ThitareeSarmkasat

When we look back at the early winners from the pandemic, perhaps the name that most investors bring up is Zoom Video Communications (NASDAQ:NASDAQ:ZM). The company saw its revenues surge and stock soar as a significant amount of employees ended up working from home. Since then however, the growth boom has all but ended, and the company’s report on Monday continued to show the weakening trend that I’ve discussed in prior quarters.

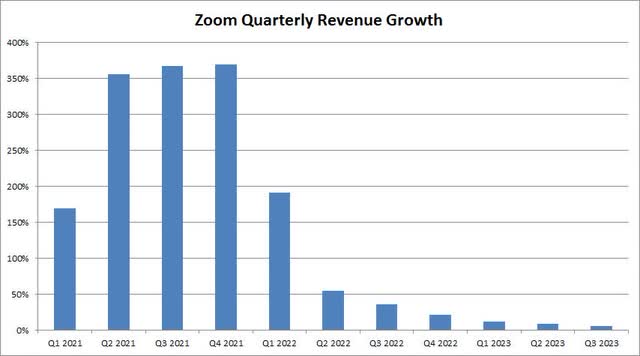

For the fiscal Q3 period that ended in October, Zoom reported revenues of just over $1.1 billion. This was in-line with reduced street estimates after the company issued downbeat guidance a few months ago. At just 5% year over year growth, this was the smallest the top line has grown during the pandemic, with the sequential increase trending towards zero. The chart below shows just how dramatic this slowdown has been. Like many companies, management noted a headwind from foreign exchange, but anyone following the dollar lately knew that companies that have any meaningful business outside the US would report currency issues.

Zoom Revenue Growth (Company Earnings Reports)

As we’ve seen recently, the company’s expenses are growing much faster than revenues currently. Operating income came in at just $66.5 million, compared to an operating profit of almost $291 million in the year ago period. A few below the operating line items swung against Zoom in this year’s period, so GAAP net income of just $48 million was dramatically below the $340 million reported in Q3 2022. It wouldn’t take too much more for the company to be in the red on a GAAP basis. On a non-GAAP basis, EPS of $1.07 beat by $0.23, but again, this was thanks to lowered estimates, and this figure was down slightly from $1.11 in the year ago period.

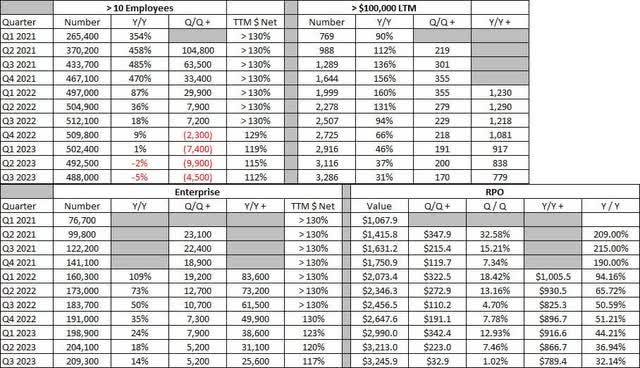

For Zoom, it’s not just revenues that are slowing down at a significant pace. In the graphic below, you can see a number of key customer metrics that are showing similar trends as shown in the company’s earnings presentation. For example, the number of customers using Zoom that have greater than 10 employees declined sequentially for the fourth straight quarter. The total decline is now over 24,000 customers, or almost 5%, from the year ago value. The net dollar expansion rate for these customers has also come down to its lowest percentage in this 11 quarter time frame. In terms of customers who generated over $100,000 in revenue over the past twelve months, the sequential and yearly growth on an absolute basis was its weakest in years, which has also caused the percentage growth figure to dip to its lowest value during this time as well.

Zoom Key Customer Metrics (Company Earnings Presentation)

On the Enterprise side, the one piece of good news was that the sequential growth in customers remained flat. Unfortunately, that also meant that the year over year percentage increase dipped further to just 14%, while the net dollar expansion rate also came down. In terms of remaining performance obligations, the sequential increase was less than $33 million, the first time that it has been in the double digit millions in some time. That meant almost no sequential growth, and one must wonder if this number will go negative in the next quarter or two.

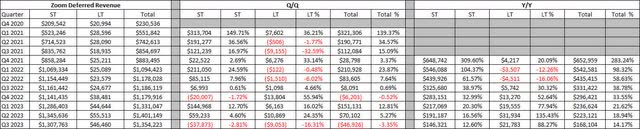

Beyond the company’s key metrics, balance sheet trends also showed a troubling picture. Free cash flow generated in the period was just $273 million, down from $375 million a year earlier, with the company’s GAAP operating cash flow margin down more than 10 percentage points over Q3 2022 to just 26.8% in the latest period. At the same time, deferred revenue numbers that can show how future business might look also were not good. The total number came down by $47 million sequentially, its largest drop in years, with the year over year increase likely to fall into the single digits in the next quarter or two if current trends continue. The table below shows a recent history of deferred revenue statistics.

Zoom Deferred Revenue (Company Earnings Reports)

With all of these numbers painting the picture of a business whose growth has all but stalled, it didn’t surprise me that fiscal Q4 2023 guidance came in a bit light. Management stated that total revenue is expected to be between $1.095 billion and $1.105 billion versus a consensus of $1.12 billion and revenue in constant currency is expected to be between $1.120 billion and $1.130 billion. Non-GAAP diluted EPS are expected to be between $0.75 and $0.78, whereas the street was at $0.82.

Don’t forget that since the August report, analysts have cut their Q4 average revenue forecast from $1.20 billion to $1.12 billion. Thus, guiding for a $1.1 billion midpoint including currency issues, which aren’t really a surprise, can be considered very weak. This forecast also implies that there is a chance that total revenue could decline sequentially. The full year forecast calls for revenues of $4.375 billion, whereas just a year ago the street was looking for roughly $4.75 billion.

As for Zoom shares, they traded down about 5% in the after-hours session to $76 a share. That’s just a small fraction of the nearly $589 the stock peaked at during the early stages of the pandemic. Going into Monday’s report, the average street price target was over $97, which implied decent upside, but I think that might come down due to the weak guidance and metrics. I should also note that analysts also saw this name as worth nearly $475 at one point, and just a year ago the average target was $347. The stock is just a handful of dollars away from its multi-year low of $70.43.

I will also be very curious to see how Cathie Wood and her team at ARK Invest react to this report. The ETF firm has Zoom as the top holding in both the flagship ARK Innovation ETF (ARKK) as well as the ARK Next Generation ETF (ARKW). It was back in June that the firm published a major report on Zoom, calling for Zoom to rise to $1,500 per share by 2026, with ARK’s base case of $700 even representing a new all-time high for the stock. This is now two bad earnings reports since, yet we haven’t heard from ARK if all of these weakening metrics are impacting their projections.

In the end, it was another troubling quarterly report for Zoom. Q3 revenues were in-line and adjusted EPS did beat, but expectations have come down tremendously so far this year. The company’s key customer metrics are also showing major growth slowdowns, with some numbers already declining and more not too far away from being there. Guidance was again weak, and deferred revenue trends show that this company’s growth struggles will likely continue for some time. Unless we see a major market rally in the coming days, it wouldn’t be a total surprise to see the stock hit a new low after this disappointing set of results.

Be the first to comment