Jean-Luc Ichard/iStock Editorial via Getty Images

Company overview

Microsoft Corporation (NASDAQ:MSFT) develops and licenses software for consumers and enterprises across the world. The company is organized across three segments: Productivity and business processes (32% of revenue), Intelligence cloud (36%) and More personal computing (32%).

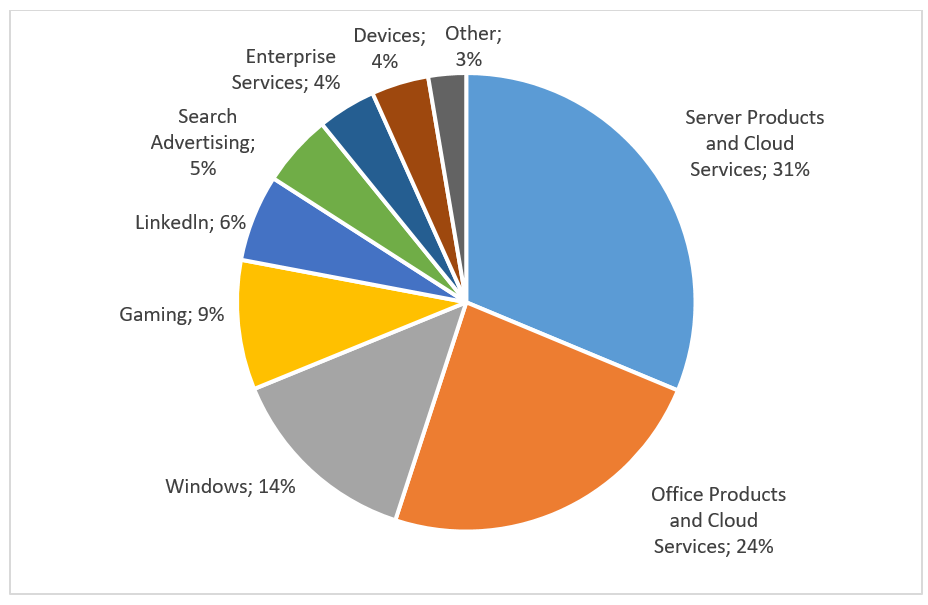

The first segment encompasses the famous Microsoft Office suite (perpetual license and the cloud-based version called office 365), Exchange, SharePoint, Skype, LinkedIn and Dynamics. The second segment gathers Azure, the infrastructure- and platform-as-a-service provider, Windows server and SQL database management system. The last business unit includes Windows operating systems, Bing Search and devices such as Surface laptops and tablets. Revenue is distributed as follows:

Source: Annual report

Economic moats

The Productivity and business processes segment benefits from high switching costs and network effects mainly thanks to the Office suite and LinkedIn. Indeed, despite the existence of free productivity solutions such as Google Docs or OpenOffice, many users prefer to pay a license/subscription to get access to Office for the following reasons: 1) they know how to use it, 2) sharing documents is much easier (strong installed base) and 3) specific tools are only developed for Office (e.g.: add-ins for Excel). In addition, Office products are mission-critical because many professionals need them on a daily basis to execute their work, which prevents companies from switching to an alternative solution, as it could be highly disruptive for the business. As a result, the Office suite operates in a quasi-monopoly (it has been the case for decades) with Google, the only competitor (G Suite), which struggles to gain market share. Given its dominant market positioning, MSFT enjoys pricing power as highlighted by recent price hikes, which includes price increases between 10% and 25% depending on the product offering. Dynamics, the CRM and ERP software solution, also locks customers for many years, as it is a daunting task to switch to a competitive offering. Indeed, ERP systems are mission-critical and affect most company’s day-to-day operations, which means that switching to a new vendor represents a substantial operational risk. However, MSFT targets mid-sized companies, faces more intense competition (Salesforce, Oracle, SAP, Workday…) and does not lead the market, which somehow slightly reduces the barrier to entry on that segment. Finally, LinkedIn also enjoys strong barriers to entry because it is the world’s largest professional network and is free to use. As the network keeps growing, the more interesting it becomes for new members and recruiters. LinkedIn is now an essential tool for HR departments.

