Images By Tang Ming Tung

Article Thesis

Pfizer (NYSE:PFE) has been one of the largest winners in the last two years, thanks to massive revenue gains from its COVID vaccine and drug. 2022 will be a gigantic year for the company, both in absolute terms and relative to how the company has performed in the past. But investors should know that this is an anomaly and that profits will likely decline to a more sustainable level in 2023 and beyond. It thus makes sense to take a longer-term view before chasing Pfizer’s stock based on unsustainable levels of profitability.

Pfizer Is More Profitable Than It Ever Was Before

Pfizer, in collaboration with BioNTech (BNTX), developed a blockbuster COVID vaccine called Comirnaty that made its sales explode upwards last year. On top of that, the company has also managed to develop a viable drug against COVID, called Paxlovid.

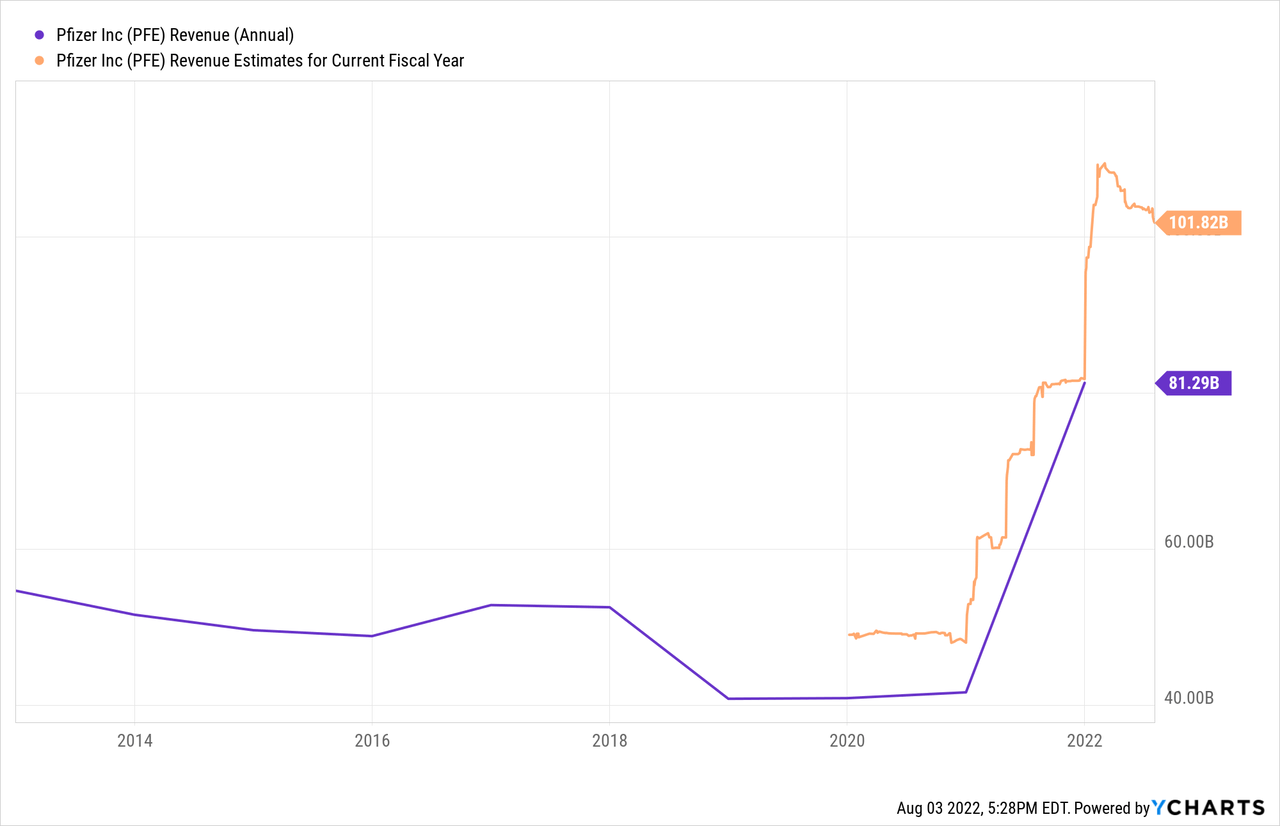

With these two drugs, Pfizer has been one of the biggest overall winners during the pandemic, as its sales rose to levels that were never seen before:

Pfizer has been generating revenues of $40 billion to $50 billion during most of the last decade. In 2021, on the back of massive Comirnaty sales, Pfizer roughly doubled its revenues compared to the previous year, hitting $81 billion in sales. That’s one of the largest topline numbers of any pharmaceutical or healthcare company, ever. This year, however, Pfizer will generate even higher revenues. Not only is Comirnaty still contributing hefty amounts of revenue, but Pfizer’s Paxlovid offers a second COVID-based revenue stream. Paxlovid is used less often than Comirnaty, but is sold at a way higher price per dose, which is why Paxlovid is still generating hefty sums of money for Pfizer, despite being used way less than the COVID vaccines.

