labsas/E+ via Getty Images

Shares of Jazz Pharmaceuticals (NASDAQ:JAZZ) performed poorly over the last few months, a consequence of the market correction, but the company continues to execute its plan. As of last week, the pipeline has a potential new addition thanks to the deal with Zymeworks (NYSE:ZYME) for zanidatamab. The deal is a potentially great one for both companies but carries a lot more risk for Zymeworks and upside for Jazz (and Zymeworks, of course) thanks to its design. Jazz only pays $50 million upfront for the option on zanidatamab and has a chance to give up if it is not happy with the HERIZON-BTC-01 results which are expected before the end of the year.

Deal structure

This is a bit of an unusual deal. As mentioned, Jazz will pay Zymeworks $50 million upfront for the global option on zanidatamab, excluding certain Asia-Pacific markets. After Zymeworks reports HERIZON-BTC-01 results, Jazz can take the option and will pay another $325 million upfront. Or it can walk away, having paid just the $50 million, if the results are not to its liking.

The risk Jazz is taking ahead of this readout is limited to the $50 million upfront, a decent cost, but not something that will materially affect Jazz’s long-term prospects. On the other hand, Zymeworks gets a little bit of monetization of zanidatamab regardless of the HERIZON-BTC-01 trial outcome.

If Jazz opts in, the deal would turn out to be a great one for Zymeworks because Jazz will not only pay the additional $325 million, but it will also pay 100% of the cost of zanidatamab development and commercialization, up to $525 million in additional regulatory milestones and up to $862.5 million in commercial milestones. And finally, Zymeworks is entitled to tiered royalties on net sales starting at 10% and peaking at 20%.

Zymeworks intends to use the proceeds to invest in the continued development of ZW49 and to push five additional candidates into the clinic, starting with two in 2024 and one additional candidate thereafter. And with the potential funding from Jazz and eliminated development costs for zanidatamab, Zymeworks’ cash runway would extend into 2026.

The clinical data that attracted Jazz

Zymeworks was flying high during the 2018-2020 period thanks to positive data updates from zanidatamab trials, but it started to fall apart at the start of 2021. The ZW49 data, the changes in the HER2 landscape, the workforce reduction and restructuring, and the biotech bear market were to blame. The stock fell from the high 50s in early 2021 to a range of $5 to $7 per share in the last few months. There was also an opportunistic buyout offer by All Blue Capital of $10.50 per share, but it was rejected.

In the HER2 market, AstraZeneca’s (AZN) Enhertu is giving everyone a run for their money. In patients with HER2-positive unresectable and/or metastatic breast cancer previously treated by trastuzumab and a taxane, Enhertu reduced the risk of disease progression or death by 72% versus trastuzumab emtansine (Kadcyla). Enhertu’s overall response was 83% compared to a 36% response rate of Kadcyla.

Zanidatamab has limited data in later lines of breast cancer, and the data are not apples to apples to Enhertu but are not as nearly as positive – a combined 36% overall response rate in combination with chemotherapy in 22 patients.

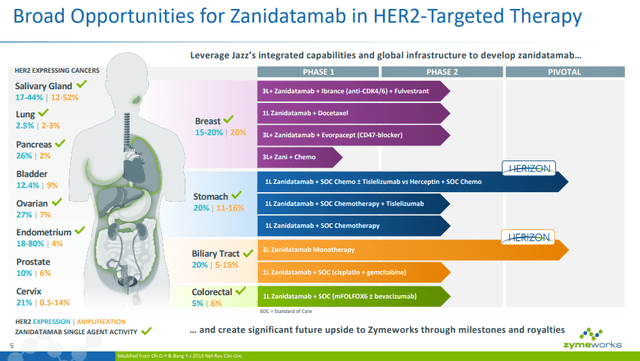

It appears zanidatamab’s path is in niche indications such as second-line biliary tract cancer in the above-mentioned HERIZON-BTC-01 trial with data expected by the end of the year, and first line gastroesophageal adenocarcinoma in combination with standard-of-care chemotherapy and a PD-1 antibody with results expected in the first half of 2024.

The advantage of zanidatamab in second-line biliary tract cancer would be a chemo-free regimen that can achieve higher response rates. In the earlier-stage study in late-line HER2-expressing biliary tract cancer, zanidatamab achieved a confirmed partial response rate of 40% and a disease control rate of 65% in 20 evaluable patients with a median duration of response of 7.4 months. The prognosis is poor for these patients and response rates to chemotherapy range from 5% to 15%.

These results have likely set the bar for the upcoming HERIZON-BTC-01 readout and zanidatamab needs to achieve at least similar data to those generated in the earlier-stage trial.

Overall, zanidatamab does not sound like a truly exciting asset and that is probably reflected in Zymeworks’ significantly contracted valuation over the last 22 months. However, I can see it generating value for Jazz (and Zymeworks) if it works well in the two most advanced indications (biliary tract cancer and gastroesophageal cancer). Success in these indications, and perhaps a few others later this decade with various potential combination approaches, could bring Jazz closer to its longer-term goals of bringing five novel drugs to market by the end of the decade and reducing its reliance on the oxybate franchise.

Zymeworks investor presentation

Conclusion

There is an apparent lack of excitement by market participants, evidenced by no significant changes in Jazz’s share price and a short pop in Zymeworks’ share price that has since faded. However, that could change if zanidatamab delivers positive data from the HERIZON-BTC-01 trial later this year, though, in terms of share price reactions, that would be the case for Zymeworks as its path forward very much depends on this trial’s outcome. For Jazz, it will represent a small step forward for its oncology pipeline, or a very minor setback of $50 million in cash if it chooses not to exercise the option to in-license zanidatamab.

I remain bullish on Jazz’s long-term prospects and can see this deal improving its revenue growth trajectory in the second half of the decade. I am neutral on Zymeworks but can see the stock trending higher on positive HERIZON-BTC-01 data and Jazz’s option exercise that would result in the elimination of all zanidatamab-related costs and a significantly extended cash runway thanks to the additional $325 million from Jazz.

Be the first to comment