DarrelCamden-Smith/iStock via Getty Images

The Q1 Earnings Season for the Gold Juniors Index (GDXJ) begins next week, and one of the most recent companies to report its preliminary results was Golden Minerals (NYSE:AUMN). Overall, it was a mediocre start to the year, with higher throughput at Rodeo offset by much lower grades. This is expected to be the trend for 2022, with slightly lower production at higher costs as grades dip in Year 2 of the mine life. Golden Minerals remains reasonably valued at an ~$80 million enterprise value, but I think there are more attractive ways to buy the dip currently.

Rodeo Gold Mine (Company Presentation)

Just over two months ago, I wrote on Golden Minerals, noting that the stock was likely to beat its guidance and had a low-risk buy point below US$0.36. Since hitting its buy point at US$0.35, the stock is up more than 40% in barely two months and is one of the better-performing juniors producers year-to-date, with a 43% return. However, after a very solid year and guidance beat in 2021, the company is up against tougher year-over-year comps. Let’s take a closer look at the company’s most recent production results below:

Production

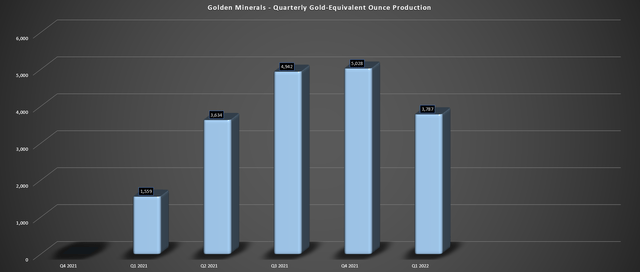

Looking at the chart below, we can see that Golden Minerals (“Golden”) had a much softer quarter in Q1 2022, though this was partially due to coming up against difficult comps in Q4 and record production. This was evidenced by a ~25% decline in production on a sequential basis, with gold-equivalent ounce [GEO] production dipping to 3,787 GEOs, down from 5,028 GEOs in Q4. The culprit for the much lower production in the period was mined grades, which should not surprise investors, with the highest-grade material exploited in the first year of the mine life as this small asset in Durango State, Mexico.

Golden Minerals – Quarterly GEO Production (Company Filings, Author’s Chart)

Digging into the results a little closer, Golden processed ~47,400 tonnes in Q1 2022, a significant increase from ~42,800 tonnes in Q4 of last year. However, this was more than offset by a more than 30% decline in gold grades, which slid to 3.1 grams per tonne of gold and 11.6 grams per tonne of silver vs. 4.6 grams per tonne of gold and 13.8 grams per tonne silver last quarter, which also negatively impacted recovery rates (75.4% vs. 76.5%). Fortunately, Golden did get some help from the gold price in Q1, with the average gold price coming in at $1,888/oz, up from $1,784/oz in Q4.

Financial Results & 2022 Outlook

Looking at the company’s financial results, Golden knocked it out of the park in FY2021, trouncing its guidance midpoint of ~13,000 ounces of gold and ~27,500 ounces of silver by producing ~14,400 ounces of gold and ~59,900 ounces of silver. This was a huge beat for the company in an area of the gold market (junior producers) where we often see misses and a trend towards over-promising and under-delivering. The only negative to this large beat is that it’s set Golden up for some difficult comps ahead in FY2022.

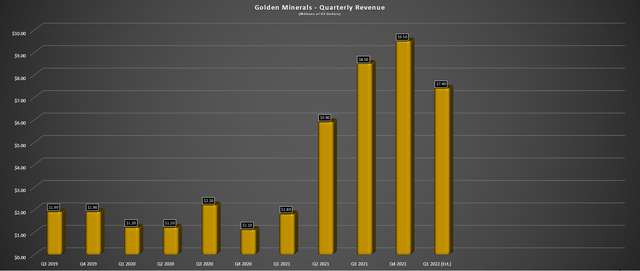

Golden Minerals – Quarterly Revenue (Company Filings, Author’s Chart)

If we look at the chart of quarterly revenue, the higher gold price in Q1 will help (~$1,880/oz), but it won’t be able to pick up all of the slack, given that the company sold ~1,300 fewer ounces vs. last quarter. This should lead to a sharp decline in revenue to ~$7.4 million. If we look ahead to Q2, I would expect slightly lower metals sales but at higher gold prices, meaning that we won’t see much progress from a quarterly revenue standpoint this quarter either. This is a negative differentiator for Golden, given that many producers are reporting revenue growth in 2022, with similar or higher production but at higher gold prices.

