MoMo Productions/DigitalVision via Getty Images

Investment Thesis

Block’s (NYSE:SQ) mix of FinTech businesses is thriving. Their heavily-integrated ecosystem carries built-in competitive moats such as network effects and switching costs. Product innovation and high optionality equip them for strong sustainable growth. The company is led by visionary founder, Jack Dorsey, who is intent on making strategic long-term investments. After a near 60% drop from all-time highs, SQ stock is trading at historically low multiples. I estimate Block will return investors near 20% annually for the next 5 years or more.

Business Segment Analysis

Block is a leading FinTech platform. They operate a portfolio of businesses geared towards the economic empowerment of businesses and individuals. The company continues to expand its core businesses, the Square and Cash App Ecosystems, while deepening their investment in new offerings.

Square Ecosystem

Block’s Square ecosystem is an omnichannel platform designed to help sellers start, grow, and run their businesses. Square combines software, hardware, and financial services to make business activities seamless. Their software package covers point-of-sale, invoicing, customer feedback, customizable APIs and much more. Square provides hardware for any size business, from a small chip reader to a full Square Terminal. In addition to being a payment service provider, the company acts as a merchant of record for its customers. Meaning, they are the entity authorized to process a consumer’s credit and debit card transactions. This allows them to help sellers manage their risk, capture transaction-level data for consumer insights, and more efficiently onboard sellers. Square also facilitates loans for sellers, eliminating the traditionally lengthy process. Block continues to build-out its Square ecosystem, with over 30 distinct products now in its offering.

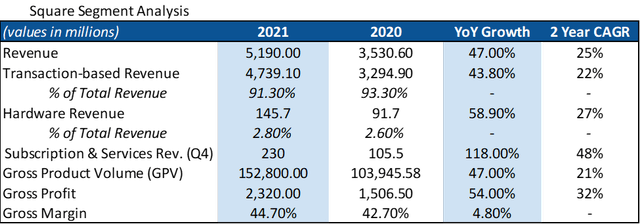

In 2021, Square gross profit grew 54% YoY, representing a two-year CAGR of 29%. Of this gross profit, 38% came from sellers who have adopted four or more products, up from 10% five years ago. Many of these higher usage customers are mid-market sellers. This reveals that sellers are both growing with Square and increasing their usage as they do so. Square’s revenues are showing a strong category mix with subscription & service revenues growing the fastest.

Data from Q4 Shareholder letter

The Square segment has had historically high returns on investment, with an ROI of 3x or greater over three years. They measure ROI by the time it takes to cover sales & marketing (S&M) spend on each annual cohort of new Square sellers. In 2020, payback time was fewer than 5 quarters. Square increased S&M spend and still achieved a payback time of near 6 quarters in 2021. Investment in the Square ecosystem continues to be profitable for Block.

Management has discussed international expansion as a strategic priority for the next few years for Square. The global payment service provider market is expected to grow to $88B by 2027 and over 10% annually until 2031. Square has significant potential for growth internationally with only $62M in gross profit outside the US, 9% of total Square gross profit.

Cash App Ecosystem

Block’s Cash App segment contains a variety of financial products for helping individuals manage their money. The main product is the peer-to-peer payments app, Cash App. Like the Square ecosystem, Block continues to expand Cash App’s product suite and features. The App is an all-in-one portal for storing, sending, receiving, spending, and investing. For spending, users order a Cash Card for free which acts as a debit card for their Cash App balances. When a Cash Card is used at a Square seller, Square collects interchange fees. Cash App also serves as an investment portal for U.S stocks, ETFs, and Bitcoin. Lastly, Block launched Cash App Taxes in early 2021 after acquiring Credit Karma Tax. This feature allows Cash App users to file taxes for free.

