JHVEPhoto/iStock Editorial via Getty Images

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is going to submit its earnings sheet for the third quarter on October 25, 2022, and the stock could potentially hit another 1-year low as EPS expectations are falling and macroeconomic headwinds are growing. Google has also been suffering from a broad-based down-turn in the advertising market in FY 2022 which has, not surprisingly, contributed to a revenue slowdown in Google’s core advertising business. While I expect headwinds in the advertising market to have lasted throughout the third quarter, I believe Google’s Cloud business could have shined in Q3’22. Since shares are trading near 1-year lows and Q3 EPS expectations are low, I continue to believe that investors are underestimating Google’s potential in the Search and Cloud markets!

My expectations for Google’s Q3’22

Google is going to submit its Q3’22 earnings sheet in 14 days which makes this a sensible time to discuss expectations for Google heading into earnings.

Google’s commercial performance and financial results in FY 2022 were largely defined by a slowdown in the advertising market which has led to Google’s advertising revenues growing at only 12% year over year to $56.3B in Q2’22. The reason for the slowdown relates to more cautious spending attitudes by marketers which can quickly pause or delete advertising campaigns altogether if they feel consumers are cutting back on spending. Apple (AAPL) updated its advertising policies regarding user tracking last year as well which negatively impacts advertisers to this day.

Considering that inflation remained elevated in the third quarter and Apple’s iOS changes weren’t reversed, advertisers will likely have maintained cautious spending attitudes and further dialed down ad campaigns in the third quarter. For those reasons, Google is likely to report a sequential slowdown in Google’s advertising revenue growth which, unfortunately, could be a reason for investors to sell the stock… especially if poor commercial performance in Google’s advertising segment goes hand-in-hand with a poor outlook for the fourth quarter.

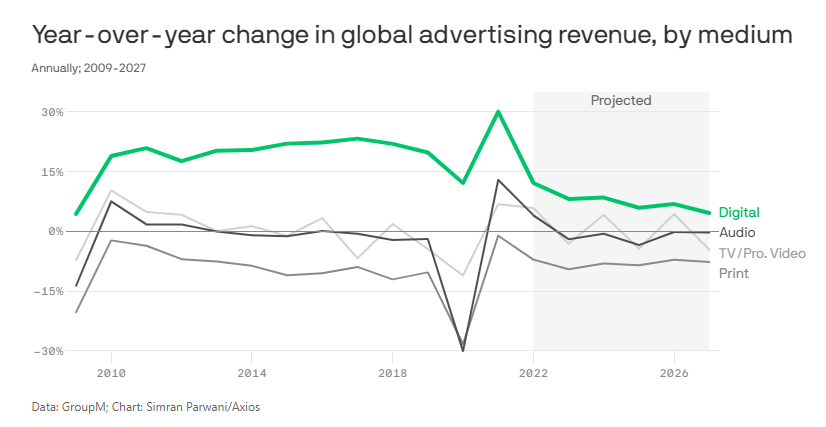

Given the headwinds in the advertising industry — which also caused Snap (SNAP) and Meta Platforms (META) to issue disappointing Q3’22 forecasts — I think investors must brace for impact regarding an additional slowdown in the ad sector in Q3’22. According to consulting company Magna, global advertising spending is set to grow only 9% this year which is below the company’s previous forecast of 12%. However, the firm also said that current spending on digital advertising is still above the longer term (2015-2019), pre-pandemic average of 7%… which could potentially indicate that ad-spending has further to fall.

The outlook is also not too positive: digital advertising spending is potentially set to contract further in the next few years as unfavorable tracking policies hurt advertisers’ conversions.

Source: Axios

Can Google Cloud make a difference?

One segment that could make a difference for Google is the Cloud business which is in a long term up-trend due to growing customer adoption. Google Cloud is the third-largest player in the Cloud market with a market share of 10%. Longer term, I could see Google Cloud grow to a 15% market share as Google has a huge opportunity to grow its penetration of the enterprise market.

