2d illustrations and photos

Constitution is not a mere lawyers document, it is a vehicle of life, and its spirit is always the spirit of the age. – B.R. Ambedkar

Introduction

Subscribers of The Lead-Lag Report would note that in the Leaders-Laggards section of this week’s report, I wrote about how this group had been underperforming for a while now. In fact, a few months back I had gotten into a productive video discussion with an EM expert- Perth Tolle trying to better understand the underlying rumblings behind this phenomenon.

EMs are such a broad and diverse canvass that it can be challenging to postulate a “one-size-fits-all” narrative, but it’s fair to say that underperformance within the EM cohort over the last few months has been fairly broad-based, except for perhaps China (which also appears to have caught the bear bug off late).

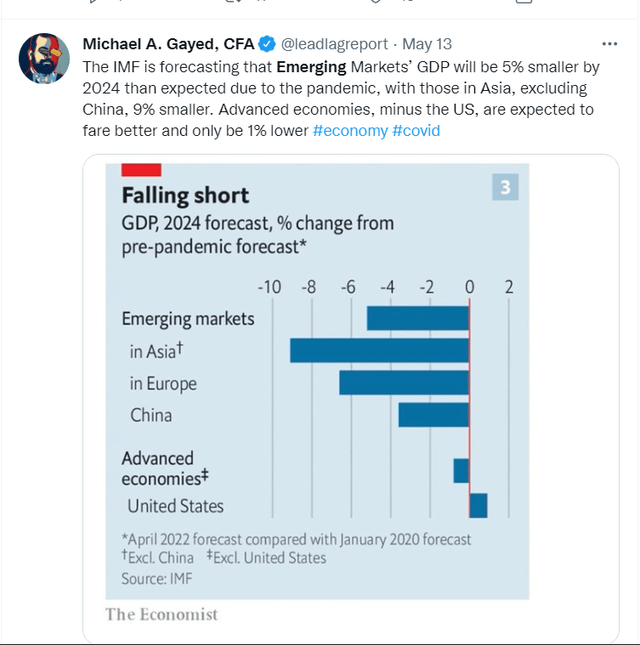

When you get down to the nuts and bolts of it, it’s important to realize that the EMs won’t quite offer you the same cadence of GDP differentials that were present previously. In fact the IMF believes that their 2024 GDP could be lower by 5%, whilst for advanced economies (ex. USA), it would only be lower by 1000bps.

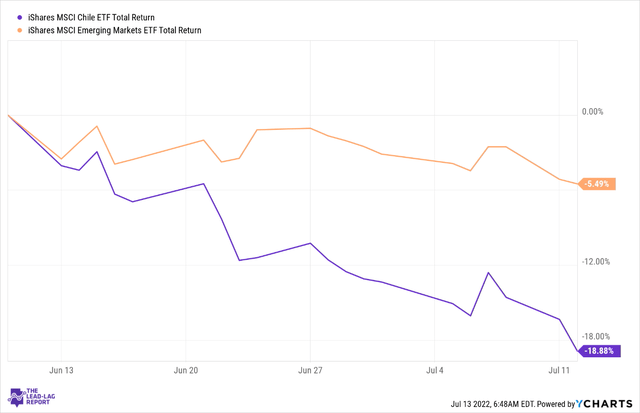

The iShares MSCI Chile ETF (BATS:ECH), a product tracking 25 odd Chilean equities is one of those EM names that has fared reasonably well on a YTD basis, delivering minuscule positive returns for that period. However, do consider that over the last month, things appeared to have pivoted quite significantly with the product down by ~19%, and underperforming the iShares MSCI Emerging Markets ETF (EEM) by more than 3x!

Underlying conditions

You can slice and dice it however you want but Chile, at the end of the day, is a commodity-based economy; given the sentiment towards commodity-themed assets in the recent past, it shouldn’t come as any surprise as to why ECH has floundered over the last month. Interestingly, those who subscribe to The Lead-Lag Report YouTube Channel may have benefitted from a fruitful discussion I had with Michael Howell last month, covering dynamics in the commodity space.

