ohmygouche

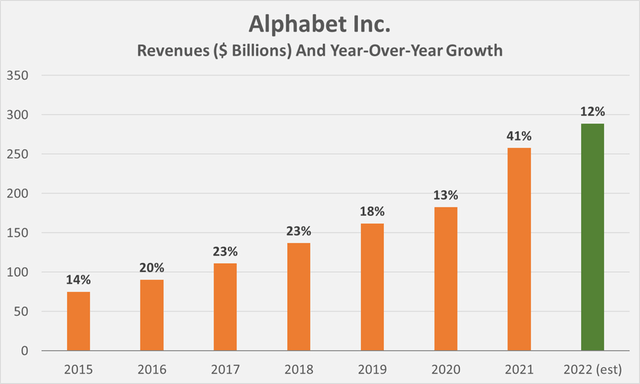

Alphabet Inc. (NASDAQ:GOOG, GOOGL) reported its third-quarter earnings after the market closed on Oct. 25, disappointing Wall Street in more ways than one. For starters, the search engine and cloud giant missed revenue estimates by more than 2%. On a year-over-year basis, revenues were up 6% and 11% on a constant currency basis. However, as a global company, I don’t think it is particularly fair to praise Alphabet for its double-digit growth in constant currency terms – currency effects a cost of doing business. Only the company’s cloud segment (still somewhat small at 10% of quarterly revenue) impressed, with revenue growth of 37.6% over Q3-2021. Google Search grew 4.3%, while YouTube disappointed with a 1.9% revenue decline. However, in fairness, it should not be forgotten that Alphabet had an excellent 2021 (Figure 1).

Figure 1: Alphabet’s annual revenues and year-over-year growth rates (own work, based on the company’s 2015 to 2021 10-Ks and analyst expectations according to Seeking Alpha)

Revenue growth is clearly slowing, and the company is preparing for a weaker economy by slowing headcount growth. It should be remembered that Alphabet increased its headcount by nearly 25% year-over-year – so a slowdown is not unexpected, nor is a renewed focus on key growth initiatives. The company also announced a curb on cost growth in 2023.

Alphabet faces some near-term challenges and could face lower advertising revenue in the event of an economic downturn, but over the long term, I believe Alphabet is a solid investment. The company is best known for its superior search technology and machine learning algorithms, and benefits from obvious network effects. Alphabet is sitting on a huge treasure trove of data that is growing every day through its many antennas (TVs, PCs, smartphones, tablets, car stereos, etc.) and has become an extremely valuable asset for advertising purposes.

My regular readers know me as a value investor who focuses on reliable, dividend-paying stocks. However, I cannot deny that the stock’s decline since the start of the new year has caught my attention, and the sell-off after the third quarter earnings miss has prompted me to take a close look at Alphabet’s current valuation, which will be the main topic of this analysis.

Is Google’s Cash All But Trash?

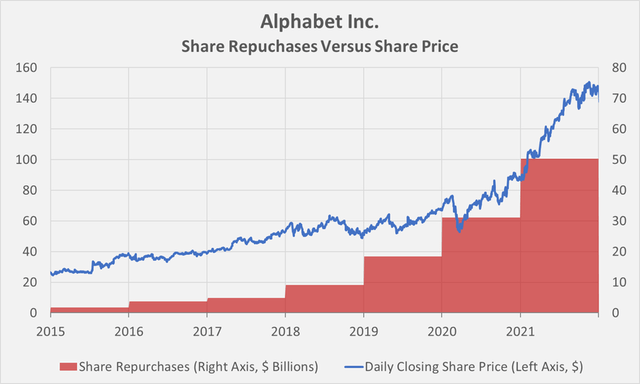

As a technology company, Alphabet naturally generates enormous amounts of free cash flow (FCF). However, many rightly criticize the overly generous amounts of stock awards granted, which dilute common shareholders or force the company to offset the dilution through share repurchases – at potentially unfavorable valuations. For those interested, I have discussed the topic of stock-based compensations (SBCs) in detail in another article.

Figure 2 serves as an illustrative example of the problematic impact of SBCs. It shows how Alphabet has spent more and more money on share buybacks even as its stock price approached a very high level. Since 2015, Alphabet has spent an incredible $119 billion on share buybacks, while the number of weighted average fully diluted shares declined by only 3.3%.

