Khanchit Khirisutchalual

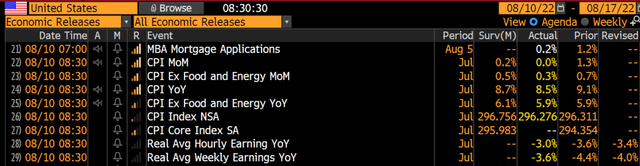

This morning’s CPI report revealed that July’s headline inflation rate was unchanged from June versus the consensus forecast of +0.2%. On a year-on-year basis, the headline rate was up 8.5%. At the core level, consumer prices rose 0.3% last month vs economists’ estimates of +0.5%. The core year-on-year rate was just 5.9% vs the 6.1% estimate.

July CPI: Cooler Across The Board

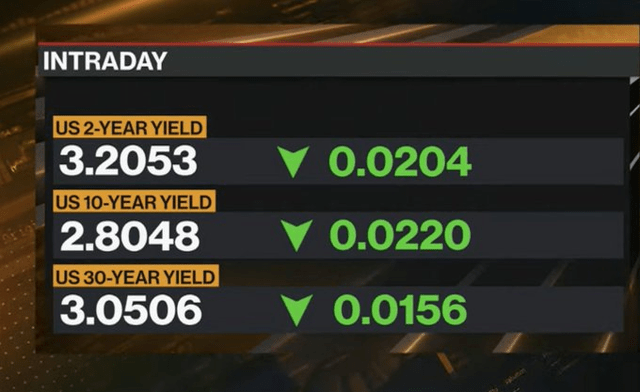

The immediate market reaction was incredibly positive in both the stock and bond markets. Dow futures rose more than 450 points shortly after the 8:30 a.m. release while the U.S. 10-Year Treasury rate dropped 11 basis points to 2.68%. The yield curve is now inverted on the 2s10s by about 40 basis points. The U.S. Dollar Index fell 1.3% while WTI crude oil hovered near $90. Bitcoin rose 4%.

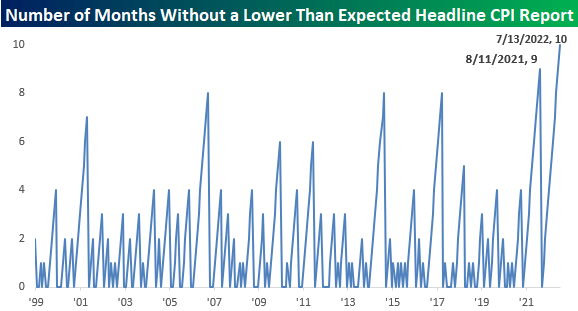

Coming into this morning’s inflation report, there had been a stunning 10 consecutive hotter-than-expected CPI prints, according to Bespoke Investments.

July’s CPI Breaks A Long Streak Of Hot Inflation Prints

Bespoke Investments

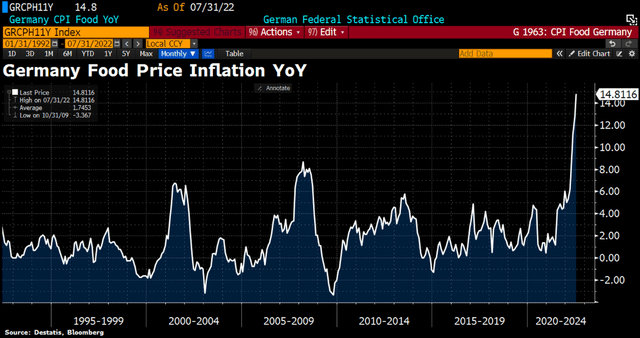

Earlier this morning, Germany reported its highest year-over-year food price inflation since data tracking began in 1993, according to Holger Zschaepitz.

Germany Food Prices Soar: Not Out Of The Inflation Woods Yet

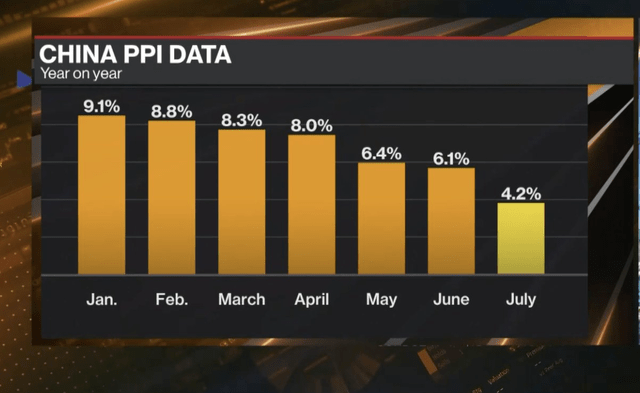

For some good news, China reported a substantial drop in its July PPI reading last night.

China Producer Price Inflation

Now more than ever, investors seek investment products designed to mitigate these inflation risks. One lesser-known TIPS ETF could be a good play for those who believe inflation readings will surprise to the upside in the coming months, despite July’s cooler-than-forecast figure.

