viking75/iStock via Getty Images

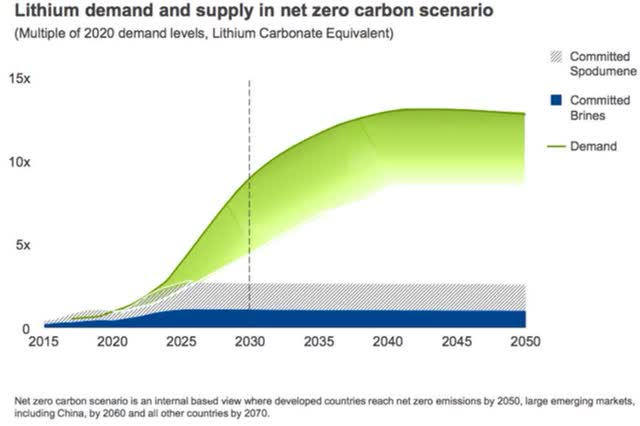

Welcome to the March 2022 edition of the “junior” lithium miner news. I have categorized those lithium miners that won’t likely be in production before 2023 as the juniors. Investors are reminded that most of the lithium juniors will most likely be needed in the mid and late 2020’s to supply the booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance, and a longer time frame.

March saw strong lithium prices before stabilizing at record highs. The lithium juniors continue to do very well and are enjoying very positive sentiment in the lithium sector, despite some short term price setbacks with the Ukraine-Russia war.

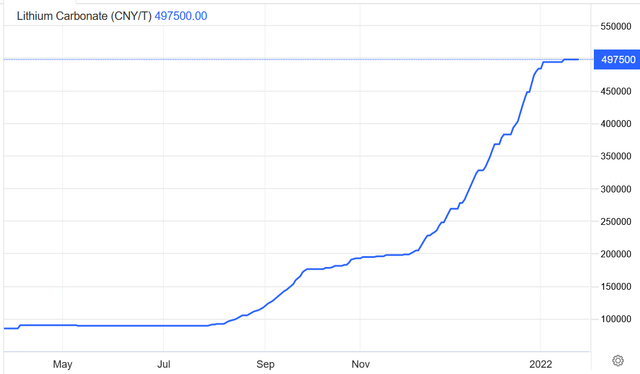

Lithium spot and contract price news

Asian Metal reported during the past 30 days, 99.5% China lithium carbonate spot prices were up 1.8%. Lithium hydroxide prices were up 8.86% the past 30 days. Lithium Iron Phosphate (Li 3.9% min) prices were up 2.24%. Spodumene (6% min) prices were up 2.61% over the past 30 days.

Benchmark Mineral Intelligence as of mid-March reported China lithium carbonate prices of US$76,700/t (battery grade), and for lithium hydroxide $71,825/t, and stated (no link available): “Benchmark continues to hear reports that inventory levels for hydroxide, carbonate, and spodumene feedstock remain very low in the Chinese domestic market, indicating that robust demand for material, and hence high prices, will be sustained in the near-term, with expectations that the seasonal recommencement of supply from domestic Qinghai brines in the coming months will provide little relief to the growing market deficit.”

Metal.com reports lithium spodumene concentrate (6%, CIF China) price of CNY 18,234 (~USD 2,863/mt), as of March 18, 2022.

China Lithium carbonate spot price – CNY 497,500 (~USD 78,127)

Source: Trading Economics

Rio Tinto’s lithium emerging supply gap chart (chart from 2021)

Source: Mining.com courtesy Rio Tinto

Lithium market news

For a summary of the latest lithium market news and the “major” lithium company’s news, investors can read my “Lithium Miners News For The Month Of March 2021“ article. Highlights include:

- Biden-Harris Administration announce major investments to expand domestic critical minerals supply chain.

- Yongxing Materials, Jiangxi Tungsten setting up JV for lithium carbonate production.

- Northvolt plans a third battery-materials factory in Sweden.

- Panasonic to build huge U.S. battery plant to supply Tesla.

- BASF acquires site for North American battery materials and recycling expansion in Canada.

- Chile a step closer to nationalizing copper and lithium.

- GM and South Korea’s POSCO Chemical will build a $400 million facility to produce battery materials in Canada.

- The EV battery market is expected to grow at a CAGR of 26% from 2021 to 2028 to reach $175.11 billion by 2028.

- As EV demand rises, Biden officials warm to new mines.

- Senators urge Biden to invoke Defense Act for battery materials.

- A handful of EV metals could determine the future of the car industry.

- Electric-car makers should rethink raw material supply chains – RBC.

- Ontario announces critical minerals strategy aiming to attract investment.

- Stellantis, LG Energy pick Ontario for battery plant.

- Tesla supplier CATL weighs sites for $5 billion battery plant, considering Mexico, U.S., Canada sites.

- LG Energy considers billion-dollar battery plant in Arizona.

