

We note that CAPEX also wound back in-line with a shift in hospital capital budgeting cycles going from 6-12 months in some instances. With that, and debt-related factors in mind, the company reduced its capital budgeting spend by ~20% or $100mm for H1 FY22.

This won’t be an issue given UHS’ stellar profitability measures. On a quarterly basis, it has averaged a 5-year ROIC of 10%, well above its WACC of 6.8%. As a result, UHS has a ROIC/WACC ratio of 1.47x and this must be factored into the valuation. A 10% quarterly return on investment has secured up substantial FCF for the company and continues to be the resiliency factor we are seeking exposure to in FY22. With this in mind, we can have more certainty in the predictability of UHS’ future cash flows and more confidence in estimating its expected return.

Exhibit 3. Normalized 5-year return on investment of 10% which easily surpasses the WACC hurdle

Data: HB Insights, UHS SEC Filings

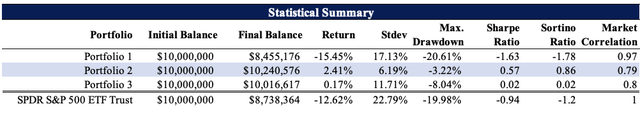

Portfolio statistical summary

Portfolio construction in FY22 should mirror the potential distribution of outcomes for the global economy. Namely, a reasonable margin of safety to absorb a further 20% decline in US earnings and also enough to weather a further 20% pullback in the benchmark.

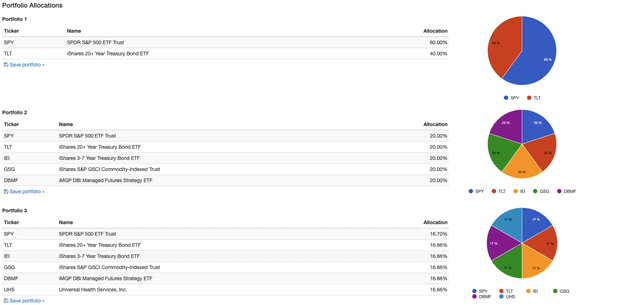

As such, low equity beta, high quality plays such as UHS have added a layer of resiliency and smoothed volatility in equity portfolios this year. As seen in Exhibits 4 and 5, an equal weighted balanced portfolio with exposure to alternatives for market neutrality [Portfolio 2] has crushed the 60/40 and/or risk parity setups from January-July FY22, on an equal weighted basis. As seen in Exhibit 5, it has produced a 2.4% total return with standard deviation of ~6%, but most impressively, it had a max drawdown of only 322 bps.

Exhibit 4. Balanced portfolios with an alternatives weighting have outperformed watermarks in FY22

Data: HB Insights, Portfoliovizualizer

As a result, including UHS into the equity portfolio [Portfolio 3] produces strikingly similar risk without adding too much of a shift to equity risk. On equal weight, we see a positive return of 17bps (+12.45% alpha) with a max drawdown of 8%, well below the benchmark’s 19%. returns are similar with weighting down to 2%. If we presume the medium-term outlook somewhat mirrors the prevailing trends, we can make inferences from the data. What this tells us is that an allocation to UHS in the equity bucket won’t hurt equity risk to a meaningful degree, and will add a layer of resiliency to long-biased equity portfolios. This isn’t just diversification benefits either – it’s an equity, and the SPY has 500 holdings in it. This is idiosyncratic premia instead.

Exhibit 5. UHS allocation on equal weight with backtesting exhibits features of resiliency in reducing drawdown, minimizing volatility and helping equity return

Valuation

Shares come in at 1.4x book value and are trading at 2.2x enterprise value (“EV”) to book value as well. At these multiples, we look to be paying $111-$177 per share respectively. At this level, the stock is overpriced by anywhere between 3%-62% depending on which measure of value is used. Given it’s stability on the chart, it’s not unreasonable to use price figures for the stock, and hence we are comfortable in saying UHS is within fair and reasonable valuations at these levels.

We also recognize a 7.5% ROE from FCF when paying 2.2x EV to book value, which gives an equity duration of 9.6 years. The question then comes down to one’s strategy and propensity to pay a premium. We are paying ~11x forward P/E, 1.4x book value and 18x FCF to access steady, persistent cash flows and an average ROIC of 10% per quarter, whilst dampening equity risk in equity portfolios. UHS therefore looks fairly priced at its current levels by estimate.

Exhibit 6.

Data: HB Insights Estimates

In short

Despite challenges at the top-line from lumpy patient turnover trends, the long-term buy case still remains intact for those investors seeking to reduce volatility within equity portfolios. Our findings show the stock can be added into a balanced portfolio equally-weighted down to 2% to reduce drawdown, stabilize returns and volatility versus the benchmark. ROIC has also averaged 10% per quarter for the name and so UHS looks to be a prime candidate to add a layer of resiliency to equity portfolios in FY22. Rate buy.

Be the first to comment