Katharina13/iStock Editorial via Getty Images

Coca-Cola Europacific Partners PLC (NASDAQ:CCEP) offers investors exposure to a large Coca-Cola bottler across Europe and, now, Asia Pacific.

The business is performing solidly, with revenues growing strongly. It is also starting to see the benefits of its acquisition of bottler Amatil. The dividend yield looks particularly attractive at the moment. However, I see the company as fully valued, so maintain a “hold” rating.

Business Performance Remains Solid

The business has been performing solidly, and the integration of Amatil seems to have gone well. In its quarterly trading update, the company referred to the integration as “well advanced.” I was concerned about the ability of the company to manage this distant business while managing its previous one at the same time. So far, though, fortunately those doubts have come to naught.

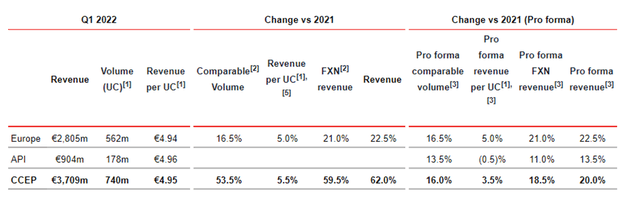

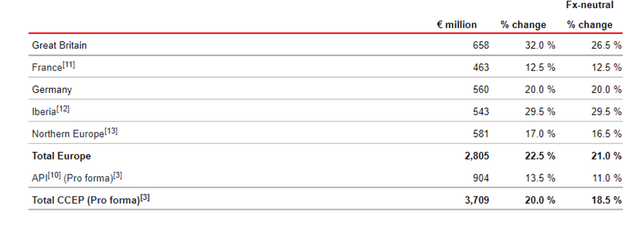

The company’s most recent numbers, for the first quarter, stacked up well.

Breaking this down by market, it can be seen that the company is performing very strongly from a sales perspective across the board.

For the present year, the company expects revenue pro forma comparable growth of 8-10%. For operating profit, it forecasts pro forma comparable growth of 6-9%.

Looking back over the past few years, while revenue growth has been fairly consistent, earnings have moved around a lot and show no consistent upwards trajectory.

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

|

Revenue (€M) |

6329 |

9133 |

11062 |

11518 |

12017 |

10806 |

13,763 |

|

Post-tax profit (€M) |

513 |

549 |

688 |

909 |

1090 |

498 |

988 |

|

Basic earnings per share (€) |

2.23 |

1.45 |

1.42 |

1.88 |

2.34 |

1.09 |

2.15 |

Chart compiled by author using data from company annual financial reports

Could integrating Amatil and realizing the benefits of scale and reach of the merger help to boost earnings? I think it could. But it remains the case that the performance of the company over the past few years has been unspectacular and inconsistent. I do not think that the merger in itself solves that problem.

I do expect improving business performance. This year is looking strong, and I expect continued growth over the next couple of years, as the Amatil acquisition synergies are fully realized. But the company’s track record lacks consistency, and it is subject to disappointments in given markets. So, although it is in growth mode now, I am not confident that CCEP earnings will consistently grow.

The Dividend is Attractive

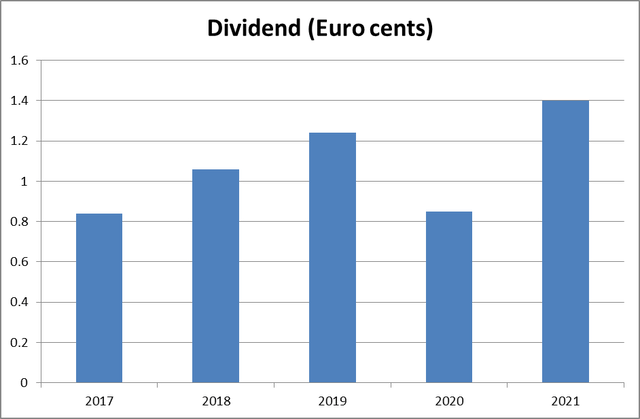

Setting aside the pandemic-hit 2020, the company has been growing dividends at a decent clip.

The company has reverted to paying biannual dividends. The first dividend this year was 56c per share. The company has indicated that the second half dividend will be calculated “with reference to the current year annualized total dividend payout ratio of approximately 50%.” So, does that equate to another increase in the full-year dividend? Based on the strong business performance expected for the year, I expect that it does.

From a dividend perspective, the share looks attractive from a long-term perspective. At its current price, the dividend yield is 4.3%. I find that an attractive yield in itself (while The Coca-Cola Company (KO) is a different type of business, its yield is 2.9% right now). On top of that, the company’s pricing power could enable it to keep raising the dividend over the years, meaning the prospective yield is even higher.

Valuation

The last time I covered the firm, last June, I concluded that it was fairly valued and assigned it a “hold” rating. Since then, the shares have fallen 18%.

They now trade on a price-to-earnings ratio of 23. I do not regard that as cheap. I do think the company has some attractive characteristics in its business model that give it pricing power. I think business performance could improve in coming years, and the dividend is attractive. But I do not see the shares as cheap. I, therefore, maintain my “hold” rating.

Be the first to comment