Justin Sullivan

Elevator Pitch

My investment rating for Snap Inc.’s (NYSE:SNAP) stock is a Hold.

In my prior February 23, 2022 update for SNAP, I touched on the company’s growth prospects in the intermediate term. In this latest write-up, I turn my attention to Snap’s share price weakness.

Snap’s shares continued to dip; its stock price declined by -39% on Friday, July 22, 2022 after announcing below-expectations revenue growth, implying that SNAP’s stock has now dropped by -84% in the last one year.

But SNAP isn’t a Sell despite negative share price momentum and the poor financial outlook for the upcoming quarters. This is because Snap still has lots of room for growth in international markets, based on an analysis of penetration rates in countries such as Japan. On the flip side, it is premature to be bottom fishing in SNAP’s shares, taking into account expectations of weak revenue growth and continued losses for SNAP in the rest of 2022. This makes Snap a Hold-rated stock in my opinion.

Why Has Snap Stock Been Dipping?

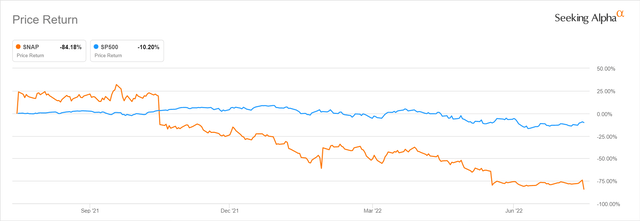

Snap’s shares were down by -84% in the past one year, and the stock has underperformed the S&P 500 since late-October 2021 as per the chart below. Notably, SNAP’s revenue fell short of market expectations in three of the past four quarters. The first of the three top line misses occurred on October 21, 2021 when SNAP announced its Q3 2021 results, and this coincided with the beginning of the stock’s underperformance relative to the broader market.

SNAP’s One-Year Stock Price Chart

Seeking Alpha

On July 22, 2022, a day after it reported its Q2 2022 financial results, SNAP’s stock price dipped by -39% to close at $9.96 at the end of the trading day. Snap’s second-quarter revenue miss and the company’s decision to do away with Q3 2022 management guidance confirmed investors’ fears that the outlook for SNAP is moving from bad to worse.

Specifically, there are three key factors that have been a drag on Snap’s financial performance in recent quarters. In my previous article written on February 23, 2022, I highlighted the two major headwinds for SNAP, namely “Apple’s (AAPL) iOS privacy changes” and “greater-than-expected competition from rivals”, and these have continued to hurt Snap’s most recent Q2 2022 results.

The third headwind or negative factor is macroeconomic weakness. Snap shared at the company’s Q2 2022 earnings briefing on July 22 that “macro headwinds have disrupted many of the industry segments that have been most critical to the growing demand for advertising solutions over prior years.”

SNAP might also have been affected by macroeconomic weakness to a larger extent than its peers due to its advertiser mix. At its second-quarter investor call, Snap noted “we have a relatively lower exposure to small- and medium-sized, brick-and-mortar businesses.” It is reasonable to assume that Snap might have a higher proportion of advertisers which have a significant online presence (as opposed to brick-and-mortar) that aren’t doing as well in the post-pandemic environment with Work-From-Home tailwinds easing.

SNAP Stock Key Metrics

I go into more detail about SNAP’s key metrics disclosed as part of the company’s Q2 2022 financial results in this section. In my opinion, Snap’s second-quarter financial performance wasn’t as bad as what the post-results announcement share price reaction suggested.

On one hand, Snap’s revenue expansion was disappointing, and the company’s profitability in the near term could be affected by the need to sustain a certain level of investments to reignite top line growth.

SNAP’s top line only increased by +13% YoY to $1,111 million in the second quarter of 2022, when sell-side analysts were expecting a much higher +17% YoY growth in its revenue as per S&P Capital IQ data. More significantly, SNAP also mentioned in its Q2 2022 investor letter that “thus far in Q3, revenue is approximately flat” YoY.

Separately, Snap acknowledged at its Q2 2022 earnings call that it has to continue “investing to improve our direct response business” so as “to keep growing.” This is reflected in Wall Street’s consensus financial projections as sourced from S&P Capital IQ, which suggest that SNAP will continue to be loss-making at the EBIT level and register negative GAAP earnings between FY 2022 and FY 2025.