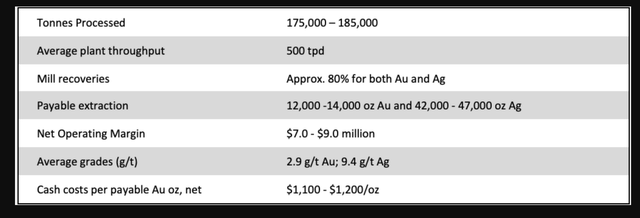

2022 Outlook – Rodeo Gold Mine (Company News Release)

If we look at the full-year outlook, the company will also be up against difficult comps from a margin standpoint. This is because the company reported cash costs net of by-product credits of $937/oz last year, but expects to report cash costs of $1,150/oz at the midpoint this year. The higher costs are related to higher processing costs due to processing significantly more tonnes to produce slightly fewer ounces. These are still respectable margins, especially for an operation of this size, but unless the gold price were to average $1,950/oz this year, I would expect Golden’s cash margins to dip year-over-year as well. Let’s look at the valuation to see if this is priced into the stock:

Valuation & Technical Picture

Based on ~185 million fully diluted shares and a share price of US$0.51, Golden Minerals trades at a market cap of ~$94 million and an enterprise value of just over $80 million. This is a reasonable valuation for a cash flow-positive producer, even if the company is producing just below 20,000 gold-equivalent ounces per annum. The argument that the stock is reasonably valued is even more accurate if the company does decide to bring its Velardena underground mine back online, which we should have more clarity on later this year.

During the company’s Q4 prepared remarks, Golden noted that it would have the results of ongoing studies relating to the final optimization of the BIOX plant design and is also working on testing mining methods to ensure limited mining dilution. These studies are expected to be available in early 2022. Assuming a restart in H2 2023, Golden Minerals could increase its production to more than 30,000 GEOs per annum in 2024 (assuming Rodeo’s mine life is extended). This would translate to revenue of more than $60 million at a $1,800/oz gold price, leaving Golden trading at barely 1.5x FY2024 revenue estimates.

Risks

While Golden Minerals is cheap, it’s not without risks, and this is something that must be taken into consideration. In addition to being a single-asset producer, Rodeo’s mine life comes in at less than three years under the current mine plan, and there’s no guarantee that Velardena will restart. This could transition the company from cash flow-positive and revenue-generating to generating no revenue by 2024. The good news is that this risk is partially mitigated by Golden Minerals’ relatively strong balance sheet ($12 million in cash, and no debt), which should allow the company to avoid future share dilution for at least a year, even if Rodeo goes offline and Velardena isn’t restarted.

The other risk that might be worth considering is continued inflationary pressures and a sharp decline in the gold price below $1,600/oz, which would make Rodeo a much less profitable operation. While both are possibilities, I see a decline in the gold price below $1,750/oz as highly unlikely given the position of real rates currently, which are deep in negative territory.

Besides, Rodeo would not lose money even at these gold prices, with all-in costs that appear to be closer to $1,200/oz. So, while there’s no question that Golden has risks like any other junior or single-asset producer, I would argue that it’s much better positioned than peers like Great Panther (GPL) and Excellon (EXN) with weak balance sheets and razor-thin margins (if any margins) even at spot prices.

So, is the stock a Buy?

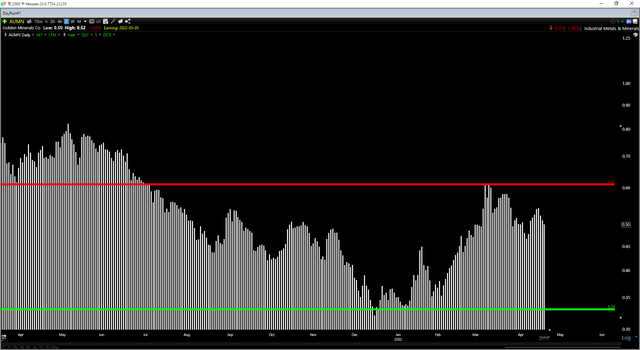

While Golden Minerals is reasonably valued, the key is to buy as close to support as possible for single-asset, micro-cap producers, given that they carry a much higher risk than their more diversified mid-cap producer peers. In the case of AUMN, the sharp rally since January has pushed the stock towards the upper portion of its trading range, with support at US$0.33 and a new confirmed resistance level at US$0.61. Given that I prefer a minimum 5 to 1 reward/risk ratio for names with sub-$100 million market caps, the low-risk buy point for Golden Minerals would not come in until $0.375 ($0.045 in potential downside to support, $0.235 in potential upside).

While the reward/risk ratio has become less favorable after the recent rally, this doesn’t mean that AUMN can’t go higher, and it’s certainly possible if gold’s floor for 2022 is at $1,900/oz. However, with several diversified producers to choose from sector-wide that are also beating guidance, I believe it’s best to be rigid with entries on micro-cap names to justify the added risk to owning them vs. their larger peers. The level where this risk would be offset, in my view, would be US$0.375 or lower.

Golden Minerals – Operations/Development (Company Presentation)

Golden Minerals may have a relatively insignificant production profile currently, but its new Rodeo Mine has helped improve its balance sheet, and with the company likely to end 2022 with $15+ million in cash, it may be able to fund a Velardena restart without share dilution. This is an enviable position to be in going forward. However, for 2022, the company will be up against difficult comps with higher costs and slightly lower production, offsetting the benefit of a higher gold price. So, while other investors might see value in the US$0.40s for AUMN, and the stock is very cheap, I would need to see US$0.38 to get more interested.

Be the first to comment