Justin Sullivan

Elevator Pitch

I assign a Hold investment rating to Broadcom Inc.’s (NASDAQ:AVGO) shares.

A Buy rating for AVGO isn’t appropriate, even though the company’s most recently quarterly financial metrics were good. It is uncertain if Broadcom will meet or even beat market expectations in subsequent quarters, considering the headwinds associated with the Chinese market. Furthermore, AVGO’s valuations now aren’t particularly attractive. Therefore, I have chosen to rate Broadcom as a Hold, instead of a Buy.

How Were Broadcom’s Chip Sales?

Broadcom’s chip sales for the most recent quarter grew strongly and exceeded the market’s expectations.

Total revenue for AVGO expanded by +25% YoY and +4% QoQ to $8,464 million in the third quarter of fiscal 2022 (YE October 31), as highlighted in the company’s recent quarterly earnings press release. Broadcom’s actual Q3 FY 2022 top line came in +0.7% higher than the Wall Street analysts’ consensus sales projection of $8.41 billion.

It was robust chip sales which drove Broadcom’s top line growth in Q3 FY 2022. AVGO’s core semiconductor solutions business, which contributed 74% of the company’s full-year fiscal 2021 sales, saw its segment revenue increase by +6% QoQ and +32% YoY to $6,624 million in the recent quarter. The company’s semiconductors solutions business segment revenue for Q3 FY2022 was also +0.9% above the sell-side’s consensus estimate of $6,565 million as per S&P Capital IQ data.

In comparison, the most recent quarterly segment revenue for Broadcom’s infrastructure software business of $1,840 million was marginally higher (+0.3% beat) than what the analysts were anticipating. The infrastructure software business also delivered a relatively more modest +5% YoY expansion (as compared to +32% YoY growth for semiconductor solutions) in segment revenue. In QoQ terms, the segment sales for AVGO’s infrastructure software even declined by -2%.

The good performance of Broadcom’s semiconductor solutions business segment in the recent quarter was attributable to the fact that the company has relatively lower exposure to consumer end-markets.

At its Q3 FY 2022 earnings briefing, AVGO acknowledged that “consumer IT hardware spending has been reported to be weak”, but it highlighted that its “consumer business within semiconductor (solutions)” accounted for between a fifth and a quarter of its semiconductor solutions segment revenue. Broadcom noted at the call that “traditional enterprise and telcos, hyperscale” contributed the remaining “75%-80%” of revenue for the semiconductor solutions segment. As a result, AVGO’s actual chip sales and overall revenue for Q3 FY 2022 have been better than what one would expect in the current market environment.

AVGO Stock Key Metrics

There are two other key financial metrics for AVGO, apart from revenue, that deserve attention. One key metric is gross profit margin, the other key metric is shareholder capital return.

Non-GAAP adjusted gross profit margin for Broadcom increased by +0.8% YoY from 75.1% for Q3 FY 2021 to 75.9% for Q3 FY 2022. Based on historical data taken from S&P Capital IQ, this is the sixth year running that Broadcom has achieved a YoY increase in its gross profit margin for every quarter.

New product innovation is the main reason why AVGO has been able to deliver consistent gross margin expansion for such a long time. Broadcom emphasized at its Q3 FY2022 investor call that “as each year passes and the newer generation products get adopted more in a measured manner, our gross margin grows that 50 to 100 basis points” annually.

Separately, Broadcom’s free cash flow grew by an impressive +26% YoY to $4.3 billion in the third quarter of FY 2022, which translated into a reasonably high free cash flow margin of 51%. Almost three-quarters of AVGO’s Q3 FY 2022 free cash flow was returned to shareholders, with the company spending $1.7 billion and $1.5 billion on dividends and buybacks, respectively in the recent quarter.

Notably, AVGO stressed at its Q3 FY 2022 results call that “we maintain our commitment to return excess cash to shareholders, including buybacks, as soon as we can under SEC rules.” Broadcom had to suspend share repurchases since the fourth quarter of fiscal 2022 due to its pending acquisition of VMware, Inc. (VMW).

In summary, it is encouraging to see Broadcom generate high gross margins, robust free cash flow, and exhibit a strong commitment towards shareholder capital return.

What Are Analyst Ratings of Broadcom?

It doesn’t come as a surprise that Wall Street analysts in general are becoming more bullish on Broadcom following its most recent quarterly financial performance which was detailed in the preceding sections.

Of the 26 sell-side analysts currently covering AVGO’s shares, 85% of them or 22 analysts have either a strong Buy or Buy rating assigned to Broadcom’s stock.

