samxmeg/E+ via Getty Images

The iShares China Large-Cap ETF (NYSEARCA:FXI) holds a portfolio of the leading Chinese large-cap companies that trade on the US stock exchange. The top holding is China’s high-profile e-commerce company, Alibaba (BABA), which trades as an ADR on the NYSE. The BABA ADR began trading in 2014 at $92.70 per share and rose to a high of $319.32 in October 2020. At the $112.99 level at the end of last week, the stock was closer to the opening price in September 2014 than the October 2020 high. Moreover, BABA shares fell to a low of $73.28 on March 15, 2022, the lowest level since March 2016. Since BABA makes up over 10% of the FXI portfolio, it weighed on the ETF. Moreover, all Chinese stocks had been weak over the past year, since February 2021. The Chinese shares have far underperformed the US stock market, and when US shares experienced selling, Chinese stocks did even worse.

The APS was long FXI as of Friday, March 25 after the shares bounced.

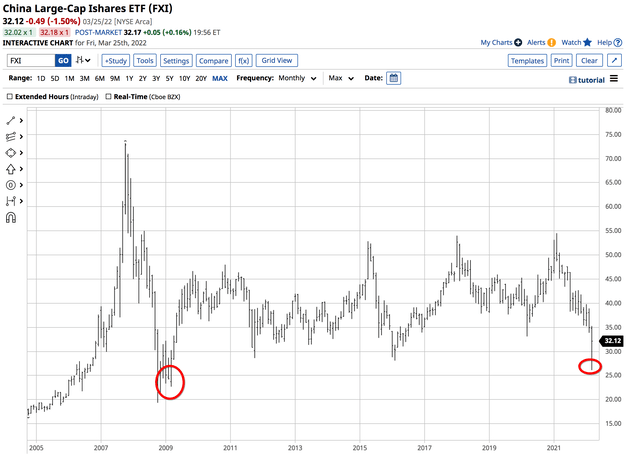

FXI falls to the lowest level since March 2009 before a rip recovery

Bear market rallies can be fast and furious, and the rips higher tend to be head spinning.

Long-term FXI chart (Barchart)

The chart highlights FXI’s bear market trend that took the ETF to the lowest level since 2009, when it traded at $26.13 on March 15.

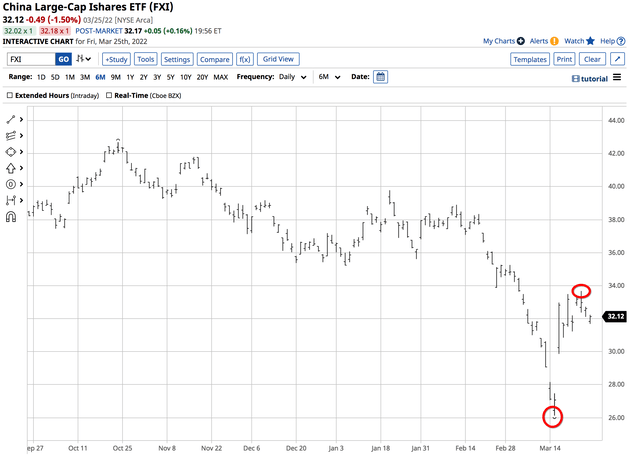

Short-term FXI chart (Barchart)

The recovery took the ETF to a high of $33.67 eight days later, a 28.9% rally. Meanwhile, the spike lower and recovery have not changed the bearish trend in the large-cap Chinese stocks.

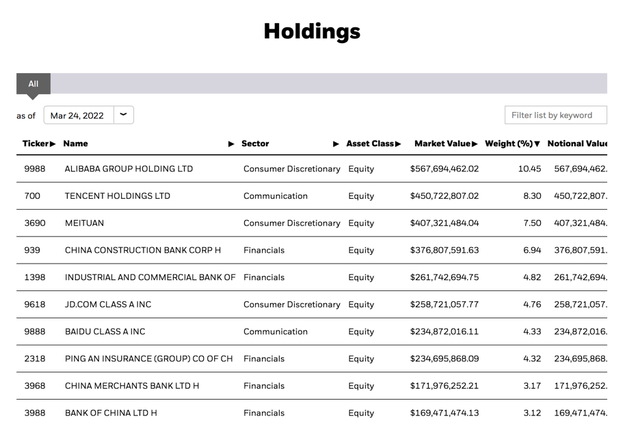

The top holdings of the FXI product include:

Top Holdings of the FXI ETF product (iShares.com)

The ETF has a 10.45% exposure to Chinese e-commerce giant Alibaba.