During the most recent quarter, Comirnaty and Paxlovid performed almost in line with each other. The COVID vaccine generated $8.9 billion in revenue, while Paxlovid added another $8.2 billion to Pfizer’s topline – together, that’s $17.1 billion, or close to $70 billion annualized. That alone is way more than Pfizer’s revenue was across all business lines prior to the pandemic – which shows how much of a game changer Pfizer’s COVID business has become. Paxlovid is the slightly smaller revenue contributor among these two right now, but its growth rate is higher. Still, even Comirnaty saw its sales rise by 13% year over year, which came as a bit of a surprise. After all, vaccination drives have lost steam in the last couple of quarters, which is why rising revenues for Pfizer’s Comirnaty were far from guaranteed. Paxlovid is growing faster right now, although there is no guarantee that growth will continue going forward.

In fact, I believe it is pretty clear that both Comirnaty and Paxlovid will peak at some point in the not-too-distant future, and that revenues will wane in the following years. It is not clear when that will happen, but I believe it is almost certain that this will happen eventually. Pandemics such as the Spanish Flu and others have come to an end eventually, and that should happen with COVID as well. Between natural immunity and vaccine-induced immunity, spread of the virus will eventually slow down, which means that fewer doses of Paxlovid will be sold. At the same time, vaccinated people won’t get boosters forever (at least that’s what I assume), which is why Comirnaty sales will also peak and start to decline at some point. But at least in the here and now, Pfizer is making massive amounts of money thanks to these two COVID revenue sources, which naturally has a positive impact on its profits as well.

During the second quarter, Pfizer was able to generate revenues of $27.7 billion, or around $110 billion annualized. Adjusted for M&A and foreign currency rate movements, Pfizer was able to grow its revenue by an outstanding 53% year over year – which is basically unheard of when it comes to pharma majors. With a gross margin of almost 70%, and once we account for operating expenses such as R&D and sales as well as for income taxes, we get to a net profit of $11.4 billion, or around $45 billion on an annualized basis. That’s enough for a net profit margin in the 40% range, one of the highest in both the pharmaceutical industry as well as in the overall investment universe. Not even a highly profitable company such as Apple (AAPL) generates this much net profit per dollar in revenue.

In H1, Pfizer has generated $20.5 billion of net profit. Based on the company’s current guidance for this fiscal year, Pfizer believes it will earn around $36 billion. This suggests that H2 will be weaker than the first half of the current year and that Q2 possibly was the high point for Pfizer’s profitability already. Due to a somewhat unclear path forward for Pfizer’s vaccine business, that may indeed be the case. After all, it is not yet clear when the next phase of (updated) boosters will be rolled out, and we also don’t know how many of the already-vaccinated people in the US and abroad will opt for another booster shot.