Junior lithium miners company news

Sayona Mining [ASX:SYA] (OTCQB:SYAXF)

On March 1, Sayona Mining announced: “Sayona doubles Québec lithium resource base amid surging demand.” Highlights include:

- “Sayona’s Québec lithium resource base swells following upgraded estimates for the combined North American Lithium [NAL] and Authier projects, with total JORC combined Measured, Indicated and Inferred Mineral Resource of 119.1 million tonnes (Mt) @ 1.05% Li2O…

- JORC Mineral Resource estimate for NAL, the first since its acquisition in 2021, identifies a total Measured, Indicated and Inferred Mineral Resource of 101.9 Mt @ 1.06% Li2O.

- Expanded combined NAL‐Authier resource base to support significant upgrade to integrated definitive feasibility study, amid surging demand for lithium supply in North America.”

On March 17, Sayona Mining announced: “Financial report for the half year ended 31 December 2021.”

Investors can read the Company presentation here, and my Trend Investing interview: “Sayona Mining Managing Director & CEO Brett Lynch Talks With Matt Bohlsen Of Trend Investing.”

Note: North American Lithium [NAL] is owned 75% Sayona Mining: 25% Piedmont Lithium.

Upcoming catalysts include:

- 2022 – Authier permitting. Possible project financing and off-take.

- 2023 – Restart of NAL (SYA 75%: PLL 25%) operations.

Piedmont Lithium [ASX:PLL] (PLL)

Piedmont Lithium 100% own the Carolina Lithium spodumene project in North Carolina, USA; as well as 25% of North American Lithium [NAL].

On March 3, Piedmont Lithium announced:

Piedmont Lithium partner Sayona Mining doubles Quebec lithium resource estimate… totaling 119.1 million metric tonnes @ 1.05% Li2O. Piedmont owns a 25% project interest in the North American Lithium and Authier Projects via an equity stake in Sayona Quebec as well as an equity interest of approximately 17% in Sayona Mining. Sayona Mining’s estimate, including 73.7 Mt @ 1.05% Li2O of Measured and Indicated Resources, was reported in accordance with JORC Code (2012) and NI 43-101 standards.

On March 9, Piedmont Lithium announced:

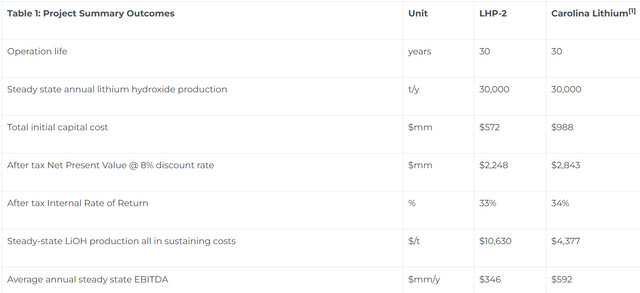

Piedmont completes Preliminary Economic Assessment for second U.S. lithium hydroxide plant… to expand Piedmont’s planned U.S. manufacturing capacity to 60,000 t/y of lithium hydroxide… The planned 2023 restart of North American Lithium in conjunction with our partner, Sayona Mining, and potential for spodumene production at Ewoyaa in partnership with Atlantic Lithium as early as 2024 ensures that our LHP-2 operations will have dedicated material supply from day one.

The second U.S. lithium hydroxide plant project after tax NPV8% is US$2.248b and for the Carolina Lithium (flagship) Project it is US$2.843b. See below.

LHP-2 PEA highlights (Carolina Lithium shown as a comparison)

Source: Piedmont Lithium

On March 15, Piedmont Lithium announced:

Piedmont Lithium releases updated corporate presentation for March 2022. Presentation includes recent Preliminary Economic Assessment of potential second hydroxide plant and projected production timelines for projects in Quebec and Ghana.

On March 21, Piedmont Lithium announced:

Piedmont announces proposed public offering of common stock. Piedmont Lithium Inc. today announced that it plans to conduct a public offering, subject to market and other conditions, of 1.5 million shares (“shares”) of its common stock (“Public Offering”). Piedmont intends to use the net proceeds from the offering to fund the Company’s share of the capital required to restart the operations at North American Lithium in Quebec, to fund exploration and definitive feasibility studies at Ewoyaa in Ghana, to advance the Company’s merchant lithium hydroxide plant in the southeastern United States, and to continue development of the Carolina Lithium Project, including ongoing permitting activities, engineering design, and property acquisition. Additionally, the net proceeds may be used to fund possible strategic initiatives and for general corporate purposes.