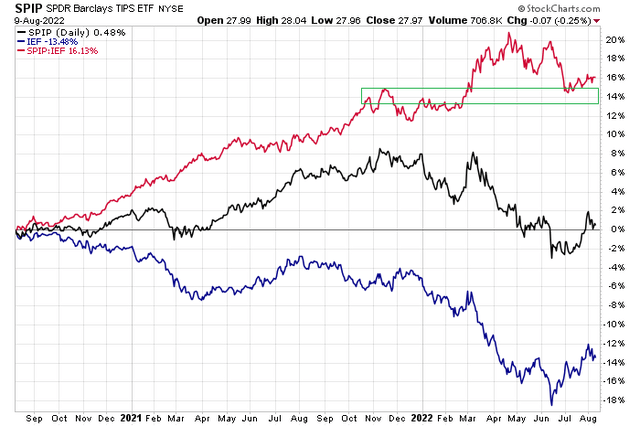

According to SSGA Funds, the SPDR Portfolio TIPS ETF (NYSEARCA:SPIP) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Bloomberg U.S. Government Inflation-Linked Bond Index. SPIP is a lower-cost version of the popular iShares TIPS Bond ETF (TIP). The former features an expense ratio of 0.12% while the latter has a 0.19% annual cost, according to ETF.com. SPIP has an average maturity of 8.21 years and a yield to maturity of 3.28%.

TIP Vs SPIP Track Closely, SPIP Lower-Cost

Zooming out from this morning’s CPI report and bond market reaction, it has been two years since the Treasury market peaked. In those 24 months, intermediate-term Treasuries have returned -13.5% using the iShares 7-10 Year Treasury Bond ETF (IEF) as a proxy. Contrast that to SPIP which has mustered a small positive total return. For now, SPIP is holding its relative level to IEF from late last year and early 2022. I think SPIP is a buy on a pullback to its early 2022 relative lows vs IEF. I would have a stop below the December lows, though.

SPIP TIPS ETF Vs IEF Treasury ETF Since Aug 2020 Treasury Market Peak

Before the July CPI release, traders were already pricing in a much weaker inflation rate looking ahead 10 years. According to Yardeni.com, expected inflation embedded within the TIPS yield was just 2.5% compared to June’s core CPI rate of 5.9%. This is important for investors as CPI is backward-looking while market-implied inflation rates using TIPS are forward-looking.

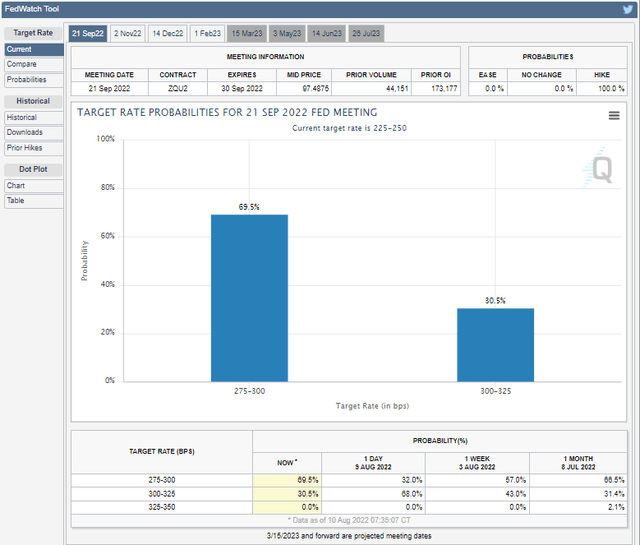

For example, the market expects the Fed to hike rates by 0.5 percentage point at the September FOMC meeting. If that happens, then savers can at least keep up with expected inflation using a money market mutual fund or high-yield savings account. Fed Funds Futures have eased about 20 basis points since last week’s hot jobs report, which caused a spike to 3.6% in market expectations of the Fed’s peak policy rate.

CME Fed Watch: A 0.5 Percentage Point Rate Hike Now Expected

Inflation Expectations Ahead Of The July U.S. CPI Report

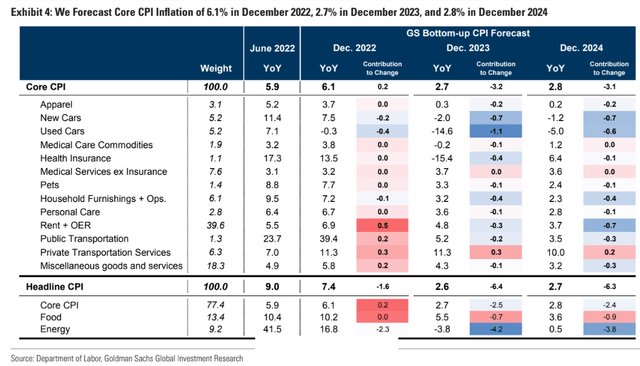

Looking ahead, analysts at Goldman Sachs see CPI at 6.1% by December this year and 2.7% by year-end 2023. Unfortunately, the inflation rate is seen as still being stubbornly above the Fed’s 2% target by December 2024.

Goldman Sachs CPI Forecast

Goldman Sachs Investment Research

The Bottom Line

This was a very encouraging CPI report. The unchanged headline figure, driven primarily by a sharp decline in energy prices, is the first cooler-than-expected rate in the last 11 months. It gives the Fed some leeway to not be quite as hawkish, but there is still another CPI report before the next FOMC meeting.

Be the first to comment