On the other hand, SNAP did well on certain operating metrics relating to user growth and engagement.

Snap’s Daily Active Users or DAUs grew by +18% YoY to 347 million in Q2 2022, and this was +1% higher than the market’s consensus DAUs of 343 million as per S&P Capital IQ. SNAP also expects DAUs amounting to 360 million for Q3 2022, which represents an +18% YoY increase and also beat consensus DAU estimates by +2%.

SNAP also highlighted in its second-quarter investor letter that “overall time spent watching content globally grew” YoY in the recent quarter. Specifically, Spotlight, a relatively new product introduced by the company in late-2020, saw time spent jump by +59% YoY in Q2 2022.

Is Snap Stock Expected To Rise Again?

Snap’s stock price isn’t expected to rise again in the very near term. SNAP should suffer from slower revenue growth and elevated costs in the coming quarters.

Advertising is an economically sensitive business, and it will be tough for Snap’s top line to grow substantially in an environment of economic weakness or even a recession. Snap emphasized at its Q2 2022 results call that “auction-driven direct response advertising is among the very few line items in a company’s cost structure that they can reduce immediately.” It is inevitable that advertising budgets will continue to shrink, and this in turn will lead to SNAP and its rivals competing even harder for a share of a much smaller pie. As per S&P Capital IQ, the sell-side’s consensus financial forecasts point to SNAP’s YoY revenue growth slowing to +0.1% and +0.7% for Q3 2022 and Q4 2022, respectively.

Also, Snap’s path to GAAP profitability should take a much longer time than expected. As I noted in the preceding section, SNAP intends to continue investing in the company’s direct response business, which will be a drag on its profitability in the foreseeable future.

Although Snap has plans in place to moderate the pace of recruitment and also cut other operating costs, the company acknowledged at its second-quarter earnings briefing that “we may incur some transition costs along the way as we execute on these changes (cost optimization initiatives).” SNAP’s net loss per share on GAAP basis is forecasted to narrow from -$0.26 in Q2 2022 to -$0.22 in Q3 2022 and -$0.13 in Q4 2022 as per S&P Capital IQ’s consensus data. But it is noteworthy that the company will still remain loss-making due to “transition costs” and a sustained level of investments for its direct response business.

Is SNAP A Good Long-Term Investment?

Looking beyond the headwinds for Snap in the short term, I am of the view that SNAP is a good long-term investment, especially relating to the long growth runway for the company in international markets.

In an earlier section of this article, I noted that SNAP’s total DAUs amounting to 347 million in the second quarter of 2022 was equivalent to a decent +18% YoY growth. The key driver was Snap’s Rest of World region, which witnessed a +35% YoY increase in DAUs to 162 million in the recent quarter. This is an indicator that SNAP has been doing well in overseas markets, even though its overall financial performance was disappointing.

Moving forward, SNAP has the opportunity to further expand its user base in non-US markets in the long run. According to Piper Sandler’s April 1, 2022 research report (not publicly available) titled “Using Ads Manager Data to Frame the Global User TAM”, Snap’s “addressable MAUs across top 15 GDP countries alone” is over 800 million. Specifically, SNAP’s penetration rates (actual MAUs as obtained from Ads Manager divided by the estimated addressable MAUs) in Japan, Indonesia, Brazil, and Italy are very low at 2%, 3%, 9% and 12%, respectively as compared to a 66% penetration rate for the US market.

Is SNAP Stock A Buy, Sell, or Hold?

I rate SNAP stock as a Hold.

Snap’s current valuations are more reasonable, with the stock’s consensus forward next twelve months’ Enterprise Value-to-Revenue multiple de-rating from above 25 times at its peak in early-2021 to 3.3 times now as per S&P Capital IQ. In addition, SNAP’s long-term growth prospects remain intact, particularly in specific non-US markets where its penetration rates are very low. As such, Snap doesn’t warrant a Sell rating. But SNAP isn’t a Buy either, since the near-term financial outlook for the company is poor and there aren’t any tangible catalysts in sight to re-rate its shares.

Be the first to comment