On March 22, Piedmont Lithium announced:

Piedmont announces pricing of upsized public offering of common stock. Piedmont Lithium Inc. today announced the pricing of an upsized underwritten public offering of 1.75 million shares (“shares”) of its common stock (“Public Offering”), at a price per share to the public of $65.00, for aggregate gross proceeds of $113.75 million… Piedmont intends to use the net proceeds from the offering to fund the Company’s share of the capital required to restart the operations at North American Lithium in Quebec, to fund exploration and definitive feasibility studies at Ewoyaa in Ghana, to advance the Company’s merchant lithium hydroxide plant in the southeastern United States, and to continue development of the Carolina Lithium Project, including ongoing permitting activities, engineering design, and property acquisition. Additionally, the net proceeds may be used to fund possible strategic initiatives and for general corporate purposes.

Upcoming catalysts include:

- 2022 – Carolina Lithium – Possible further off-take, permitting or project funding announcements.

- Early 2023 – NAL (25% Piedmont Lithium) production set to begin.

You can view the company’s latest presentation here.

Standard Lithium [TSXV:SLI] (SLI)

On February 24, Standard Lithium announced: “Standard Lithium and LANXESS finalize plan for first commercial lithium project in Arkansas.” Highlights include:

- “Standard Lithium will form an initially wholly-owned company (“Project Company”) that owns 100% of the Project during pre-FEED and FEED engineering studies (see news release dated January 20th, 2022). The FEED engineering will be used to produce a NI43-101 Definitive Feasibility Study (“DFS”) in Q4 2022.

- LANXESS will, via a series of commercial agreements, provide the brine supply for the Project, the Project site lease, and rights of way, infrastructure, and other services for the Project.

- Standard Lithium will provide a market fee-based license to the Project Company of its suite of intellectual property.

- Standard Lithium is able to utilize its intellectual property, extraction technology and know-how at its 100% owned South West Arkansas Project, certain other sites in Arkansas and at all project sites outside of Arkansas, and will maintain control and ownership over the future development of its IP portfolio.

- LANXESS is obliged to support development of the Project and upon completion of a DFS, has the option to acquire an equity interest in the Project Company of up to 49% and not less than 30%, at a price equal to a ratable share of SLL’s aggregate investment in the Project Company.”

If LANXESS acquires an ownership interest:

- “The parties will share the costs of financing construction of the Project on a ratable basis.

- LANXESS will have the right to acquire some, or all of the lithium carbonate off-take produced at the commercial plant at market-based terms less a handling fee.”

If LANXESS does not acquire an ownership interest:

- “Standard Lithium will own 100% of the Project including customary dividends, distribution, or similar rights.

- Standard Lithium can elicit bids from other interested parties to buy up to 49% of the Project Company.

- LANXESS will have the right to acquire some, or all of the lithium carbonate off-take produced at the commercial plant at a price of market minus up to 20%, to be agreed by LANXESS and Standard Lithium and taking into consideration several key commercial agreements (including the costs of brine supply and disposal for the Project, the Project site lease cost and rights of way, infrastructure, and other services for the Project).”

Vulcan Energy Resources [ASX: VUL] (OTCPK:VULNF)

Vulcan Energy Resources state that they have “the largest lithium resource in Europe” with a total of 15.85mt LCE, at an average lithium grade of 181 mg/L. The Company is in the development stage developing a geothermal lithium brine operation (geothermal energy plus lithium extraction plants) in the Upper Rhine Valley of Germany.

On March 10, Vulcan Energy Resources announced: “Vulcan Energy Resources half year results FY22.”

HY22 financial highlights

(Vulcan Energy Resources website)

Source: Vulcan Energy Resources website

On March 18, Vulcan Energy Resources announced: “Zero carbon lithium project update.” Highlights include:

- “Lithium division: pre-fabrication of Vulcan’s Direct Lithium Extraction [DLE] – Demonstration Plant (Demo Plant) has commenced offsite in Germany, while 80% of the equipment has been ordered and design-work has been finalised. Start of commissioning of the Demo Plant is on track for mid-year…

- Vulcan’s operational DLE Pilot Plant is reporting consistent lithium concentration and low level of impurities. Lithium recovery rates are averaging 94-95%, above the levels noted in the 2021 Pre-Feasibility Study. The Pilot Plant has been operating since April 2021.

- New laboratory in Karlsruhe-Durlach, Germany, extending the analytical capability and expertise of the Company’s lithium division, is now fully operational, with further expansions planned.

- Renewable energy division: the Company has commenced discussions with local stakeholders to expand operations at its 100% owned geothermal renewable energy plant, which is currently operating in Insheim, to provide heating and energy security to local communities.

- Refurbishment of the electric drill rigs purchased in 2021 is underway, with the rigs due to be operation-ready by the end of the year, before being deployed for mass scale geothermal renewable energy development in Germany, reducing reliance on Russian gas.

- Feasibility & financing: kick-off of Bankability Study with BNP Paribas completed, in advance of planned financing process which will follow the DFS completion.

- Led by Vulcan’s in-house team and supported by Hatch Ltd, the Definitive Feasibility Study [DFS] is progressing on track to be finalised in the second half of 2022.”