Figure 2: Share repurchases by Alphabet, compared to the GOOGL’s daily closing share price (own work, based on the company’s 2015 to 2021 10-Ks and GOOGL’s split-adjusted share price)

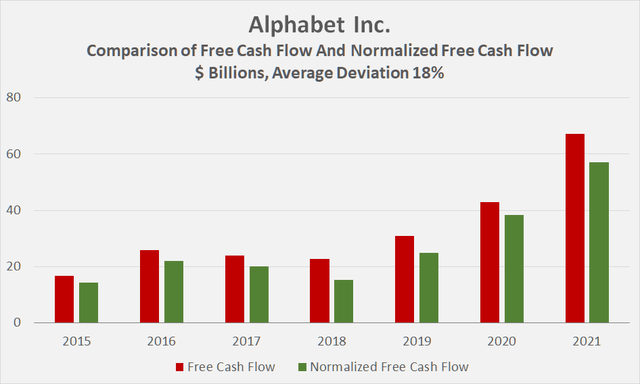

At about 20% of operating cash flow (OCF), normalized with respect to working capital movements (see my educational article), stock-based compensations are certainly rich, but it might seem somewhat conservative to deduct them entirely from OCF due, in part, to the nature of their accounting. However, it does seem fair to instead deduct the net payments related to stock-based compensation – a cash flow from financing activities item that is not typically captured when calculating FCF. Aside from the company’s emphasis on stock-based compensation, I think it is prudent to include cash outflows due to acquisitions in addition to regular capital expenditures. In this way, Alphabet’s normalized free cash flow (nFCF) is on average 18% lower than the commonly quoted OCF net of capital expenditures (Figure 3).

Figure 3: Comparison of Alphabet’s free cash flow and normalized free cash flow (own work, based on the company’s 2015 to 2021 10-Ks)

This haircut of almost 20% to actual free cash flow for shareholders may seem very high, but it is actually quite reasonable compared to other companies in this segment, such as Twitter (TWTR). Still, a discounted cash flow analysis should not be based on conventional free cash flow estimates that Wall Street analysts are often so fond of adopting.

Given that Alphabet looks back on an extremely strong 2021 for obvious reasons, I believe it is prudent not to use the company’s fiscal 2021 nFCF as the baseline cash flow for valuation purposes. Instead, I used the average nFCF for 2020-2021, which some may still consider optimistic.

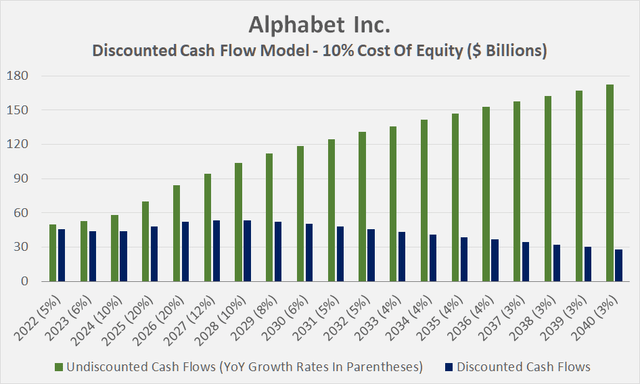

Since 2015, Alphabet has grown its nFCF by an average of 31% per year. The outsized growth due to the pandemic should be considered a one-time event, so it seems only reasonable to assume more modest growth rates going forward. Taking into account yesterday’s 8-K filing, cash flow from operations in the first nine months is up around 2% year-over-year, so my expectation of 5% growth may already be optimistic, even taking into account the double-digit sales growth while keeping currency effects in mind.

However, with a reasonable expectation of continued strong growth in Google’s cloud segment and a revival of advertising-related growth after the likely impending recession, I have modeled free cash flow growth of 6%, 10%, 20%, 20%, and 12% over the next five years. Note that the expected free cash flow growth profile – based on compound annual growth rate – is in line with analysts’ revenue forecasts until 2031, albeit with a focus on the later years. Assuming a cash flow conversion ratio of 1:1 may sound optimistic, but one should keep in mind that Alphabet operates a lean-asset business model, which brings enormous economies of scale. Given that Google is likely to be self-limited by its own size at some point, and also given the fierce competition in the cloud business, I assume a decline in nFCF growth through 2037, after which the company is expected to grow at a terminal rate of 3% per year.