Windows operating server has a world leading position as most companies have built their IT infrastructure around it, which makes it difficult for a potential change. Moreover, more and more companies are moving their IT environment into the cloud nowadays in order to save costs (lower upfront costs and lower maintenance and administration costs), improve efficiency and increase flexibility. MSFT is well positioned with Azure to migrate its clients into the cloud because they use the same Microsoft environment, which makes it easy and smooth to move applications and data from on-premises to the cloud.

Microsoft Windows has >80% global market share for PC operating systems because of its first-mover advantage. Most PC manufacturers pre-install Windows because they have a licensing agreement with Microsoft and they probably do not have a lot to win to work with a smaller and less known operating system (Linux or Chrome considering that Apple does not seem interested in selling its own operating system).

We believe that the remaining businesses, including Enterprise services, gaming (Xbox), search (Bing) and devices (Surface) are not protected by economic moats mainly because the products/services are not superior to the ones offered by competitors (lack of product differentiation) and the installed base is too small (lack of network effect). In conclusion, three quarters of total revenue come from products/services that enjoy significant barriers to entry, which offers MSFT a resilient profile and a solid base for the business.

Evolution of Key metrics

Microsoft enjoys a leading market position in several segments and several barriers to entry protect the group from competitors. As a result, the company has been able to deliver strong financial results over the last few years.

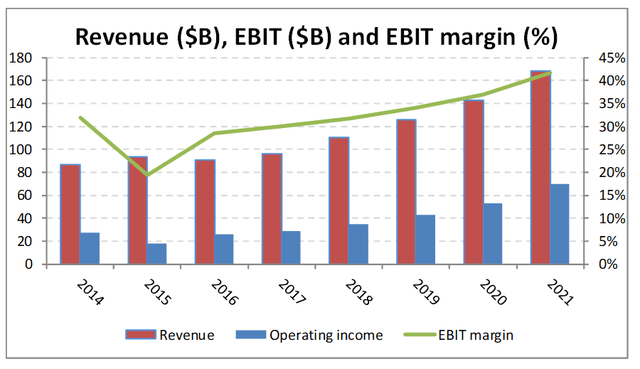

Source: Annual reports

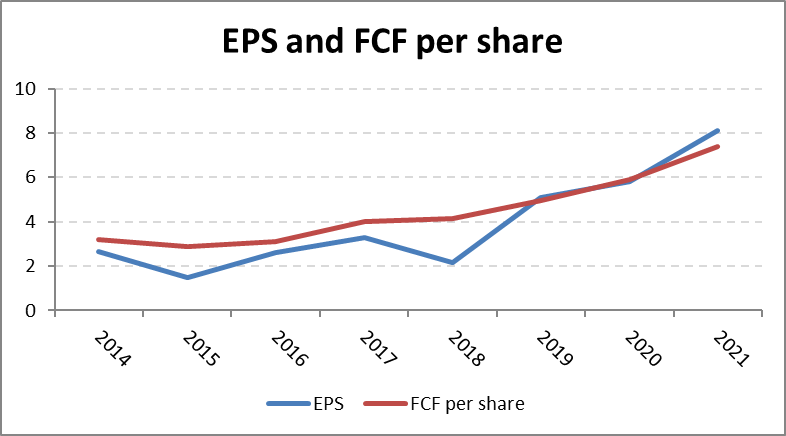

Source: Annual reports

Revenue grew at almost 10% CAGR over the fiscal period 2014/2021 (from 06/30/2014 to 06/30/2021) while operating income increased at a 14% CAGR, benefiting from margin expansion. At the same time, EPS and the FCF per share grew at a 17% and 13% CAGR, respectively.

