TayaCho/iStock Unreleased via Getty Images

Investment thesis

Ricoh Company, Ltd.’s (OTCPK:RICOF, OTCPK:RICOY) shares are trading cheaply on PBR 0.8x with a robust balance sheet and a dividend yield of 3.8%. Management is making progress with business transformation efforts together with M&A activity. However, we conclude the result will be positive but not significantly enough to make the shares attractive. We rate the shares as neutral.

Quick primer

Established in 1936, Ricoh is an office printing and services business with a global footprint. In FY3/2022 40% of total sales were derived from Japan, followed by North America making up 25%. Its peers are Canon (CAJ, OTCPK:CAJFF), Fujitsu (OTCPK:FJTSF, OTCPK:FJTSY), Toshiba (OTCPK:TOSBF, OTCPK:TOSYY), and Konica Minolta (OTCPK:KNCAF, OTCPK:KNCAY). Its customer base is focused on the small and medium-sized enterprise market.

As with all former office automation businesses, Ricoh is aiming to reinvent itself as an office digital services company providing software, networking, security, and digital transformation. Their expansive product portfolio includes automotive camera parts, factory automation, and the Pentax DLSR camera range.

Ricoh is unique, as it has been held by activist investor Effissimo Capital Management since 2015, currently with a top shareholding of 17.5%. The fund does not have a seat on the board of directors.

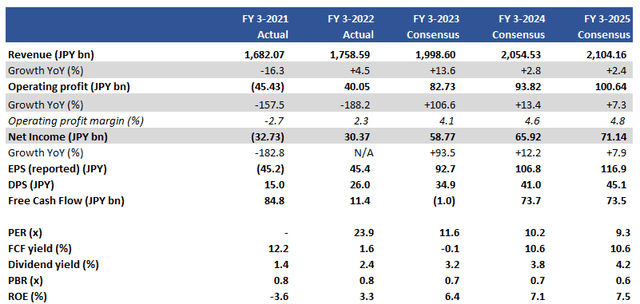

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

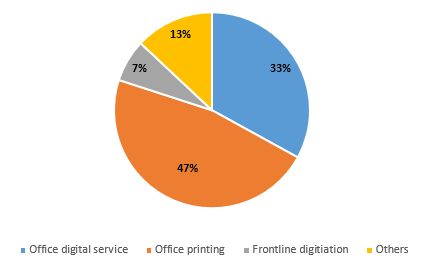

Q1 FY3/2023 revenue split by core business segments

Q1 FY3/2023 revenue split by core business segments (Company)

Our objectives

Ricoh’s Q1 FY3/2023 results highlighted the company in full recovery mode post-pandemic, with sales growth of 8% YoY but with operating profit surging 69.9% YoY. FY3/2023 company guidance is punchy, forecasting FY sales growth of 17% YoY and operating growth at 125% YoY.

Whilst a recovery profile is positive, we want to assess Ricoh’s medium-term outlook as it continues to target its goal of achieving over 60% of sales related to digitization by FY3/2026, together with a return on equity of above 10%.

Current earnings drivers

Q1 FY3/2023 results were positive, with strong earnings growth YoY providing encouraging optics. Overall, Ricoh appears to be trading in line, as opposed to being significantly above management expectations. The key challenge for both Office Printing and Office Digital Services is IT equipment shortages, with the Shanghai lockdown and increased shipping costs affecting the former and acute server shortages for the latter. Company guidance is forecasting around a 30:70 split in total profit for the first and second halves of the year, with the reasoning that supply issues would be on the mend and demand will be approaching levels seen back in FY3/2020.

Although management stress trading was in line, there are a few concerns. Firstly, overseas Q1 FY3/2023 sales grew at 16.6% YoY, but considering that the Japanese yen weakened by 18% against the U.S. dollar and 5% against the euro, underlying demand does not look strong. Secondly, Ricoh commented that office attendance rates at customer sites in both the United States and the United Kingdom are below company assumptions. This will hurt printing volumes, consumables, and future demand for its MFP hardware (multifunctional printers).

There are some positives that the company can look forward to. The lockdown in Shanghai has been lifted, resulting in the normalizing of supply chains. The Japanese yen has appreciated significantly of late (the U.S. dollar is now JPY145 versus the company assumption of JPY126), which will be a positive translation gain. Thirdly, there are secular drivers such as Japan’s electronic bookkeeping requirements that should boost demand for Ricoh’s electronic invoicing SaaS. However, with increasingly challenging macro conditions worldwide, small and medium-sized enterprises will be more sensitive to controlling office expenses as well as capex.

A difficult balancing act

For Ricoh to remain relevant in a digital world, M&A is a core part of its strategy to optimize its business portfolio. For example, DocuWare is a German document management and workflow software business that was acquired in 2019, and Ricoh’s strategy is to utilize its global platform to drive scale and reduce reliance on its legacy printing business. Axon Ivy is a Swiss consultancy firm specializing in business process automation which was acquired in January 2022. These bolt-on acquisitions are helpful and increase Ricoh’s service offering to its existing customers, but do not move the needle in isolation. The company has earmarked JPY200 billion/USD1.3 billion (page 5) for M&A, as well as an additional JPY100 billion/USD0.6 billion for investment in social infrastructure and vision equipment. Acquisitions tend to focus on overseas assets whose services can be imported into the Japanese market, although the latest acquisition is PFU, a domestic Fujitsu subsidiary that operates as a document scanning business.

Ricoh management has their work cut out. Conducting strategic business transformation with global expansion, cutting operating costs as well as managing rising prices whilst placating an activist fund as the lead shareholder is hard to do at the best of times. Ricoh and all its legacy office equipment peers have a difficult business transformation to execute. The problem is that for us as investors, the end goal does not look that appealing considering all the effort that is being put in. The returns of the business remain relatively low with its target ROE of 10%, and the target dividend payout ratio of 50% is respectable but is unlikely to deliver a jaw-dropping yield.

We conclude that Ricoh is making progress in adjusting and transforming to the digital age, but the result is unlikely to be a high-return business that can compete with other SaaS and other cloud-focused service businesses.

Valuation

On current consensus forecasts, Ricoh shares are trading on PER FY3/2024 10.2x with a dividend yield of 3.8%. With the current PBR at 0.8x, the shares are cheap for a company with a net cash balance sheet.

Whilst valuations are in “value” territory, it appears as fair value to us. We do not see any major upside to the shares.

Risks

Upside risk comes from major growth potential as the company shifts to digital services and gains greater traction than expected, raising profitability above targeted levels at an accelerated pace.

Downside risk comes from a deteriorating economic environment that will impact small and medium-sized enterprises, a sector that is financially more sensitive to a recession than large enterprises. Difficulties over post-merger integration of acquired assets may result in impairments of goodwill and deterioration of equity.

Conclusion

Ricoh’s shares are cheap on conventional metrics, and management is making progress in transforming the business. Despite efforts being made, the result is unlikely to be so major that operating profit margins reach double-digits, topline growth is double-digit YoY and ROE reaches the low teens. In the short term, the company will see a tailwind from favorable FX rates and some acquisitive growth, but we remain on the sidelines and rate the shares as neutral.

Be the first to comment