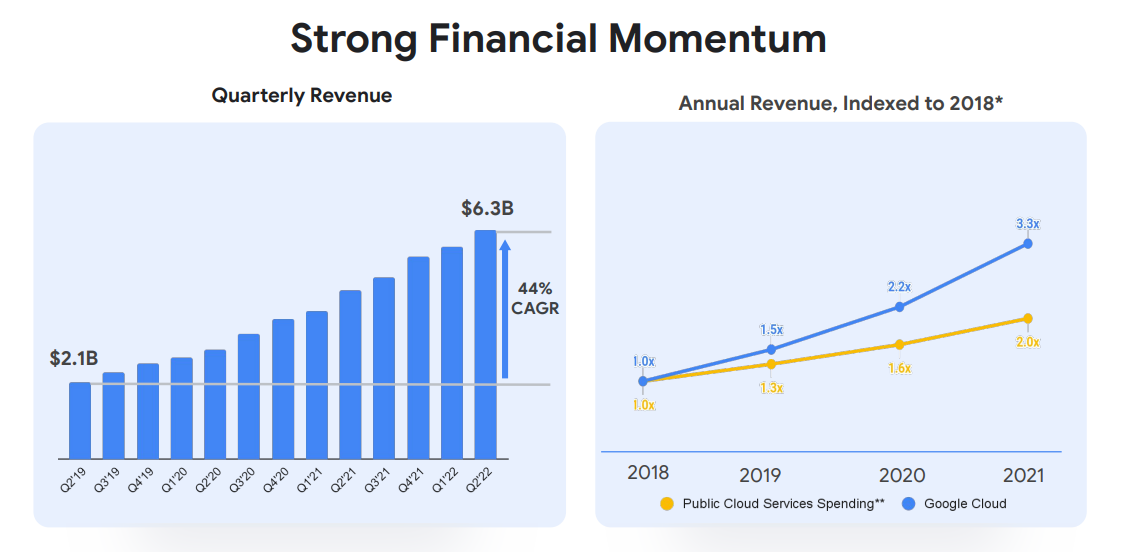

Google Cloud — like I mentioned in Google Vs. Apple: Better Recession Pick? — is Google’s growth engine and the segment grew its revenues 36% to $6.3B in Q2’22 which was three times faster than the advertising business grew. In total, Cloud has seen 44% annual revenue growth in each of the last three years.

Source: Google

For the third quarter, I expect Google Cloud to report revenues of $6.6B to $6.7B which translates to approximately 32-34 % year over year growth. Given the continual migration of workloads to the Cloud, I expect this business segment to continue to shine for Google.

Low expectations heading into earnings

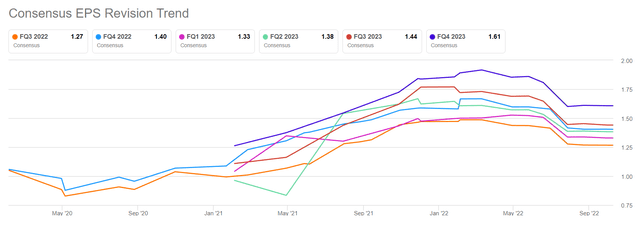

Estimates for the third quarter show that the market has very, very low expectations for Google’s Q3’22. Revenue estimates for Google’s Q3’22 have seen 28 down-ward revisions and only 1 up-ward revisions while EPS down-ward revisions outnumber up-ward revisions 27:1. The consensus expectation is for Google to report $1.27 in Q3’22 earnings which would represent a year over year growth rate of (9.5)%. Investors clearly have low expectations heading into earnings which likely explains Google’s share price weakness in recent weeks.

Seeking Alpha: Google Quarterly EPS Estimates

Valuation prospects greatly improved

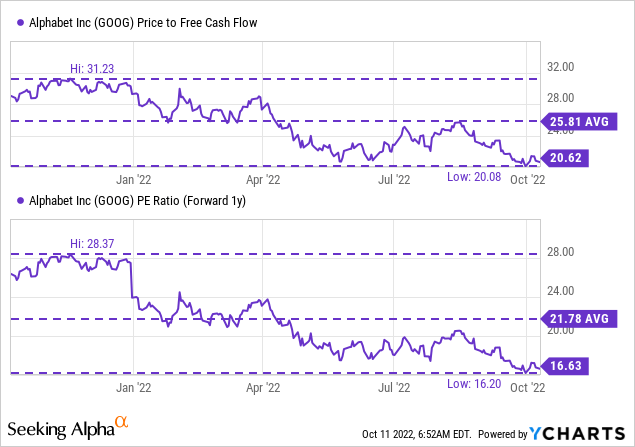

Google is trading at compelling valuation multiplier factors considering that the stock has traded at significantly higher valuations in the last year. Google’s shares reached a 1-year high of $151.55 (split-adjusted) and now trades at just 20.6 X free cash flow and 16.6 X earnings. Both multiplier factors are considerably lower than their 1-year ratio averages.

Risks with Google

Google’s biggest risk regarding Q3’22 earnings is that the Search business saw a stronger than expected slowdown in the third quarter. While it is impossible to make a precise prediction for Google’s large advertising business, I believe the trends in the second quarter will have extended all the way through the third quarter: Google Search will have likely seen a sequential growth slowdown and may only grow at single digits quarter over quarter. What would make things worse for Google is if the Cloud business — Google’s growth engine — were to slow down simultaneously with Search. In this case, investors may be forced to rework their assumptions about Google’s top line growth and a lower valuation factor may be the result.

Final thoughts

Investors must brace for impact when Google releases its third quarter earnings sheet in about two weeks. The market is expecting a soft presentation for the third quarter, largely, I believe, due to expectations of a continual slowdown in the ad market as ad tracking limitations continue to bite advertisers. Because of persistently high inflation and economic growth, expectations are very low for Google’s Q3’22. I believe Google’s share price weakness is a great buying opportunity for investors if the stock drops to new lows in the next two weeks!

Be the first to comment