Upcoming catalysts include:

- H2 2022 – DFS, permitting, then project funding.

- 2024 – Target to commence production.

Savannah Resources [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

On March 3, Savannah Resources announced:

Barroso Lithium Project decarbonisation strategy initiated… Savannah expects the decarbonisation strategy to be defined and ready for implementation in Q2 2022.

Upcoming catalysts include:

2022 – DFS due, EIA permit due.

POSCO [KRX:005490] (PKX)

On March 22, Reuters reported:

South Korea’s Posco to invest $4 bln in lithium project in Argentina. Posco expects to initially produce 25,000 tonnes of lithium hydroxide, an especially high-demand lithium product for battery makers, there per year, reaching 100,000 tonnes once the venture is completed.

Upcoming catalysts include:

- 2024 – Target to commence production at Hombre Muerto and ramp to 25ktpa LiOH.

Wesfarmers [ASX:WES] (OTCPK:WFAFY)(took over Kidman Resources)

The Mt Holland Lithium Project is a 50/50 JV between Wesfarmers [ASX:WES] (OTCPK:WFAFF) and SQM (SQM), located in Western Australia. There is also a proposal for a refinery located in WA. Wesfarmers acquired 100% of the shares in Kidman for A$1.90 per share, for US$545 million in total.

No lithium related news for the month.

You can view the latest company presentation here and news on the Mt Holland construction here.

Upcoming catalysts include:

- H2, 2024 – Mt Holland spodumene production and Kwinana LiOH refinery planned to begin and ramp to 45–50ktpa LiOH.

Liontown Resources [ASX:LTR] (OTC:LINRF)

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia. DFS completed in November 2021.

On March 11, Liontown Resources announced:

Half year report 31 December 2021. During the half year ended 31 December 2021, the Group completed technical and financial studies at its flagship 100% owned Kathleen Valley Lithium Project located in Western Australia. The Company divested non-lithium assets located in Western Australia through the demerger of wholly owned subsidiary Minerals 260 Limited which was subsequently listed on the ASX as part of an Initial Public Offering [IPO]). At Kathleen Valley, the Definitive Feasibility Study [DFS] confirmed the technical and financial viability of a long life, high-grade mining and processing operation. The DFS outlined a Tier-1 global lithium project with exceptionally strong financial and technical merits, combined with a class-leading sustainability and ESG framework that is being fully integrated with the Project’s development. Final investment decision [FID] is targeted for Q2, 2022 with first production expected in the first half of 2024.

On March 21, Liontown Resources announced: “Positive drilling results confirm growth potential at Buldania Lithium Project, WA. Drilling confirms potential for incremental extension at the main Anna Lithium Deposit and defines multiple, new lithium mineralised pegmatites at the Northwest Prospect.” Highlights include:

- “… Anna Deposit: Better intersections include: 3m at 1.1% Li2O from 36m [BDRC0189]. 21m at 0.5% Li 2O from 8m [BDRC0190] including: 1m at 2.0% Li 2O from 13m. 17m at 1.1% Li 2O from 18m (BDRC0193) including: 7m at 1.4% Li 2O from 19m and 2m at 1.9% Li 2O from 30m. 15m at 1.0% Li 2O from 23m [BDRC0197] and 4m at 1.6% Li2O from 45m [BDRC0197]. Shallow lithium mineralisation defined immediately east and outside of the current Anna Mineral Resource Estimate (15Mt at 1.0% Li2 O and 44ppm Ta2O 5), with the new zone extending over a strike length of ~150m and 300m down-dip. Further drilling planned prior to updating the Anna Mineral Resource Estimate. Northwest Prospect: Liontown has previously identified the Northwest area of the Buldania Project as having lithium potential and the recently completed drilling program has identified further mineralised zones, with assay results including: 5m at 1.3% Li 2O from 32m [BDRC0203]. 10m at 1.1% Li 2O from 48m (BDRC0203). 6m at 0.8% Li 2O from 12m [BDRC0204]. 3m at 1.1% Li2O from 189m [BDRC0205]. 6m at 1.0% Li2O from 70m [BDRC0215]. Significant lithium results returned over a strike length of 800m, with the mineralisation open in all directions.”

- The potential for incremental extension of the Anna Deposit, together with the lithium mineralisation identified at the Northwest Prospect, reinforces the Buldania Project as an emerging asset of comparable size and quality to several recent lithium discoveries.”

You can view the company’s latest presentation here.

AVZ Minerals [ASX:AVZ] (OTC:AZZVF)

AVZ Minerals owns 51% of its Manono Lithium & Tin Project in the DRC, after selling 24% of it to Suzhou CATH Energy Technologies for US240m. DRC-owned firm Cominiere has a 25% share.