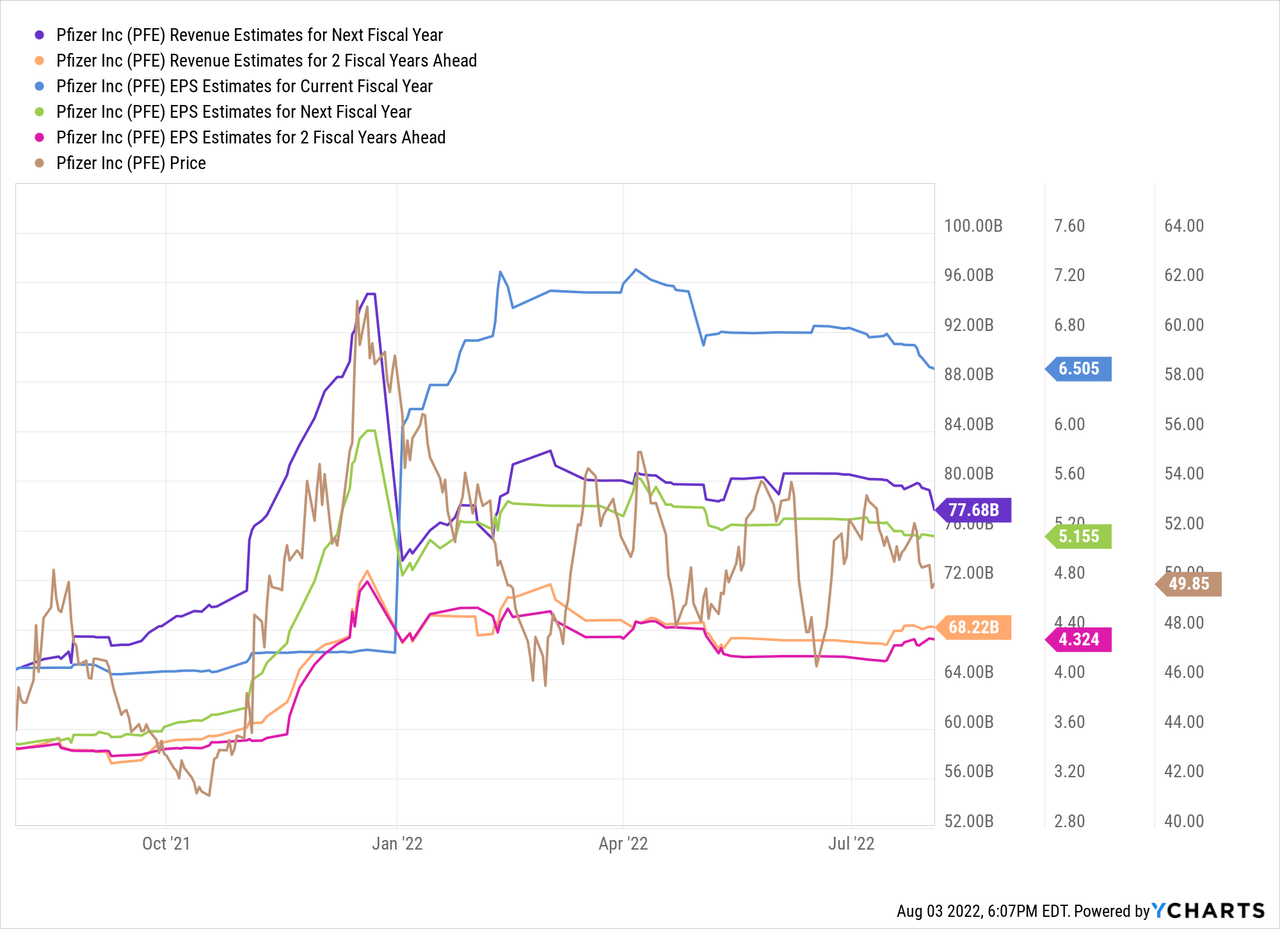

When we look at what Wall Street thinks about Pfizer’s future profits, we see that most analysts agree that the profit level that will be hit in the current year will not be sustainable.

In the above chart, we see that revenues are forecasted to decline by about 25% to 30% next year, relative to this year. In 2024, Pfizer will see its revenue drop again, at least if the analyst community is correct. That being said, Pfizer’s forecasted revenue of around $68 billion in 2024 would still be higher than during any year of the previous decade, backing out the pandemic years. Compared to 2019, $68 billion in revenue would represent an increase of more than 50%. But even beyond 2024, revenues will likely continue to decline for some time. According to Seeking Alpha, revenues are expected in the $55 billion range at the end of the current decade.

Likewise, profits are forecasted to decline as well – from $6.50 this year to just $4.30 two years from now, which represents a decline of around one-third. Due to the revenue headwinds that analysts see in the next couple of years, profit declines are to be expected.

It is thus pretty clear that Pfizer’s current profits aren’t sustainable. But still, the company is earning these surplus profits for now, and it can utilize them to hopefully drive shareholder value in the long run. One possibility is organic investment, which primarily means investing in R&D when it comes to pharma companies. Pfizer is doing that at a sizeable pace, but that was already the case before the recent windfall profits. Another option to utilize extra income is M&A – Pfizer has always been active there, and the company continued to make deals in recent quarters. In H1, for example, Pfizer bought Arena Pharmaceuticals for more than $6 billion. Arena Pharmaceutical works on a range of agents that are currently being tested for indications such as pulmonary arterial hypertension and Crohn’s disease. It’s not guaranteed that these efforts to bring new drugs to the market will be successful, which makes M&A a somewhat higher-risk strategy. Still, if it works, these drugs could move the needle for Pfizer, as both PAH and Crohn’s are multi-billion dollar markets.

Dividends and share repurchases are another way for Pfizer to use its cash. Dividend payments have been made regularly for quite some time, but buyback spending has seen ups and downs over the years. In Q2, Pfizer bought back $2 billion worth of shares – still, its diluted share count was up year over year, as share issuance to employees more than offset the buyback efforts.

Is Pfizer A Buy Today?

