yucelyilmaz/iStock via Getty Images

Introduction

NVIDIA Corporation (NASDAQ:NVDA), a trailblazer in accelerated computing reports under five divisions. Over the years, the Data Center segment has grown to become a vital fulcrum of the overall story. In Q2, this division contributed $3.8bn of revenue (that is more than any other division), accounting for 57% of NVDA’s overall topline.

When things were moving along quite smoothly here, it was rather dispiriting to note that the company had become a victim of geopolitical tensions between China and the US; in late August/early September, the US government imposed new license requirements which would hinder the ability of NVIDIA to export its A100 and upcoming H100 GPUs without much encumbrances. NVDA is now in the process of working out alternative solutions to mitigate this impact, but the initial reading is that this development could prove to impact revenues to the tune of $400m per quarter. That would imply a roughly 11% impact on the data center business which is certainly not ideal, particularly when the other large division- gaming, continues to slow down every quarter.

The Implications Of The Nvidia and Oracle Partnership

Whilst NVIDIA continues to figure out the best course of action for the Chinese market going forward, it was heartening to read about another development a few days back- the expansion of an ongoing multiyear alliance with Oracle (ORCL), which is designed to enhance Oracle Cloud Infrastructure’s (OCI) positioning with its enterprise clients (these clients will now have access to all of NVDA’s AI platforms). Needless to say, this will also provide added visibility for NVIDIA’s AI, which can only be good for further and rapid adoption from other parties.

As part of the “multi-year” deal, OCI will be adding “tens of thousands more NVIDIA GPUs, including the A100 and upcoming H100”. I believe this could be a very symbiotic connection for both entities; we know that ORCL’s databases attract a plethora of companies that use them to store chunks and chunks of raw enterprise data. But just having the data isn’t enough; you need the requisite AI-ready infrastructure, and there are not too many companies that can offer what NVDA does

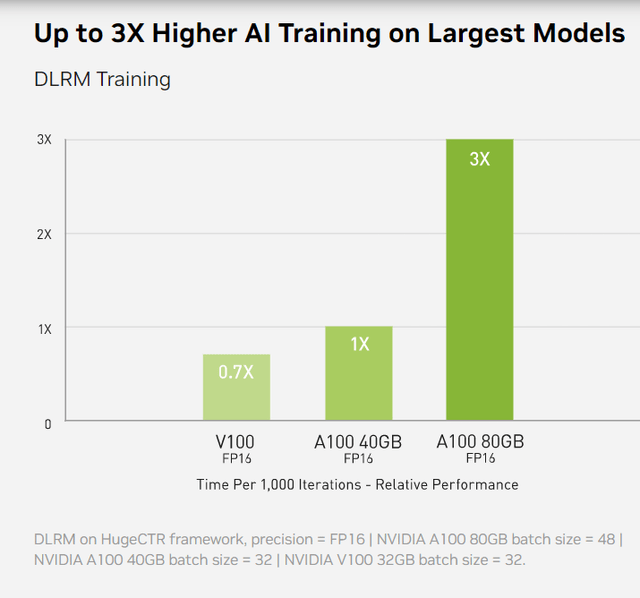

Leave aside the H100 for now, which is still in the works, but using the A100 80GB GPU, OCI could cater to a diverse set of AI workloads for its clients, particularly deep learning training, and the creation of data frames, at 3x the level of an A100 40GB GPU. One can combine the A100 GPU with Oracle’s innate low latency cluster networks and you get a landscape where enterprise clients could potentially host around 500GPUs in a cluster. The “pace” and “scale” at which this mammoth data is harnessed and made sense of (how best can we address gaps in the market, how can we speed up product development, etc.) will likely make this one of the most glimmering partnerships in the industry.

NVIDIA Website

I also feel this partnership with ORCL could more than negate the adverse impact of the recent geopolitical events, although, given the paucity of publicly disclosed numbers, one can’t be too certain of a definitive contract figure.