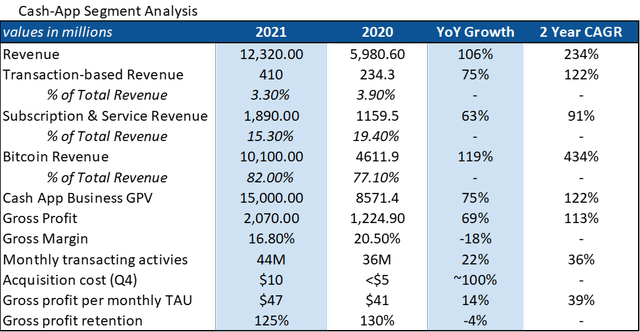

Cash App’s reach has been tremendous. The app was the fourth most downloaded app in the U.S. in 2021 with 56 million downloads. Cash App has been on the top ten list the last two years in the U.S., currently number 6 and 5 on iOS and Android. In December of 2021, the app had 44 million monthly transacting actives, a 22% YoY increase. 13 million of these MAUs were Cash Card users. Acquiring customers is vital for peer-to-peer payments. Cash App’s customer acquisition cost in 2021 was about $10, with cohort payback times less than one year. Even with increased Sales & Marketing (S&M) spend, Cash App cohorts have generated ROIs of 6x or greater over three years. The Cash App ecosystem continues to see accelerated revenue and gross profit growth. Below is a snapshot of the segment’s recent growth and KPIs.

Data from Q4 Shareholder letter

It should be noted that Cash App activities benefited hugely from COVID-19 tailwinds. Growth is beginning to normalize as demand cools slightly but still remains strong. Some concerns are slight margin compression and increasing acquisition costs. Bitcoin represents a large portion of Cash App revenue as Block holds bitcoin on its balance sheet and sells it to customers, taking only a small margin. The result is lower margins for Cash App. The increased acquisition cost seems to be due to greater investment in S&M. Nevertheless, Cash App continues to grow meaningfully and provide a capital base for new growth verticals.

Afterpay and Crypto

Block made large investments in 2021 to broaden their product offering and drive optionality. The company acquired Afterpay, a buy-now-pay-later (‘BNPL’) firm based in Australia, in late 2021. Afterpay enables Square sellers to offer BNPL services in-person and online. Cash App users can also manage their installments through the app. Afterpay drives greater customer acquisition for merchants and greater credit availability for consumers. BNPL later is a significant growth vertical for Block, expected to grow to over $90B by 2029, a CAGR of 27%. And Afterpay has shown its ability to capture this demand.

In 2021, GMV grew 74% with only 1.17%, revenue and gross profit were both up by over 70%, and 98% of installments were paid on time with consumer losses on only 1.17% of GMV. Afterpay had more than 122,000 annual active merchants and 19 million annual active customers, up 64% and 47%.

In addition to its bitcoin initiatives, Block is investing in the future of crypto through Spiral and TBD. Spiral builds and funds open-source projects that advance the use of Bitcoin, while TBD is an open platform for crypto developers to access blockchain technologies without an intermediary. All of Block’s businesses are built around the idea of economic empowerment for individuals and businesses, Spiral and TBD are no different. Block’s vision for the future puts them on the cutting edge of financial technology, with exposure to high-risk, high-reward industries. But what gives them competitive durability in such a rapidly evolving space?

Competitive Advantages & Threats

Block’s integrated ecosystems fortify it with two notable moats: network effects and switching costs. The Square ecosystem has features for every level of a business’s activities, from point-of-sale to financial support. As we saw, Square sellers are adopting more and more features the longer they are with the platform. This expanding usage creates significant switching costs as businesses rely heavily on Square’s product suite and software. It would be a hassle for them to dump SQ and adopt a different provider, most of which would have less broad of an offering. I believe this protects SQ from Apple’s (AAPL) new tap-to-pay feature, which allows consumers to pay with their iPhone without the need for POS hardware. First, Square already sells a contactless chip reader that accepts not only Apple pay, but almost any other type of payment. Second, Android users make up over 70% of the global mobile OS market. In the US, iOS takes up about half the smartphone market, but even then, not all iOS users have Apple Pay set up. Businesses need the ability to accept a broad range of payments to compete. Because of this, I believe Apple’s threat to Square is overestimated.

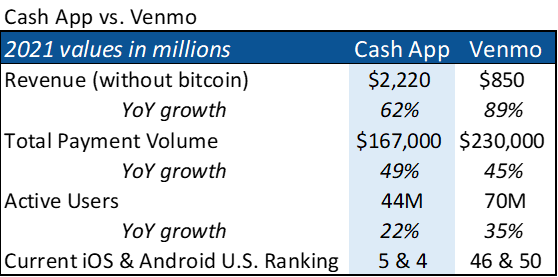

Cash App’s peer-to-peer nature carries built-in network effects as users will most often choose a payments platform that their acquaintances use. The more people that adopt Cash App, the greater its value. These network effects allow Block to greater monetize Cash App users through the other avenues and maintain strong retention rates. Cash App’s largest competitor, Venmo (PYPL), has also performed well in recent years. I give Cash App the edge over Venmo given its greater popularity. But the rapidly expanding P2P payments industry is a tide that lifts all ships, expected to grow at 17.1% annually until 2030.