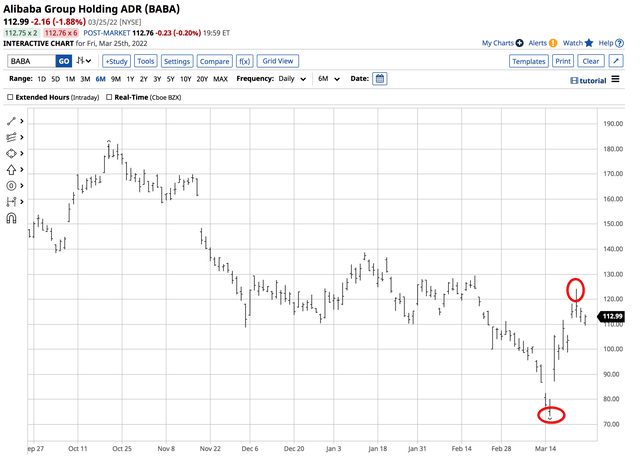

Chart of BABA Shares (Barchart)

The short-term chart of BABA shares shows the rally from $73.28 on March 15 to a high of $124.11 on March 23. The 69.4% rip gain pushed the FXI higher. BABA shares ran out of upside steam at $124.11 and were at just below the $113 level on March 25.

Chinese stocks are not popular with US investors in the current geopolitical environment

February 4, 2022 will be watershed event in history. At the 2022 Beijing Winter Olympics opening ceremony, Chinese President Xi and Russian President Vladimir Putin shook hands on a $117 billion trade deal and a “no-limits” alliance for mutual support. Twenty days later, after the closing ceremony, Russia invaded Ukraine, a sovereign country in Eastern Europe the Russian President considers Western Russia. One month later, the brutal war continues to cause devastation and rising fatalities.

While Russia looks to swallow the bordering country that was part of the Soviet Union, China seeks reunification with Taiwan. Sanctions on Russia and the “no-limits” agreement with China have made US and European investors more than skittish about investing in a Chinese company that trades on the US or other stock exchanges.

The last push lower could have been liquidation

On February 23, the day before Russia invaded Ukraine, the FXI closed at the $35.31 level. The ETF dropped 26% by the March 15 low. BABA shares were at $109.72 on February 23 and declined by 33.2% over the same period. On March 25, BABA was slightly higher than the February 23 closing level, while the FXI was still below.

The spike lower in BABA, which weighed on the FXI from February 23 through March 15, had all the hallmarks of a massive long liquidation in Chinese shares. In April, we will find out if the highest-profile buyer of the leading Chinese e-commerce company bailed out or bought more shares.

The “no-limits” support agreement could have been a convenient excuse to liquidate

In Q3 and Q4 2021, legendary investor Charlie Munger accumulated BABA shares. At the beginning of Q3 2021, the stock traded at $228.07 per share, over double the current price and more than three times the price at the March 15 low.

We will find out if Mr. Munger decided that the risk of the “no-limits” agreement and Russia’s invasion of Ukraine were too much for him to stomach in early Q2 when he makes his latest ownership disclosure. His partner, Warren Buffett, once said it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.” The shift in the geopolitical landscape could be an exception that caused Mr. Munger to throw in the towel on his BABA investment. Alternatively, he may have continued to purchase the stock at lower prices. If Charlie Munger liked BABA at the $228 level, he could have loved it at below $75 a share.

The APS is long FXI – The trend is our friend

As of March 25, 2022, the trend in FXI shares was higher. The APS was long FXI shares as the trend is always your best friend in all markets. APS holds ten highly-liquid and optionable stocks and ETF products. FXI is a component as it meets the strategy’s requirements. At $32.12 per share, FXI had $5.4 billion in assets under management, traded an average of over 63.3 million shares each day, and charges a 0.74% management fee.

Following trends via an algorithmic system requires strict adherence to rules. We do not attempt to pick bottoms or tops in any markets and are typically short at bottoms and long at tops. Taking the most significant percentage out of trends requires removing emotional impulses from trading and investing. We ignore fundamentals, news, and all of the daily noise. Our signals are never intraday; they can only change at the end of a session. Our system does not get caught up in the daily frenetic trading activity. News and noise are at a frenzied level with the war in Ukraine, sanctions, and concerns over China’s loyalties and plans for reunification with Taiwan. The APS is always long or short its components.

The price of any asset is always the correct price because it is the level where buyers and sellers meet in a transparent environment, the marketplace. Crowd behavior that determines trends can be the optimal market approach across all asset classes. As of March 25, the crowd’s wisdom points to a bullish trend in FXI. APS took a significant profit on the short side of FXI before reversing to a long position. When the trend changes, the APS will issue a sell signal for the ETF that holds China’s leading large-cap stocks that trade on the US exchanges.

Be the first to comment