On March 4, AVZ Minerals announced:

AVZ admitted to S&P/ASX 200 Index. AVZ Minerals Limited is pleased to advise that S&P Dow Jones Indices has announced that AVZ will be admitted to S&P/ASX 200 Index, effective prior to the open of trading on March 21 – as a result of S&P Dow Jones Indices March quarterly review.

On March 16, AVZ Minerals announced: “Interim financial report 31 December 2021.”

Upcoming catalysts include:

- 2022 – Initial project work. FID on the Manono Project.

Global Lithium Resources [ASX:GL1]

On March 3, Global Lithium Resources announced: “10 year strategic spodumene concentrate offtake agreement signed. Agreement signed with Suzhou TA&A Ultra Clean Technology Co – the controlling shareholder in Yibin Tianyi.” Highlights include:

- “…CATL is the major shareholder of Yibin Tianyi, the industry leading lithium chemical producer.

- Suzhou TA&A Ultra Clean Technology Co, the largest GL1 shareholder, to provide technical support services as required by GL1.

- Pricing will be based on a market price for spodumene concentrate determined by internationally recognised price reporting agencies…

Either party may terminate the Agreement if the following has not occurred on or before 31 December 2024 (or such other date as may be agreed between the parties)- GL1 completing construction and commissioning of a Concentrates Plant- GL1 completing internal product qualification to meet the agreed product specification.”

On March 9, Global Lithium Resources announced: “10 year strategic spodumene concentrate offtake agreement – clarification.”

On March 14, Global Lithium Resources announced: “$30 million placement attracts Mineral Resources as cornerstone investor proceeds to fast track lithium exploration and study work at Marble Bar and Manna Lithium Projects.”

On March 15, Global Lithium Resources announced: “Consolidated financial report for the half year ended 31 December 2021.”

On March 22, Global Lithium Resources announced: “Multi asset lithium exploration update. RC drilling ongoing at Marble Bar. Drilling contractor appointed at Manna.” Highlights include:

- “RC drilling program of 60,000m at Marble Bar Lithium Project [MBLP] continues with a total of 7,789m completed to date.

- 1,400 drill samples from MBLP sent to Perth for assaying with results anticipated Q2 2022.

- Diamond drilling at MBLP to test and expand the deposit at depth to commence Q3 2022.

- Experienced contractor Profile Drilling (Profile) have been contracted to undertake the RC drilling program which will initially comprise 20,000m at the Manna Lithium Project (Manna).

- Mobile camp being prepared with drilling to commence in April 2022 at Manna.

- Exceptional safety performance recorded at both assets.

- Drilling results of both campaigns to be incorporated into an updated Mineral Resource later this year.

- Global Lithium existing combined equity share (across MBLP and Manna) Inferred Mineral Resource of 18.4Mt @ 1.06% Li2O.”

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (OTCQX:CRECF)

No news for the month.

You can view last month’s corporate update here.

Upcoming catalysts include:

- 2022 – Rose Lithium-Tantalum Project provincial permitting. Possible off-take or financing announcements. Results of studies for a chemical plant to produce high quality lithium hydroxide monohydrate.

You can read my August 2021 Critical Elements Lithium article here.

Lithium Power International [ASX:LPI] (OTC:LTHHF)

On March 15, Lithium Power International announced: “Interim report 31 December 2021.” Highlights include:

Corporate

- “In December 2021, LPI raised a total of A$12.4 million from a share placement of 47.7 million new ordinary shares at a price of $0.26 per share.

- There was a change in the Board of the consolidated entity, with the resignation of Mr. Reccared (Ricky) Fertig as a Non-Executive Director. Mr. Fertig’s position will not be replaced.”

Maricunga Joint Venture – Chile

- “The consolidated entity’s main focus during the financial half-year was to continue development of its flagship Maricunga Lithium Brine Project (‘the Maricunga’) through the Maricunga joint venture (‘JV’) company, Minera Salar Blanco S.A. [MSB].

- A staged development approach continued for our flagship Maricunga Lithium Project in Chile, with Stage One to fast-track the properties known as “Old Code” concessions.

- A drilling program to 400 metres was completed during the period resulting in a 90% increase to the JORC resource of Lithium Carbonate Equivalent for Stage One of the project.

- Stage One of the project has a nameplate capacity of 15,000 tonnes-per-year of very high purity lithium carbonate over a 20-year mine life. Significant expansion potential exists from subsequent stages…”

Upcoming catalysts:

- 2022 – Further developments with Mitsui re off-take partner and funding announcements for Maricunga Lithium Brine Project in Chile.

Lake Resources NL [ASX:LKE] [GR:LK1] (OTCQB:LLKKF)

Lake Resources own the Kachi Lithium Brine Project in Argentina. Lake has been working with Lilac Solutions Technology (private, and backed by Bill Gates) for direct lithium extraction and rapid lithium processing.

On March 3, Lake Resources NL announced: “Lilac demonstration plant being delivered to Kachi Lithium Project.”