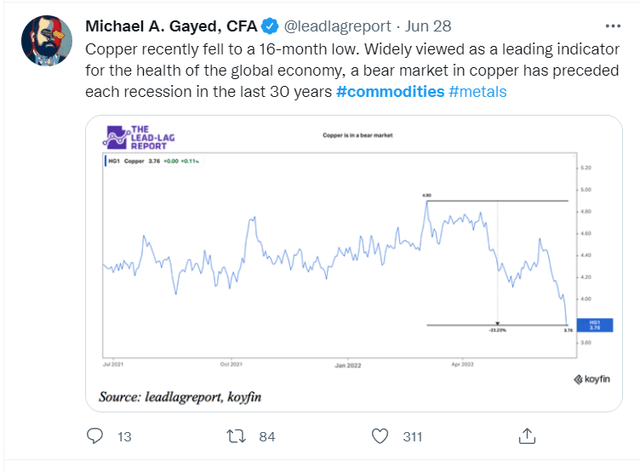

One of those commodities that have had to take it on the chin is Copper, which of course has also served as a very useful barometer in signaling broader recessionary conditions. Towards the end of June, it was trading at 16-month lows; two weeks on, it is at 20-month lows, providing some semblance of the ferocity of the bearish sentiment that has enveloped this counter. The recent bout of weakness is predominantly connected with developments in China, where the deadly BA.5 variant has made inroads.

For Chile, in particular, weakness in copper comes as a massive hit, as copper ores, refined copper, copper alloys and concentrates all account for the country’s largest exports (contributing roughly $36bn). Incidentally, China remains its biggest exporting destination.

If you’ve been following my work for the last 6-9 months, you’d note that the recent weakness in copper and other commodities isn’t a great surprise to me, as I’ve been banging on for a long time, the risk of short-term inflationary conditions transitioning to a long-term deflationary spiral. If you’re interested you can catch snippets of this in my discussion with Ron Insana on The Lead-Lag Report YouTube Channel.

Whilst commodity weakness is likely to serve as a lingering headwind for Chile’s trade position, must also consider what happens with the Chilean constitution. For the uninitiated, a group of largely political independents had recently rewritten the Chilean constitution which was submitted to the President last week. The constitution will likely see Chile shift from its neoliberal ethos which has been in place since 1980. Next on the agenda is a referendum on this constitution in around two months. It is questionable if this will come into force, as the most recent opinion polls showed that only 33% of the pollsters voted for its passage with 51% rejecting it. Despite the uncertainty surrounding this, what should be of some comfort, is the fact that the proposal-Article 27 was rejected. This would have seen the state gain exclusive control of mining rights of key metals whilst also gaining a majority stake in copper mines.

The other major challenge is the burgeoning inflation picture in Chile, where year-end forecasts were raised to even higher levels (previously the expectations were for 8.9%, but this has been scaled up to 11.1%). Inflation may be the talk of the town at the moment, but as I’ve reiterated previously, I don’t expect this to be a constant phenomenon for too long. The more pertinent question is, will the central bank have enough tools to support consumers when conditions do reverse, by way of rate cuts and the like. I’d like to think so because they’ve already raised rates quite aggressively, offering plenty of elbow room to pull back. Besides crucially, do consider that the Chilean debt to GDP is fairly well controlled at only 33%, quite unlike the blasphemous situation closer home, where debt to GDP levels are closer to the 140% mark! So principally this isn’t such a pressing issue in the grand scheme of things.

Conclusion

ECH is no doubt going through some challenging times, and as global recessionary conditions pick up, it won’t be the favorite name on most people’s wish lists. Having said that, one shouldn’t disregard the enormously cheap valuations on offer here; the product only trades at 6.1x forward P/E, a 43% discount to the corresponding forward P/E of the flagship iShares Emerging Markets ETF.

Be the first to comment