The cash flows are shown in Figure 4, along with an illustration of their discounting at what I believe is not too high a cost of equity of 10%. It should be remembered that the risk-free rate (long-term government bonds) is now above 4%, implying an equity risk premium of less than 6%. If we add the discounted cash flows and terminal value and divide by the number of diluted weighted average shares outstanding, we arrive at a fair value of $88 per share, suggesting Alphabet is still slightly overvalued. However, my growth rates may be too conservative, or Alphabet might as well weather the coming recession better than expected.

Figure 4: Cash flows underlying the discounted cash flow analysis for Alphabet; terminal value not shown (own work)

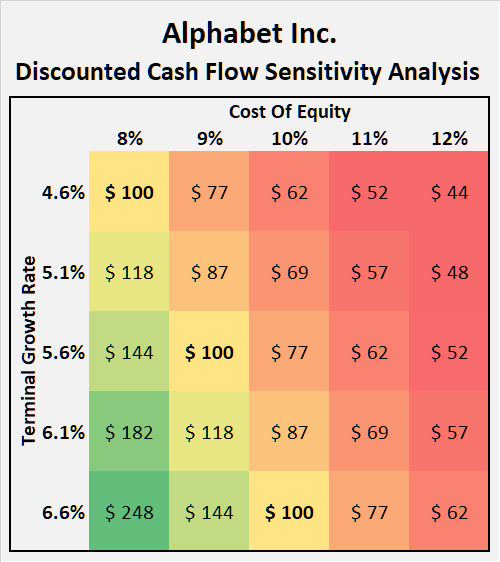

To give you a better understanding of the sensitivity of this valuation model, Figure 5 shows a sensitivity analysis of Alphabet’s fair value per share as a function of various costs of equity and various terminal growth rates. Note that this analysis does not take into account the short-term growth rates mentioned above, but assumes the respective terminal growth from year 1.

Figure 5: Discounted cash flow sensitivity analysis for Alphabet stock (own work)

Conclusion

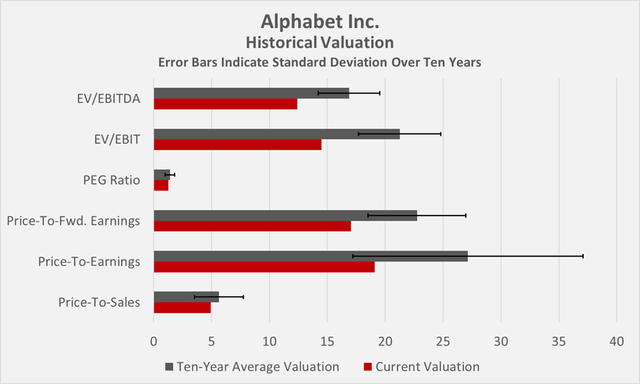

As a dyed-in-the-wool value investor, I find it somewhat difficult to accept that the company I am investing in needs to grow at a rate of nearly 7% in perpetuity to justify a share price of $100 at a cost of equity of 10%. However, Alphabet has proven beyond doubt that it is capable of serious double-digit growth, even though it is already a relatively large company. All in all, I think the current valuation is reasonably acceptable. However, in my thinking I also assume that long-term interest rates will decline in the future, which will have a positive effect on the discounting of cash flows in the future. This affects stocks with very high duration in particular, e.g., growth stocks such as Alphabet (see my article on stock and bond duration). Of course, an isolated discounted cash flow analysis – even if accompanied by a sensitivity analysis – is a dangerous tool. Therefore, I also performed a multiples-based historical valuation for Alphabet, taking into account average valuations over the past ten years (Figure 6). Alphabet is undervalued or at least fairly valued by all metrics, but it is important to remember that these valuations are the product of what is likely the strongest bull market in modern history.

Being a big fan of Alphabet’s business model myself, I dipped my toe in the water during the late September sell-off. However, at the current price of $100, I’m not overly excited to bring my position to size and instead plan to wait for better opportunities. Part of my reasoning is also related to the fact that I believe we could be in for an exhaustive sideways market for several years. As a result, I continue to focus on world-class dividend-paying companies.

Figure 6: Historical valuation of Alphabet stock (own work)

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment