Portugal2004

Last time, we presented Heineken Q3 results (OTCQX:HEINY) and decided to lower our internal estimates on our 2023 forecasted numbers. The main reasons were: 1) lower EBIT margin in Continental Europe, 2) negative impact on FX, 3) higher NCI (non-controlling interest), and 4) higher WACC estimates (assuming a higher cost of debt as well as a higher equity risk premium). However, the company delivered a good quarter, and coupled with a 15% price earning discount compared to the European staples historical average, we decided to maintain a buy rating target of €110 per share. In the mind time, in early December, the company hosted a Capital Markets Day on 1-2nd with many follow up based on geographical end-market exposure as well as a specific theme such as Logistics and Supply Chain. Here at the Lab, we believe that the new top-management team that emerged during the COVID-19 pandemic is re-configuring Heineken’s business for better quality growth over the medium to long term horizon.

We also do believe that many of this development are not getting any credit at the investor community level, as Wall Street analysts are pricing a pessimistic view on the EU consumer outlook and higher input costs. As a memo, Heineken topline sales in the EU are approximately 42% of its total turnover. Out of the many presentations released by the company, there are three key takeaways that we are reporting:

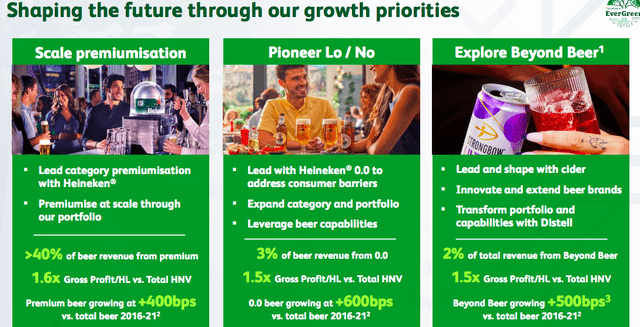

- Given the solid track record of Heineken’s topline performance, the management is emphasizing more and more the company’s price/mix component development. Heineken’s global footprint supports at least 150 basis point volumes outperformance, and with more beer premium sold, they might be a further upside. The price delta over cost is covered in 2022, and margins will be more meaningful as premiumization accelerates (Fig below). The company has a strong brand power, which supports its price increase trend without compromising market share;

- Looking at the company’s history, the beer giant has always been decentralized. The Heineken structure is evolving towards consumer giant best practices. The company aims to better leverage scale across its internal organization. We already emphasized these upsides in our initiation of coverage; however, thanks to the latest launches, e.g., Heineken Silver, the company is moving forward into a new commercial perspective with capabilities in the digital world;

- We see a different approach at the cultural level. Heineken is clearly focusing on a culture of productivity gains and moving away from cost savings plan initiatives. The company’s mindset is evolving, and they expect and target €400 million in savings per year from 2024 onwards. 40% of these initiatives will regard Europe. We believe that Heineken is behind its comps such as Carlsberg and Diageo and still operates with a 45 ERP system. When raw material inflationary pressure cost will normalize, we will see the significant step that the company is undertaking and the Heineken equity story will change.

Beer Premiumization (EverGreen 2025 Heineken Plan)

Conclusion and Valuation

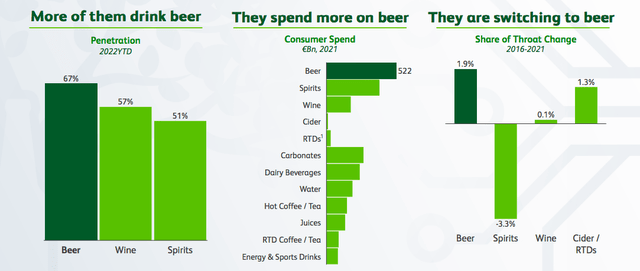

Heineken confirmed that it expects a stable to slightly up year-on-year operating profit margin for 2022 and ‘well above 2019‘ accounts. For 2023, organic growth in operating profit is expected between 6% and 9% and is well in line with Mare Evidence Lab’s forecast (ahead of consensus numbers). The outlook is based on the continued progress of the EverGreen strategic plan to 2025, against the backdrop of a challenging global economic backdrop and declining consumer confidence in developed markets. More specifically, for 2023, Heineken expects stable to modestly growing volumes, deriving from an increase in developing markets and a decline in Europe, a continuous discipline in prices based on local market conditions with the aim of covering most of the inflation impact with gross savings above €2 billion, compared to 2019 baseline. Our thesis on inflation expectations and customers’ attention to look for cheaper alternatives is working pretty well. B2C is definitely switching from spirits to beer products.

Beer Penetration (EverGreen 2025 Heineken Plan)

With cost savings and pricing, giving good visibility on its Fiscal Year 2023 mid to high single-digit EBIT growth coupled with the three key strategic changes reported above, we continue to value Heineken at €110 per share, maintaining our overweight valuation.

Be the first to comment