On March 7, Lake Resources NL announced: “$39 million at-the market raise…”

On March 15, Lake Resources NL announced: “Interim report – Half year financial statements for the six months ended 31 December 2021.”

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF)

ioneer ltd. announced in September 2021 the sale of 50% of its flagship lithium boron project to Sibanye Stillwater for US$490m.

No news for the month.

Upcoming catalysts include:

- Any debt funding deals on top of the existing Sibanye-Stillwater US$490m to fund Rhyolite Ridge.

European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTC:ERPNF) (NASDAQ:OTCPK:EMHXY)

On March 16, European Metals Holdings announced: “Interim financial report 31 December 2021.”

Upcoming catalysts include:

- 2022 – Any off-take or project funding deals.

Galan Lithium [ASX:GLN]

Galan is developing their flagship Hombre Muerto West (“HMW”) Lithium Project located on the west side edge of the high grade, low impurity Hombre Muerto Salar in Argentina. In total Galan Lithium has 3.0m tonnes contained LCE @858mg/L.

On March 15, Galan Lithium announced: “Financial report half year ended 31 December 2021.”

On March 24, Galan Lithium announced:

Positive anomalous soil assays delineate Donnybrook-Bridgetown Shear Zone… Anomalous pathfinder elements in lags derived from the adjacent pending tenement indicate potential targets… Galan has recently completed its first exploration sampling and mapping work at the Greenbushes South Lithium project (joint venture between Galan and Lithium Australia NL (LIT) (20%)).

Cypress Development Corp. (TSXV:CYP) (OTCQB:CYDVF)

Cypress Development owns tenements in the Clayton Valley, Nevada, USA.

On February 24, Cypress Development Corp. announced:

Cypress Development consolidates strategic land position at Clayton Valley, Nevada… Under the transaction, Cypress will pay US$1.1 million in cash and issue 3,000,000 common shares in the capital of Cypress (“Share Considerations”) to Enertopia to purchase 100% ownership interest in Enertopia’s Project. Closing is expected to be completed in April 2022 and is subject to customary approvals and closing conditions for a transaction of this nature, including approval of the Share Consideration by the TSX Venture Exchange.

On February 28, Cypress Development Corp. announced:

Cypress Development commences feasibility study on Clayton Valley Lithium Project and engages Wood Plc as independent lead author.

Frontier Lithium [TSXV:FL] (OTCQX:LITOF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 26,774 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

On March 1, Frontier Lithium announced: “Frontier successfully converts inferred resource to 14 MT of indicated resource on the Spark deposit.” Highlights include:

- “Resource estimate update for Spark Pegmatite includes 14 million tonnes averaging 1.40% Li2O in the Indicated category.

- Includes another 18 million tonnes averaging 1.37% Li2O in the Inferred category.

- The Spark lithium deposit remains open along strike and down dip.”

Firefinch Limited (ASX: FFX)(OTCPK:EEYMF)(lithium spinout 50/50 JV with Ganfeng Lithium named as Leo Lithium Limited to list on ASX end Q1 2022)

On March 4, Firefinch Limited announced:

S&P Dow Jones Indices announces March 2022 quarterly rebalance of the S&P/ASX Indices. S&P Dow Jones Indices announced today the changes in the S&P/ASX Indices, effective prior to the open of trading on March 21, 2022, as a result of the March quarterly review.

American Lithium Corp. [TSXV: LI] (OTCQB:LIACF) (acquired Plateau Energy Metals Inc.)

On February 24, American Lithium Corp. announced: “American Lithium named to TSX Venture Exchange “Venture 50″.”

Wealth Minerals [TSXV:WML] [GR:EJZN] (OTCQB:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars.

On March 18, Wealth Minerals announced: “Wealth grants stock options.”

Investors can view the company’s latest presentation here.

E3 Metals [TSXV:ETMC] (OTCPK:EEMMF)

E3 Metals is a lithium development company focused on commercializing its extraction technology and advancing the world’s 7th largest lithium resource with operations in Alberta. E3 has an inferred mineral resource of 6.7 million LCE.

On March 8, E3 Metals announced:

E3 increases confidence in Clearwater Aquifer continuity through seismic interpretation… Over 60km of seismic lines were used in the interpretation, which have been licenced from data already acquired from oil and gas development…

On March 22, E3 Metals announced: “E3 Metals receives milestone funds of $0.5M from Alberta innovates grant for completion of lab pilot prototype…”

You can read the company’s latest presentation here.

Iconic Minerals [TSXV:ICM] [FSE:YQGB] (OTCPK:BVTEF)/ Nevada Lithium Corp.[CSE: NVLH]

Joint Venture (Nevada Lithium Corp. earn in option to 50%) in the Bonnie Claire Project in Nevada, USA; with an Inferred Resource of 18.68 million tonnes LCE.

No news for the month.

