Noah Berger

Investment Thesis

Amazon’s (NASDAQ:AMZN) bull thesis is today mostly focused on AWS. Investors wanted to see AWS still growing at +30% CAGR. Recall, Alphabet’s (GOOG)(GOOGL) cloud was up 38% y/y, while Microsoft’s Azure (MSFT) was up 42% in constant currency.

Simply put, the dominant cloud company, AWS, is losing market share. There’s no need to overcomplicate and over-intellectualize this dynamic.

Consequently, we are looking at a stock that is by my estimates priced at approximately 45x next year’s EPS, which is simply not growing on the topline anywhere near enough to support its valuation.

Does that mean that Amazon is done for? Probably not. But it does mean that going forward investors are going to be a lot more skeptical of simply buying Amazon. I believe that is the case.

The whole idea of investing for growth is now no longer as attractive as it was during the past several years.

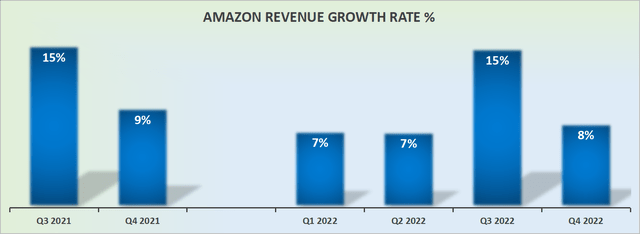

Amazon’s Revenue Growth Rates Slow Down

There are two key takeaways here. Firstly, that Amazon is no longer a high-growth company. You can see from its guidance that Amazon’s revenues are expected to reach 8% at the high end. Including 460 basis points of FX-headwind, and we are at 13% CAGR.

And so that there’s no ambiguity that Amazon is lowballing estimates, consider the following table.

AMZN revenue surprises

What you see above is that over the past several quarters, Amazon has more often than not missed revenue estimates.

So, that means that going forward, investors will increasingly be asking Amazon to show a bottom line that goes some way to support its valuation.

Profitability Profile, AWS Margins Compress

As I noted in my previous article, the bulk of the bull case is around AWS. This is not only the growth engine for Amazon, but it also has an extremely high-profit margins platform.

That being said, in Q3 2022, operating margins were 26.31% compared with 30.31% in the same period a year ago, a 400 basis point compression y/y.

So, not only did Amazon’s AWS revenue growth rates slow down below that critical 30% CAGR handle, but margins compressed too.

I specifically highlighted this concern just 2 days ago in my previous article. calling AWS’ SMB exposure its Achilles Heel.

AMZN Stock Valuation – 45x Next Year’s Eps

There are now going to be fair concerns around Amazon’s ability to reach $2.28 of EPS next year. For my part, I ardently believe that this figure will need to come down by at least 5%, if not 10%.

That means that Amazon reporting approximately $2.10 is probably a better approximation.

That means that Amazon is priced at 45x next year’s EPS. A multiple that I believe is too high relative to other high-quality compounders, even in tech.

I’m not saying that Alibaba and Amazon are all that similar. Yes, Alibaba is predominantly an e-commerce platform with a cloud business attached and Amazon is mostly skewed towards a cloud business with an e-commerce business attached. Also, obviously, there’s a substantial amount of political risk surrounding Alibaba.

On yet the other hand, Alibaba is priced at around 8x EPS! While Amazon is clearly more expensive.

On yet the other hand, there are a lot of regulators starting to circle around Amazon. That’s something that is difficult to appraise and quantify but is becoming increasingly likely to have a substantial impact on Amazon’s future prospects.

The Bottom Line

This has been one of the most interesting weeks of investing in a long time. There has been a changing of the guard. Many of the biggest and best winners of the past decade have now started to get repriced lower.

This is astonishing. For investors, this week of October 2022 will go down in history. The same as March 2009 during the great financial crisis, March 2020 in the dot-com period, and October 1929 in the Great Depression.

On the positive news, these periods are extremely rare. And we have just gone through it now. What comes out on the other side will be materially better. Good luck. We are now much closer to the bottom than we were at the start of the year.

Be the first to comment