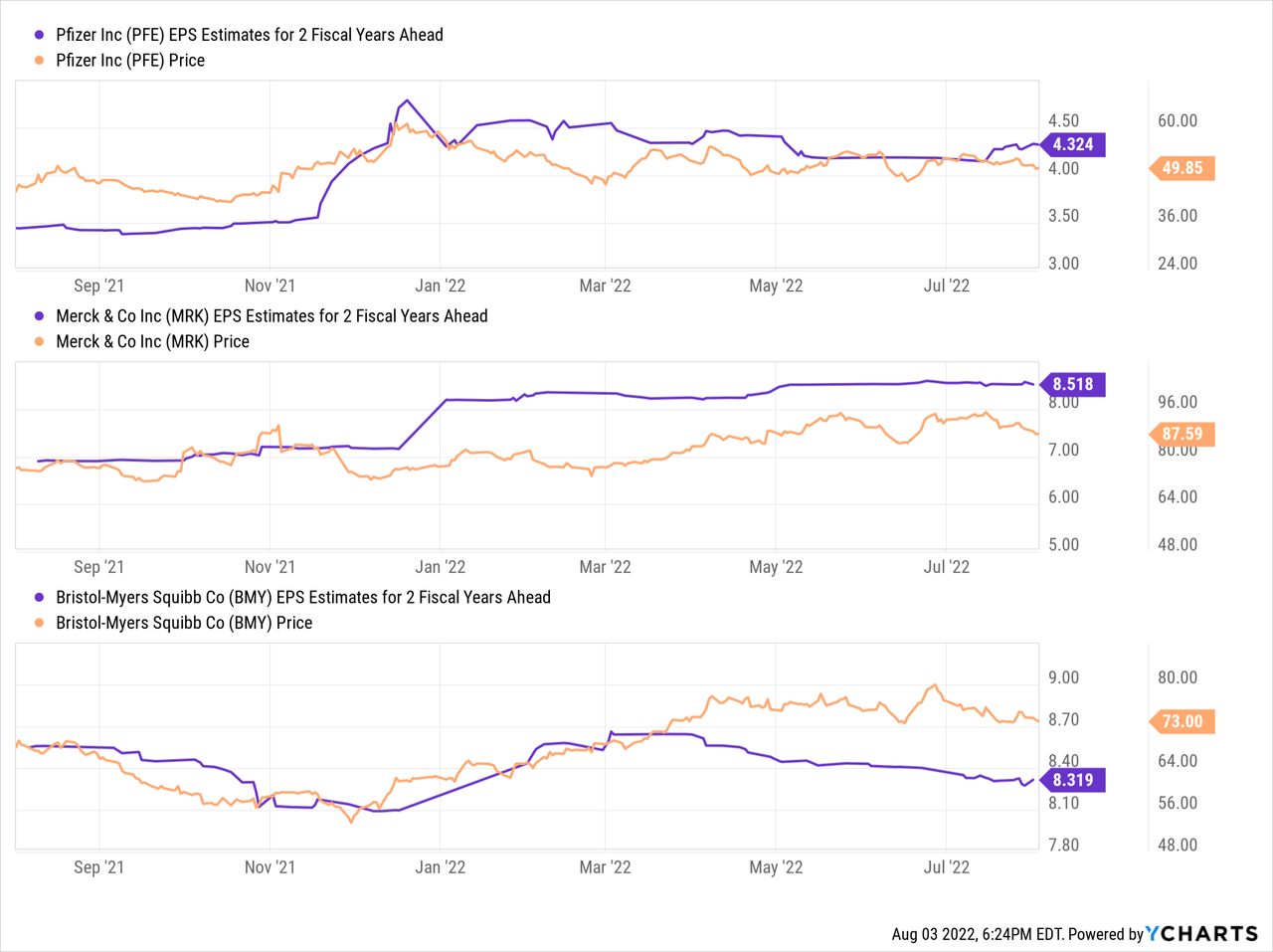

At first glance, Pfizer looks cheap – it’s trading for just 7.6x this year’s net profit. But when we account for the expected profit declines over the next couple of years, Pfizer doesn’t look all that cheap any longer. Shares are valued at 12x 2024’s expected net profit today.

Merck (MRK) trades at 10x 2024’s expected net profit while Bristol-Myers Squibb (BMY) trades at 9x that year’s expected earnings per share right now. Pfizer is thus not the cheapest major pharma company – and at the same time, Merck and Bristol-Myers Squibb won’t face the same revenue headwinds that Pfizer will be subject to. Pfizer offers a solid income yield of 3.2% today, but that isn’t the highest in the biopharma world, either.

We can summarize that Pfizer will have an outstanding 2022, and 2023 should be a pretty strong year as well. But its COVID windfall profits will decline over time, which is why Pfizer is not a stock where meaningful growth is likely – instead, profit declines are to be expected for some time.

Shares aren’t unreasonably expensive, but they don’t look overly cheap either – at least when we look beyond the current year. I thus do not think that shares are a buy right here, as other biopharma stocks trade at even lower valuations without the same growth headwinds.

Be the first to comment