peterschreiber.media

Investment Thesis

Eagle Materials (NYSE:EXP) is continuing to experience strong demand for its products, which is allowing it to increase prices across businesses. However, the company should soon start seeing the impact of the slowdown in the housing industry on its revenue. While this should be partially offset by the price increase in its cement business along with tailwinds in the infrastructure and non-residential end markets, I am not optimistic about the revenue outlook. On the margin front, the volume decline from the slowdown in the residential market should negatively impact the Light sector (Gypsum Wallboard and Recycled Paperboard) margins which should be partially offset by declining gas prices, freight costs, and OCC prices as well as tailwinds in the heavy side (aggregates, cement, and concrete) of the business. While the valuation is cheap, I prefer to be on the sideline until these headwinds subside.

Revenue Analysis and Outlook

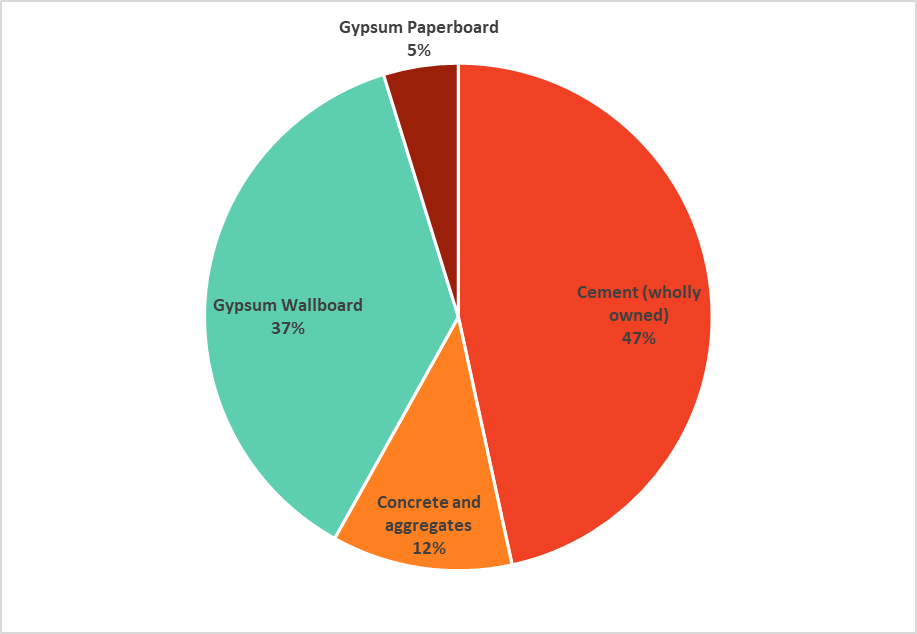

EXP’s revenue in Q2 FY23 increased 19% Y/Y due to the strong demand for its products and pricing actions across its businesses as well as geographies. Given the strong demand backdrop, the company implemented a price hike in July in its cement business. The purchase of assets from a ready-mix concrete and aggregates business (ConAgg acquisition) in April 2022 contributed 3% to the sales growth in the quarter. The Heavy Materials sector, which includes cement, concrete, and aggregates grew 14% Y/Y in the quarter due to the higher sales price in the cement business. The Light Materials sector, which includes Gypsum Wallboard and Recycled Paperboard segments, increased 26% Y/Y due to higher Wallboard prices and sales volume.

The company is continuing to grow its heavy side of the business through asset acquisitions that meet its strategic and financial criteria, and through investments that will expand its system capabilities. EXP acquired a cement distribution terminal in Nashville, Tennessee, for $39 mn in the quarter, expanding its operational reach in the southeastern region. It also purchased an aggregates quarry in Northern Nevada, which increases its ability to serve this market and gain access to the aggregates reserves.

EXP’s segment wise revenue distribution (Company data, GS Analytics Research)

Looking forward, the company should benefit from the pricing actions taken in the calendar year 2022 as well as new price hikes in 2023. Management has announced a price increase in its cement business across its network of plants, effective January 1, 2023. The demand in the U.S. Cement market looks strong over the next two to three years given the funding from the infrastructure bill and strong state Department of Transportation budgets. Approximately, 50% of Cement sales come from the Infrastructure market. The non-residential end markets are also healthy as indicators such as Architectural Billing Index (ABI) and Dodge Momentum Index are showing positive signs with the economy reopening and work from office gaining momentum. Also, cement imports on a delivered basis to the U.S. Heartland markets are expensive. These factors give EXP good pricing power in the cement business.

In the Light Materials sector, the company has not yet seen a softening in demand due to rising interest rates, as almost 1.7 mn housing units were under construction as of October 2022. Housing sales in the Southern region are faring comparatively better than the total U.S. demand and this is helping the company as it has good exposure there. However, I am not too optimistic about the residential end market and believe higher interest rates should, sooner or later, start negatively impacting the demand across all the geographies. Approximately 80% of the Gypsum Wallboard sales come from Residential Construction and Repair & Remodel. So, once this end market starts slowing down, the impact on EXP’s revenues should be significant.