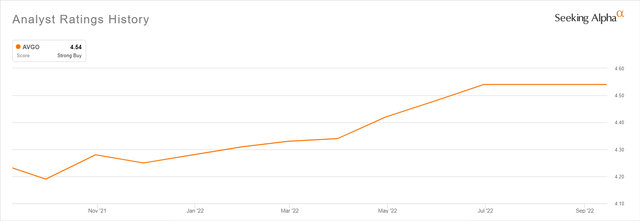

Average Wall Street Analyst Rating For Broadcom In The Past One Year

Seeking Alpha

As per the chart presented above, the mean sell-side analyst investment rating (5 for a Strong Buy, 3 for a Hold, and 1 for a Strong Sell) for AVGO has increased from 4.19 as of end-September 2021 to 4.54 now.

Also, there hasn’t been any Sell or Strong Sell analyst ratings for Broadcom since April 2022.

In a nutshell, the sell-side analysts have a bullish view of AVGO, and they have become increasingly confident about the stock’s future share price performance in the recent year, as evidenced by the change in analysts’ ratings.

What Is AVGO’s Stock Outlook Now?

Both company management and Wall Street analysts have a positive view of AVGO’s financial outlook in the near term, but I think they are too optimistic.

As indicated in its Q3 FY 2022 earnings media release, Broadcom has guided for revenue of $8.9 billion and an EBITDA margin of 63% for the fourth quarter of fiscal 2022.

AVGO’s Q4 FY 2022 top line guidance is equivalent to +20% YoY growth and this is +1.5% higher than the prior sell-side’s consensus fourth-quarter revenue forecast of $8.77 billion (source: S&P Capital IQ). Wall Street analysts have revised their Q4 FY 2022 sales estimate for Broadcom upwards to $8,905 million now which is line with the company’s recently issued guidance.

Separately, the 63% EBITDA margin guidance for Q4 FY 2022 represents an expected +200 basis points YoY expansion as compared to the company’s Q4 FY2021 EBITDA margin of 61.0%. The market’s consensus fourth-quarter EBITDA margin forecast for AVGO is 62.5%, which will round up to be 63% or the same as management guidance.

In my opinion, the expectations for Broadcom in the short term are way too bullish. It is possible that AVGO’s top line and bottom line for Q4 FY 2022 and subsequent quarters in fiscal 2023 might fall short of what investors are anticipating. Specifically, Broadcom’s exposure to the Chinese market is the most significant downside risk for the company’s future financial performance.

At its Q3 FY 2022 earnings call, Broadcom disclosed that the company derived “13% of our semiconductor revenue” from China. Seeking Alpha News reported on September 12, 2022 that “President Joe Biden and his administration intend to widen the restriction cast on exports of semiconductors to China.” Earlier, NVIDIA Corporation (NVDA) had issued a 8-K filing on August 31, 2022 highlighting that the US government “has imposed a new license requirement” with respect to “any future export to China (including Hong Kong) and Russia of the Company’s A100 and forthcoming H100 integrated circuits.”

Slower economic growth in China was the major reason for a 4% YoY decline in revenue generated from the industrial sub-segment of Broadcom’s semiconductor solutions business segment, as per management comments at the recent quarterly earnings briefing. The recent restrictions on semiconductor export to China might be a further drag on future sales derived from this specific market.

In conclusion, Broadcom’s Q3 FY 2022 results were good, and it is natural that the company is expected to do well in the upcoming quarter as well. But high expectations leave room for negative surprises, and the risk of lower-than-expected sales from the Chinese market can’t be ignored.

Is AVGO Stock A Buy, Sell, or Hold?

I have AVGO stock rated as a Hold. Broadcom’s current valuations are unfair and unappealing.

The market currently values AVGO at consensus forward next twelve months’ Enterprise Value-to-Revenue and EV/EBITDA multiples of 6.7 times and 10.7 times, respectively as per S&P Capital IQ. Broadcom’s forward EV/EBITDA multiple is roughly on par with its 10-year mean EV/EBITDA metric of 10.6 times, while its forward Enterprise Value-to-Revenue multiple is higher than its 10-year average Enterprise Value-to-Revenue ratio of 5.6 times. In addition, AVGO might potentially disappoint the market with its future quarterly performance, assuming that demand from China turns out to be weaker than expected.

Considering the above-mentioned factors, a Hold rating or Neutral view for Broadcom is justified.

Be the first to comment