Arena Minerals [TSXV:AN] (OTCPK:AMRZF)

No news for the month.

Rio Tinto [ASX:RIO] [LN:RIO] (RIO)

No lithium related news for the month.

Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

On March 3, Lithium South announced:

Drill pads and roads completed at Alba Sabrina claim. Lithium South Development Corporation is pleased to announce that road access and drill pads have been completed and a 2000 Meter drill program is staged to commence at the HMN Li Project, Salta Province, Argentina…

On March 3, Lithium South announced:

Lithium South announces final property payment on 3287 hectare Hombre Muerto North Lithium Project… The vendors shall retain a 3 percent royalty on the net return from the production of lithium carbonate and/or from any other product derived from brine operations.

On March 17, Lithium South announced: “Lithium South completes Environmental Baseline Study.”

Alpha Lithium [TSXV:ALLI][GR:2P62] (OTCPK:APHLF)

On March 15 Alpha Lithium announced:

Alpha Lithium provides update on Argentine operations and Uranium One transaction… Given the recent challenges experienced with Uranium One, the Company has chosen to provisionally suspend closing of that transaction. The Company adds that it has no knowledge of any sanctions currently in place against Uranium One, its subsidiaries, affiliates, or its executives and that this decision is being made responsibly and in the best interest of shareholders. Prior to this announcement, and without actively marketing the project, the Company has received several inbound expressions of interest from numerous parties, all of which are multi-billion-dollar, experienced electric vehicle supply chain related companies. Alpha is fortunate to have multiple development paths for Tolillar Salar, one of which is to continue independently, utilizing the Company’s significant cash reserves and expert operational team.

International Lithium Corp. [TSXV:ILC] (OTCPK:ILHMF)

On March 22 Bloomberg reported:

International Lithium Corp. intersects 10 metres of zoned pegmatite with up to 40% spodumene in first two holes at Raleigh Lake… The pegmatite intersections from these first two holes are the thickest observed to date and coupled with structural inferences made from oriented core, suggest that a feeder dyke system may have been discovered at Raleigh Lake… Results demonstrate strong Caesium [CS] and Rubidium (Rb) anomalies Cs and Rb anomalies correlate well with known buried pegmatite occurrences.

Lithium Energy Limited [ASX:LEL]

On March 11, Lithium Energy Limited announced: “Half year report – 31 December 2021.”

Argentina Lithium and Energy Corp. [TSXV: LIT] (OTCQB: OTCQB:PNXLF)

On March 16, Argentina Lithium announced:

Argentina Lithium receives TSXV approval to acquire Rincon West and Pocitos Properties in Salta Province. “Now that we’ve received TSXV approval, we can begin our exploration and drilling program. These properties hold exceptional lithium discovery potential,” stated Nikolaos Cacos, President and C.E.O.

On March 16, Argentina Lithium announced:

Argentina Lithium closes option agreement for Rincon West and Pocitos Properties in Salta Province.

On March 21, Argentina Lithium announced:

Argentina Lithium announces commencement of Geophysics Program at Rincon West Project…

Battery recycling, lithium processing and new cathode technologies

Rock Tech Lithium [CVE:RCK](OTCQX:RCKTF)

On February 22, Rock Tech Lithium announced: “Rock Tech Lithium starts permitting process for Europe’s first lithium hydroxide converter.”

On March 16, Rock Tech Lithium announced:

Rock Tech Lithium to collaborate with Fraunhofer Institute and Circulor to pursue CO2 neutral lithium… from the raw material, spodumene, to the end product, lithium hydroxide.

Neometals (OTC:RRSSF) (Nasdaq:RDRUY) [ASX:NMT]

On February 28, Neometals announced:

Neometals admission to London Stock Exchange. Innovative project development company, Neometals Ltd is pleased to advise that further to its announcement on 14 February 2022, the Company confirms the admission of its entire issued share capital to trading on the AIM market of the London Stock Exchange plc.

On March 10, Neometals announced: “Half-year report for the 6 months ended 31 December 2021.”

On March 11, Neometals announced: “Mercedes-Benz press release regarding battery recycling with Primobius.” Highlights include:

- “Neometals notes the press release made today by Mercedes-Benz AG (“Mercedes-Benz”), regarding its global strategy for recycling automotive battery systems, which includes a recycling plant at its Kuppenheim operations in Southern Germany.

- Mercedes-Benz has announced that its subsidiary LICULAR GmbH (“LICULAR”) plans to cooperate with Neometals’ battery recycling JV, Primobius, as its technology partner, for the design and construction of the proposed recycling plant.

- Primobius is in advanced discussions with Mercedes-Benz regarding the design and construction of a 2,500 tpa lithium-ion battery recycling plant for LICULAR’s facilities.

- Neometals looks forward to Primobius’ continuing collaboration with Mercedes-Benz and will keep the market informed of developments.”