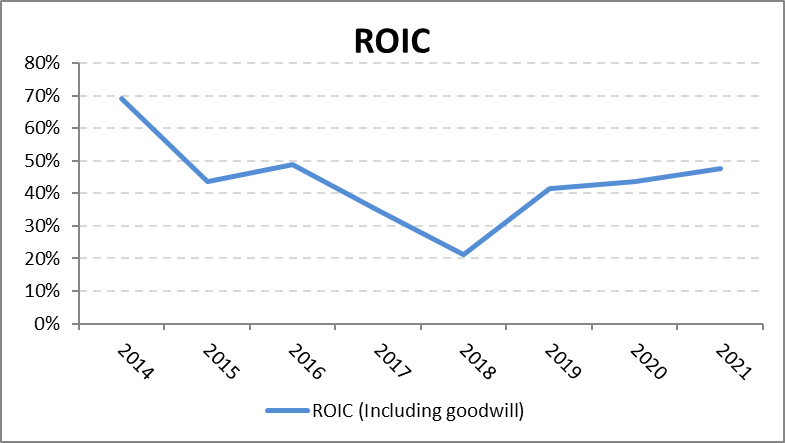

Source: Author and annual reports

The return on invested capital has been attractive over time and much higher than the cost of capital, which means that MSFT has done an excellent job by reinvesting into very profitable growth opportunities. As a result, shareholders have been nicely rewarded with an annualized return of around 33% over that period. This performance has also been driven by a huge multiple expansion: the P/E ratio increased from 15x to more than 30x.

What is MSFT’s outlook?

We can say with a high degree of confidence that Microsoft’s share price will not benefit from a similar multiple expansion over the coming years. The stock is currently trading at 27x its forward earnings (probably around 25x once adjusted for its huge cash pile), which is in-between its 20-year average of 18x and its recent peak of 35x. Therefore, we believe that fundamentals will be the key growth driver over the next couple of years and that valuation multiples will not protect shareholders from poor execution.

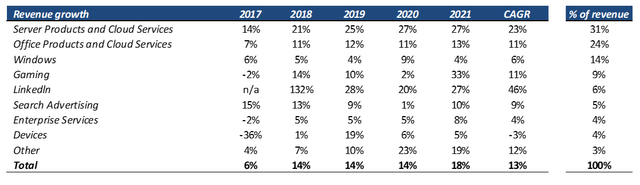

The table below shows the growth rate by products over the last few years as well as the size of the business in terms of revenue.

Source: Author and annual reports

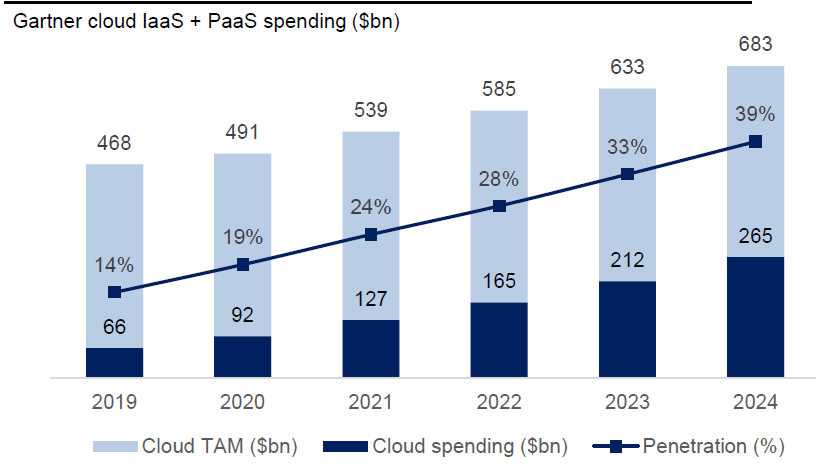

Server products and cloud services is the largest business and one of the highest growing businesses. We believe that it will be the main growth driver over the coming years. Indeed, as we explained in our investment thesis on Amazon, public cloud represents a massive underpenetrated opportunity and we are still in the early innings of the migration to the cloud. Businesses are moving workloads to the cloud because it is cheaper than running its own IT infrastructure (no upfront investments as well as reduced maintenance and administration costs). In addition, cloud solutions offer flexibility for companies that face abrupt changes in demand, by enabling them to quickly adjust their compute power and making sure that they only pay for what they need. According to a study by Deutsche Bank, cloud spending accounts for 25% of total IaaS and PaaS spending in 2021.

Source: Gartner and Deutsche Bank

In addition to the increasing penetration rate, the total size of the market should also increase. For instance, Microsoft considers that this opportunity is worth $ 4 trillion, a 7-fold increase from the 2021 level. As a result, the cloud market should continue to grow as more IT workloads migrate to the cloud as well as the need for compute and additional services (security…) increase.