Data from Apptopia

Not only does Block integrate vertically within Square and Cash App, but they are focused on integration horizontally across their business segments. This is especially evident with Afterpay which can be utilized within Cash App and Square. As Block continues to deepen integration across its business mix, its network effects and switching costs expand. High-quality leadership is not a moat in itself but is foundational to a company’s long-term success. Block has a proven management team led by visionary founder, Jack Dorsey. Insiders also own over 11% of outstanding stock, showing an alignment of incentives with shareholders.

Valuation

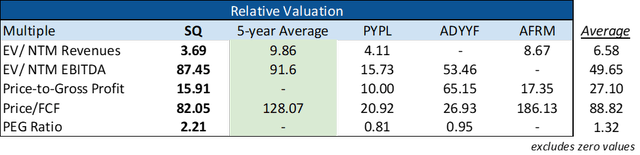

Block and other fintech names have been hit hard so far this year with many down over 50% from all-time-highs. As a result, SQ valuation multiples have compressed from their elevated levels in the second half of 2021. SQ has historically traded at a rich valuation as investors priced in the company’s potential. Through 2020 and 2021, Block saw rapid multiple expansion, exacerbated by a surge in growth during the pandemic. Now, growth seems to be normalizing and profitability improving. Square is fairly cheap relative to its historical averages but expensive compared to its fintech peers.

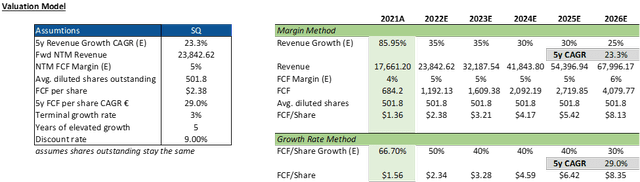

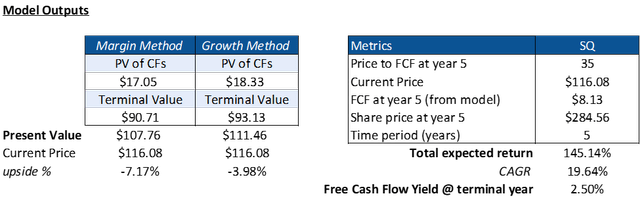

For further evaluation, I ran SQ through a basic DCF model that estimates present value using two methods. One is based on projected revenue growth and FCF margins. The other is a simplified version using only the FCF/Share growth. The forecast period is from 2022-2026 and assumes diluted shares outstanding don’t change. Below are the model inputs, estimates, and forecasted FCF/Shares.

I estimated that Block would see continued strong revenue growth for the next five years with a CAGR of 23.3%. I also estimated FCF margin would expand slightly to 6% as the company improves profitability. The present value of forecasted FCF/Shares shows SQ is relatively fairly valued based on these estimates, returning investors near 20% CAGR over the next 5 years.

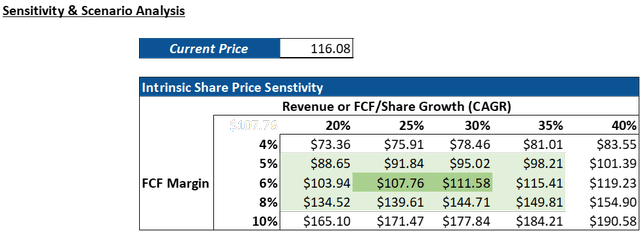

DCF models are built heavily on assumptions which can be faulty and shouldn’t be fully relied upon. Given this fact, I ran a sensitivity analysis to measure the impact of differing growth rates and FCF margins on the model’s output. Evidently, more growth and margin expansion results in a greater present value. I would look to add slowly in the low $100s as SQ continues to perform well.

Conclusion

Block has seen robust growth since the pandemic across its business mix. Though growth seems to be normalizing, the company is focused on creating long-term value for shareholders. Block’s flagship businesses, Square and Cash App, are sticky by nature and provide cash flow for other growth opportunities. Their heavy integration also fortifies them against competitive threats. After a recent large drawdown, SQ is trading at historically low multiples and near my estimated fair value. Given this, I rate SQ as a Buy for long term investors.

Be the first to comment