You can read my very recent article “An Update On Neometals 5 Key Projects Across The Energy Storage Metals And EV Battery Metals Sector”.

Other lithium juniors

Other juniors include: 5E Advanced Materials Inc [ASX:5EA] (FEAM), Anson Resources [ASX:ASN] [GR:9MY], Ardiden [ASX:ADV], Atlantic Lithium [LON:ALL] (OTCPK:ALLIF), Avalon Advanced Materials [TSX:AVL] [GR:OU5] (OTCQX:AVLNF), Bradda Head Lithium Limited [LON:BHL] (BHLIF) (OTCPK:CDCZF), Carnaby Resources Ltd [ASX:CNB], Electric Royalties [TSXV:ELEC], Eramet [FR: ERA] (OTCPK:ERMAF) (OTCPK:ERMAY), European Lithium Ltd [ASX:EUR] (OTCPK:EULIF), Essential Metals [ASX:ESS] (OTCPK:PIONF), Far Resources [CSE:FAT] (OTCPK:FRRSF), Green Technology Metals Limited [ASX:GT1], HeliosX Lithium & Technologies Corp. [TSXV:HX] (formerly Dajin Lithium Corp. [TSXV:DJI]), Hannans Ltd [ASX:HNR], Infinity Lithium [ASX:INF], International Battery Metals [CSE: IBAT] (IBATF), Ion Energy [TSXV:ION], Jadar Resources Limited [ASX:JDR], Kodal Minerals (LSE-AIM: KOD), Latin Resources Ltd [ASX:LRS] (OTC:LAXXF), Liberty One Lithium Corp. [TSXV:LBY] (OTCPK:LRTTF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Energi Exploration Inc. [TSXV:LEXI](OTCPK:LXENF), Metals Australia [ASX:MLS], MetalsTech [ASX:MTC], MGX Minerals [CSE:XMG] (OTC:MGXMF), Noram Ventures [TSXV: NRM], One World Lithium [CSE:OWLI] (OTC:OWRDF), Portofino Resources Inc.[TSXV:POR] [GR:POT], Power Metals Corp. [TSXV:PWM] (OTCPK:PWRMF), Prospect Resources [ASX:PSC], Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), Quantum Minerals Corp. [TSXV:QMC] (OTCPK:QMCQF), Snow Lake Lithium (LITM), Spearmint Resources Inc [CSE:SPMT] (OTCPK:SPMTF), Ultra Lithium Inc. [TSXV:ULI] (OTCQB:ULTXF), United Lithium Corp. [CSE:ULTH] (OTC PINK:ULTHF)[FWB:0UL], Vision Lithium Inc. [TSXV:VLI] (OTCQB:ABEPF), Winsome Resources Limited [ASX:WR1], Zinnwald Lithium [LN:ZNWD].

Conclusion

March saw lithium spot prices hit new record highs then stabilize.

Highlights for the month were:

- North American lithium projects get a large boost from the governments of USA and Ontario Canada.

- Sayona doubles Québec lithium resource base amid surging demand. Total NAL and Authier projects JORC combined M, I&I Mineral Resource of 119.1 million tonnes [MT] @ 1.05% Li2O.

- Piedmont Lithium second U.S. LiOH plant project after tax NPV8% is US$2.248b and for the Carolina Lithium (flagship) Project it is US$2.843b. Combined they plan to produce 60,000tpa LiOH.

- Standard Lithium and LANXESS finalize plan for first commercial lithium project in Arkansas.

- Vulcan Energy Resources DLE Pilot Plant is reporting consistent lithium concentration and low level of impurities, recovery rates of 94-95%.

- South Korea’s Posco to invest $4 bln in lithium project in Argentina.

- Liontown Resources positive drilling results confirm growth potential at Buldania Lithium Project, WA.

- Global Lithium Resources signs 10 year spodumene off-take agreement with Suzhou TA&A Ultra Clean Technology Co.

- Lake Resources – Lilac demonstration plant being delivered to Kachi Lithium Project.

- Cypress Development consolidates strategic land position at Clayton Valley, Nevada.

- Frontier Lithium successfully converts inferred resource to 14 MT of indicated resource on the Spark deposit.

- Lithium South final property payment on Hombre Muerto Project, drilling begins, completes Environmental Baseline Study.

- Alpha Lithium has chosen to provisionally suspend closing of Uranium One transaction.

- International Lithium Corp. intersects 10 metres of zoned pegmatite with up to 40% spodumene in first two holes at Raleigh Lake.

- Argentina Lithium closes option agreement for Rincon West and Pocitos Properties in Salta Province.

- Rock Tech Lithium starts permitting process for Europe’s first lithium hydroxide converter.

- Neometals admission to London Stock Exchange. Neometals looks forward to Primobius’ continuing collaboration with Mercedes-Benz.

As usual all comments are welcome.

Be the first to comment