Mario Tama/Getty Images News

Elevator Pitch

I rate Morgan Stanley’s (NYSE:MS) shares as a Hold. The earnings are expected to decline YoY in Q1 2022, taking into account the prospects of lower revenue and earnings from equity capital markets and M&A advisory. But I expect Morgan Stanley’s first-quarter EPS to be in line with market expectations, implying a muted market reaction to its upcoming earnings announcement. More importantly, the shares don’t seem to be mispriced as its premium valuations are in line with the bank’s higher ROE expectations for 2022, which justifies a Hold rating for the stock prior to its Q1 earnings announcement.

MS Stock Key Metrics

Prior to outlining expectations for the upcoming Q1 earnings report, it is helpful to review the metrics disclosed by Morgan Stanley on January 19, 2022 as part of the bank’s Q4 2021 results and its strategic update.

As per the company’s fourth-quarter 2021 earnings media release, Morgan Stanley’s earnings per diluted share increased by +11% YoY from $1.81 in Q4 2020 to $2.01 in the final quarter of last year. The Return on Average Tangible Common Shareholders’ Equity or RoTCE expanded from 17.8% to 19.8% over the same period.

On a full-year basis, EPS grew to $8.03 in fiscal 2021, and that represented a +24% increase as compared to the bank’s FY 2020 EPS of $6.46. Morgan Stanley also achieved a RoTCE of 20% for full-year FY 2021.

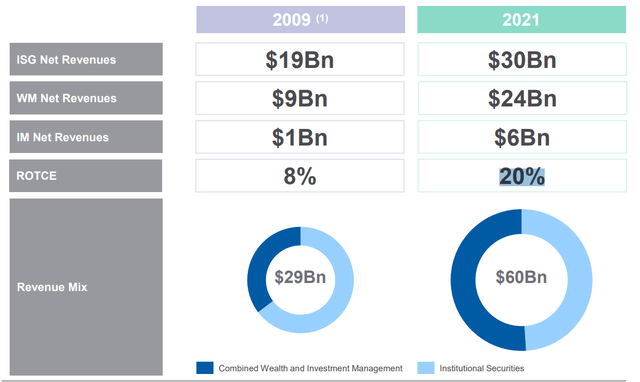

Changes In Morgan Stanley’s Revenue Mix And RoTCE In The Past 12 Years

MS 2022 Strategic Update

The chart above illustrates how Morgan Stanley has managed to improve the bank’s RoTCE from 8% in FY 2009 to 20% in FY 2021. This is largely driven by a more favorable mix, as the revenue contribution from its wealth and investment management businesses rose from slightly above one-third in 2009 to approximately 50% by FY 2021.

Looking forward, Morgan Stanley has raised the bank’s long-term RoTCE target from 17%+ at the start of 2021 to 20%+ at the beginning of 2022. At its Q4 2021 earnings briefing on January 19, 2022, MS explained that it is “increasing our RoTCE goal to reflect the earnings power we see in our business model.” Morgan Stanley also specifically highlighted that it has a new “long-term goal to achieve $10 trillion in client assets across Wealth and Investment Management.” As a reference, client assets were $6.5 trillion ($4.9 trillion for wealth management and $1.6 trillion for investment management) as of December 31, 2021.

Although Morgan Stanley’s intermediate to long term outlook appears to be excellent, the bank faces certain short-term headwinds as I detail in the subsequent sections.

When Does Morgan Stanley Report Earnings?

In a press release issued more than two months ago on February 1, 2022, Morgan Stanley confirmed that it will be announcing its Q1 2022 earnings on April 14, 2022 before the market opens.

What To Expect From Earnings

Morgan Stanley’s wealth and investment management businesses are expected to drive the bank’s growth in the intermediate to long term, but these two business segments are likely to underperform in Q1 2022 vis-a-vis 2021 given that equity markets haven’t done well since the beginning of this year. Notably, the S&P 500 has corrected by -7% year-to-date in 2022.

However, the institutional securities business might be an even bigger concern as compared with its wealth and investment management business segments. In fiscal 2021, the equity underwriting and advisory businesses that are part of the bank’s institutional securities business segment saw their respective revenues grow by +43% and +74% to $4,437 million and $3,487 million, respectively.

Fees derived from equity underwriting and mergers & acquisitions worldwide in the global investment banking industry were estimated to decrease by -65% and -10% to $3.2 billion and $9.0 billion, respectively according to Dealogic (data not publicly available). A March 21, 2022 Seeking Alpha News article making reference to a Financial Times commentary noted that “there wasn’t one traditional initial public offering in the U.S.” between mid-February 2022 and mid-March 2022. This suggests that there is a high probability that revenue generated from Morgan Stanley’s equity underwriting and advisory businesses declines YoY in the first quarter of 2022.

What Is Morgan Stanley’s Forecast?

Wall Street analysts predict that Morgan Stanley’s earnings per share or EPS will contract by -21% YoY from $2.22 in the first quarter of 2021 to $1.75 in Q1 2022. the consensus EPS has been lowered by -7% and -11% for the past one month and three months, respectively.

Based on my calculations, I estimate EPS for the first quarter of 2022 to be around $1.71 which is close to that of the sell-side’s consensus forecasts. In other words, I am of the view that Morgan Stanley’s bottom line estimates have been adequately reduced to incorporate expectations of lower earnings generated from the bank’s institutional securities business segment.

In summary, I don’t foresee either a substantial earnings beat or EPS miss for Morgan Stanley when it announces its latest quarterly earnings this Thursday.

Is MS Stock Overvalued Now?

The current valuations appear to be fair.

Peer Valuation Comparison For Morgan Stanley

| Stock | Historical Trailing Price to Net Tangible Book Value | Consensus Forward Fiscal 2022 Return On Equity Metric |

| Morgan Stanley | 2.05 | 13.3% |

| JPMorgan (JPM) | 1.88 | 12.2% |

| Bank of America (BAC) | 1.81 | 10.6% |

| Wells Fargo (WFC) | 1.34 | 9.1% |

| Goldman Sachs (GS) | 1.08 | 12.9% |

| Citigroup (C) | 0.64 | 6.8% |

Source: S&P Capital IQ

Morgan Stanley’s price to tangible net asset value ratio of 2.05 times is the highest among its banking peers as highlighted in the peer comparison table above. But this is fair, as Morgan Stanley’s expected return on equity metric is also superior as compared to the other banks.

Going forward, I expect the valuation premium over its peers to be sustained, as the bank continues to grow its client asset base and increase revenue contribution from the wealth and investment management businesses.

Is MS Stock A Buy, Sell, or Hold?

MS stock is a Hold following my analysis of the bank’s upcoming earnings and long-term growth plans. I expect Morgan Stanley’s Q1 2022 EPS to meet market expectations, implying that a sharp sell-down post-earnings for MS is less probable. On the other hand, I have a favorable view of Morgan Stanley’s long-term RoTCE and client asset targets, but this seems to be priced in already judging by the stock’s valuation premium relative to its peers.

Be the first to comment