Margin Outlook

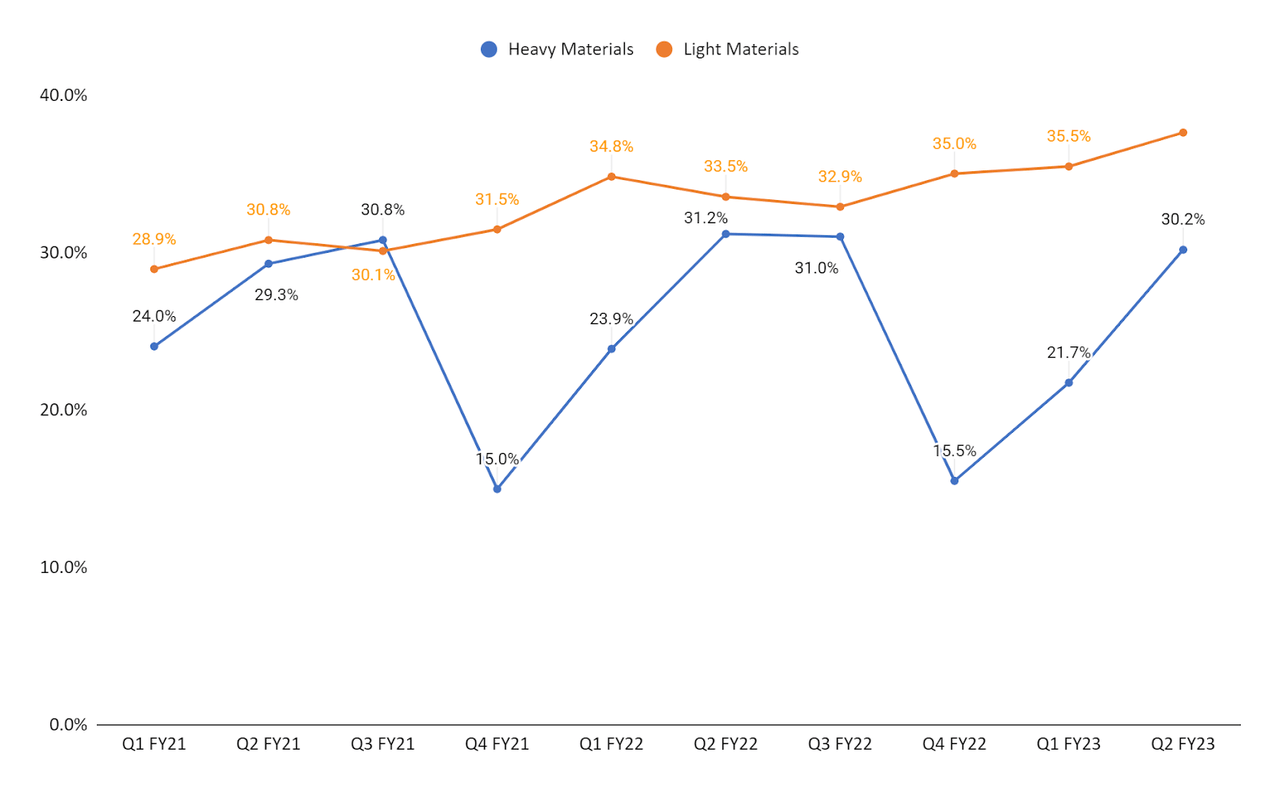

The segment operating profit of the Heavy Materials sector in Q2 FY23 improved by 10% Y/Y due to higher cement prices, partially offset by increased energy and maintenance costs. However, the margins declined 100 bps Y/Y to 30.2% due to increased operating costs. The segment operating profit in the Light Materials sector increased 41.6% Y/Y due to higher net sales prices, partially offset by higher input costs in freight, energy, and paper. The margin improved by 410 bps Y/Y in the quarter to 31.6%.

EXP’s sector-wise operating margin (Company data, GS Analytics Research)

Looking forward, the Heavy Materials sector’s operating margin should benefit from the July 2022 price increase and the new price hike in January 2023. The Light Materials sector’s operating margin should be negatively impacted due to the anticipated volume decline from the slowdown in the housing industry. This headwind should be partially offset by easing freight costs and declining OCC (Old Corrugated Containers) costs and gas prices. OCC is used in the Recycled Paperboard segment to produce gypsum liners for Gypsum Wallboard. It usually takes a couple of quarters for the benefit from the lower OCC costs to flow through the P&L. My medium-term margin outlook for the company is mixed, as it remains to be seen if the operating margin deterioration due to decline in the Light sectors can be offset by strength in the heavy side of the business.

Valuation & Conclusion

The stock is currently trading at 11.45x FY23 consensus EPS estimates which is lower than its five-year average forward P/E of 15.31x. The revenue of EXP’s heavy business should benefit from the pricing actions taken in July 2022 and the new price hike announcement effective in January 2023, along with the strong public end market. While the residential end market has remained strong till now, it should start getting impacted by rising interest rates over the coming quarters. In addition to revenues, these upcoming headwinds in the residential end market should also impact margins, which should be partially offset by the benefit from the price hikes and declining gas prices, OCC prices, and freight costs. While I like the company’s valuation, I would prefer waiting on the sidelines before headwinds in the residential markets start subsiding. Hence, I have a neutral rating on the stock for now.

Be the first to comment