For instance, we don’t know the mix of A100 and H100 GPUs this Oracle partnership calls for; to be conservative, I’m considering only the A100 Tensor Core 80GB GPU which is priced at $13,999 as per public data (the H100 which could typically facilitate AI training at 9x the speed of an A100 GPU, will no doubt be priced at much superior rates). Then, “tens of thousands” could be any number from 10000 units to 99000 units, but assuming the A100 80GB GPU pricing, you’re looking at a potential boost of anything from $140m to $1400m. This is also unlikely to be limited to just hardware. There could also be a few additional millions linked to enterprise support work designed to make the AI software run more efficiently, across the subscription period, which could extend for a few years. We’d have to wait for more clarity for the nuances of this deal, and one may likely get it on the 16th of November when they announce Q3 results.

Closing Thoughts- Is NVDA Stock A Buy, Sell, or Hold?

After gauging some of the other sub-plots related to the NVIDIA story, it’s fair to say that we’re looking at a rather mixed picture.

After giving up close to two-thirds of its value from lifetime highs, the forward valuations for NVDA’s stock certainly look a lot more palatable. We know that the FY Jan 2023 numbers will likely be nothing to write home about, with flattish revenue growth (roughly $27bn yet again) and a 24% decline in the EPS YoY.

For the FY Jan 2024 though, the narrative is likely to perk up, with expected revenue of $31.3bn and an EPS of $4.47; this would translate into a forward P/E of roughly 29x, which I believe is quite a steal when you consider that the 5-year average is a lot higher at 52x! The current multiple also puts it a lot closer to the lower end of the 5-year forward P/E band of 25-99x.

YCharts

The attractive valuation backdrop can be further substantiated by the level of earnings growth you’re getting at this multiple. An expected EPS of $4.47 translates to 33% bottomline growth, and with a P/E of just 29x, you’re staring at a forward PEG ratio of less than 1x! This feels criminally low for an enterprise which is at the forefront of bringing through critical next-generation tech. I remain doubtful if we will see too many instances where NVDA’s forward P/E is lower than the earnings growth on offer (just for some additional context the 5-year PEG average is above 8x).

When I shift focus to NVIDIA’s weekly chart, there’s no evidence yet of a reversal from the downtrend that has been in play for close to a year. But, if you’re looking for green shoots, there’s decent probability that the stock attempts to build some sort of floor around the current levels, as it coincides with the congestion zone of $120-$160, last seen during August 2020-May 2021. Even if you’re bearish about NVIDIA’s prospects over the long-run, and think the descending channel pattern could continue to persist, the stock still offers decent risk-reward at current levels, as it is a long way from the upper boundary of the descending channel.

Investing

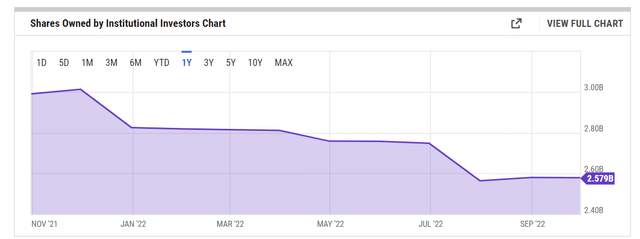

Having said that, I suspect, for the stock to make big moves on the upside you would need the spending power of the institutional cohort; but so far, they’ve shown little inclination to get on board. In fact, the latest data shows that these guys continue to bail on the stock, with the aggregate shares owned by them, declining for yet another month, to $2.579bn.

YCharts

Besides, based solely on the relative strength ratio of the NVIDIA stock and other options in the semi space, it doesn’t look like the former will be a prime rotational candidate; as you can see from the image below, despite correction from the +1 levels, the current RS ratio of NVDA and the VanEck Semiconductor ETF (SMH) is still above the mid-point (0.55x) of the long-term range.

Stockcharts

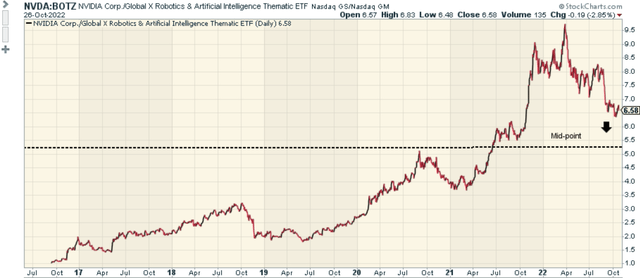

A similar takeaway can be gleaned from the image below which measures NVDA’s strength vs its peers from the robotic and AI space as represented by the Global X Robotics and AI ETF (BOTZ).

Stockcharts

To conclude, the NVDA stock is a HOLD.

Be the first to comment