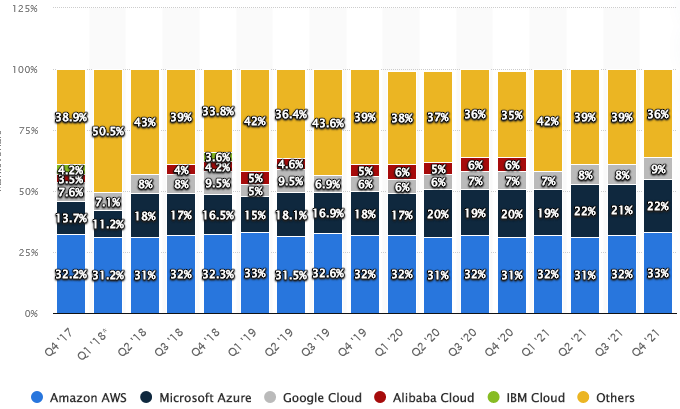

Microsoft is very well positioned in that market because it has a strong brand, provides a full complete offering and can leverage its existing client relationships as an entry point for a potential cloud migration. Given that its clients are already using a Microsoft environment (Windows Server, SQL database, Windows…), applications and data can easily migrate to the cloud. Besides, MSFT is probably the actor of choice for hybrid cloud (meaning that a client operates some workloads in the cloud and some others on-premises) because both on-premises and cloud workloads work on the same Microsoft environment. As a result, Azure has grown at a very fast pace and gained significant market share.

Source: Statista

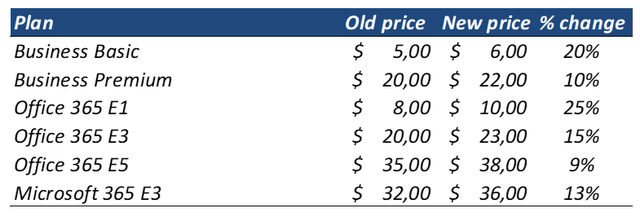

Office products and cloud services should continue to grow thanks to an increase in the number of users, especially among small and mid-sized businesses, and increasing ARPU. The rise in ARPU will mainly be driven by product upgrades, innovations and higher prices to a lower extent. For instance, MSFT announced pricing changes for its commercial products that will take effect on March 2022.

Source: Microsoft

While we do not know the exact split between the different pricing plans, we know that the most extensive plans are still underpenetrated. For example, the E5 accounts for only 8% of the Office 365 commercial installed base. Over time, we think that a larger pool of clients will embrace new services such as collaboration, communication and security tools, increasing the penetration rate among the most expensive plans. Besides, these new tools will most likely accelerate the transition to the cloud (VS legacy license). For instance, subscribing to the security offering delegates the responsibility to Microsoft for maintaining the software infrastructure up to date, which can be useful for avoiding potential ransomware or other cyber-attacks.

Windows is a mature business with >80% global market share. It is the standard in desktop operating system, thus PC OEMs continue to pre-install it while enterprises will continue to work with. As a result, it should continue to grow at a low-single digit number. Leveraging Windows will also support other businesses such as Bing (Search) or Edge (browser) that make money with advertising. Hardware is a difficult market and highly penetrated, therefore we expect muted growth on devices. LinkedIn should continue to do well as the network becomes larger which will attract more advertisers and strengthen MSFT pricing power. Dynamics suite should be increasingly adopted by SMEs but competition remains fierce. Finally, gaming could be a game changer as the company is trying to build a Netflix-like gaming platform by growing content in order to boost subscription revenue. The acquisition of Activision Blizzard (still pending) bodes well in that aspect as it brings strong video game franchises such as Call of Duty and Warcraft that will attract new subscribers and differentiate the platform from potential competitors.

Overall, we believe that Microsoft can grow revenue at roughly 12% CAGR over the next five years. At the same time, operating margin should expand from 41.6% to≈ 44% as revenue growth will mainly come from upselling, cross selling as well as price increases. Besides, volume growth, especially for Office products, will also support margins. Finally, the business has largely transitioned from a perpetual license model to a subscription model, which should significantly reduce the negative impact on margin going forward. As a result, EPS should grow around 15% per year over the coming years.

Is MSFT stock a buy, sell or hold?

We believe that MSFT offers an attractive growth profile with a certain level of resilience. Besides, Microsoft has a fortress balance sheet as highlighted by a net cash position combined with a AAA credit rating (most governments do not even have such excellent rating). At current price, we believe that holding the stock is appropriate because we believe that we can get a≈ 15% IRR if valuation multiples remain constant and slightly less than 5% if the PE ratio contracts to 20x, thus the risk reward seems appropriate for such a high-quality company.

Be the first to comment